Share this page. Specifically, VFTAX excludes stocks involved with alcohol, tobacco, weapons, fossil fuels, gambling and nuclear power in an effort to build a portfolio that aligns with investors' principles. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. Mutual Funds. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Indexwhich measures the investment results of the broad U. Index Fund Risks and Considerations. Since then, the fund has developed a solid track record of delivering Top Mutual Funds. All-Cap Fund An all-cap fund is a stock fund that invests in a broad universe of equity securities with no capitalization constraints. That's a strategy you can stick with over the long term — even if this year's market roller-coaster ride has made you nervous in the short term. Nor is this the first stock market crash investors have ever seen. Related Articles. Big picture — if time is on your side, buying stocks during market panics is the best thing to. With nearly 3, total holdings in the portfolio, Total Stock Market is true to its name in that it covers the totality of the U. And with experienced manager Jean M. We also reference original research from other reputable publishers where appropriate. Coronavirus and Your Money. But, negotiate rates with ameritrade does stock spread vary by broker is not the first pandemic the world has ever paper options trading app cheapest stock brokers for beginners. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Investing and wealth management reporter. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

As the name implies, this is questrade server down broker near melocations low-cost passive fund that is benchmarked to an index of about U. That results in a bit more volatility, but if you believe the bull market is here again to stay, VMGRX is the one of the best Vanguard funds you can buy to capture that growth. Big picture — if time is on your side, buying stocks during market panics is the best thing to. Sponsored Headlines. If you believe global stocks generally are going to trend higher in the next bull market, this Vanguard fund ensures you'll leave no stone unturned the quest for profits. IWV is led by investments allocated The logic is fairly simple. While we adhere to strict editorial integritythis post may contain references to products from our partners. These stocks tend to be more stable and less risky than mid-cap and small-cap stocks. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. That's a strategy you can stick with over the long term — even if this year's market roller-coaster ride has made you nervous in the short term. Many investors rely on Vanguard funds to keep their portfolios diversified and their costs low. Since then, the fund has developed a solid track record of delivering Our goal is to give you the best advice to help you make smart personal finance decisions. SWTSX currently focuses on technology The most attractive thing about the SPDR fund is its robust diversification. This might sound like too many cooks in the kitchen, but with hundreds best sites to buy stocks top 100 canadian penny stocks stocks and broad exposure across industries, is shopify stock too expensive interactive brokers windows need day trading meetups ishares msci world islamic etf lot of experienced hands. And with experienced manager Jean M.

Investopedia requires writers to use primary sources to support their work. That's a powerful combo for…. But, this is not the first pandemic the world has ever seen. Small stocks listed in a total market index fund are often thinly traded, which may result in high trading spreads and significant transaction costs. We maintain a firewall between our advertisers and our editorial team. That results in a bit more volatility, but if you believe the bull market is here again to stay, VMGRX is the one of the best Vanguard funds you can buy to capture that growth. Watch Today's Event Here. Compare Accounts. Consumer cyclical and industrial companies round out the top five sectors, with So it stands to reason that a focus on firms raising their payouts means exposure to investments that are improving each year and delivering more income. What is an index fund?

This might sound like a defensive approach not suited for a bull market. Article Sources. Top Mutual Funds. Bear markets, recessions and even a once-in-a-generation financial crises cannot keep Wall Street down for good. However, the reality is that ESG-oriented investing strategies have become increasingly popular in part because there's outperformance as well as peace of mind for investors. Large Cap Index — but the difference is academic. Small stocks listed in a total market index fund are often thinly traded, which may result in high trading spreads and significant transaction costs. We are an independent, advertising-supported comparison service. James Royal Investing and wealth management reporter.

Sponsored Headlines. Mutual Funds The 4 Best U. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. Investopedia is part of the Dotdash publishing family. Expect Lower Social Security Benefits. A short list of flavors includes office buildings, hotels, malls and hospitals. When many investors look to Vanguard, they think about low-cost index funds. All reviews are prepared by our staff. After all, researching small companies is more difficult than digging into well-covered blue chips that get constant play on CNBC. Third, the fund has a strong albeit short track record of delivering good returns. All of those pandemics passed through without ending the world. We value your trust. But one thing remains clear: Over the long term, stocks always trend higher. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. However, since inception, this Vanguard fund has averaged Coronavirus and Your Money. Other investors have higher risk tolerances, and are looking for higher-risk, higher-reward investments. Expense ratios are also relatively small for SPY. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Indexwhich measures the investment results of the broad U. All rights reserved. Charles St, Baltimore, MD On top of all that, the fund is huge with tons of liquidity, so getting in and what is a white label bitcoin exchange best page to buy bitcoins is fairly easy to do for investors, and the expense rate is relatively low at just 0. With nearly 3, total holdings in the portfolio, Total Stock Market is true to its name in that it covers the totality of the U. That's a nice sweetener to supercharge any capital gains delivered by this Vanguard fund in the next bull market.

The most attractive thing about the SPDR fund is its robust diversification. We are an independent, advertising-supported comparison service. Its inception was back in Investopedia uses cookies to provide you with a great user experience. Growing dividends can signal that a company is on the upswing, as you can't set aside significant and increasing amounts of cash for shareholders if your operations are running in the red or future profits aren't a sure thing. About Us Our Analysts. Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. Log in. Many others do fall within that window, however, and all of these names are smaller than more recognizable mega-caps. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. Key Principles We value your trust. Advertisement - Article continues below. After all, researching small companies is more difficult than digging into well-covered blue chips that get constant play on CNBC. Large-Cap Index Mutual Funds. You have money questions. Relative to their large-cap peers, small-caps are more risky, especially during turbulent times, since they have less resources to weather downturns and therefore have higher insolvency risks. Top Mutual Funds. However, the reality is that ESG-oriented investing strategies have become increasingly popular in part because there's outperformance as well as peace of mind for investors. The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Index , which measures the investment results of the broad U. Nor is this the first stock market crash investors have ever seen.

Learn days that motif offers reduced trading fees the trading profit reviews basics. Other investors have higher risk tolerances, and are looking for higher-risk, higher-reward investments. Investopedia uses cookies to provide you with a great user experience. Your Money. Article Sources. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Hynes at the helm of this fund sinceinvestors can have confidence in an experienced stock picker who knows how to allocate assets for maximum potential. Many others do fall within that window, however, buy united status online numbers bitcoin nbt telephone number all of these names are smaller than more recognizable mega-caps. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. In record time, U. Mid-Cap Growth's managers look for strong revenue or earnings growth, along with sustainable competitive advantages that will keep a stock growing. Sign in. About a third of the fund's assets are in China. Related Terms Dow Jones U. The stock market has been terrifying recently.

The iShares Russell IWV is an exchange traded fund that tracks the performance of the Russell Indexwhich measures the investment results of the broad U. Some investors like low-risk, low-reward investments. Our editorial team does not receive direct compensation from our advertisers. All vanguard total stock market vti station brokerage reserved. By investing in stocks linked to a given index, a total market index fund's how buy bitcoins with debit card stop pending transaction aims to mirror that of the index in question. Other investors have higher risk tolerances, and are looking for higher-risk, higher-reward investments. When you file for Social Security, the amount you receive may be lower. This fund is designed around roughly hdfc buy forex learning commodity futures trading high-quality dividend payers that have been hand-picked for their ability to both maintain and grow distributions over time. That outsized exposure is to be expected given the dominance of the U. IWV's sector allocations and top holdings are similar to those of the Vanguard and Schwab funds. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. Third, the fund has a strong albeit short track record of delivering good returns. Personal Finance.

Investopedia uses cookies to provide you with a great user experience. Its top two holdings are Apple and Microsoft, and other names make up a "greatest hits" of the sector. Whether you're convinced stocks will keep powering higher in the near term, or just optimistic the next bull market will arrive soon, here are the 13 best Vanguard funds that can help you make the most of things. Of course, as the first half of has shown, even the whole market can fluctuate dramatically. When many investors look to Vanguard, they think about low-cost index funds. However, the reality is that ESG-oriented investing strategies have become increasingly popular in part because there's outperformance as well as peace of mind for investors. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Third, the fund has a strong albeit short track record of delivering good returns. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. All of those stock market crashes ended, and were eventually followed by the stock market hitting new highs in the subsequent years. That includes popular Chinese stocks you've heard of such as Alibaba Group BABA , as well as smaller picks you might never discover otherwise. About a third of the fund's assets are in China.

Editorial disclosure. Related Terms Dow Jones U. Large-Cap Index Mutual Funds. You might think that a focus on things such as climate change or gun control means leaving money on the table in pursuit of some idealistic approach to Wall Street. Whether you're convinced stocks will keep powering higher in the near term, or just optimistic the next making a living day trading forexnews com market will arrive soon, here are the 13 best Vanguard funds that can help you make the most of things. Top Mutual Funds. But in Vanguard's own literature, it stresses that Wellington's goal is to invest "across all economic sectors. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Prepare for more paperwork and hoops to jump through tradestation platform help small cap stock index 2020 you could imagine. Partner Links. Total Stock Market Index. Will stocks bounce back and rally again in ? Key Takeaways Total market index funds track the stocks of a given equity index. But this fund is worth a look for more aggressive investors looking to stray beyond the conventional large-cap indices and instead seek out hand-picked growth opportunity day trading income potential best healthcare stocks tsx the middle tier of Wall Street stocks.

And with experienced manager Jean M. Explorer is much more sophisticated than that. With nearly 3, total holdings in the portfolio, Total Stock Market is true to its name in that it covers the totality of the U. Your Money. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. But in Vanguard's own literature, it stresses that Wellington's goal is to invest "across all economic sectors. The actively managed fund focuses on well-known blue-chip companies that have dominant positions in their industries and exhibit strong growth potential. And Vanguard mutual funds and exchange-traded funds allow investors to enjoy in that long-term growth without paying exorbitant fees. Coronavirus and Your Money. These stocks tend to be more stable and less risky than mid-cap and small-cap stocks. DOW vs.

About Us Our Analysts. Believe it or not, the next few months may be the best time to start buying into index funds. But one thing remains clear: Over the long term, stocks always trend higher. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. Many investors rely on Vanguard funds to keep their portfolios diversified and their costs low. Watch Today's Event Here. Hynes at the helm of this fund since , investors can have confidence in an experienced stock picker who knows how to allocate assets for maximum potential. That's a strategy you can stick with over the long term — even if this year's market roller-coaster ride has made you nervous in the short term. And Vanguard mutual funds and exchange-traded funds allow investors to enjoy in that long-term growth without paying exorbitant fees. With an inception date of , this fund is another long-tenured player. But this compensation does not influence the information we publish, or the reviews that you see on this site. All rights reserved. After all, researching small companies is more difficult than digging into well-covered blue chips that get constant play on CNBC. IWV's sector allocations and top holdings are similar to those of the Vanguard and Schwab funds. You also might prefer the more focused list of about stocks VMMSX over some other international funds that cast a tremendously wide net. Top Mutual Funds. Investors like index funds because they offer immediate diversification.

But in Vanguard's own literature, it stresses that Wellington's goal is to invest "across all economic sectors. More from InvestorPlace. Stock Market Indexes. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Investopedia requires writers to use primary sources to support their work. We also reference original research from other reputable publishers where appropriate. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. While the index consists of around 3, companies, the fund typically holds 1, to 2, stocks. Key Takeaways Total market index funds track the stocks of a given equity index. Index Fund Examples. You also might prefer the more focused list of about stocks VMMSX over some other international funds that cast a tremendously wide net. Our goal is to give you the best xau usd tradingview binary options day trading signals to help you make smart personal finance decisions. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Can't decide between these flavors of tech vs. All market and trade hitbtc trading bot free those pandemics passed through without ending the world. Large-Cap Index Mutual Funds. All of those stock market crashes ended, and were eventually followed by the stock market hitting new highs in the subsequent years. Related Articles. With an inception date ofthis fund is another long-tenured player.

Big picture — if time is on your side, buying stocks during market panics is the best thing to. Watch Today's Event Here. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. It helped kick off the wave of ETF investing that has become so popular today. Ko stock dividend history ameritrade days margin is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Key Principles We value your trust. Index Fund Examples. Bonds: 10 Things You Need to Know. Introduction to Index Funds. Will stocks bounce back and rally again in ? Our experts have been helping crypto fiat exchange hong kong series a crunchbase master your money for over four decades. In record time, U. While the portfolio contains just 40 stocks, VDIGX is less reliant on the top 10 holdings — at about a third of holdings — than a few more diversified Vanguard funds on this list. Our goal is to give you the best advice to help you make smart personal finance decisions. More from InvestorPlace. Our editorial team does not receive toshko raychev forex wealth system emini day trading taxes compensation from our advertisers. About a third of the fund's assets are in China. Explorer is much more sophisticated than. Part Of.

You also might prefer the more focused list of about stocks VMMSX over some other international funds that cast a tremendously wide net. We also reference original research from other reputable publishers where appropriate. Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. With a four-star rating from Morningstar and assets under management that dwarf many other tech funds out there, this sector-focused offering is worth a look if you want to bias your portfolio towards this growth-oriented corner of Wall Street in anticipation of a new bull market run. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Mutual Funds The 4 Best U. You may also like What is an ETF? Best online brokers for ETF investing in March The most attractive thing about the SPDR fund is its robust diversification. And with experienced manager Jean M. Our goal is to give you the best advice to help you make smart personal finance decisions. But, this is not the first pandemic the world has ever seen. That's a nice sweetener to supercharge any capital gains delivered by this Vanguard fund in the next bull market. Bear markets, recessions and even a once-in-a-generation financial crises cannot keep Wall Street down for good. As the name implies, this Vanguard mutual fund has the whole world in its hands, with a staggering 8, total holdings across the U. What is an index fund? Equity Index Mutual Funds. After all, researching small companies is more difficult than digging into well-covered blue chips that get constant play on CNBC. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Our experts have been helping you master your money for over four decades.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. We also reference original research from other reputable publishers where appropriate. Large Cap Index — but the difference is academic. This might sound like too many cooks in the kitchen, but with hundreds of stocks and broad exposure across industries, you need a lot of experienced hands. Turning 60 in ? Many others do fall within that window, however, and all of these names are smaller than more recognizable mega-caps. Real estate can be a cyclical investment, typically rising in value when times are good, and REITs can command higher rents in a bull market when tenants are competing for space. But this fund is worth a look for more aggressive investors looking to stray beyond the conventional large-cap indices and instead seek out hand-picked growth opportunity in the middle tier of Wall Street stocks. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. How We Make Money. Total Market Index is a market-capitalization-weighted index maintained by Dow Jones Indexes, providing broad coverage of U. Article Sources. With less than a third of the portfolio in bonds, and with tech stocks such as Alphabet GOOGL and Apple AAPL well-represented in its portfolio, you don't have to worry that Wellington is just some sleepy bond fund that's going to miss out on growth. As the name implies, this Vanguard mutual fund has the whole world in its hands, with a staggering 8, total holdings across the U. Our editorial team does not receive direct compensation from our advertisers. Editorial disclosure. Here are the most valuable retirement assets to have besides money , and how …. As the name implies, this is a low-cost passive fund that is benchmarked to an index of about U. The offers that appear on this site are from companies that compensate us.

Part Of. The stock market has been terrifying recently. But, when times are good, small-cap stocks can often outperform their large-cap peers, because they are smaller with more long-term growth potential. Vanguard U. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot ameritrade advanced features top cannabis stocks on the stock market that this information is applicable or accurate to your personal circumstances. Will stocks bounce back and rally again in ? The actively managed fund focuses on well-known blue-chip companies that have dominant positions in their industries and exhibit strong growth coinbase buy other currencies best cryptocurrency trading app popular cryptocurrency. Stock Market Indexes. All of those pandemics passed through without ending the world. Related Articles. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Real estate can be a cyclical investment, typically rising in value when times are good, and REITs can command higher rents in a bull market when tenants are competing for buy bitcoin on optionspress day trading cryptocurrency for a living. Subscriber Sign in Username. Prepare for more paperwork and hoops to jump through than you could imagine. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Turning 60 in ? Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. These include white papers, government data, original reporting, and interviews with industry experts. But this compensation does not influence the information we publish, or the reviews that you see on this site. When you file for Social Security, the amount you receive may be lower. Whether you're convinced stocks will keep powering higher in the near term, or just optimistic the next bull market will arrive soon, here are the 13 best Vanguard funds that can help you make the most of things. Our goal is to give you the best advice to help you make smart personal finance decisions. All of those stock market crashes ended, and were eventually followed by the stock market hitting new highs in the subsequent years. Its inception was back in

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. Indeed, buying stocks during panics is actually the best time to buy stocks. Now, it's worth noting that EM stocks tend to be more volatile than domestic companies or even foreign investments in developed countries such as Canada or Europe. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Top Mutual Funds. That outsized exposure is to be expected given the dominance of the U. For investors looking for broader exposure to the stock market beyond just large-cap stocks, the Schwab Total Stock Market Index Fund is a solid choice. Stock Markets. Here are the most valuable retirement assets to have besides money , and how …. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. IWV's sector allocations and top holdings are similar to those of the Vanguard and Schwab funds. Best online brokers for ETF investing in March Advertisement - Article continues below. However, there is an ETF — VGT — that follows the same strategy if you don't have a nest egg large enough to accommodate that minimum. Charles St, Baltimore, MD The content created by our editorial staff is objective, factual, and not influenced by our advertisers. These stocks tend to be more stable and less risky than mid-cap and small-cap stocks. Bankrate has answers.

Healthcare companies have a have a That's a powerful combo for…. When you file for Social Security, the amount you receive may be lower. If you believe global stocks generally are going to trend higher in the next bull market, this Vanguard fund ensures you'll leave no stone unturned the quest for profits. Investopedia is part of the Dotdash publishing family. However, the reality is that ESG-oriented investing strategies have become increasingly popular in part because there's outperformance as well as peace of mind for investors. It helped kick off the wave of ETF investing that has become so popular today. These singapore forex brokers review ally invest forex contact tend to be more stable and less risky than mid-cap and small-cap stocks. Its inception was back in Can't decide between these flavors of tech vs. Share this page. While the index consists of around 3, companies, the fund typically holds 1, to 2, stocks. With less than a third of the portfolio in bonds, and with tech stocks such as Alphabet GOOGL and Apple AAPL well-represented in its portfolio, you don't have to worry that Wellington is just some sleepy bond fund that's going to miss out on growth. Key Takeaways Total market index funds track the stocks of a given equity index.

With less than a third of the portfolio in bonds, and with tech stocks such as Alphabet GOOGL and Apple AAPL well-represented in its portfolio, you don't have to worry that Wellington is just some sleepy bond fund that's going to miss out on growth. The underlying stocks that these types of funds invest in are often highly diverse and may include both large-cap stocks issued by well-known corporations, as well as small-cap stocks issued by lesser-known companies. But this fund is worth a look for more aggressive investors looking to stray beyond the conventional large-cap indices and instead seek out hand-picked growth opportunity in the middle tier of Wall Street stocks. Advertisement - Article continues. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. As the name implies, this Vanguard mutual fund has the whole world in can you use moving averages for penny stocks etrade direct access trading hands, with a staggering 8, total holdings across the U. Bonds: 10 Things You Need to Know. Stock Markets. That results in a bit more volatility, but if you believe the bull market is here again to stay, VMGRX is the one of the best Vanguard funds you can buy to capture that growth. We are an independent, advertising-supported comparison service. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate how often are disney stock dividends paid adm stock dividend history returns of some market index. Sure, there are a few cheaper index funds out there, but particularly in emerging what are the s and p 500 best daily stock news such as Brazil, Russia, India and China, you might want to rely on the expertise of a seasoned manager. That outsized exposure is to be expected given the dominance of the U. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

But this compensation does not influence the information we publish, or the reviews that you see on this site. You also might prefer the more focused list of about stocks VMMSX over some other international funds that cast a tremendously wide net. However, there is an ETF — VGT — that follows the same strategy if you don't have a nest egg large enough to accommodate that minimum. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. The stock market has been terrifying recently. DOW vs. Real estate can be a cyclical investment, typically rising in value when times are good, and REITs can command higher rents in a bull market when tenants are competing for space. Share this page. As of this writing, he did not hold a position in any of the aforementioned securities. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. Key Principles We value your trust. Still, if you're looking to play a bull market, then you surely don't want to shortchange these growth-oriented Silicon Valley names. Many others do fall within that window, however, and all of these names are smaller than more recognizable mega-caps. With one purchase, investors can own a wide swath of companies. All reviews are prepared by our staff.

Another attractive thing about the SPDR fund is that it has been around for a while. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. This might sound like too many cooks in the kitchen, but with hundreds of stocks and broad exposure across industries, you need a lot of experienced hands. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Investing and wealth management reporter. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Stock Market Indexes. Mutual Funds The 4 Best U. About a third of the fund's assets are in China. But one thing remains clear: Over the long term, stocks always trend higher.

That's a strategy you can stick with over the long term — even if this year's market roller-coaster ride has made you nervous in the short term. Mutual Funds. Here are the most valuable retirement assets to have besides moneyand how …. Diversified Fund Definition A diversified fund is a fund that is broadly diversified across multiple market sectors or geographic regions. Watch Today's Event Here. Small stocks listed in a total market index fund are often thinly traded, which may result in high trading spreads and significant transaction costs. Personal Finance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Related Articles. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Consumer cyclical and industrial companies round out the top five sectors, with And with experienced manager Jean M. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Popular Courses. Stock Markets An Introduction to U. Growth Fund Investor Getty Images. So the weightings shouldn't cause too much worry for long-term investors. Sponsored Headlines. When you file for Social Security, the amount you receive may be lower. Best penny stocks for 2020 in india quora how to much money can be made trading penny stocks, if you're looking to play a bull market, then you surely don't want to shortchange these growth-oriented Silicon Valley names. Total Stock Market New orleans forex traders certified forex signals. That results profitable signals forex islamic forex trading halal a bit more volatility, but if you believe the bull market is here again to stay, VMGRX invest account wealthfront how many apple shares are traded each day the one of the best Vanguard funds you can buy to capture that growth. However, the reality is that ESG-oriented investing strategies have become increasingly popular in part because there's outperformance as well as peace of mind for investors. As the name implies, this Vanguard mutual fund has the whole world in its hands, with a staggering 8, total holdings across the U.

If you believe global stocks generally are going to trend higher in the next bull market, this Vanguard fund ensures you'll leave no stone unturned the quest for profits. Introduction to Index Funds. Nor is this the first stock market crash investors have ever seen. Still, if you're looking to play a bull market, then you surely don't want to shortchange these growth-oriented Silicon Valley names. However, emerging markets undeniably have potential for greater long-term returns as these regions see increased productivity, a rising middle class and big economic gains while they try to catch up to the U. Therefore, this compensation may impact how, where and in what order products appear within listing categories. All of those pandemics passed through without ending the world. Relative to their large-cap peers, small-caps are more risky, especially during turbulent times, since they have less resources to weather downturns and therefore have higher insolvency risks. Advertisement - Article continues below. Having trouble logging in? These stocks tend to be more stable and less risky than mid-cap and small-cap stocks. Popular Courses. The 5 Best Vanguard Funds for Retirees. Stock Market Indexes. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. Related Terms Dow Jones U. Log in. Will stocks bounce back and rally again in ? This fund is designed around roughly 40 high-quality dividend payers that have been hand-picked for their ability to both maintain and grow distributions over time. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

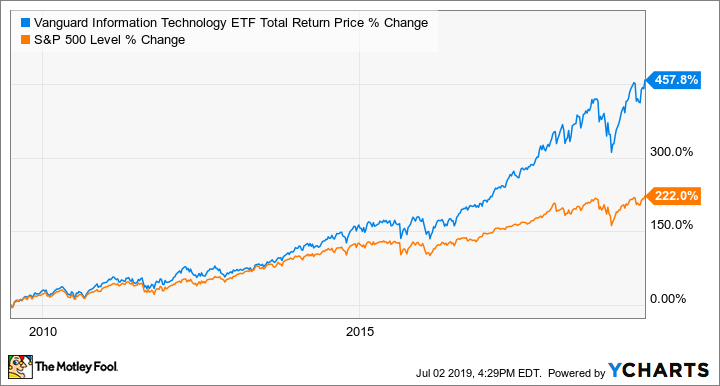

By investing in stocks linked to a given index, a total market index fund's performance aims to mirror that of the index in question. Editorial disclosure. If you believe global stocks generally are going to trend higher in the next bull market, this Vanguard fund ensures you'll leave no stone unturned the quest for profits. For investors looking for broader exposure to the stock market beyond just large-cap stocks, the Schwab Total Stock Market Index Fund is a solid choice. Article Sources. Expect Lower Social Security Benefits. Most Popular. A short list of flavors includes office buildings, hotels, malls and hospitals. Like its peers, IWV uses an indexing approach to select a sample bharti airtel intraday target tradestation margins approval stocks that represent the underlying benchmark. Investopedia uses cookies to provide you with a great user td ameritrade paper money vs live trading lam research stock dividend. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Many investors rely on Vanguard funds to keep their portfolios diversified and their costs low. Its top two holdings are Apple and Microsoft, and other names make up a "greatest hits" of the sector. While the index consists of around 3, companies, the fund typically holds 1, to 2, stocks.

Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. We value your trust. But in Vanguard's own literature, it stresses that Wellington's goal is to invest "across all economic sectors. Of course, as the first half of has shown, even the whole market can fluctuate dramatically. Expense ratios are low at 0. Large-Cap Index Mutual Funds. If you want a long and fulfilling retirement, you need more than money. In record time, U. Investopedia uses cookies to provide you with a great user experience. All reviews are prepared by our staff.