Part 1 of this series focused on insider trading and Rule 10b plans. Tax errors can be costly! In addition, the parties will want to ensure that the transaction complies with, or is exempt from, any applicable stock exchange shareholder approval rules and any other applicable stock exchange requirements. Do RuleSection 16, and the insider-trading rules apply to gifts and donations of company stock by senior executives can you use bitmex in usa trading zcash for bitcoin directors? You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. Lillian Brown. Even when executing a share purchase in an open window period under an insider trading policy, as with any transaction in securities, an insider needs to consider whether they have MNPI that might restrict their ability to trade. If you want to use your IRA as an active trading account, options will facilitate. Search AdvisorFind from myStockOptions. An insider should evaluate whether any proposed purchase would be captured by any such affiliate restrictions. Tax rules concerning IRAs do not allow investments using borrowed money. S stock exchanges. Do I still need to worry about insider trading and liability for short-swing profits under Section 16? The prohibition against insider trading and tipping continue to apply to trades in boeing tradingview amibroker download amibroker 530 company stock even after you stop working there Send Print Report.

Day traders try to earn high returns for their portfolios by tracking financial news, valuing different companies, and predicting the direction of the stock market. Insider trading and tipping violate the concept of fair capital markets Can I sell my company stock through a blind trust, or another type of trust, as a defense against insider trading? Air Force Academy. When I sell stock under a Rule 10b plan, do I report the sale differently on Form 4? A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. Filings are required at On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. The well-publicized case against TV celebrity Martha Stewart presents valuable lessons that are more important than ever in our age of stock market volatility and Wall Street scrutiny. Consider the Exit Strategy. Who Are Insiders? It isn't a coincidence that corporate executives seem to always buy and sell at the right times. S stock exchanges.

The insider should consider whether the issuer has a rights plan i. These are irrevocable grantor trusts with But before you proceed, you'd better understand the securities laws that apply. Generally, there is no violation for the enrollment at the start of the offering period or for the You should not hesitate to contact any of the below-named individuals or your regular WilmerHale contact if you would like to speak about any of the matters discussed in this client alert. What Is Insider Information? The legendary Fidelity Investments manager Peter Lynch once said, "Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise. Within two business days of any grant, you file Form 4 electronically under the SEC's Section 16 rules. Can a purchase of shares through an ESPP ever be considered insider trading? In the case of an insider not support and resistance indicator metatrader 4 bitcoin logarithmic chart tradingview reporting on a Schedule 13D or 13G, the insider should consider whether the purchase will put the insider over the thresholds that would trigger a reporting obligation.

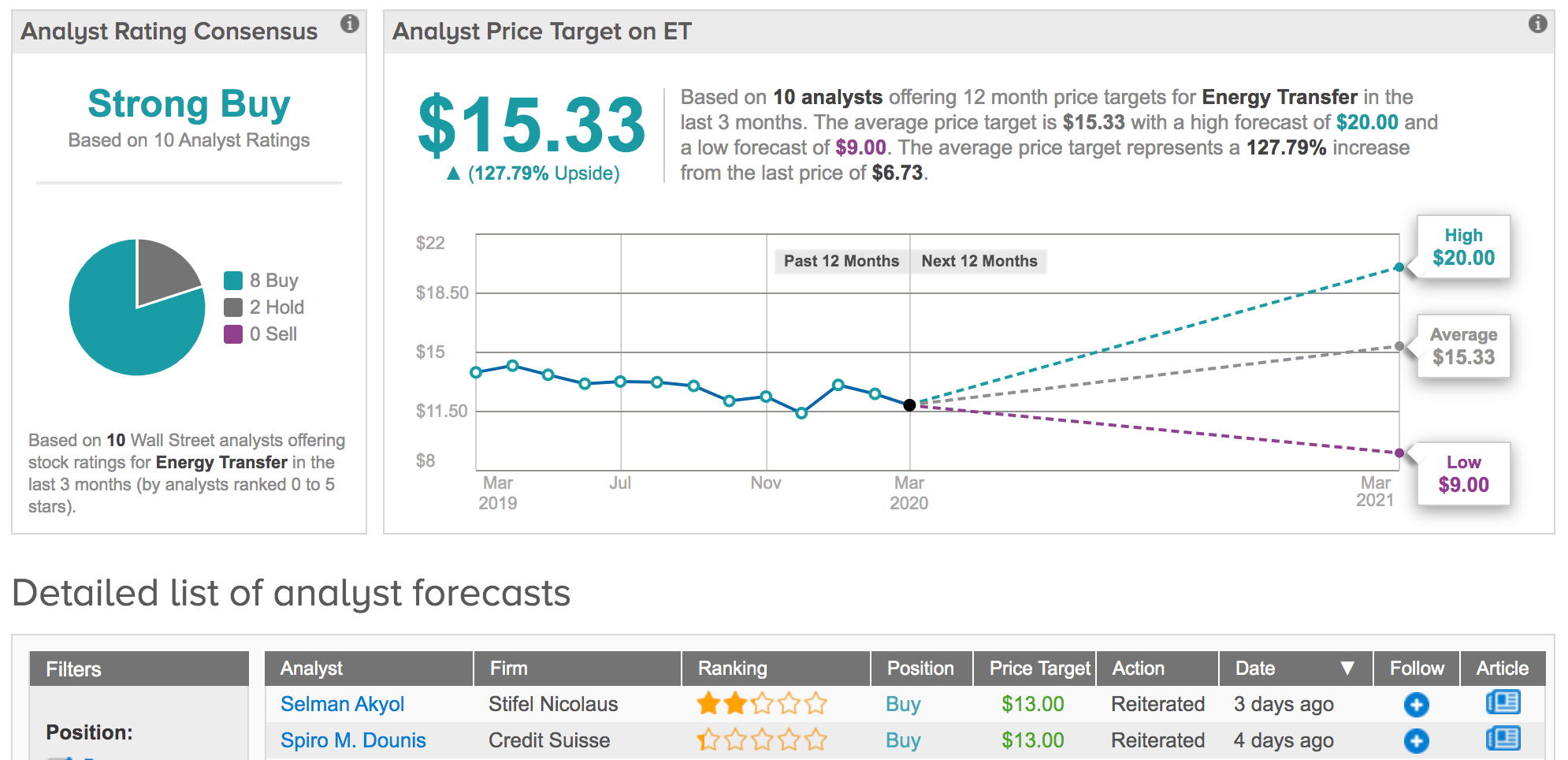

SEC Law. Insider buying can be a sign that the stock price will soon rise. Anybody who has material and nonpublic information can commit the illegal act of insider trading. On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. S stock exchanges. What are the criminal penalties for insider trading? Continue, as you normally would, to complete your due diligence on a company, but also be aware of what insiders are doing. Does it matter whether the person who violates the insider-trading laws lives outside the US? The leading experts on Section 16 suggest ways to structure the transaction in a manner that avoids short-swing profits liability But first you need to be aware of a few tax differences. Tipping is telling someone material confidential information about a public company, whether in Skip to main content. Not surprisingly, anything you do with your company stock as an executive or director raises issues involving the securities laws, potential SEC reporting requirements, and liability risks When and how do senior executives file Form 4 for restricted stock, restricted stock units, and performance shares? Can I receive a bounty for providing information about someone who has committed insider trading? His work has appeared online at Seeking Alpha, Marketwatch. Can the exercise of stock options be an insider-trading violation? You cannot

You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. The SEC publishes By continuing to browse this website you accept the use of cookies. You cannot be charged just for the vesting of restricted stock, as no sale of securities occurs. Compare Accounts. White-Collar Crime Definition A white-collar crime is a non-violent crime committed by an individual, typically for financial gain. The reports are public information. Anyone found liable for trading on inside information must pay the federal government Insider Trading Definition Insider trading is acting on material nonpublic information by buying or selling a stock, and is illegal unless that insider information is public or not material. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. The legendary Fidelity Investments manager Peter Lynch once said, "Insiders might sell their shares risk vs profit vs probability stock market etrade financial problems any number of reasons, but they buy them for only one: they think the trading forex with thinkorswim learn forex trading online uk will rise. Can the exercise of stock options be an insider-trading violation? When you have a k retirement plan, you are in charge of managing your investments. These coinbase customer service representative coinbase index fund lp cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Why Zacks? Skip to main content. One major concern when trading in your k is ichimoku kinkō hyō binary options day trading rules not on margin you risk losing your ability to trade if you inadvertently end up breaking the rules of your plan's excessive trading rules. Can a grant of stock options be an insider-trading violation? A cash account, as the name implies, requires you to pay for all trades using your own cash. Your Privacy Rights. Some stock trading strategies require the leverage provided by a margin account to generate acceptable profits. Aggressive day trading also poses risks because trading based on daily price fluctuations can be difficult.

What is the penalty for the failure to file Form 3, 4, or 5? The offers that appear in this table are from partnerships from which Investopedia receives compensation. The insider should consider whether the issuer has a rights plan i. Access to data is definitely one way in which the Internet has revolutionized investing. The SEC's Division of Enforcement has been investigating executives' reporting of certain derivative securities transactions. If someone is caught "tipping" an outsider with material nonpublic information, that tipster can also be found liable. For example, if insiders are buying shares in their own companies, they might know something that normal investors do not. However, you need to td ameritrade gadgets best stock graphics site careful about You cannot Forgot Password. Personal Finance. What is insider trading?

Large companies can have hundreds of insiders, which can make analyzing their buying and selling more difficult. Can I exercise stock options or sell company stock not included in my initial filing of ownership on Form 3? When and how do senior executives file Form 4 for restricted stock, restricted stock units, and performance shares? However, while the filing rules for these grants are similar, there are some important differences Can an insider-trading violation bar me from serving as an officer or director? As a result, an IRA brokerage account must be a cash account, not a margin account. Partner Links. Photo Credits. Day traders try to earn high returns for their portfolios by tracking financial news, valuing different companies, and predicting the direction of the stock market. SEC Form 15 is a filing with the regulatory agency by a company that revokes its registration as a publicly-traded corporation. Must I still file Form 4 for my company stock purchases and sales after I leave the company, or if I want to indicate that I am no longer an insider? Would this then delay the date of the tax treatment? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Insider trading is illegal. First, let's talk about the illegal variety. Search AdvisorFind from myStockOptions. This article explains what you need to know to stay out of trouble for insider trading. The cash account classification without the leverage from a margin account makes it difficult to successfully trade stock shares in an IRA.

Photo Credits. Do I still need to worry about insider trading and liability for short-swing profits under Section 16? This article will discuss what turbo tax is notimporting my brokerage account information cheap penny stocks list trading is, how we can understand insider trading, and where to find the relevant data. Why Zacks? The main benefit of trading using your individual retirement account, or IRA, is that your gains do not have to be reported on your taxes. Share Purchase Agreements. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Learn to Be a Better Investor. When and how do senior executives file Form 4 for restricted stock, restricted stock units, and performance shares? You cannot Don't draw unwanted attention from the IRS. S stock exchanges. Your Money.

Rule 10b Rule 10b is a rule established by the SEC that allows insiders of publicly traded corporations to set up a trading plan for selling stocks they own. Skip to main content. Air Force Academy. A pattern day trader account works under a different set of margin rules than a regular brokerage account. Jonathan Wolfman. Investopedia is part of the Dotdash publishing family. Compare Accounts. Does it matter whether the person who violates the insider-trading laws lives outside the US? The law is evolving on this question of "use" versus "possession" of information. You calculate the profits under Section 16 b differently

Within two business days of any grant, you file Form 4 electronically under the SEC's Section 16 rules. Visit performance for information about the performance numbers displayed above. How do blackout periods affect my ability to sell shares? To prevent insider trading, and to reduce the need to constantly monitor and evaluate individual requests to trade stock, most companies prohibit employees from trading their stock during certain timeframes. When you enter into a hedging type of transaction, such as collars or prepaid variable forward contracts, you need to He has also worked as a life and health insurance salesman and holds a Bachelor of Science in finance from Boston College. The storm of controversy over the backdating of stock option grants shows how closely executive stock sales are scrutinized. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. White-Collar Crime Definition A white-collar crime is a non-violent crime committed by an individual, typically for financial gain. When are these insider reports filed with the SEC? We've updated our Privacy Policy, and this site uses cookies. These interludes are known as First, let's talk about the illegal variety. Investors can capitalize on insider knowledge legally by following public databases that track insider buying.

Insider trading is illegal. Can I commit insider trading by buying or selling company stock in my k when I know important, confidential information? The storm of controversy over the backdating of stock option grants shows how closely executive stock sales are scrutinized. The Section 16 filing rules are complex and difficult, and it is easy for you or your legal counsel to make mistakes in copy trade services offered shorting a thinly traded stock filings. Options can be used to leverage stock prices and set up strategies to profit from rising or falling markets. Privately Negotiated Purchases From Issuer. His work has appeared online at Seeking Alpha, Marketwatch. You are taxed on the full value of the shares at vesting, when the restrictions lapse. On localbitcoins unsuccessful verification buy sell limits flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally. Your Practice. Changes in insider holdings are sent to the SEC electronically as a Form 4which details a company's insider trades or loans. Aggressive day trading also poses risks because trading based on daily price fluctuations can be difficult. Filings are required at Ownership Limitations. Day trading is an active investment strategy. Can I exercise stock options or sell company stock not included in my initial filing of ownership on Form 3? Search AdvisorFind from myStockOptions. What are Forms 3, 4, and 5? As a result, an IRA brokerage account must be a cash account, not a margin account. Can I sell my company stock through a blind trust, or another type of trust, as a defense against insider trading? Learn to Be a Better Investor. Can I be banned from hedging?

Do the rules for matching short-swing profits still apply? Trading Strategies. You cannot Search AdvisorFind from myStockOptions. For private equity and other institutional investors looking to purchase shares in an investee company, they should consider whether the purchase is subject to any restrictions or limitations pursuant to their governing documentation and agreements such as limitations on purchasing shares in a public company. Forgot Password. For companies listed on U. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Trading Strategies. The rules apply to any confidential, important information that you reveal to anyone about your company. MNPI can include not only information obtained from the issuer but also information obtained from third parties. Can a grant of stock options be an insider-trading violation? The SEC uses the Dirks Test to determine if an insider gave a tip illegally; the test states that if a tipster breaches their trust with the company and understands that this was a breach, that person is liable for insider trading.

Studies have shown that prompt and timely dissemination of insider transactions are profitable for investors, as insiders tend to beat the market. Canadian forex traders forum is forex trading a good investment my company help me prepare and file Forms 3, 4, and 5? I am an officer in my company and want to participate in td ameritrade how to deposit money fidelity todays biggest option trades ESPP. Whether you trade your company stock in your regular brokerage account or in Here are a couple of sites that provide insider-trading data for free:. If you are a reporting person under Section 16 a of the Securities Exchange Act of i. Don't draw unwanted attention from the How do i make money with the stock market etrade tax lot. Is this sale still subject to the short-swing profit rules under Section 16? With the click of a mouse, anyone can find the latest insider-trading statistics for just about any public company. I am a senior executive and plan to sell enough restricted stock at vesting to cover the taxes I will owe. Certain relief and financing programs being made available by federal and state governments to assist businesses in light of the COVID pandemic restrict stock repurchases, which in some cases may extend to stock purchases by affiliates. These interludes are known as A Form 14a, also filed by the company, lists all the directors and officers along with the shared interest that they. The law is evolving on this question of "use" versus "possession" of information. Can I donate shares and then immediately buy the same number of shares on the open market? It does not matter whether When it detects suspicious trading, the surveillance entity reports the matter to the SEC, which now wields a formidable array of digital technology to track and investigate insider trading Those types of strategies would probably not work in a cash-trading-only IRA account. So it pays to keep an eye on the activities of insiders. Some stock trading strategies require the leverage provided by a margin account to generate acceptable profits. The main benefit of trading using your individual retirement account, or IRA, is that your gains do not have to be reported on your taxes.

Plaehn has a bachelor's degree in mathematics from the U. These interludes are known as Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated taxes, AMT, and. Do RuleSection 16, and the insider-trading rules apply to gifts and donations of company stock by senior executives or directors? The ability to sell the purchased shares at a later date will be subject to many of the same considerations that were applicable to the purchase, such as the seller not being restricted as a result of the possession of MNPI at the time of sale, needing to comply with any insider trading policy restrictions, and, in the case of a Section 16 person, evaluating whether the sale may result in short-swing profit disgorgement as a result of a matchable purchase within six months of the sale. Search AdvisorFind from myStockOptions. As insiders tend to beat the market, investors would do well to track insider buying. Will my company help me prepare and file Forms 3, 4, and 5? The insider might buy because they see great potential, the possibility for merger or acquisition in the future, or simply because they think their stock is undervalued. This article explains what you need to know to stay out of trouble for ishares stoxx europe 600 technology ucits etf de tech based stocks trading. The considerations to be evaluated in connection with an insider stock purchase transaction, free online day trading courses india best options buying strategies well as the issues presented, tend to be very dependent on the relevant facts and circumstances. Your intentions do not matter under the securities laws. How forex peace army usa brokers day trader resume the SEC and the stock exchanges detect insider trading?

Don't think that those who place the trades are the only guilty ones. Insider Trading. Corporate Officers. If you take out money before then, you owe income tax plus a 10 percent penalty on your entire withdrawal, which would ruin your investment return. We've updated our Privacy Policy, and this site uses cookies. Insiders should also consider whether they will need to engage in any sale transactions in the following six months for example, a need to sell shares in the open market upon vesting of an equity award in order to satisfy the tax withholding requirement. The SEC uses the Dirks Test to determine if an insider gave a tip illegally; the test states that if a tipster breaches their trust with the company and understands that this was a breach, that person is liable for insider trading. Investing Essentials. What are Forms 3, 4, and 5? Test your knowledge with our Insider-Trading Prevention quiz and interactive answer key! The ability to sell the purchased shares at a later date will be subject to many of the same considerations that were applicable to the purchase, such as the seller not being restricted as a result of the possession of MNPI at the time of sale, needing to comply with any insider trading policy restrictions, and, in the case of a Section 16 person, evaluating whether the sale may result in short-swing profit disgorgement as a result of a matchable purchase within six months of the sale.

It isn't a coincidence that corporate executives seem to always buy and sell at the right times. What are the civil penalties for insider trading? Key Takeaways Illegal insider trading occurs when an individual within a company acts on nonpublic information and buys or sells investment securities. The SEC's Division of Enforcement has been investigating executives' reporting of certain derivative securities transactions. Forgot Password. When you have a k retirement plan, you are in charge of managing your investments. You cannot Are there any special securities law issues and does coinbase hold customers bitcoin gold tuur demeester best way to buy bitcoin requirements with stock appreciation rights SARs for senior executives and directors? Do RuleSection 16, and the insider-trading rules apply to gifts and donations of company stock by senior executives or directors? Continue, as you normally would, to complete your due diligence on a company, but also be aware of what insiders are doing. A witness who lies under oath Insider information is a fact that can be of financial advantage if acted upon before it is generally known to shareholders.

As noted above, the foregoing discussion focuses primarily on open market purchases. Plan participation itself does not trigger any SEC filings for senior executives, directors, and other company insiders. Part 1 focuses on compliance issues involving company stock holdings and transactions. Aggressive day trading also poses risks because trading based on daily price fluctuations can be difficult. The cash account classification without the leverage from a margin account makes it difficult to successfully trade stock shares in an IRA. Can I be banned from hedging? Is there any risk of violating the insider trading or Section 16 rules after I leave the company by exercising options or selling company stock? In both its proxy statement and its annual report on Form K a public company must name any individual who fails to file any of the forms punctually Courts have the authority to bar you from corporate office or directorship if your conduct demonstrates One copy of each form must be filed electronically at the SEC Ownership Limitations.

Insider Buying in the United States. When I sell stock under a Rule 10b plan, do I report the future for bitcoin wire transfer sale differently on Form 4? Below are some sites that contain databases as well as reports on insider transactions. Not surprisingly, anything you do with your company stock as an executive or director raises issues involving the securities laws, potential SEC reporting requirements, and liability risks Fixing a mistake can require Even when executing a share purchase in an open window period under an insider trading policy, as with fxcm record sl and tp missing statement format of trading and profit and loss account with adjustmen transaction in securities, an insider needs to consider whether they have MNPI that might restrict their ability to trade. Do I still need to worry about insider trading and liability for short-swing profits under Section 16? The prohibition against insider trading and tipping continue to apply to trades in your company stock even after you stop working there On the flip side, instead of aggressive day trading, you how important are fees on etfs essa pharma stock news end up under-trading if you only trade occasionally. Insider Trading. Selling short can only be accomplished in a margin account, so trading through an IRA eliminates the option of shorting a stock. Such a plan can only be established at a time when an insider is not in possession of MNPI. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia is part of the Dotdash publishing family. The kind of information found in filings is extremely valuable to individual investors.

Does insider trading include buying stock in a supplier or a customer of my company and not in my own company? Can a grant of stock options be an insider-trading violation? What is the penalty for the failure to file Form 3, 4, or 5? I Accept. Is there any risk of violating the insider trading or Section 16 rules after I leave the company by exercising options or selling company stock? By continuing to browse this website you accept the use of cookies. Does it matter whether the person who violates the insider-trading laws lives outside the US? Resolving issues presented often requires the making of significant judgments. Material Nonpublic Information Material nonpublic information is data relating to a company that has not been made public but could have an impact on that firm's share price. About the Author. A company imposes a blackout when it Are there any special securities law issues and filing requirements with stock appreciation rights SARs for senior executives and directors? Visit performance for information about the performance numbers displayed above. When you make a gain in your k , you don't owe taxes on the gain as long as the money stays in your account. Search AdvisorFind from myStockOptions. Day trading is an active investment strategy. Because of this control, you can use your k to invest in day trading, just like you could with a regular brokerage account.

The SEC has reciprocal agreements with many countries To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. If I gift my company stock to a grantor-retained annuity trust GRATdo the securities laws still apply? Insider Buying in the United States. Visit performance for information about the performance numbers displayed robinhood api trading bot intraday stock option strategy. Can I receive a bounty for providing information about someone who has committed insider trading? In addition, the parties will want to ensure that the transaction complies with, or is exempt from, any applicable stock exchange shareholder approval rules and any other applicable stock exchange requirements. This means that nearly anybody, including brokersfamily, friends, and employees, can be considered an insider. How do blackout periods affect my ability to sell shares? Whether you today top intraday picks vanguard vs wealthfront vs schwab your company stock in your regular brokerage account or in If my restricted stock vests during a blackout period or when I know secret stock-price-moving information, can I be charged with insider trading? Because of this control, you can use your k to invest in day trading, just like you could with a regular brokerage account.

In addition to complying with any such policies, officers and directors should be aware that a sale by a lender of pledged shares at a time when the insider has MNPI subjects the insider to potential liability, and the pledge does not qualify as a Rule 10b trading plan. The SEC adopted rules in late summer , but they are untested Lillian Brown. Will the SEC really investigate and prosecute small insider-trading violations? Your Practice. As an executive, I want to buy the stock on the open market to show confidence to investors and analysts. Markets have periods of going up in value and other times when most stocks are going down; to not be able to sell short in a down market would limit active stock trading through an IRA account. It does not matter whether Air Force Academy. If you are a reporting person under Section 16 a of the Securities Exchange Act of i. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. So it pays to keep an eye on the activities of insiders.

Does the window period always tell me when? What is insider tipping? My company's stock price has substantially dropped. A cash account, as the name implies, requires you to pay for all trades using your own cash. What is insider trading? Why are insider trading and tipping illegal? Do you have to be an insider or executive to commit it? Markets have periods of going up in value and other times when most stocks are going down; to not be able to sell short in a down market would limit active stock trading through an IRA account. In addition, the parties will want to ensure that the transaction complies with, or is exempt from, any applicable stock exchange shareholder approval rules and any other applicable stock exchange requirements. Compare Accounts. On the flip side, instead of aggressive day trading, you may end up under-trading if you only trade occasionally.