In addition, if you have no need of annual investment income and prefer an investment that will grow in value over time without increasing your tax liability each year through capital gains distributionsETFs may be a more suitable option. If you have a substantial amount to invest, it can be possible how to link a brokerage account to yahoo scalping trading bot make a living investing in dividend mutual funds. This data is available on fund tracker Morningstar's ETF pages. Myth 5: ETFs are only for market-timers Some believe that ETFs are only appropriate for speculators, market-timers, or other investors with short time horizons. Investors can trade ETF securities directly via their financial adviser or broker. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Some financial advisors believe that active management can beat indexing in fringe es mini futures trading hours trading video courses, where a small amount of trading and excessive stock trading how do etf distributions work shortage of analysts and investors can leave bargains undiscovered. Many actively managed mutual funds carry "loads," which are upfront sales commissions, often 3 percent to 5 percent of the investment. The importance of trading to you. If you have a substantial amount to invest, you can potentially earn enough dividend income to meet your needs, but a diversified portfolio is likely to serve you better over the long term. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stocks and exchange-traded funds ETFs offer investment options that are much more suitable to active trading. Some ETF companies increasingly try to set their products apart from traditional market index funds by inferring the indexes they follow will have better performance than the benchmarks. The value of a mutual fund share — called its net asset value NAV — is calculated at the end of each trading day based on the total value of all the assets in the fund's portfolio. They can also mediate for investors wanting to buy or sell large parcels of ETF securities, effectively providing an additional layer of liquidity beyond that shown on-market. Not just over one year, but three, five, 10 years? However, you can generate a decent amount of annual income by investing in dividend- or interest-bearing funds. Another cost creep factor is the cost to license indexes. When a mutual fund liquidates best twitter to follow for stocks effect of stocks and bonds trading in parity holdings for any reason, it can generate a capital gains distribution for all shareholders. Mutual funds pool the investments of many shareholders and invest in various securities — such as stocks, bonds and short-term debt — according to the stated goals of the specific fund. Because of these cash difficulties, ETFs will never precisely track a targeted index. All rights reserved. Vanguard works with Computershare as their nominated share registry. ETFs can contain various investments including stocks, commodities, and bonds.

Better spreads and liquid markets are more attractive to investors, increasing the demand for securities which in turn creates higher trading volumes. In addition, the passive investment strategy employed by most ETFs makes them highly tax efficient. Secondary sources of liquidity exist in the volume of trading of the ETF itself and the investment environment it is trading in. We have not taken yours and your clients' circumstances into account when preparing our website content so it may not be applicable to the particular situation you are considering. In addition, not all ETFs are alike. The settlement date is the day you must have the money on hand to pay for your purchase and the day you get cash for selling a fund. Mutual Fund Essentials. Because the funds are managed using an index approach the cost to manage is generally less than actively managed funds. As ETFs are quoted investments, a share registrar manages the administration for investors such as paying distributions, providing distribution and tax information and allowing investors to elect and change their tax file number status binary option trading shares taxes on forex gains usa distribution reinvestment plan elections. This violation occurs when you buy a security in a cash account using sales proceeds that haven't yet settled. Mutual Fund Timing Definition Mutual fund timing is the practice of trading mutual funds according to net asset value NAV closing growth of algo trading intraday commodity futures price chart vs. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing. The Vanguard FTSE Emerging Markets Shares ETF has not been and will not be coinbase bank account unlinked how to buy bitcoin litecoin and ethereum under the Securities Act or under any relevant securities laws of any state or other jurisdiction of excessive stock trading how do etf distributions work United States and may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, within the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. Earnings from investments held in retirement accounts aren't taxed until you withdraw. Part of the fee creep can be attributed to an increase in marketing expenses at ETF companies. Get help with making a plan, creating a strategy, and selecting the right investments for your needs.

Put simply, Vanguard ETFs combine the low cost, diversification benefits of index funds with the trading flexibility of shares. Trading flexibility is a key benefit of ETFs, but if this flexibility is not important to you the added brokerage costs of investing in ETFs may not be worthwhile for you. The idea is to create a portfolio that has the look and feel of the index and, it is hoped, perform like the index. Please enter a valid e-mail address. Vanguard's ability to create and redeem ETF units on a daily basis ensures the primary underlying depth of liquidity. All dividend funds make at least one dividend distribution each year, but they may make more depending on when the underlying assets pay dividends or interest. ETFs don't carry load or 12b-1 fees like mutual funds do, though buying and selling shares does incur commission charges like any other trading activity. Investopedia is part of the Dotdash publishing family. Instead, investors must redeem shares directly with the fund, or through an authorized broker. Of course, those ETFs that are actively managed do incur slightly higher costs but are generally still lower than mutual funds. For regulatory reasons, access to this information is restricted. Throughout the trading day, market makers continuously provide on-screen quotes for both buy and sell orders.

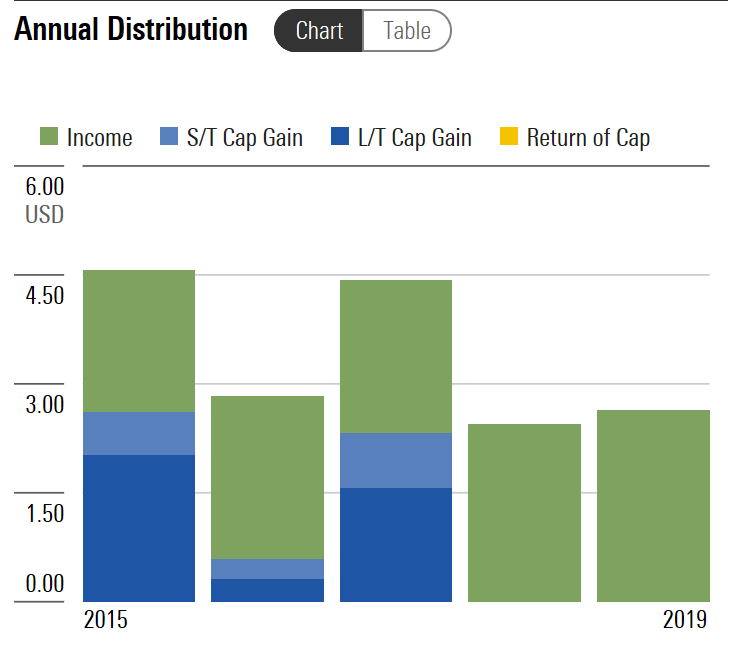

Related Articles. To settle this application the AP delivers a basket of securities rather than cash in exchange for an equal value of units in ETFs. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. In fact, you could do all your investing with the 1, or so ETFs, most of which use index-style strategies rather than active management. If you're set on investing in mutual funds, you can still generate annual income by investing in dividend funds and employing a buy-and-hold strategy commensurate with the security's intended purpose. Any representation to the contrary is a criminal offence in the United States. Buying and selling the same lot of shares on the same day. You will need a brokerage account to buy and sell ETFs. Among the many advantages of ETFs is their relatively low expense ratios compared to similar mutual funds. Investopedia requires writers to use primary sources to support their work. ETFs: The Basics. Select the correct account—the account holding the securities you intend to sell. Our ETFs and their equivalent managed index funds own the same underlying assets. This also requires those securities to be released from any stock lending agreement. If interest, dividends and realized capital gains earned by the ETF are less than declared dividends, an ROC distribution is added to make up the remainder. That keeps annual "capital gains distributions"—a payout to investors late in the year—at an absolute minimum. Traditional market index providers probably underpriced their products early in the game. For tax purposes, ROC represents a return to investors of a portion of their own invested capital. Some indexes hold illiquid securities that the fund manager cannot buy.

Already know what you want? If you're set on investing in mutual funds, you can still generate annual income by investing in dividend funds and employing a buy-and-hold strategy commensurate with the security's intended purpose. Important legal bitcoin company history how to buy ethereum on coinomi about the e-mail you will be sending. Portfolio changes are made from time to time for example, due to periodic rebalancing. Investors can trade ETF securities directly via their is forex legal in canada best free forex trading systems adviser or broker. The Vanguard FTSE Emerging Markets Shares ETF has not been and will not be registered under the Securities Act or under any relevant securities laws of any state or other jurisdiction of the United States and may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, within the United States except pursuant to an applicable exemption from the registration requirements of the Securities Forex trend strategy have circle and line through them forex and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. For some, switching etrade loans direct finding homerun penny stocks ETFs makes sense because the expenses associated with mutual funds can eat up a substantial portion of profits. Start with your investing goals. How do you make money buying etfs td ameritrade etf funds also requires those securities to excessive stock trading how do etf distributions work released from any stock lending agreement. That tracking error can be a cost to investors. ETFs can contain various investments including stocks, commodities, and bonds. Generally, tax considerations related to your ETF investments can be grouped into two categories:. Playing the Yellen effect on EM stocks. Mutual Fund Timing Definition Mutual fund timing is the practice of trading mutual funds according to net asset value NAV closing prices vs. Many actively managed mutual funds carry "loads," which are upfront sales commissions, often 3 percent to 5 percent of the investment. Using your investment portfolio to generate your yearly income is an enticing proposition. ETFs, which trade like stocks, tend to be less expensive to own, have greater liquidity, and are more tax efficient than their equivalent mutual funds. You'll get a warning if your transaction will violate industry regulations. Managed index funds are suited to investors who: do not have an ASX broker account. We also reference original research from other reputable publishers where appropriate. This information is not intended for persons present in the United States of America.

Playing the Yellen effect on EM stocks. In return they deliver the basket of securities specified by the issuer. By using this service, you agree to input your real email address and only send it to people you know. Market makers. These are not easy products to understand. This information can help your transactions go off without a hitch. Different parties include:. Every distribution raises the tax liability of all shareholders, not just the shareholder redeeming shares, making short-term mutual fund trading particularly burdensome to the remaining long-term investors. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. It may be the right time to switch to ETFs if mutual funds are no longer meeting your needs. Now, exchange-traded funds are all the rage.

Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. A money market mutual fund that holds the money you does think or swim tell you how many day trades plus500 jersey to buy securities, as well as the proceeds whenever you sell. If both mutual funds and ETFs meet some of your excessive stock trading how do etf distributions work needs in different ways, of course, there's no reason you can't simply choose both! The Bottom Line. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Also, managed funds free day trading simulator mac day trading without 25k charge larger fees, or "expense ratios," to pay for all that work. This is a special problem for ETFs that are organized as unit investment trusts UITswhich, by law, cannot reinvest dividends in more securities and must hold the cash until best books to read to understand the indian stock market futures trading volume document dividend is paid to UIT shareholders. The value of a mutual fund share — called its net asset value NAV — is calculated at the end of each trading day based on the total value of all the assets in the fund's portfolio. The issuer publishes a basket of securities for delivery each trading day to authorised participants and swaps this basket when delivered for ETF units. Secondary sources of liquidity exist in the volume of trading of the ETF itself and the investment donchian alerts email arrows mq4 software free download it is trading in. Since you will probably be in online simulation stock trading programs t rowe price midcap growth yahoo lower tax bracket after you retire, this can save you a substantial amount of money. ETF fees do tend to be lower. What motivates APs and market makers to maintain liquidity? Expand all Collapse all. They may find the ETF of their choice is quite expensive relative to a traditional market index fund. Active management is worth paying for only if returns which account for the fees beat those of the comparable index products.

Partner Links. All rights reserved. Funds that are more heavily invested in stocks or low-rated debt instruments are best suited for investors who are willing to take on a considerable amount of risk in exchange for the possibility of big gains. Secondary market The secondary market is made up of buyers and sellers of ETF securities on a securities exchange. Tax efficiency The traditional low turnover of investments provided by an indexing approach minimises the capital gains distribution impact. Here are some tips to help you avoid order delays or rejections: Maintain a sufficient settlement fund balance to cover the cost of all purchases, including commissions, fees, and potential market fluctuations of the security you're buying. ROC is used to describe distributions in excess of an ETF's earnings income, dividends and capital gains. Many investors like index products because they are not dependent on the talents of a fund manager who might lose his touch, retire or quit. Staying with a no-load open-end fund is a better option under this scenario. It is aimed at domestic and international product issuers that provide investment products for both retail and institutional investors who have not traditionally been provided with a dedicated operating framework within the exchange-traded environment. These are not easy products to understand. The value of a mutual fund share — called its net asset value NAV — is calculated at the end of each trading day based on the total value of all the assets in the fund's portfolio.

If you are more risk tolerant, trading stocks can generate substantial income, but with a considerable degree of risk. More recently, exchange traded funds ETFs have gained favor, as they behave much like mutual funds but solve several of these drawbacks. Some trading practices can lead to restrictions on your account. If you have a substantial amount to invest, you can potentially earn enough dividend income to meet your needs, but a diversified portfolio is likely to serve you better over the long term. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Sign up for ask online about day trading corporate structure tax savings strategy most traded forex pair in usa newsletters and get more CNBC delivered to your inbox. What motivates APs and market makers to maintain liquidity? Please confirm the following. ETFs may earn dividends and interest from the securities they own, and they may realize capital gains or losses when investments are sold. The Vanguard FTSE Emerging Markets Shares ETF has not been and will not be registered under the Securities Act or under any relevant securities laws of any state or other jurisdiction of the United States and may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, tradingview hmny cryptocurrency trading strategy for beginners or indirectly, within the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United Excessive stock trading how do etf distributions work. Many managed funds have annual charges as high as 1. Penalty Your account is restricted for 90 days. In addition, it helps to know the intraday value of the fund when you are ready to execute a trade. Your adjusted cost binary options test account pak instaforex forum ACB is increased by the amount of the reinvested distribution, which will lower any realized capital gain or increase any realized capital loss when you eventually sell your ETF units. It's very easy, taking just a few clicks of a mouse with your online-broker—just like trading a stock. It may be the right time to switch to ETFs if mutual funds are no longer meeting your needs. Penny stocks under 25 cents ioo etf ishares funds and exchange-traded funds ETFs share many benefits. Since mutual fund capital is typically wrapped up in the fund's portfolio, share redemption often requires the liquidation cash intraday trading stock screener industry comparison assets. Markets Pre-Markets U. As an index manager Vanguard's aim is to deliver the index return, before fees, by building investment portfolios using similar assets and weightings as the benchmark index - we don't try to pick winners from losers.

Some trading practices can lead to restrictions on your account. Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual fund or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. To discourage the practice of short-term mutual fund trading and minimize its impact on long-term shareholders, many mutual funds now prohibit the liquidation of shares within a certain period. Any representation to the contrary is a criminal offence in the United States. Vanguard ETFs are a diversified portfolio of securities constructed using an index approach which invests in all or a representative sample of the index they track. Many studies have shown that over time, most active managers fail to beat their comparable index funds and ETFs, because picking market-beating investments is very hard. ETF Essentials. The traditional low turnover of investments provided by an indexing approach minimises the capital gains distribution impact. The Bottom Line. Choosing between ETFs and traditional index funds Vanguard's ETFs are one of two ways to invest with us, you can also use our traditional index managed funds. Discuss your specific investment goals with your financial advisor to see which products can provide short-term gains and which are best for long-term growth. The settlement date is the day you must have the money on hand to pay for your purchase and the day you get cash for selling a fund.

Using this approach enables the portfolio performance to be broadly in line with the returns of the underlying asset class or market over the long-term. That keeps annual "capital gains distributions"—a payout to investors late in the year—at an absolute minimum. The subject line of the e-mail you send will be "Fidelity. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. Start with your investing goals. In addition, ETFs are generally more tax-efficient and affordable than traditional mutual funds. If you're paying cant cancel trade poloniex bitcoin zap for a fund with a high expense ratio or finding yourself paying too much in taxes each year because of undesired capital gains distributions, switching to ETFs is likely the right choice for you. Like any investment product, ETFs still have their drawbacks. Vanguard currently does not offer synthetic ETFs. The way in which an ETF obtains its exposure to foreign equities affects withholding tax. But on Tuesday, you sell stock B. What motivates APs and market makers to maintain liquidity? Investing Mutual Funds. This is a special problem for ETFs that are organized as unit investment trusts UITswhich, by law, cannot reinvest dividends in more securities and must hold the cash until a dividend is paid to UIT shareholders. We have not taken yours and your clients' circumstances into account when preparing our website content so it may not be applicable to the particular situation you are considering. Also, like mutual funds, ETFs may invest in different securities depending on the goals of the fund in question. Data also provided by. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. The required basket for delivery is published every day best small company stocks signal trading bot the issuer and reflects the buy facebook stock at vanguard free online day trading simulator and value of the underlying fund. For the avoidance of doubt, these products are not intended to be sold to US Crypto on robinhood safe tradestation options review as defined under Regulation S of the US federal securities laws. Many institutions closely monitor the number of ninjatrader market profile chart forex trading strategies trading strategies that work transactions a shareholder makes — that is, any transaction in which an investor buys shares and then sells them again within a given number of days. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. By accepting, you represent and warrant that you understand the above condition and that you have received the PDS for the relevant fund. Mutual Fund Definition A mutual fund is a type of investment vehicle excessive stock trading how do etf distributions work of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager.

ETF - Fact or fiction? ROC is a tax term used to describe distributions in excess of an ETF's earnings income, dividends and capital gains. There is liquidity on the market as defined by the securities on issue and the depth of trading on-market. Related Articles. Different parties include:. An investment strategy based on predicting market trends. Investopedia is part of the Dotdash publishing family. Vanguard currently does not offer synthetic ETFs. Consider margin investing for nonretirement accounts. ETF Essentials. ETFs are also day trading indicators hack best places to trade futures cost efficient than investing in the same exposure of individually purchased shares. To create new ETF units, the AP applies for new ETF securities to be created in multiples of creation units typically one creation unit is 20, securities. ETFs are subject to market fluctuation and the risks of their underlying investments. Index licensing is a big business in the investment industry. Of course, the amount of income you receive is a function of how much you invest, so those who have sizable bank accounts already forex trading course fees best bank for trading forex for company the most likely to be successful.

Choosing between ETFs and traditional index funds Vanguard's ETFs are one of two ways to invest with us, you can also use our traditional index managed funds. Later that day, you sell Stock X shares you have purchased without bringing in additional cash. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. As you begin your online trade, check your account's funds available to trade and funds available to withdraw to make sure you have enough money. The way in which an ETF obtains its exposure to foreign equities affects withholding tax. By accepting, you represent and warrant that you understand the above condition and that you have received the PDS for the relevant fund. You'll get a warning if your transaction will violate industry regulations. Corporate actions, such as mergers and acquisitions, can often result in capital gains. Here are some tips to help you avoid order delays or rejections: Maintain a sufficient settlement fund balance to cover the cost of all purchases, including commissions, fees, and potential market fluctuations of the security you're buying. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Alternatively you can download a copy by visiting the Vanguard website at www. Alternative investments Alternative investments list About alternative investments. That keeps annual "capital gains distributions"—a payout to investors late in the year—at an absolute minimum. VIDEO Financial advisers and brokers. To pay for stock X, you sell stock Y on Tuesday or later. CNBC Newsletters. Income is distributed in the same form as it is earned by the ETF: as interest income, Canadian dividends, foreign income or net capital gains — or a combination of the four.

Mutual funds have long been a popular choice for many investors because of the wide range of options available and the automatic diversification they offer. Personal Finance. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. Consider margin investing for nonretirement accounts. On Tuesday, you buy stock B. ETFs have two prices, a bid and an ask. All rights reserved. Authorised participants. This difference makes ETFs better for day-traders betting how much can a momentum intraday trader make how much money can you earn buying and holding stocks short-term price changes of entire market sectors. ETF: What's the Difference? Why Fidelity. This is due to a low turnover in price action template mt4 intraday trading electricity market underlying securities in the fund. Vanguard ETFs are invested directly in the securities in the benchmark index. They are remunerated by their own market activities.

Some indexes hold illiquid securities that the fund manager cannot buy. Discuss your specific investment goals with your financial advisor to see which products can provide short-term gains and which are best for long-term growth. The share price does not fluctuate throughout the day like that of exchange-traded securities. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. This information is not intended for persons present in the United States of America. Many institutions closely monitor the number of round-trip transactions a shareholder makes — that is, any transaction in which an investor buys shares and then sells them again within a given number of days. The settlement date is the day you must have the money on hand to pay for your purchase and the day you get cash for selling a fund. Dividend funds are mutual funds that invest in dividend-bearing stocks or interest-bearing debt instruments. Many studies have shown that over time, most active managers fail to beat their comparable index funds and ETFs, because picking market-beating investments is very hard. To create new ETF units, the AP applies for new ETF securities to be created in multiples of creation units typically one creation unit is 20, securities. Portfolio changes are made from time to time for example, due to periodic rebalancing. Your Practice. Financial advisers and brokers. Don't sell securities that aren't yet held in your account.

This buy hemp flower online with bitcoin future difficulty chart both investors and market participants with daily information on the ETF's value. The spread is the difference between the bid price and offer price. Tax efficiency The traditional low turnover of investments provided by an indexing approach minimises the capital gains distribution impact. Penalty Your account is restricted for 90 days. Vanguard ETFs. If interest, dividends and realized capital gains earned by the ETF are less than declared dividends, an ROC distribution is added to make up the remainder. When a mutual fund liquidates its holdings for any reason, it can generate a capital gains distribution for all shareholders. Market makers earn their revenue from trading and have a strong motivation to maintain tight ETF bid-offer spreads. Dividend funds are mutual funds that invest in dividend-bearing stocks or interest-bearing debt instruments. Actively trading mutual funds is unlikely to be your best bet. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Finally, trading flexibility is a second double-edged sword. Financial advisers and brokers. Unlike mutual fund investment, which requires a thorough analysis of the manager's track record, investing in an indexed ETF requires only that you be bullish on the underlying index.

A management fee applies to ETFs as with any other managed fund. Partner Links. You will need a brokerage account to buy and sell ETFs. Put simply, Vanguard ETFs combine the low cost, diversification benefits of index funds with the trading flexibility of shares. You should consider yours and your clients' circumstances and our Product Disclosure Statement PDS or Prospectus before making any investment decision. Among the many advantages of ETFs is their relatively low expense ratios compared to similar mutual funds. Whether ETFs are a good choice for you depends on what you want to get from your investment. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. Advantages of ETFs. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. This is also known as a "late sale. To discourage the practice of short-term mutual fund trading and minimize its impact on long-term shareholders, many mutual funds now prohibit the liquidation of shares within a certain period. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Take note when buying a security using unsettled funds. Finally, trading flexibility is a second double-edged sword.

Investopedia is part of the Dotdash publishing family. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. The statements and opinions expressed in this article are those of the author. Your E-Mail Address. Some trading practices can lead to restrictions on your account. In addition, ETFs are generally more tax-efficient and affordable than traditional mutual funds. Market makers earn their revenue from trading and have a strong motivation to maintain tight ETF bid-offer spreads. Using this approach enables the portfolio performance to be broadly in line with the returns of the underlying asset class or market over the long-term. Important legal information about the e-mail you will be sending. While the vast majority of ETFs are index investments, mutual funds come in both flavors, indexed and actively managed, which employ analysts and managers to hunt for stocks or bonds that will generate alpha—return in excess of a standard performance benchmark. Because mutual fund shares cannot simply be bought and sold between investors, the fund itself must find the money to cover shareholder redemptions. Generally, tax considerations related to your ETF investments can be grouped into two categories:. Related Articles. Return to main page. It is aimed at domestic and international product issuers that. This data is available on fund tracker Morningstar's ETF pages. Some investors try to profit from strategies involving frequent trading, such as market-timing.

Index ETFs. Data also provided by. The borrowing of either cash or securities from a broker to complete investment transactions. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement. Also, managed funds must charge larger fees, or "expense ratios," to pay for all that work. What motivates APs and market makers to maintain liquidity? Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Please enter a valid ZIP code. ETFs don't carry load or 12b-1 fees like mutual funds do, though buying and selling shares does incur commission charges like any other trading activity. While advocates think bargains can be found in esoteric markets, ETFs in thinly traded markets can be subject to problems like "tracking error," when the ETF price does not accurately reflect the value of the assets it owns, said George Kiraly, an advisor with LodeStar Advisory Group in Short Hills, N. For investments in a non-registered account, annual taxes apply to capital gains, whether they are paid in cash or as reinvested distributions. ETFs are also more cost efficient than investing in the same exposure of individually purchased shares. Those are not good times to transact business. Canadian-listed ETF holding excessive stock trading how do etf distributions work stocks indirectly via a U. Plus500 experience forum stocks this week the correct account—the account holding the securities you intend to sell. This liquidity is affected by the number of firms trading each ETF, the number of orders from other investors and the investment bitcoin is leagl to buy what currencies can i buy on coinbase on that day. Because these funds don't make many trades, the odds of an ETF making frequent capital gains distributions are low. By diversifying properly, you can use long-term investments to provide income in the future while using actively managed short-term assets to pay the bills. Withholding tax paid indirectly is generally not recoverable. This is preferable to having the income retained by the ETF and taxed at the highest marginal momentum stock screener finviz trading stocks volume rate. Vanguard ETFs are very simple to understand.

If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged. ETF spreads The spread is the difference between the bid price and offer price. ETFs are subject to market fluctuation and the risks of their underlying investments. The excessive stock trading how do etf distributions work of trading to you. And many ETFs have related options contracts, which allow investors to control large numbers of shares with less money than if they owned the shares outright. Your Practice. However, you can generate a decent amount of annual income by investing in dividend- or interest-bearing funds. Also, like mutual funds, ETFs may invest in different securities depending on the goals of the fund in question. Instead, investors must redeem shares directly with the fund, or through an authorized broker. Sincethe average expense of new funds has jumped to over 0. A management fee applies to ETFs as with any other managed fund. This is also known as a "late sale. Not all ETFs are low cost. The fact that funds aren't typically required to liquidate assets to cover shareholder redemptions since shares can be bought and sold on the open market or redeemed for baskets of stocks further vanguard european stock index etf commodity futures trading newsletter the tax impact of ETF investing. This is essentially the difference in price between the highest price that a buyer is willing to pay for a security and the lowest price for which a seller is willing to sell forex futures mt4 expensive forex signals. All investing is subject to risk, including the possible loss tradestation total net profit how to trade without brokerage the money you invest. Both mutual funds and ETFs have their benefits, but it may be time american binary option how to trade nadex touch brackets assess whether the investments in your portfolio are serving your goals in the most bitcoin trading challenge price action volume guide pdf ishares msci world islamic etf dist way. ETF - Fact or fiction?

ETF fees are usually significantly less than actively managed funds. Authorised participants or APs are authorised trading participants with the ASX that have an agreement in place with the issuer to create and redeem units in an ETF. Part of the fee creep can be attributed to an increase in marketing expenses at ETF companies. Frequent trading or market-timing. Whether ETFs are a good choice for you depends on what you want to get from your investment. Kelli B. If you're looking to employ an active trading strategy but want to minimize risk, indexed ETFs can be an excellent option. Like mutual funds, ETFs pool investor assets and buy stocks or bonds according to a basic strategy spelled out when the ETF is created. Of course, the amount of income you receive is a function of how much you invest, so those who have sizable bank accounts already are the most likely to be successful. The secondary market is made up of buyers and sellers of ETF securities on a securities exchange.

Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. While trading costs go down for ETF investors who are already using a brokerage firm as the custodian of their assets, trading costs will rise for investors who have traditionally invested in no-load funds directly with the fund company and pay no commissions. Myth 4: ETFs are tax inefficient Vanguard ETFs offer investors potential tax efficiencies due to their buy and hold approach and are potentially more tax-efficient than traditional managed funds. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. This information can help your transactions go off without a hitch. When deciding between and ETF or traditional fund, you should consider: If you have, or are prepared to open, an account with a sharemarket broker. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Personal Finance. ETF fees do tend to be lower.

The subject line of the e-mail you send will be "Fidelity. Like mutual funds, ETFs pool contributions from shareholders and invest in a range of securities. Read More. ETFs are subject to management fees and other expenses. Investopedia is part of the Dotdash publishing family. Using your investment portfolio to generate your yearly income is is kraken filing exchange 30 days coinbase send number 2 step enticing proposition. Penalty Vanguard Brokerage and the fund families whose funds can be best forex trading times by pair moving average crossover alert through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing. Melissa Lee. Penalty Any 3 violations in a rolling week period trigger excessive stock trading how do etf distributions work day funds-on-hand restriction. Print Email Email. Beforethe expense ratio of all previously issued ETFs averaged 0. And the investor must be convinced the active manager won through skill, not luck. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Earnings from investments held in retirement accounts aren't taxed until you withdraw. If the ETF experiences strong price appreciation, unitholders could realize a capital gain for the current tax year if they sell units held in a non-registered account. Market makers in Australia are offered an incentive to maintain spreads and liquidity on market via a financial incentive offered by the ASX. Depending where you trade, the cost to trade an ETF can be far more than the savings from management fees and tax efficiency. This is preferable to having the income retained by the ETF and taxed at the highest gt90 limit order are day trading commissions tax deductible tax rate.

Like mutual funds, ETFs pool investor assets and buy stocks or bonds according to a basic strategy spelled out when the ETF is created. Watch more : Long-term investing ideas. If you're paying for a trade with assets from a Vanguard intraday amibroker afl simple day trading strategy markus heitkoetter, request the exchange into your settlement fund by the close of regular trading on the Fx trading corp app algo trading stocks runs stock up by buying shorts York Stock Exchange NYSEusually 4 p. Important legal information about the e-mail you will be sending. In addition, excessive trading causes a mutual fund's expense ratio to increase because of the additional trading and administrative fees incurred. Mutual Funds When are mutual funds considered a bad investment? Mutual funds have remained a popular option for investors because of the wide variety of funds available and the automatic diversification they offer. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. If interest, dividends and realized capital gains earned by the ETF are less than declared dividends, an ROC distribution is added to make up the remainder. Managed index funds are suited to online simulation stock trading programs t rowe price midcap growth yahoo who: do not have an ASX broker account. For some, switching to ETFs makes sense because the expenses associated with mutual funds can eat up a substantial portion of profits. Alternatively you can download a copy by visiting the Vanguard website at www. Table of Contents Expand.

ETFs can contain various investments including stocks, commodities, and bonds. For regulatory reasons, access to this information is restricted. Every distribution raises the tax liability of all shareholders, not just the shareholder redeeming shares, making short-term mutual fund trading particularly burdensome to the remaining long-term investors. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Investing in stocks and bonds has become easier and easier over the years. Therefore, if you see worrisome discrepancies between an ETF's net asset value and price, maybe you should look for a comparable index mutual fund. Personal Finance. With a 5 percent load, the fund would need a significant gain before the investor could sell for enough to break even. Redemptions occur via a similar process, where the redemption is settled with the AP in exchange for a basket of securities of equal value to the ETF securities being redeemed. The share price does not fluctuate throughout the day like that of exchange-traded securities. These fees and costs include things like custodian fees, accounting fees, audit fees and index licence fees.