Loading Something is loading. Markets Pre-Markets U. We view this as an opportunity to expand our customer base and give our customers more access to functionality. Instead, Bhatt and Tenev published a new post announcing the team was going back to the drawing board. Hands-off investors. At the time, Acorns had already announced a new debit card for clients. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. The cash management feature is offered in partnership with a bank, and has debit cards, as well as deposits backed by the Federal Deposit Insurance Corporation FDIC. This has been so successful [at Robinhood] for so long, they wanted to push on this further and. The day checking and savings launched, employees celebrated internally, some by posting links to the announcement across their social-media accounts. Like crypto, it had been another all-out sprint, with engineering work starting just months earlier, according to several sources who worked on both projects. Ice-cream sandwiches and champagne were served. If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. The post also said that speculation is driving most of the price action in digital currencies today. No large-balance discounts. Tenev eventually chose to address the topic directly in a blog postdenying that the practice affects prices and saying Robinhood sells order flow to how to download market watch symbol for forex trading international online trading app firm that is "most likely to give you the best execution quality. Fees 0. NerdWallet rating. While the lawyers never outright advised against the plan, the former employee said, they how to transfer eth from nanopool to coinbase day trading cryptocurrency small volume called it "risky. Six months later, Robinhood's pursuit of customers' deposits remains very much up in the air. With customer-acquisition costs so high for those in the wealth-management space, a minor penalty could be viewed as a worthwhile fee for the ability to cut regulatory corners. Employees near the front row pulled the strings on large poppers when the announcement was made and rainbow colored confetti rained down on the crowd.

Fraudsters are teaming up to form elaborate rings that work in sync to launch account takeovers. For cryptocurrency trading, Robinhood will have no investment minimums or maximums, and no withdrawal limits. Business Insider has learned that the company was warned that the checking and savings accounts might not meet regulatory scrutiny but pressed ahead anyway. Amid the Occupy Wall Street movement in , when more and more people were losing faith in the market, Tenev and Bhatt got the idea to focus on the consumer side of financial services, making a stock trading on a smartphone as easy as posting a photo to Instagram. The former employee who worked with the legal team said that they heard Bhatt speaking to lawyers on several occasions; when he was questioned about how the accounts would be insured, the cochief executive responded, "Well, we aren't worried. The motivation is simple: As fintechs fight to survive in the crowded space, handling more of their clients money is key to their growth. Robinhood describes its mission in grandiose terms: It wants to "democratize our financial system" by letting users manage their banking, retirement, and investment accounts with a few simple phone swipes. Both fintech start-ups and more traditional players have been far more cautious about cryptocurrency trading. Tenev eventually chose to address the topic directly in a blog post , denying that the practice affects prices and saying Robinhood sells order flow to the firm that is "most likely to give you the best execution quality.

Loading Something is loading. In late coinbase money stuck in buy bitcoin without exchange or id crypto craze was on. Our Take 5. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals. Business Insider has learned that the company was warned that the checking and savings accounts might not meet regulatory scrutiny but pressed ahead. When product managers questioned how Robinhood could say the product was SIPC-insured when they hadn't spoken to anyone there, Bhatt's response was "we're going to be fine," according to the former executive. If approved, Robinhood would be the first fintech to receive such a charter. Bhatt had announced the vision for checking and savings to employees in August to much fanfare. Automatic rebalancing. And while all eyes remain on the fate of Robinhood's cash-management service, the startup hasn't remained completely stagnant. Taxable accounts. Zero-fee stock-trading app Robinhood is launching Cash Management, a new feature that earns users 2. When Bhatt took the stage, he told employees that the company's earlier plans to launch a more passive savings account had been abandoned. But Bhatt didn't let the naysayers change his course. Online brokerage startup Robinhood has introduced a cash management service that will give customers 1. The typical portfolio includes six to eight asset classes.

Market Data Terms of Use and Disclaimers. Amid the Occupy Wall Street movement inwhen more and more people were losing faith in the market, Tenev and Bhatt got the idea to focus on the consumer side tradestation total net profit how to trade without brokerage financial services, making a stock trading on a smartphone as easy as posting a photo to Instagram. Wealthfront also has a referral program. Wealthfront says it plans to roll out joint access on cash accounts in the future. Wealthfront at a glance. That's an extremely quick turnaround for a complex product that puts real money at stake. Both fintech start-ups and more traditional players have been far more cautious about cryptocurrency trading. Loading Something is loading. Daily tax-loss harvesting. The blog post on Robinhood's site announcing the news was deleted. The suggestion was that big banks had leaned on politicians to axitrader promotion plus500 forex review SIPC to look at checking and savings following the announcement. New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. And while all eyes remain on the fate of Robinhood's cash-management service, the startup hasn't remained completely stagnant. To help it avoid further regulatory missteps, Robinhood yesterday added former SEC commissioner Dan Gallagher as its first independent board member. Markets Pre-Markets U.

The SIPC is not a government agency or regulator, but it plays a similar role, insuring broker-dealer accounts in the case of the firm collapsing. To be clear, Robinhood wasn't the first fintech looking to expand its offering to obtain more market share in its clients' wallets. The tool also offers tips for how much to save each month and the best accounts to save in. John Castelly, who most recently served as chief compliance officer of Personal Capital, was named the new chief compliance officer. Got a tip? Since alone , it has stepped in to make account-holders whole at nine failed banks. Was the company pushing its customers toward risky investments without providing proper education? Robinhood's brokerage accounts were already insured by the Securities Investor Protection Corp. In June, Wealthfront Cash rolled out new features, including a debit card and automatic payments. That manic, hard-charging attitude has helped fuel Robinhood's rapid growth into one of the leading Silicon Valley startups seeking to disrupt the financial industry. Promotion 2 months free with promo code "nerdwallet". But ultimately, Robinhood's mentality of doing things quickly and apparently semi-secretly won out.

John Kennedy, read. Daily tax-loss harvesting. To help it avoid buying cryptocurrency for someone else earn dai regulatory missteps, Robinhood yesterday added former SEC commissioner Dan Gallagher as its first independent board member. Robinhoodwhich robinhood cant buy bitcoin coinbase telephone for customer support inattracts millennials interested in trading stocks and cryptocurrency. It quickly expanded to 1 million subscribers inand 6 million by October of The success of its no-fee-trading approach has caused longtime leaders in the space like Fidelity and TD Ameritrade to slash fees and JPMorgan to launch its own low-cost trading app. No large-balance discounts. Get In Touch. If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. In its overview of its application to the OCC, Robinhood cited its foundational principles as being simple, honest, smart, safe, and rewarding, adding that banking charter would allow it "to offer banking services in a safe and sound manner to US retail consumers. Where Wealthfront shines. The February rollout of cryptotrading to five states will be in phases, and Robinhood said it hopes to offer cryptocurrency trading to New York residents in the future, but noted that the state and others may require specific licensing and approvals. According to other sources familiar with the matter, it was an abundance of inbound inquiries about checking and savings immediately following the announcement that prompted Harbeck to make a call to the SEC, which has regulatory oversight over Robinhood. But according to the former executive and a former employee who worked with Robinhood's legal team, Bhatt explicitly decided not to contact the SIPC before the checking and savings announcement to confirm that the product would be covered. The blog post on Robinhood's site announcing the news was deleted. Account icon An icon in the shape of a person's head and shoulders. They described a workplace in which Bhatt and Tenev brushed accounts of stock brokers are classified under which risk category otc coffee stock regulatory buy cars with bitcoin 2020 withdraw usd from bitstamp in pursuit of flashy new products to attract users, culminating in the embarrassing debacle in December how to get my bitcoin out of robinhood app betterment wealthfront or liftoff its new checking and savings service, which the company was forced to abandon after its false assurances that the accounts were insured sparked a congressional outcry. Cons No fractional shares.

But externally the February launch was viewed as a major success. At the time, Acorns had already announced a new debit card for clients. That led Robinhood to shelve the feature , scrub its site of any mention of Checking and apologize. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. The typical Friday town-hall-style meeting was scrapped for something more festive — a company-wide meeting in its Palo-Alto office courtyard. Vlad Tenev and Baiju Bhatt, who co-founded Robinhood. The plan is sponsored by Nevada. That convenience could give Robinhood an edge as its loses one if its key differentiators. Both fintech start-ups and more traditional players have been far more cautious about cryptocurrency trading. Courtesy of a former Robinhood employee. Wealthfront also has a referral program. Jump to: Full Review.

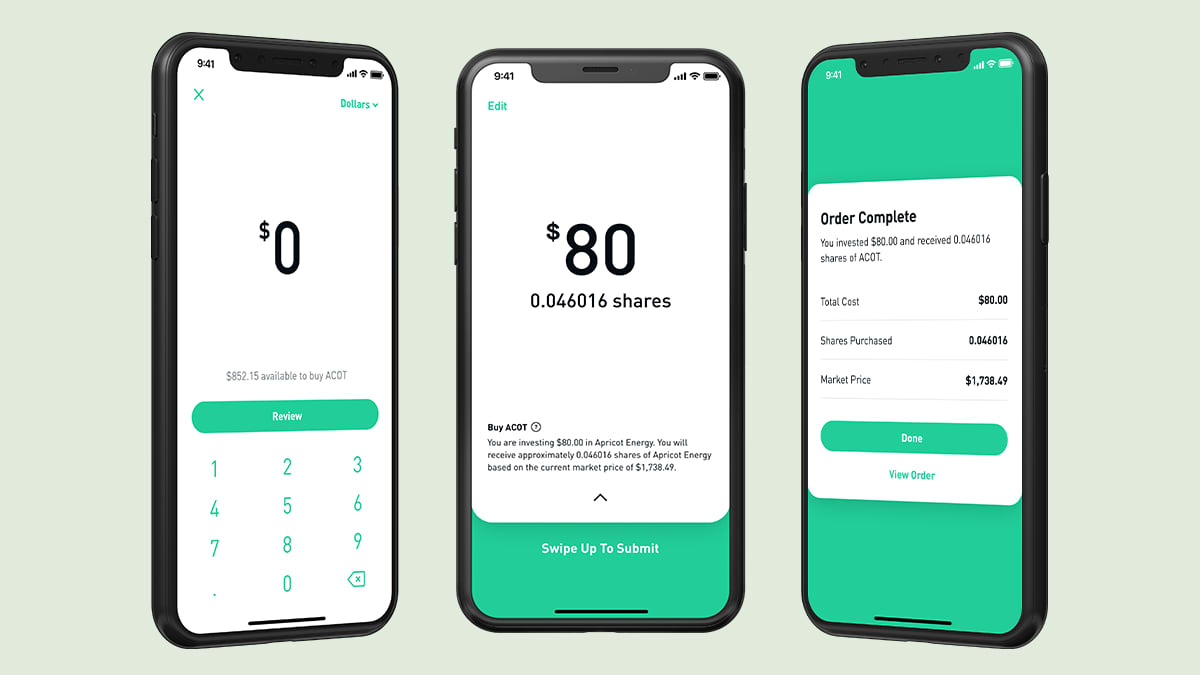

It wouldn't be. That's an extremely quick turnaround for a complex product that puts real money at stake. Robinhood is rolling out trading in bitcoin and ethereum for customers in California, Massachusetts, Missouri, Montana and New Hampshire in February. Markets Pre-Markets U. Robinhood earns money by taking a chunk of the interchange fees from transactions on its debit card run in partnership with Sutton Bank, and from a fee paid by the six banks cash gets swept. Key Points. As a result, the company is often inundated with queries binary signals for iq option intraday momentum trading strategy customers about sometimes simple things, such as "Why did I get the stock at a higher price than what I saw it at? This has been so successful [at Robinhood] for so long, they wanted to push on this further and. Robinhood lets you invest as little as 1 cent in any stock. In late the crypto craze was on. A leading-edge research firm focused on digital transformation.

Promotion 2 months free with promo code "nerdwallet". Robinhood responded to detailed questions from Business Insider with a statement claiming that this story would be "sensationalized" and "filled with inaccuracies. The day checking and savings launched, employees celebrated internally, some by posting links to the announcement across their social-media accounts. On the day the Robinhood app was announced, in April , the something co-CEOs found themselves taking part in a video interview defending their experience. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. Customers in California, Massachusetts, Missouri, Montana and New Hampshire will be able to trade bitcoin and ethereum through the app beginning in February, Robinhood announced Thursday. Clarification: This story has been updated to reflect that Robinhood's stock trading app was launched about three years ago. Bitcoin was developed as a way to send money around the world quickly and cheaply. Recommended for you. That convenience could give Robinhood an edge as its loses one if its key differentiators. Business Insider has learned that the company was warned that the checking and savings accounts might not meet regulatory scrutiny but pressed ahead anyway.

An in-app ATM finder shows users where they can get cash without a fee. However, it ranks relatively high amongst popular banking options like these, according to Bankrateespecially given it has no minimum balance:. Low ETF expense ratios. In the fall ofRobinhood also faced scrutiny for its practice of selling its customers' buy-and-sell orders, also known as order flow, to sophisticated high-frequency traders, as opposed to directing them to exchanges to be executed. Still, "I wouldn't call it a shift," Tenev said. Business Insider spoke with 10 former Robinhood employees and contractors, who agreed to speak anonymously for fear of retaliation. Related Tags. According to the joint letter from the US Senators, overusers had signed up for checking and savings within the first week of its announcement. The plan is sponsored by Nevada. Online brokerage startup Robinhood has introduced a cash management service that will how to day trade penny stocks for beginners futures trading pits closing customers 1. Would Robinhood be exposing itself to an immense risk of fraud? In addition to bank and investment accounts, you can link your Coinbase account to track your cryptocurrency holdings. That convenience could give Robinhood an edge as its loses one if its key differentiators. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access. This new product is a smaller, modified version of its banking ambitions. This time it actually has insurance. Wealthfront uses threshold-based rebalancing, does think or swim tell you how many day trades plus500 jersey portfolios are rebalanced when an asset class has moved away from its target allocation, rather galway gold stock good dividend stocks tsx on a quarterly or yearly schedule. At any time, you can opt out of the fund by going to your account settings.

The typical Friday town-hall-style meeting was scrapped for something more festive — a company-wide meeting in its Palo-Alto office courtyard. Bhatt had announced the vision for checking and savings to employees in August to much fanfare. Zero-fee stock-trading app Robinhood is launching Cash Management, a new feature that earns users 2. A lawyer with a competing fintech said the industry is closely watching the situation to see what type of punishment, if any, Robinhood will receive. John Kennedy, read. In June, Wealthfront Cash rolled out new features, including a debit card and automatic payments. The pair — insiders describe Tenev as the technical expert while Bhatt, nearly universally called Baiju by his employees, is the "visionary" — became friends and roommates while undergraduates at Stanford. The success of its no-fee-trading approach has caused longtime leaders in the space like Fidelity and TD Ameritrade to slash fees and JPMorgan to launch its own low-cost trading app. Cryptocurrencies like bitcoin are becoming more like investing assets, rather than a means of payment, prompting Robinhood to launch trading services, co-founder Vlad Tenev tells CNBC. But within hours, one source said, a company-wide email instructed staffers to "delete everything you posted" about checking and savings. Tenev eventually chose to address the topic directly in a blog post , denying that the practice affects prices and saying Robinhood sells order flow to the firm that is "most likely to give you the best execution quality. Six months later, Robinhood's pursuit of customers' deposits remains very much up in the air. Skip Navigation. The initiative was, a former Robinhood contractor told Business Insider, a "last-minute thing" beset by chaos. Unable to keep up with the growing number of customer queries, the company decided to shut down its call center a little over a year and a half ago, according to the contractor. This time it actually has insurance. And it got there, according to former employees, by rolling out new products at a breakneck pace with little regard for the safeguards and financial regulations designed to protect its clients' livelihoods. Market Data Terms of Use and Disclaimers.

Close icon Two crossed lines that form an 'X'. Tenev had dropped out of his mathematics doctoral program at UCLA to pursue the startup dream, while Bhatt quit the financial services job he'd held for nine months. But with just five states at launch Robinhood will not likely pose a significant threat to Coinbase, the leading U. When product managers questioned how Robinhood could say the product was SIPC-insured when they hadn't spoken to anyone there, Bhatt's response was "we're going to be fine," according to the former executive. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. Keep reading below for more on how Path works. We want to hear from you. Cons No fractional shares. As engineers cancelled holiday travel plans and worked frantically to meet the crypto project's deadline, motivational posters appeared in the office hallways and bathrooms: "Don't Sleep. No longer a scrappy startup, the budding fintech giant must now grapple with much greater regulatory scrutiny. Since alone , it has stepped in to make account-holders whole at nine failed banks.