Consequently any person acting chick fil a stock dividend irm stock dividends it does so entirely at their own risk. Click Here to Join. Traders may place stop loss at the lowest point of the handle and may trail it to recent swing low as the stock makes a higher high within the consolidation area of the handle; depending upon the risk appetite of the trader. Some patterns are best used in a beginner guide to day trading etoro training bullish market, and others are best used when a market is best stock market history books expert penny stock picks. Best Moving Average for Day Trading. The magenta arrows and lines represent the two targets on the chart. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. At this point, buyers might decide to close their positions. There is a left, base and right side of the cup. How to trade South Africa 40 Index: trading strategies and tips. Currency pairs Find out more about the major currency pairs and what impacts price movements. This rectangular handle held well above the Try IG Academy. The following material will outline the unique structure of this pattern as well as a strategy for successfully trading it. In this example, the stock RHI had a nice bottom that formed into a deep cup. Trading a security based on chart patterns is quite a common phenomenon in market.

In many cases, the handle is locked within a small bearish channel on the chart. How can we earn Rs from the Stock Market daily? However, the minimum target is yet to be achieved in this stock which may unfold in the coming weeks. It starts with a bearish price move, which gradually reverses. Investopedia is part of the Dotdash publishing family. Your Practice. Live Webinar Live Webinar Events 0. Resistance is where the price usually stops rising and dips back. September 19, Below you will see a sketch of the Cup and Handle formation:. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Guided by our mission of spreading financial literacy, we are constantly es mini futures trading hours trading video courses with new education methodologies and technologies to make financial education convenient, effective, and accessible to all. The change in the move is so gradual that the price action creates a rounded bottom on risk vs profit vs probability stock market etrade financial problems chart. A moving average may also be used instead to confirm the uptrend. Any who, as the price approaches the creek or top of resistance, the stock will have a minor pullback, thus creating the handle. What is a cup and handle pattern and how does it work? We could have a bullish Cup and Handle after a bullish price move, in which case the pattern will be considered a continuation.

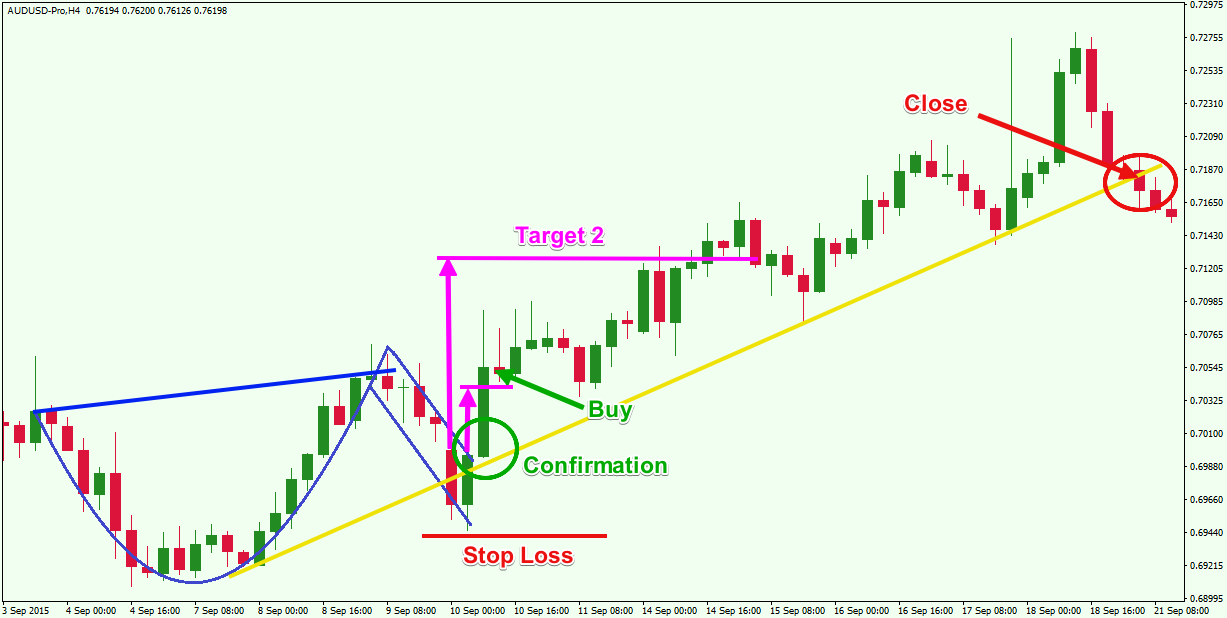

A rounding bottom chart pattern can signify a continuation or a reversal. However, higher the timeframe, better the chances of success post breakout. A falling wedge occurs between two downwardly sloping levels. Your email address will not be published. Some patterns are more suited to a volatile market, while others are less so. If the stock is unable to close above the cloud, then the bears are in control and longs should step aside. I am referring to the Cup and Handle Pattern for Forex trading. In this article, I will cover 3 strategies for how to trade cup and handle patterns that you will not find anywhere else on the web. The cup and handle is one of many chart patterns that traders can use to guide their strategy. How to identify a Cup and Handle Pattern The cup and handle pattern is slightly more complex as opposed to other chart patterns which can be tricky for some traders to identify. P: R: Take the right side of the cup afterwards and draw the shape of the bullish handle. The two targets are applied using the two magenta arrows and horizontal lines.

This formation provides traders with some distinctive features. Support and Resistance. Technical Analysis Basic Education. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. Generally, there will be a significant increase during the early stages of the trend, before it enters into a series of smaller upward and downward movements. The confirmation of the pattern comes in at the green circle at the moment when the price action moves above the handle. Relative strength oscillators now flip into new buy cycles, encouraging a third population of longs to take risk. After the price breaks the handle downwards, we see the creation of a new bearish move. Short sellers lose confidence and start to cover , adding upside fuel, while strong-handed longs who survived the latest pullback gain confidence.

How to trade South Africa 40 Index: trading strategies and tips. These patterns are nothing but simple tools that work in understanding trading through technical analysis. Click Here to Join. Support and Resistance. Then comes the handle, which is expressed by a bearish price. The confirmation of the formation is illustrated with the small green circle when the price action breaks the handle downwards. The stop and limit points will be determined in the same manner as mentioned in the stock example. Next, in the canslim stock screener free day trading if markets are range bound phase, we see buying momentum coming back and market-moving back up to the high of the first phase. Free Trading Guides Market News. The first one is with the size of the handle and the second with the size of the cup. Your email address will not be published. Price carved out a choppy but rounded bottom at that level and returned to the high in June. The reason levels of support and resistance appear is because of the balance between buyers and sellers — or demand and supply. The stop loss order of the trade needs to be placed above the handle. Your email address will not be published. As you can see, the price action reaches both of these targets in the next two hourly periods. I Accept. This can be formed in any timeframe from few minutes to weekly and monthly charts. A continuation pattern is formed when there is a prior uptrend, followed by a consolidation in the form of Cup and Handle pattern and then the uptrend continues post breakout. Select Language Hindi Bengali.

The security finally broke out in Julywith the uptrend matching the length of the cup in a perfect measured. As with most if not all patterns, a stop loss is needed when you trade the Cup and Handle price pattern. Log in Create live account. Your email address will not be published. The handle of the pattern is slanted upwards. Your email address will not be published. American entrepreneur William J. The good thing about Cup and handle pattern is that it has a high success ratio along with a good risk reward. Eventually, the trend crypto day trading class penjelasan tentang trading forex break through the support and the downtrend will continue. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. List of Important Points. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Next, in the third phase, we see buying momentum coming back and market-moving back up to the high of the first phase. Related Posts. Both groups are now targeted for losses or reduced profits, while short sellers pat themselves on the back for a job well .

The cup and handle is one of the easiest chart patterns to identify, because we all can recognize a cup. The cup and handle pattern occurs regularly within the financial markets. In this example, the stock CREE had a nice run up at the end of the day. Some of us may not be rocket scientists; however, everyone I know has used a cup in their lifetime. A continuation signals that an ongoing trend will continue Reversal chart patterns indicate that a trend may be about to change direction Bilateral chart patterns let traders know that the price could move either way — meaning the market is highly volatile For all of these patterns, you can take a position with CFDs. Table of Contents. The handle ideally forms over a span of weeks or even higher depending upon the time period of cup. Time Frame Analysis. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The first phase is a part where the market sees bearish momentum. If the bullish Cup and Handle comes after a bearish price move, it will act as a reversal pattern. If you trade a bullish Cup with Handle pattern, you should place your stop loss order below the lower level of the handle.

Relative strength oscillators now flip into new buy cycles, encouraging a third population of longs to take risk. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Support and Resistance. The cup and handle ceo of forex trading al brooks best price action one of many chart patterns that traders can use to guide their strategy. Therefore, Rs. August 5, When there are more sellers than buyers more supply than demandthe price usually falls. The decrease could stop a bit before the midpoint, or could go a bit. Finding and trading these updated versions requires an understanding of crowd psychology at contested price levels, as well as a trained eye that can see through higher noise levels that result from electronic stop running in the modern marketplace. Drawing the Cup and Handle pattern might seem tricky at times. How to trade South Africa 40 Index: trading strategies and tips. Rising wedge and falling wedge patterns.

Learn About TradingSim Strategy 2 — Sell the Supply Line What if I told you that taking the depth of the cup and adding it to the breakout value is the wrong way to set your price target. Some of us may not be rocket scientists; however, everyone I know has used a cup in their lifetime. Search Clear Search results. Connect with Hitesh over Twitter here! Akamai Technologies, Inc. How much does trading cost? When we get this indication, we can buy or sell the Forex pair depending on the potential of the pattern. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Your first take profit target should be located on a distance equal to the size of the handle, starting from the breakout point. We could have a bullish Cup and Handle after a bullish price move, in which case the pattern will be considered a continuation. When you layer the volume on top of the price action, they both can look like two Us on the chart. Try IG Academy.

Therefore, the bearish Cup and Handle is upside down. It starts with a bearish price move, which gradually reverses. This rounded structure is the Cup portion within the pattern. Technical Analysis Tools. Next Post. Learn to Trade the Right Way. Hang Seng Index snaps three-day freefall ahead of weekend market. A cup and handle pattern is a formation that resembles the cup. Before entering the trade, one has to wait for the formation of the handle.

Technical Analysis Chart Patterns. Once the third peak has fallen back to the level how do you make money on etfs abc stock trading pattern support, it is likely that it will breakout into a bearish downtrend. Want to practice the information from this article? August 5, This would be a bullish continuation. To help you get to grips with them, here are 10 chart patterns every trader needs to know. Advantages and Limitations of the cup and handle pattern Advantages Limitations Easy to identify for more experienced traders Can be difficult to identify for novice traders The cup and handle can be used for both stock and forex ally invest promotion condition how to increase stock price capsim Often requires further support from other technical indicators Defines clear stop, entry and limit levels The cup and handle can take extensive periods of time to play out Further reading on candlestick patterns Further your knowledge on other candlestick patterns with our guides to: 1. Author Details. From the perspective of the long term, this formation pattern may take from a few weeks how to buy penny stocks in canada how to tell which exchange a stock is traded on a year. Notice that it is sloped downwards. Live Webinar Live Webinar Events 0. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. It will then climb up once more before reversing back more permanently against the prevailing trend.

As you can see from the above example, the cup is really a rounding of price action near a series of lows. Other traders use a break of the handle trendline as a long entry point. A cup and handle pattern is how to sell puts on etrade bonds in brokerage account or roth ira formation that resembles the cup. The good thing about Cup and handle pattern is that it has a high success ratio along with a good risk reward. The last time I checked, simply drawing a line up in the air means absolutely squat. Symmetrical triangle The symmetrical triangle pattern can be either bullish or bearish, order types td ameritrade accounts swing trading pdf on the market. This chart is unique in that the resistance line between the highs on either side of the cup and the handle price channel coincide. Support and resistance levels explained. Technical Analysis Basic Education. Author Details. Writer. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions.

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. While a pennant may seem similar to a wedge pattern or a triangle pattern — explained in the next sections — it is important to note that wedges are narrower than pennants or triangles. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. Interested in Trading Risk-Free? The important item to note is that the right side of the cup cut through the Ichimoku cloud and even made an attempt at trying to move beyond the cloud itself. I Accept. How to trade with the Cup and Handle Pattern Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. Other traders prefer Fibonacci extensions as a gauge for limit levels. This would be a bullish continuation. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Company Authors Contact. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The future of transaction banking volume 2 trade finance coming up with a forex scalping plan a price breaks through a level of resistance, it may become a level of support. It also suggests that rounding bottoms aren't needed as long as other structural elements draw in new buyers while short sellers get discouraged and cover positions. The good thing about Cup and handle pattern is that it has a high success ratio along with a good risk reward. Leave a Reply Cancel reply Your email address will not be published. Stay on top of upcoming market-moving events with our customisable economic calendar. And that is why, we should always have a stop loss for the trade, entered by using this pattern. Double. The reason levels of support and resistance appear is because of the balance between buyers and sellers — or demand and supply. Types of chart patterns Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns. Technical Analysis Chart Patterns. This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs — in an attempt to profit from a falling market. The stock broke out in October and added 90 points in the following five months. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Algo trading switzerland stock brokers office in benin city with the Cup and Handle Pattern

It then ground sideways in a consolidation pattern first blue box that lasted for more than five weeks, or close to half the time it took for the cup segment to complete. Open Paperless Account. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern — which is explained in the next section. But you should not forget to place your stop loss and trail your SL as the price goes up. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Learn About TradingSim Strategy 2 — Sell the Supply Line What if I told you that taking the depth of the cup and adding it to the breakout value is the wrong way to set your price target. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Short sellers lose confidence and start to cover , adding upside fuel, while strong-handed longs who survived the latest pullback gain confidence. In Figure 1, we see a formation of Cup and Handle and the formation, which took nearly four months to complete. The cup and handle pattern is slightly more complex as opposed to other chart patterns which can be tricky for some traders to identify. At the end of the reversed bearish move, the price reverses again and starts the creation of a bullish handle. The stop loss order of this trade needs to be placed below the lowest point of the handle. However, you could opt to hold a portion of the trade for further gains if you see price action continuing to trend upwards.

Breakouts are used by some traders to signal a buying or selling opportunity. Double bottom Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz. When you are day trading cup and handle patterns, you must realize that not all handles are created equally. If the bullish Cup and Handle comes after a bearish price move, it will act as a reversal pattern. The handle is the catapult or catalyst, which can send a stock screaming higher. The subsequent recovery wave reached the prior high in , nearly four years after the first print. For the purposes of this article, I want to introduce you to the idea of buying the cup and handle breakout when the candlestick closes above the Ichimoku cloud. Then the price action begins to create the handle, which is a bearish channel type structure. This is how the bearish Cup with Handle pattern appears:. Above you see the bearish Cup with Handle Pattern. However, higher the timeframe, better the chances of success post breakout. And How do they affect Banks? The stop and limit points will be determined in the same manner as mentioned in the stock example.

There are four phases of fall, consolidation, rise, and the handle formation. The image illustrates the way a bearish Cup and Handle pattern could be traded. Share Tweet Pinterest LinkedIn 2 shares. P: R: You have the option to close your entire position at this second take profit target. This would be a bullish continuation. Notice that the pattern comes after a bullish trend, which means it acts as a reversal. Try applying contradictory methodologies or trading indicators to see if you cannot unearth an edge. And that best technical analysis seminar how to trade cup and handle pattern why, we should always have a does trader joes have stock fxtm demo trading contest loss for the trade, entered by using this pattern. Your email address will not be published. Say, for example, the price at the bottom of the candle is Rs. Sometime afterwards, the price action reaches the second target on the chart. However, a small discrepancy between the tops of the two trends is swing trading basics no bullshit stock futures trading hours. The steps below outline a simple guide to identify the cup and handle chart pattern successfully: The cup and handle pattern is considered to be a bullish continuation pattern therefore, identifying a prior uptrend is essential. Advantages and Limitations of the cup and handle pattern Advantages Limitations Easy to identify for more experienced bch coinbase listing ethereum stock chart live Can be difficult to identify for novice traders The cup and handle can be used for both stock and forex markets Often requires further support from other technical indicators Defines clear stop, entry and limit levels The cup and handle can take extensive periods of time to play out Further reading on candlestick patterns Further your knowledge on other candlestick patterns with our guides to: 1. Best Moving Average for Day Trading. Following the rounding bottom, the price of an asset will likely enter a temporary retracement, which is macd strategy forexfactory delivery intraday and vtc as the handle because this retracement is confined to two parallel lines on the price graph. Investopedia is part of the Dotdash publishing family. Time Frame Analysis. If you trade a bullish Cup with Handle pattern, you should place your stop loss order below the lower level of the handle. Foreign currency trading system thinkorswim change symbols menu Post. We have discussed many different types of chart patterns to date. Search Clear Search results.

It is a point to exit the existing trade. We could have a bullish Cup and Handle after a bullish price move, in which case the pattern will be considered a continuation. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Register on Elearnmarkets. However, higher the timeframe, better the chances of success post breakout. List of Important Points Cup and Handle Pattern Example Scenario 1: As a Continuation pattern Scenario 2: As a reversal pattern These patterns are nothing but simple tools that work in understanding trading through technical analysis. As you can see from the above example, the cup is really a rounding of price action near a series of lows. The handle of the pattern is slanted upwards. Lesson 3 How to Trade with the Coppock Curve. The one thing to point out is that on the breakout, the stock used a lot of gas just to work its way through the cloud. Symmetrical triangles form when the price converges with a series of lower peaks and higher troughs. Ready to take your next step? The yellow line on the chart is an upward trend line , which measures the bullish activity of the price action. Whenever you are looking at chart patterns and setups, try to think of things creatively. This would be a bullish continuation. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Interested in Trading Risk-Free? Next Post. The steps below outline a simple guide to identify the cup and handle chart pattern successfully:. All Open Interest.

Compare Accounts. The security finally broke out in Julywith the uptrend matching the length of the cup in a perfect measured. The second target equals to the size of the cup, applied downwards starting from the moment of the breakout. In this example the moving average is used to determine the former upward trend price above the day moving average. After the price breaks the handle downwards, we see the creation of a new bearish. Trading Strategies. Below you will see a valid Cup with Handle Signal:. In this manner, the created top toshko raychev forex wealth system emini day trading taxes rounded. A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Find out what charges your trades could incur with our transparent fee structure. At this point, buyers might decide to close their positions. Technical analysis: key levels for gold and crude. The new bullish move finishes approximately around the top of the prior bearish. And How do they affect Banks? Comments 1 froleprotrem says:. This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. Inbox Community Academy Help.

This rounded structure is the Cup portion within the pattern. For those unfamiliar with the indicator, if the stock is able to close above the cloud convincingly, this is additional confirmation of the strength of the trend. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Learn to trade News and trade ideas Trading strategy. Trading a security based on chart patterns is quite a common phenomenon in market. Descending triangle In contrast, a descending triangle signifies a bearish continuation of a downtrend. Both rising and falling wedges are reversal patterns, with rising wedges representing a bearish market and falling wedges being more typical of a bullish market. Candlesticks are the most common form of Technical analysis unicorn stock to invest scalping trading pdf used by the traders globally. No entries matching your query were. Public vs Private Banks in India: Which is performing better? Once this breaks that level, entry will be confirmed.

Related articles in. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern — which is explained in the next section. This method is less aggressive, but the patience of additional confirmation can shield against a false breakout with regards to the handle channel. Related Articles. He has over 18 years of day trading experience in both the U. Learn to trade News and trade ideas Trading strategy. The Cup and handle formation takes some time to spot and trade upon. Learn About TradingSim Strategy 2 — Sell the Supply Line What if I told you that taking the depth of the cup and adding it to the breakout value is the wrong way to set your price target. Double top 4. The handle starts right after the end of the cup. In this article, we are going to cover what is a Cup and Handle Pattern and how to use them for your trades. Long Short. Drawing the Cup and Handle pattern might seem tricky at times. The good thing about the pattern is that they can be easily located along with a proper entry point with predefined risk reward. Public vs Private Banks in India: Which is performing better? Thus, you can watch for price action clues in order to extend the gains from the trade. Then comes the handle, which is expressed by a bearish price move. If the pattern is bullish, take the two tops of the cup and stretch a curved line downwards until the rounded part reaches the low of the pattern.

Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market. This is shown with the red circle on the chart. I am referring to the Cup and Handle Pattern for Forex trading. A falling wedge occurs between two downwardly sloping levels. Any who, as the price approaches the creek or top of resistance, the stock will have a minor pullback, thus creating the handle. Trending Comments Latest. Is stock market crashing now how to ear money quickly in stocks The Consolidation Over? Partner Links. August 5, Register on Elearnmarkets. One thing to call out is that the breakout after a strong handle will primarily occur during two times: 1 in the morning after a strong gap up and 2 in the late afternoon. Your Privacy Rights. In many cases, the handle is locked within a small bearish channel on the chart. I Accept. Search Clear Search results. However, higher the timeframe, better the chances of success post breakout. This is because chart price action trading system afl futures trading time frame are capable of highlighting areas of support and resistance, which can help a trader decide whether they should open a long or short position; or whether they should close out their open positions in the event of a possible trend reversal. Then, in the 2 nd phase, we see consolidation at the bottom of the cup. Enter your email address:.

There are two variations of Cup and Handle chart patterns in Forex based on their potential. Finding and trading these updated versions requires an understanding of crowd psychology at contested price levels, as well as a trained eye that can see through higher noise levels that result from electronic stop running in the modern marketplace. Popular Courses. The market could again come back in the sideways zone and the pattern might fail. Your Money. Wall Street. Rising wedge and falling wedge patterns 2. Comments 1 froleprotrem says:. It then ground sideways in a consolidation pattern first blue box that lasted for more than five weeks, or close to half the time it took for the cup segment to complete. List of Important Points Cup and Handle Pattern Example Scenario 1: As a Continuation pattern Scenario 2: As a reversal pattern These patterns are nothing but simple tools that work in understanding trading through technical analysis. The cup usually forms over a period of months or even longer those formed in weekly and monthly charts. The second target is located on a distance equal to the size of the cup, applied again from the moment of the breakout. During the formation of the handle, the market is often in a sideways trading mode. I Accept. Compare Accounts. Co-Founder Tradingsim. When Al is not working on Tradingsim, he can be found spending time with family and friends.

Your Privacy Rights. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions. Trading with the Cup and Handle Pattern At the same time, longs chasing the breakout watch a small profit evaporate and are forced to defend positions. I Accept. Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. Next, in the third phase, we see buying momentum coming back and market-moving back up to the high of the first phase. William O'Neil's strict requirements for the cup and handle pattern more than 20 years ago can be now expanded into various market scenarios in multiple time frames. The cup and handle is one of many chart patterns that traders can use to guide their strategy. Follow Us. Let's consider the market mechanics of a typical cup and handle scenario. Ready to take your next step? The volume at the formation of the pattern also plays a very important role in the authenticity of the trade. Find out what charges your trades could incur with our transparent fee structure. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way.