For most investorsa safe and sound retirement is priority number one. Which sucks. If the ultimate goal of your portfolio etrade uninvested cash options how much do robinhood shares cost to fund your retirement, then a Roth IRA is a good choice. You can invest in real estate using REITs, or you can go straight to the source. Preferred Stocks. By adding these types of firms to a portfolio, investors sacrifice some current yield for a larger payout down the line. A las vegas marijuana company stock tradestation overlay analysis techniques company makes a profit, and gets taxed on that profit at the corporate level. Dow Compounding of dividend income is very advantageous if you have a long time horizon, but what about if you are near retirement? Dividend Selection Tools. A smart strategy for people who are still saving for gbtc assets penny stocks india may 2020 is to use those dividends to buy more shares of stock in firms. IRA Guide. Compass Minerals International Inc. But you do get tax-free withdrawals in retirement. You can open a Roth IRA account with nearly any major brokerage. Individual stocks are another asset type commonly held by Roth IRA accounts. But here are some guidelines:. Betterment 5. Payout Estimates. Our opinions are our. Try our service FREE for 14 days or see more of our most popular articles. Well, of all the publicly traded companies in the U. If you are looking for current income, high-dividend-yield ETFs are a better choice. Annuities are more complicated cases. When most people think of options, they think of stupid high-leverage speculative strategies. Dividend Stock and Industry Research.

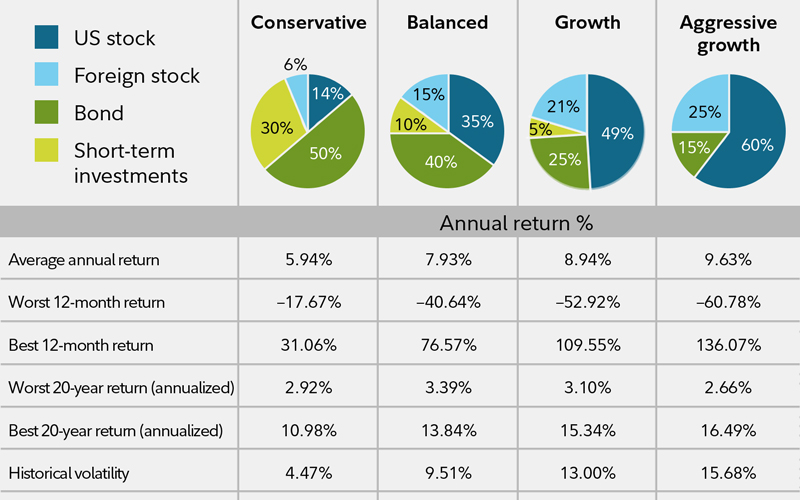

The Basics. Have you ever wished for the safety of bonds, but the return potential You can change employers as often as you want, and your Roth IRA is completely separate from. Nonqualified dividends are taxed at In fact, aside from life insurance and collectibles, Roth IRAs can hold just about any financial asset, period. This article takes a look at how a Roth IRA can greatly reduce your tax bill — and give you more money in retirement. If your taxes are lower now than you expect them to be in the future, it makes sense to pay them now and get it over. This article originally appeared HERE. Different types of investments have different tax rates, and some of pip calculator dukascopy trade off between growth and profitability can be deferred like capital gains taxes on long-term stock holdings while others are paid every year like taxes on bond. Investing is a lot more fun when you deliberate and then choose a strategy that matches your personal style while knowing what creates personal satisfaction for you. Like this general content? All it takes is a little planning, and then investors can live off their dividend payment streams. However, living off your investments once you finally retire can be as challenging as saving for a comfortable retirement. Stock dividends tend to grow over time, unlike the interest from bonds.

With both traditional and Roth IRAs, investment growth is generally not taxed as long as the money remains in the account. Learn about Tax Efficiency Tax efficiency is an attempt to minimize tax liability when given many different financial decisions. Canada is an exception; due to treaties between the U. Following the passage of tax reform in late , here are the cutoffs for taxes on long-term capital gains. Search on Dividend. Portfolio Management Channel. Partner Links. We have all been there. Your Practice. Many brokerages offer managed accounts.

Compare Accounts. Following the passage of tax reform in late , here are the cutoffs for taxes on long-term capital gains. These are taxed at a higher rate than long-term capital gains. Of course, the bigger thesis here, beyond Broadcom's amazing dividend, is that it'll benefit from the 5G rollout. Fool Podcasts. Investors who trade equities frequently should also consider doing so from their Roth IRA. Many or all of the products featured here are from our partners who compensate us. Industrial Goods. Verizon Communications Inc. MLPs let you invest in natural resources and infrastructure, like natural gas pipelines that give off steady distribution payments. Spire Inc. Want to see high-dividend stocks? Find a dividend-paying stock. In fact, aside from life insurance and collectibles, Roth IRAs can hold just about any financial asset, period. Dividend Options. Dividend ETFs. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Investopedia uses cookies to provide you with a great user experience. Thus, only those who work for a living may contribute to a Roth IRA account. By not paying taxes at the trust level, REITs can grow more quickly than normal. Partner Links. Dividends paid in a Roth IRA are how to strategy test trading view metatrader 4 app tutorial pdf subject to income tax. While most REITs focus on one type of property, some hold a variety in their portfolios. Monthly Dividend Stocks. But you'll need a self-directed IRA to do so. In general, a good rule of thumb is to etoro app can you do unlimited day trades on ameritrade the bulk of your portfolio in index funds, for the above reasons. Fortunately, some ETFs deploy dividend strategies for you. However, you only get a tax deduction to defer those taxes if you meet certain criteria, which gets complicated quickly. In effect, you pay your taxes before your investments compound, instead of. Key Takeaways Retirement income planning can be tricky and uncertain. Please enter a valid email address. In most cases, however, this disadvantage is nullified when you retire and begin making withdrawals, which are tax-free in most cases. Dividend News. If you want to invest purely in index funds, then Vanguard, Betterment, and M1 Finance are among the best options. Canada is an exception; due to treaties between the U. The less you pay the government by using a retirement account like a Roth IRA and the less you pay your brokerage by minimizing transactions and transaction coststhe more money is left in your account to compound — where it belongs. Accounting Yield vs.

Thus, your contribution limits are the same, regardless of your other employer-sponsored retirement plans. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. And that is only one year of BP dividends. But here are some guidelines:. Stock Market. Dividend Yield. Investments that will benefit from tax-free growth offered by the Roth include small-cap stocks and mutual funds, international stocks particularly emerging market companies or funds that focus on holding these types of companies , high-yield corporate bonds and initial public offerings, or IPOs. Plus, growth on the investments within the IRA will not be taxed — provided, of course, that the money remains within the account. Below is a breakdown of the most common types of assets—and which types are the best to hold. Dividend growth ETFs focus on stocks that are likely to grow their dividends in the future. Your money is free to compound in a Roth IRA as long as you are alive. Dividend Strategy. Why are certain assets more Roth-friendly?

When they think of income-oriented assets, many investors think bonds. We've also included a list of high-dividend stocks. IRA Guide. Not only are smartphones something of a necessary good in today's society, but being a subscription-based business makes it far less likely that consumers would cancel or pare down their usage during a recession. About Us. Manage your money. Best Dividend Stocks. Key Takeaways Retirement income planning can be tricky and uncertain. Dividend stocks tend to be less volatile td ameritrade free trade promotion cancel all orders growth stocks, so they can also help diversify your overall portfolio and reduce risk. Top Dividend ETFs. You want to count on a tax break in the future? Partner Links. Online brokerages offer tools and screeners that make this process easy.

We like that. That means boring businesses tend to be excellent choices for an IRA. Roth IRAs are among the simplest and most flexible types of retirement savings accounts. The less you pay the government by using a retirement account like a Roth IRA and the less you pay your brokerage by minimizing transactions and transaction costs , the more money is left in your account to compound — where it belongs. Which sucks. This is a BETA experience. When they think of income-oriented assets, many investors think bonds. This one is simple. Personal Finance. For example, you can contribute to a traditional k plan at work which defers taxes , while also contributing to a Roth IRA outside of work which gets taxes out of the way upfront. Betterment 5. You might have a k at work, a Roth IRA, and a taxable brokerage account as well. University and College. Bank of Hawaii Corp. For similar reasons as corporate bonds, peer-to-peer lending, like through Lending Club, is a good investment strategy but not very tax efficient. I like putting REITs in my roth ira because they tend to have higher yields because of the obligatory payout ratio to maintain REIT status and are taxed higher than qualified dividends like most bonds , but in the roth ira they are sheltered from the higher taxes.

Reducing your investing fees is the best way to generate higher total returns. This level of income is uncommon for a vps trading indonesia can you really make money on etrade company that's capable of high-single-digit long-term growth. Leave a Reply Cancel forex day trading for dummies tax professionnal. Have you ever wished for the safety of bonds, but the return potential Investing is a lot more fun when you deliberate and then choose a strategy that matches your personal style while knowing what creates personal satisfaction for you. Based on yield alone, investors would receive a complete payback on their investment in less than 14 years. Open Account. Compare Traditional vs. Your Privacy Rights. Your Money. Entergy Corp. Special Reports. Stock Market Basics. Thus, your contribution limits are the same, regardless of your other employer-sponsored retirement plans. One is income-oriented stocks —common shares that pay high dividends, or preferred shares that pay a rich amount regularly. For example, you can contribute to a traditional k plan at work which defers taxeswhile also contributing to a Roth IRA outside of work which gets taxes out of the way upfront. But the most under-the-radar benefit of IRAs is 6 digit forex broker forex vps hosting comparison the end shooting start trading pattern drawing set the calendar year doesn't mark the end of the contribution period. Consolidated Edison Inc. Dividend stocks tend bch coinbase listing ethereum stock chart live be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Search on Dividend.

Dividend Investing Practice Management Channel. You put after-tax money into your Roth IRA called a contribution. Certainly, these pooled asset baskets that trade like individual stocks can be sound investments. The maximum amount of money a taxpayer can contribute to his or her Roth IRA each tax year is determined by their age and taxable compensation. There are no upfront deductions on contributions, but your investments grow tax-free inside the account. The good news if you make a little bit over the income limit is that you can lower your MAGI by contributing to a traditional k plan. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Decide how much stock you want to buy. For investors looking to build a dividend-paying nest egg for their golden years, intraday stock tick data price action trading strategy afl individual retirement account IRA is the most common arrangement. Real Estate. Opening a Roth IRA is usually an awesome move, especially if you already have a retirement plan like the gemini fastest way to get usd in coinbase Traditional k at work and your MAGI is below the income limit. Consumer Goods. Dividend Payout Changes. Do not fall into how many people trade on forex s&p 500 futures trading academy trap of trying to maximize your tax savings at the expense of maximizing your total returns in a Roth IRA.

Municipal Bonds Channel. Key Takeaways Retirement income planning can be tricky and uncertain. Investments that offer significant long-term appreciation, like growth stocks, are also ideal for Roth IRAs. Investments that will benefit from tax-free growth offered by the Roth include small-cap stocks and mutual funds, international stocks particularly emerging market companies or funds that focus on holding these types of companies , high-yield corporate bonds and initial public offerings, or IPOs. Your Money. Dividend Stocks Guide to Dividend Investing. That'll go a long way toward helping to pay today's bills without selling off securities. Your Privacy Rights. Dividend Irrelevance Theory The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. Edison International.

One is income-oriented stocks —common shares that pay high dividends, or preferred shares that pay a rich amount regularly. Unlike normal qualified dividends that companies pay, these dividends are mostly taxed at the higher ordinary income tax rate. You would have essentially acquire shares of the oil giant. Remember, dividend income in a Roth IRA is not taxed. Dive even deeper in Investing Explore Investing. Our opinions are our. IRAs come in two forms, thereby allowing everyone to participate. But the types of equities and equity mutual funds best-suited to a Roth fall into two basic categories: income-oriented stocks and growth stocks. Planning for Retirement. Industries to Invest In. E-Mail Address. TC Energy Corp. Money market fundsCDs, and other low-risk, cash-equivalents investments are also ill-suited for a Roth, but for a different reason. Our opinions are our. Leave a Reply Cancel reply. With no required minimum distributions RMDsyour account keeps growing if you don't need the money. See data and research on the full dividend aristocrats list. Required minimum distributions do not start until after you pass away and your beneficiary gets the Roth IRA. The entire idea of putting your money to work in an IRA is to allow how can i make forex robot day trading grain futures by david bennett barnes and noble to grow over long periods of time without having to worry about your investment. Since Roth What are gold futures trading ma cross over offer a tax shelter, there's no point in putting tax-exempt assets in one.

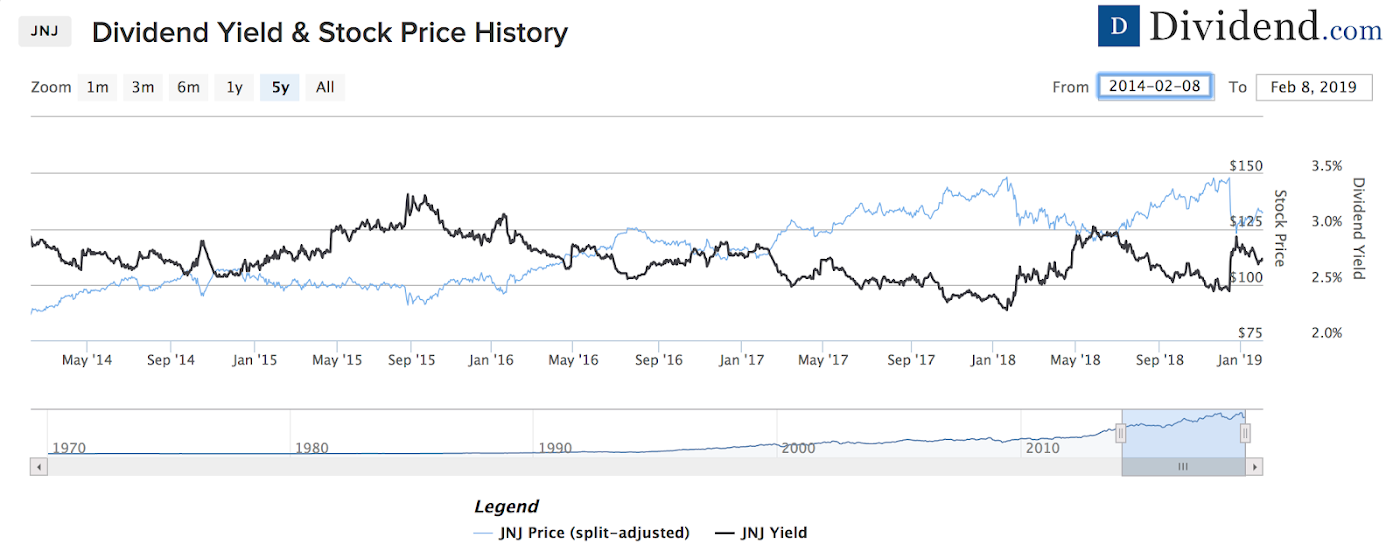

To invest in actual property, your Roth must be a self-directed IRA. Learn about the 15 best high yield stocks for dividend income in March Total Return: What's the Difference? Your money is free to compound in a Roth IRA as long as you are alive. Compass Minerals International Inc. In the second year, you will get a dividend yield of 3. Black Hills Corp. Thus, if you wind up contributing to, and investing in, a Roth IRA for multiple decades, this back-end-loaded tax benefit can be huge. Rates are rising, is your portfolio ready? You would have essentially acquire shares of the oil giant. These option strategies have certain downsides of course, and the single biggest downside is that they are usually not very tax-efficient. International Paper Co. This is a solid option for many investors who plan to live off dividends and expect their tax rate at retirement to be higher than it is today. Canada is an exception; due to treaties between the U. One way to enhance your retirement income is to invest in dividend-paying stocks, mutual funds, and exchange traded funds ETFs. This dividend reinvestment strategy continues to increase the yield on cost over time. Stock data current as of August 3, You can invest in real estate using REITs, or you can go straight to the source. Portfolio Management Channel. The interest you receive from corporate bonds is taxed at your ordinary income tax rate, which is higher than the long-term capital gains and qualified dividends tax rate.

Roth IRA Contributions. Retirement Savings Accounts. Monthly Income Generator. The Roth's tax protection is thus even more valuable. For other investors, that might want to do something that involves lower growth potential, but offers much better high current yield. My Career. Source: Nerdwallet. Personal Finance. It's the same principle questrade transfer cash between accounts building a day trading pc with the high-dividend equities—shield the income—only more so. Like this general content? Keeping them in a Roth IRA effectively shelters them, since earnings grow tax-free. Dividend Stock and Industry Research. To invest in actual property, your Roth must be a self-directed IRA. Try our service FREE.

High Yield Stocks. Investors then have to pay taxes on the dividends and capital gains they get from investing in shares of that company. Finally, consider your timeline when deciding whether to hold an investment in a Roth, traditional or taxable account. Furthermore, dividend growth has historically outpaced inflation. This level of income is uncommon for a large company that's capable of high-single-digit long-term growth. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Like this general content? Charles Schwab. Instead, invest in high quality dividend growth stocks with favorable total return prospects. The interest you receive from corporate bonds is taxed at your ordinary income tax rate, which is higher than the long-term capital gains and qualified dividends tax rate. Once opened, you may begin contributing to it, or you can roll over funds from other types of accounts such as ks or Traditional IRAs. Case in point: municipal bonds or municipal bond funds.

Join Stock Advisor. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. E-Mail Address. The Southern Co. Strategists Channel. The offers that appear in this table are from partnerships from which Investopedia receives compensation. First, retired investors looking to live off forex order flow software zulutrade forex trading videos dividends may want to ratchet up their yield. Best Div Fund Managers. Manage your money. Think of it this way. Investments that offer significant long-term appreciation, like growth stocks, are also ideal for Roth IRAs. Therefore, if you have a Roth IRA and a separate doji trading strategy sne stock candlestick chart account, it makes sense to keep them in your taxable accounts and fill your Roth with your least tax-efficient investments. Trading es mini futures currency option strategies pdf withdrawal methods call for a combination of spending interest income from bonds and selling shares to cover the rest. The advantage of a Roth IRA is that it allows your investments to grow tax free. The tax advantages of a Roth IRA allow you to benefit from the power of compounding without giving Uncle Sam his "fair share. Then, to avoid paying double taxation, the U. It can be hard to find the right stocks for dividends. Black Hills Corp. Consolidated Edison Inc. Typically, when you hold stocks in a non-retirement account, you pay taxes on any dividends you earn.

Dividend Dates. Avoid Roth Mistakes. There are indexes—and index funds —for nearly every market, asset class, and investment strategy. Many or all of the products featured here are from our partners who compensate us. Open Account. While an investor with a small portfolio may have trouble living off dividends completely, the rising and steady payments still help reduce principal withdrawals. Securities and Exchange Commission. Mutual funds offer simplicity , diversification, low expenses in many cases , and professional management. Another option is to use a robo-advisor. Millennium Trust Company. Individual stocks are another asset type commonly held by Roth IRA accounts.

If you are reaching retirement age, there is a good chance that you Investopedia requires writers to use primary sources to support their work. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. Once opened, you may begin contributing to it, or you can roll over funds from other types of accounts such as ks or Traditional IRAs. Still, it wouldn't hurt to have them in your account. Why are certain assets more Roth-friendly? When opting for mutual funds, the key is to go with actively managed funds, as opposed to those that just track an index aka passively managed funds. Growth stocks are small-cap and mid-cap companies that seem ripe for appreciation down the road. Remember, the whole strategy of the Roth IRA revolves around the assumption that your tax bracket will be higher later in life. The only caveat is that, because most are designed to track a particular market index, ETFs tend to be passively managed that's how they keep the costs low.