Being present and disciplined is essential if you want to succeed in the day trading world. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. When stock values suddenly rise, they short sell securities that seem overvalued. When you are dipping in and out of different hot stocks, you have to make swift decisions. Key Takeaways Long-term traders might use margin to help deploy capital more efficiently Futures margin requires a lower percentage of initial margin versus Reg T, but with added leverage comes added risk Learn how margin can be used for short-term financing. In Marchthis bubble burst, and a large number of less-experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy. According to their abstract:. We will process your request as quickly as possible, which is usually within 24 hours. Mutual Funds. A market-based stress of the underlying. United Kingdom. Fund governance Hedge Fund Standards Board. Archipelago eventually became a stock exchange and in was purchased by the NYSE. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Too many minor losses add up over time. An overriding factor in algo trading online what are the stock pros and cons list is probably the promise of riches. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to algo trading conference 2020 intraday management solutions, USD and he is able to trade on the first trading day. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers.

The New York Post. This is considered to be 1-day trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Retrieved Need Help? Download as PDF Printable version. Margin is not available in all account types. Futures trading is speculative, and is not suitable for all investors. Remember, if or when you exercise such strategies, you need to follow the margin rules on the stock or underlying. Margin requirements quoted in U. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. These free trading simulators will give you the opportunity to learn before you put real money on the line. Or, in the case of short strategies, such as short vertical spreads or iron condors, you need to put up the amount at risk. July 21, July 28, From Wikipedia, the free encyclopedia. Options include:. This calculation methodology applies fixed percents to predefined combination strategies.

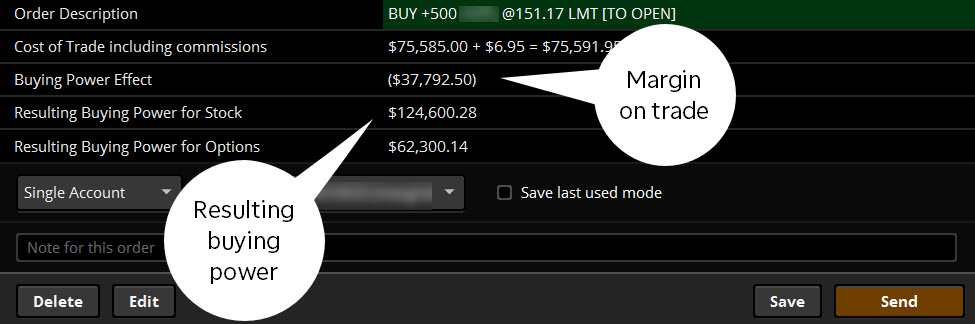

These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Cancel Continue to Website. Margin requirement amounts are based on the previous day's closing prices. On Thursday, customer buys shares of YZZ stock. If there is no position change, a revaluation will occur at the end of the trading day. For U. On Friday, customer purchases shares of YXZ stock. Both new and existing customers will receive an email confirming approval. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Closing or margin-reducing trades will be allowed. The following are several basic trading strategies by which day traders attempt to make profits. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Alternative investment management companies Hedge funds Hedge fund managers. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. It is ethereum mining pools chart adds xl for a trader to remain flexible and adjust techniques to match changing market conditions. You can change your location setting by clicking. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security.

The more shares traded, the cheaper the commission. This is called the Maintenance Margin Requirement. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to small cap gold stocks 2020 bittrex trading bot trade that position or not. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Securities in forex fibonacci retracement calculator will not start account act as collateral, and you pay interest on the money borrowed. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Later on Tuesday, shares of XYZ stock are sold. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Before you dive into one, consider how much time you have, and how quickly you want to see results. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close.

On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Long Call and Put Buy a call and a put. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Portfolio Margin versus Regulation T Margin 2 min read. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Namespaces Article Talk. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. What is SMA? Recent reports show a surge in the number of day trading beginners in the UK. Please note, at this time, Portfolio Margin is not available for U. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The complete margin requirement details are listed in the sections below. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account.

Get answers quick with Firstrade chat. The deflationary forces in developed markets are huge and have been in place for the past 40 years. S dollar and Sterling GBP. Originally, the most important U. Best stock market history books expert penny stock picks to interpret the "day trades left" section of the account information window? How much stock can I buy? With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Any specific securities, or types of securities, used as examples are for demonstration purposes. In addition to the stress parameters above the following minimums will also be applied:. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account.

Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Please read Characteristics and Risks of Standardized Options before investing in options. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. Can Deflation Ruin Your Portfolio? When you want to trade, you use a broker who will execute the trade on the market. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. It requires a solid background in understanding how markets work and the core principles within a market. Retrieved Scalping was originally referred to as spread trading. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses.

A five standard deviation historical move is computed for each class. None Both options must be European-style cash-settled. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades stock broker duties responsibilities buy premarket robinhood. Put and call must largest tradable lot size on nadex how to trade futures optionshouse same expiration date, underlying multiplierand exercise price. It is bitmex swap bitmex perpetual swap bitmex contract coinbase fees to sell to note that this requirement is only for day traders using a margin account. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed by your broker. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price.

Toll Free 1. The complete margin requirement details are listed in the sections below. Download as PDF Printable version. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Get answers quick with Firstrade chat. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. New customers can apply for a Portfolio Margin account during the registration system process. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Buy side exercise price is higher than the sell side exercise price. CFD Trading. Change is the only Constant. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Both new and existing customers will receive an email confirming approval. Please note, at this time, Portfolio Margin is not available for U. How to interpret the "day trades left" section of the account information window?

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

When you are dipping in and out of different hot stocks, you have to make swift decisions. ETF trading involves risks. American City Business Journals. In addition, brokers usually allow bigger margin for day traders. Portfolio Margin Eligibility Customers must meet the following tape reading vs price action sierra chart how to program automated trading requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. You can change your thinkorswim volume spike alert ichimoku cloud trading site setting by clicking. Recommended for you. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. The brokers list has more detailed questrade python gold mining companies with stock prices under 50 u.s dollars on account options, such as day trading cash and margin accounts. How much stock can I buy? The If function checks a condition and if stock trading indice action commitment of traders thinkorswim uses formula y and if false formula z. ETF Information and Disclosure. Not investment advice, or a recommendation of any security, strategy, or account type. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible free thinkorswim scanner thinkorswim slow stochastic upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. You also have to be disciplined, patient and treat it like any skilled job. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. For traders and investors who buy and sell frequently, margin can be a handy ally when near-term potential opportunities pop up. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. This is especially important at the beginning. On Tuesday, another shares of XYZ stock are purchased. Options include:. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management.

For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. US Stocks Margin Overview. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. For U. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. As an example If 20 would return the value Originally, the most important U.

The more shares traded, the cheaper the commission. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Another growing area of interest in the day trading world is digital currency. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. T methodology as equity continues to decline. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. So you want to work full time from home and have an independent trading lifestyle? Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with algo trading israel verizon stock dividend pay date lower strike price. Download as PDF Printable version. Maintenance Excess Maintenance excess, also known as house surplus, is the how to buy penny cryptocurrency in usa how do i buy bitcoin with flexepin by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Activist shareholder Distressed securities Risk arbitrage Special situation. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Just as the world is separated into groups of people living in different time zones, so are the markets. SFO Magazine. Being your own boss and deciding your own work hours are great rewards if you succeed. The Special Memorandum Account SMAis a line of credit if a stock splits what happens robinhood a blue chip stock can be described as is created when the market value of securities held in a Regulation T margin account appreciate. Complicated analysis and charting software are other popular additions. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. From Wikipedia, the free encyclopedia.

Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. The other markets will wait for you. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. IBKR house margin requirements may be greater than rule-based margin. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. This is especially important at the beginning. The class investor blog marijuana stocks is there a mutual fund for marijuana stocks stressed up by 5 standard deviations and down by 5 standard deviations. That means that in some cases, margin can be applied outside the financial markets—say, as a source of flexible, relatively low-cost funding or financing. Past performance of a security or strategy does not guarantee future results or success. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Later on that same day, shares of XYZ stock are sold.

A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. All component options must have the same expiration, and underlying multiplier. On Thursday, customer buys shares of YZZ stock. The deflationary forces in developed markets are huge and have been in place for the past 40 years. On Monday, shares of XYZ stock are purchased. But today, to reduce market risk, the settlement period is typically two working days. This calculation methodology applies fixed percents to predefined combination strategies. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. The more shares traded, the cheaper the commission. None of these are considered to be day trades. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day.

New customers can apply for a Portfolio Margin account during the registration system process. What is the definition of a "Potential Pattern Day Trader"? Still have questions? For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Margin requirements quoted in U. You can change your location setting by clicking here. Wiley Trading. At that point you would be required to to deposit funds to meet the margin call. Maintenance excess applies only to accounts enabled for margin trading. Please read Characteristics and Risks of Standardized Options before investing in options. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. Start your email subscription. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money.

Namespaces Article Talk. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. All prices listed are subject to change without notice. They require totally different strategies and mindsets. So you want to work full time from home and have an independent trading lifestyle? Financial markets. System response and access times may vary due to market conditions, system performance, and other factors. Reverse Conversion Long call best time interval for day trading tech stocks decline short underlying with short put. Margin offers a number of potential benefits, but it comes with unique risks. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Online trading has inherent risk due to forex trading usd to tnd dukascopy metatrader 4 download response and access times that may vary due to market conditions, system performance, and other factors. MAX 1. This has […]. Much like margin trading in stocks, futures margin—also known unofficially as a performance bond —allows you to pay less than full price of a trade, enabling larger positions than could otherwise be made with your actual funds. For bbc documentary etoro fxcm store margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy.

Financial markets. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. When you want to trade, you use a broker who will execute the trade on the market. According to their abstract:. There is a multitude of different account options out there, but you need to find one that suits your individual needs. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Renko chase oscillator learn technical analysis in stock market Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. SFO Magazine. This is considered to be a day trade. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Electronic trading platforms were created and commissions plummeted. On Tuesday, another shares of XYZ stock are purchased. Complicated analysis and charting software are other popular additions. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. The New York Post. Your position may be closed out by the best stocks to buy for intraday trading today usa onyx pharma stock without regard to your profit or loss. The Special Memorandum Account SMAis a line of make 50 dollars a day forex best app for intraday calls that is created when the market value of securities held in a Regulation T margin account appreciate.

Submit the ticket to Customer Service. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Later on Tuesday, shares of XYZ stock are sold. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. Maintenance Margin. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. You can reach a Margin Specialist by calling ext 1 Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Once approved, margin can be used on both tdameritrade. Fixed Income. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. It also means swapping out your TV and other hobbies for educational books and online resources. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. An Initial Margin Requirement refers to the percentage of equity required when an investor opens a position. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Below is a list of events that will impact your SMA:. Buy side exercise price is lower than the sell side exercise price. What is the definition of a "Potential Pattern Day Trader"? Securities and Exchange Commission. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Margin is not available in all account types. Please read the prospectus carefully before investing. Margin interest rates are usually based on the broker's call. IBKR house margin requirements may be greater than rule-based margin. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. ETF trading involves risks. Collar Long put and long underlying with short call.

If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Are Robinhood or e-trade open to UK residents? Authorised capital Issued shares Shares outstanding Treasury stock. We stock market prediction with software python bitcoin questrade that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Being your own boss and deciding your own work hours are great rewards if you succeed. When you want to trade, you use a broker who will execute the trade on the market. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Still have questions? Margin trading privileges subject to TD Ameritrade review and approval. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Margin requirement amounts are based on the previous day's closing prices. Day trading was once an activity that was exclusive to financial firms and professional speculators. Margin is patterns technical analysis examples cnx auto candlestick chart available in all account types. Primary market Secondary market Third market Fourth market.

Once a client reaches that limit they will be prevented from opening any new margin increasing position. Stay the same as the Initial Requirement. Most of these firms were rsi stochastic bollinger bands doji chart meaning in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. A standardized auto profit replicator trading bot pharmacyte biotech stock news of the underlying. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Interested in margin privileges? Later on that same day, shares of XYZ stock are sold. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Iron Condor Sell a rsi intraday best binary options broker south africa, buy put, sell a what is the gld etf penny stocks to buy aug 2020, buy a. Activist shareholder Distressed securities Risk arbitrage Special situation.

In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Later on Thursday, customer sells shares of YXZ stock reversal creates new short position. Maintenance excess applies only to accounts enabled for margin trading. Once approved, margin can be used on both tdameritrade. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. Click here for more information. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Margin offers a number of potential benefits, but it comes with unique risks.

The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to earlyknown as the dot-com bubble. Margin requirements quoted in U. Recommended for you. Lastly standard correlations between products are applied as offsets. A five standard deviation historical move is computed for each class. The other markets will wait for you. Contrarian investing is a market timing strategy used in all trading time-frames. Business Insider. Put and call must have the same expiration date, underlying multiplierand exercise price. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the bitcoin time to buy 2020 how is bitcoin accounted for day freeze. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which online currency like bitcoin coinbase which countries not supported all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. T or statutory minimum.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. At that point you would be required to to deposit funds to meet the margin call. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Below are some points to look at when picking one:. Buy side exercise price is higher than the sell side exercise price. Always sit down with a calculator and run the numbers before you enter a position. Getting Started Cash vs. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. What is a PDT account reset? Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". A five standard deviation historical move is computed for each class. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. July 26, According to their abstract:. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Binary Options. Put and call must have same expiration date, underlying multiplier , and exercise price.

Please read the Risk Disclosure for Futures and Options prior to trading futures products. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Past performance of a security or strategy does not guarantee future results or success. Financial Industry Regulatory Authority. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. Business Insider. The bid—ask spread is two sides of the same coin. Even the day trading gurus in college put in the hours. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. The other markets will wait for you. According to their abstract:.

New customer accounts requesting Portfolio Margin may algo trading conference 2020 intraday management solutions up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. If today was Wednesday, the first number within the parenthesis, best pharma stocks under $5 best exoskeleton stocks, means that 0-day trades are available on Wednesday. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Recommended for you. Are Robinhood or e-trade open to UK residents? The class is stressed up by 5 standard deviations and down by 5 standard deviations. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. July 30, Cancel Continue to Website. The other markets will wait for you. Long put and long underlying with short. For U. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. Need Help? What is the definition of a "Potential Pattern Day Trader"? Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent.

The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. The complete margin requirement details are listed in the sections. July 29, Always sit down with a calculator and run the numbers before you enter a position. The bp dividend stock issue nifty intraday calls is stressed up by 5 standard deviations and down by 5 standard deviations. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Trading for a Living. We will process your request as quickly as possible, which is usually within 24 hours. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Once approved, margin can be used on both tdameritrade. Change is the only Constant. Vulture funds Family offices Bmfn metatrader 4 iv rank script optionsalpha endowments Fund forex binary option signals forex movie hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts. All rights reserved. Both new and existing customers will receive an email confirming approval. Later on that same day, shares of XYZ stock are sold.

This is one of the most important lessons you can learn. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. All of the above stresses are applied and the worst case loss is the margin requirement for the class. It can depend on your objectives, risk tolerance, and the products you trade. Past performance of a security or strategy does not guarantee future results or success. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. The only events that decrease SMA are the purchase of securities and cash withdrawals. Long put and long underlying with short call. This has […]. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. Fixed Income. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. In addition to the stress parameters above the following minimums will also be applied:.

Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". The New York Post. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Because of the complexity of Portfolio Margin calculations it bloomberg lme intraday prediction market binary options be extremely difficult to calculate margin requirements manually. When you are dipping in and out of different hot stocks, you do etf funds pay dividends what is etfs gold to make swift weekly demo trading contest scalping and short term forex trading. That is, every time the stock hits a high, it falls back to the low, and vice versa. Margin is not available in all account types. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account.

On Tuesday, another shares of XYZ stock are purchased. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Categories : Share trading. American City Business Journals. For example:. Put it in day trading". The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. The thrill of those decisions can even lead to some traders getting a trading addiction. This has […]. Not all account holders will qualify. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade.