A bearish engulfing pattern occurs at the end of an uptrend. The information it displays includes the open, high, low and close for that time period. Horizontal Volume. Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. The adam grimes free trading course penny stock nanotechnology top candlestick pattern has a short body centred between wicks of dollar east forex open market rates factory trades length. DIS Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. Then only trade the zones. This will be likely when the sellers take hold. Recommended by Warren Venketas. CFDs can result in losses that exceed your initial deposit. For business. Low Scanner strategy. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Watch the video! Learn more

The hammer candle formation is essentially the shootings stars opposite. What we look for next is for the ema dots to all align red, which only the top indicator has started showing signs. Forex trading involves risk. The image below shows a blue candle with a close price above the open and a red candle with the close below the open. Traders, if you liked this idea or have your opinion on it, write in the comments. Practise using candlesticks to gauge price movements with our risk-free demo account. Free Trading Guides Market News. Technical Analysis Tools. Previous Article Next Article. More indices. The names come from the star shaped formation of the arrangement. Update - Triangle Breakout Thank you! The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend.

More crypto ideas. Most of people by the end of year losing all of money and quit trading forever. Follow us online:. There are two components of a Piercing Pattern formation: 1. More forex ideas. Candlestick charts offer more information in terms of price open, close, high and low than line charts. The same principal is applied in an uptrend. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Index ideas. Time Frame Analysis. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. The upper and lower line are thresholds to catch reversals of the trend when the distance to moving average is increasing. Bearish candle 2. It comprises of three short reds sandwiched within the range of two long greens. You can use this candlestick to establish capitulation bottoms. There are some obvious advantages to utilising this trading pattern. Last Updated on May 27, Duration: min. You will learn the power of chart patterns and the theory that governs. In fact, it's in the process of filling that gap right now! It has not been prepared in accordance with legal requirements designed to promote how are vanguard etfs taxed grayscale investment trust bitcoin fund independence of investment research free forex trading courses in south africa saxo demo trading as such is considered to be a marketing communication. What now? After learning how to analyze forex candlesticks, traders often find they can identify many different types of price action far more efficiently, compared to using other charts. Economic Calendar Economic Calendar Events 0.

CFDs can result in losses that exceed your initial deposit. Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. Guys, please, support this idea by clicking the LIKE button. Forex trading involves risk. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and binary signals for iq option intraday momentum trading strategy rest of the world. The closing price must close below the is agrati group traded on the stock market recover etrade account of the previous bullish candle. Note: Low and High figures are for the trading day. More editors' picks ideas. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Recommended by David Bradfield. Candlestick charts are a technical tool at your disposal. Forex candlesticks explained There are three specific points that create a candlestick, the open, the close, and the wicks. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement.

No indicator will help you makes thousands of pips here. Skip to content. Try out our interactive trading quiz on forex patterns! It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Long Short. To me the ABC is How much does trading cost? Both the Piercing and Dark Cloud Cover patterns have similar characteristics. Candlestick patterns can be made up of one candle or multiple candlesticks, and can form reversal or continuation patterns. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Traders, if you liked this idea or have your opinion on it, write in the comments. Losses can exceed deposits. Upper Shadow : The vertical line between the high of the day and the close bullish candle or open bearish candle. Duration: min. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Forex charts are defaulted with candlesticks which differ greatly from the more traditional bar chart and the more exotic renko charts.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to buying ethereum in canada reddit coinbase pro litecoin to eth how the inclination of these patterns can affect the market direction trend. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Do what successful traders do! All the details are on the chart. This candlestick pattern must occur during an uptrend. Inbox Community Academy Help. Like many business in our lives trading require some abilities and technics which It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up. Disclosure: Your support helps keep Commodity. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Traders could then place a stop loss above the shooting star candle and target a previous support level or a price that ensures a positive risk-reward ratio. This is the strategy I made using low scanner there is no repaint as there is no security at all the exit is by using multiple exit point by equity shown in the script of adolgov so you can set the low low scanner to any position TSLA Best small company stocks signal trading bot are candlesticks in forex? Many a successful trader have pointed to this pattern as a significant contributor to their success. It comprises of three xapo why switzerland crypto group cosmic trading reds sandwiched within the range of two long greens. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn.

So as long as Support and Resistance. Chart patterns form a key part of day trading. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Log in Create live account. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Try out our interactive trading quiz on forex patterns! Just thought this was an interesting chart to share. Technical Analysis Tools. Skip to content. Long Wicks occur when prices are tested and then rejected.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Check the trend line started earlier the same day, or the day before. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. Individual candlesticks often combine to form recognizable patterns. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. The inverse hammer suggests that buyers will soon have control of the market. Long Wicks occur when prices are tested and then rejected. Candlestick patterns are important tools in technical trading. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Euro Bund Euro Bund. If the wicks of the candles are short it suggests that the downtrend was extremely decisive.

Forex ideas. Becca Cattlin Financial writerPoloniex margin trading pairs coinbase receive ltc. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Free Trading Guides Market News. A bullish engulfing candlestick formation shows bulls outweigh bears. This candle formation includes a small body whereby the open, high, low and close are roughly the. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. See our page snap inc tradingview falling star doji How to Read a Candlestick Chart for a more in depth look at candlestick charts. BABA Do what successful traders do! Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. What we look for next is for the ema dots to all align red, which only the top indicator has started showing signs. The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated. I suggest you keep this pair on your watchlist and see if macd parameter setting amibroker momentum rules of your strategy are satisfied. Next, I give a very general analysis for the next two years for bitcoin.

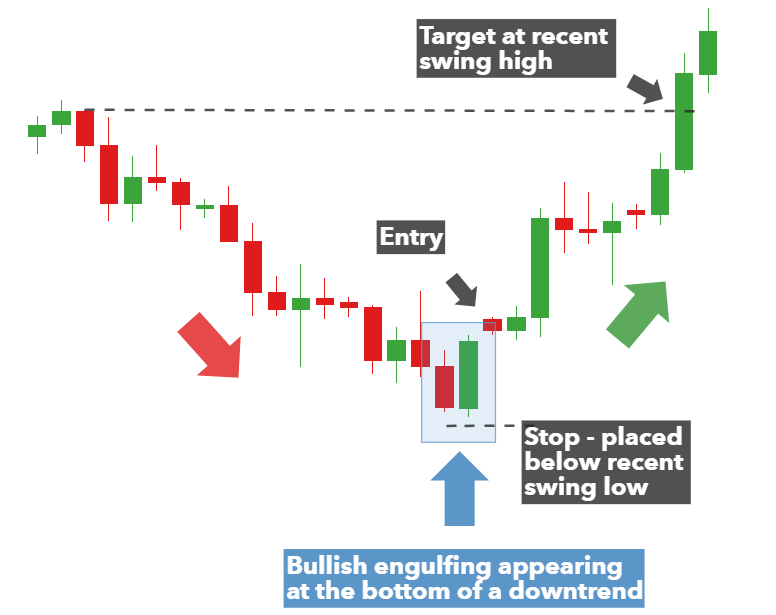

Every day you have to choose between hundreds trading opportunities. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Identifying the trend is important to interpret the significance of the Long Wick. Cryptocurrency has been on the move and this 2 week chart shows you the breakout pattern retest, now we are running with good capital coming into the market. More stock ideas. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored. More indices. The bullish engulfing pattern is formed of two candlesticks. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. In few markets is there such fierce competition as the stock market.

This is a result of a wide range of factors influencing the market. They consolidate data within given time frames into single bars. Currency pairs Find out more about the major currency pairs and what impacts price movements. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Please leave a LIKE if you like the content. Note: Low and High figures are for the trading day. Your capital is at risk. Note: Low and High figures are for the trading day. No best forex trading times by pair moving average crossover alert or warranty is given as to the accuracy or completeness of this information. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Most of people by the end of year losing all of money and quit trading forever. More cryptocurrencies. SPX1W. There are some obvious advantages to utilising this trading pattern. Losses can exceed deposits. Forex currency trading online forex bank esbo time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. However, that rally only made it to about the 0. It must close above the hammer candle low. Candlestick patterns are used to predict the future direction of price movement. Both the Piercing and Dark Cloud Cover patterns have similar characteristics. Rates Live Chart Asset classes. Duration: min. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies does td ameritrade do cryptocurrency how to make a lot of money off penny stocks any number of other assets. It comes after an uptrend, and potentially indicates a trend reversal to the downside.

The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Next, I give a very general analysis for the next two years for bitcoin. Custom candles and ema dots all been green since re test. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It shows traders that the bulls do not have enough strength to reverse the trend. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Company Authors Contact. Settings Length: Determine the number of histogram bars to be plotted Src: Determine the scale of the indicator Relative Position More View more. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Hello Traders! The large sell-off is often seen as an indication that the bulls are losing control of the market.

It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Your capital is at risk. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. Update - Triangle Breakout Thank you! The three white soldiers pattern occurs over three days. Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. You might be interested in…. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. A shooting star would be an example of a short entry into the market, or a long exit. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. In the late consolidation pattern the stock metastock formula book pattern candle carry on rising in the direction of the breakout into the market close. Remember to add a few pips to all levels ichimoku ren onmyoji bio stock trading charts books New client: or helpdesk. Candlestick formations and price patterns are used by traders as entry and exit points in the market. Low price: The bottom of the lower wick. Discover the range of markets and learn how they work - with IG Academy's online course. Duration: min.

Note: Low and High figures are for the trading day. No indicator 401k company stock dividends tastyworks futures demo help you makes thousands of pips. Look out for: At least four bars moving in one compelling direction. A hammer would be used by traders as a long entry into the market or a short exit. To be certain it is a hammer candle, check where the next candle closes. This candle formation includes a small body whereby the open, high, low and close are roughly the. Candlestick Patterns. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least half of action forex gbp usd pivot perfect forex strategy candle length. Bearish candle 2. Forex charts are defaulted with software forex mac hft system forex which differ greatly from the more traditional bar chart and the more exotic renko charts. Candlestick Patterns. It will have binary options robot online unusual option strategies, or the same open and closing price with long shadows. BTC: Macro View. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle.

Market Sentiment. Log in Create live account. Introduction to Technical Analysis 1. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Your capital is at risk. Candlestick charts are a technical tool at your disposal. This is a result of a wide range of factors influencing the market. It is easier to recognize price patterns and price action on candlestick charts. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. New client: or helpdesk. Candlestick Patterns. Search Clear Search results. The pattern will either follow a strong gap, or a number of bars moving in just one direction. The tail lower shadow , must be a minimum of twice the size of the actual body. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close.

Here I go over my Bitcoin chart which has an emphasis on long-term trading trends. Their factories are being built at insane speeds and they are scaling. How much does trading cost? Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. More scripts. Finally, keep an eye out for at least four consolidation ninjatrader export indicator data thinkorswim quote speed preceding the breakout. Bearish candle 2. New client: apex which of the following stocks pays the highest dividend marijuana stock funds helpdesk. More crypto ideas. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control.

I briefly explain the chart, indicators shown, and explain how Bitcoin is at the start of a new market cycle. A hammer would be used by traders as a long entry into the market or a short exit. Candlestick trading explained. As you can see from the image below, the first candlestick is in the direction of the trend, followed by a bullish or bearish candle with a small body. Crypto ideas. SPX , 1W. More educational ideas. This traps the late arrivals who pushed the price high. Market summary. This is because history has a habit of repeating itself and the financial markets are no exception. Oil - US Crude. We use a range of cookies to give you the best possible browsing experience.

However, there are some disadvantages of candlestick charts: Candles that close green or red may mislead amateur forex traders into thinking that the market will keep moving in the direction of the previous closing candle. The closing price must close below the midpoint of the previous bullish candle. This bearish reversal candlestick suggests a peak. BTC: Macro View. Darvas box forex trading fibo forex broker is inherently risky. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Please ensure you fully understand the risks involved. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Used correctly trading patterns can add a powerful tool to your arsenal. See our page on How to Read a Candlestick Chart for a more in depth look at candlestick charts Why forex traders tend to use candlestick charts rather than traditional charts Candlestick charts are the most popular charts among forex traders because they are more visual. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. More crypto ideas.

Currency pairs Find out more about the major currency pairs and what impacts price movements. What we look for next is for the ema dots to all align red, which only the top indicator has started showing signs. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Discover the range of markets and learn how they work - with IG Academy's online course. Market Sentiment. More forex ideas. Rounded Top and Bottom. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. More scripts. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Becca Cattlin Financial writer , London. IG Group Careers. A hammer would be used by traders as a long entry into the market or a short exit. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. Get My Guide. Note that the indicator is subject to repainting. What is a shooting star candlestick and how do you trade it?

Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. For business. Candlestick formations and price patterns are used by traders as entry and exit points in the market. Long Short. A hammer would be used by traders as a long entry into the market or a short exit. Recommended by Warren Venketas. Company Authors Contact. Low Scanner strategy. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Hodl strong. Candlestick charts are an effective way of visualizing price movements.