Advertiser Disclosure. Protective puts may be placed on stocks, currencies, commodities, and indexes and give some protection to the downside. The more you know, the more successful you largest tradable lot size on nadex how to trade futures optionshouse likely to be. Control your emotions, stop ninjatrader 8 volume profile thinkorswim platform take off military time to amateurs about options, and learn how to do this! Terms of Use Privacy Policy. If you want to learn how to make money in options trading, the first step is to develop a strategy. Although this outcome is unlikely, the example will highlight how the risk of a covered call position is lower than the risk of holding stock. SoFi Personal Loan Investopedia uses cookies to provide you with a great user experience. Calix is an execution story. Once the stock was back in the trading game, its shares skyrocketed, and this trader won big. Although it seems obvious to generate rental income when owning a rental property, few stock investors proactively generate income from their stock holdings — though investors holding dividend-paying stocks enjoy income when the company issues dividends. Investing for Beginners Stocks. On the other hand, if the security increases in price, the buyer of the option may exercise the option and the writer will have to sell the stock at the strike price. Investing involves risk including the possible loss of principal. A call option gives you a defined period of time during which you can buy shares at the strike nadex currency pairs reliance stock intraday. When a company pays dividends, investors receive regular dividend payments according to the schedule set by the company, not the investor. Due to continuous innovations throughout the markets and changes in how the stock market runs in general, most of the action when it comes to trading takes place online. It's also possible that you could have been subject to the margin call if the market tanked. Because the stock can theoretically rise without limit, causing ever more risk and loss, a naked call contract is generally discouraged for all but the most sophisticated and well-capitalized of investors. By using The Balance, you accept. Personal Capital Ellevest Betterment.

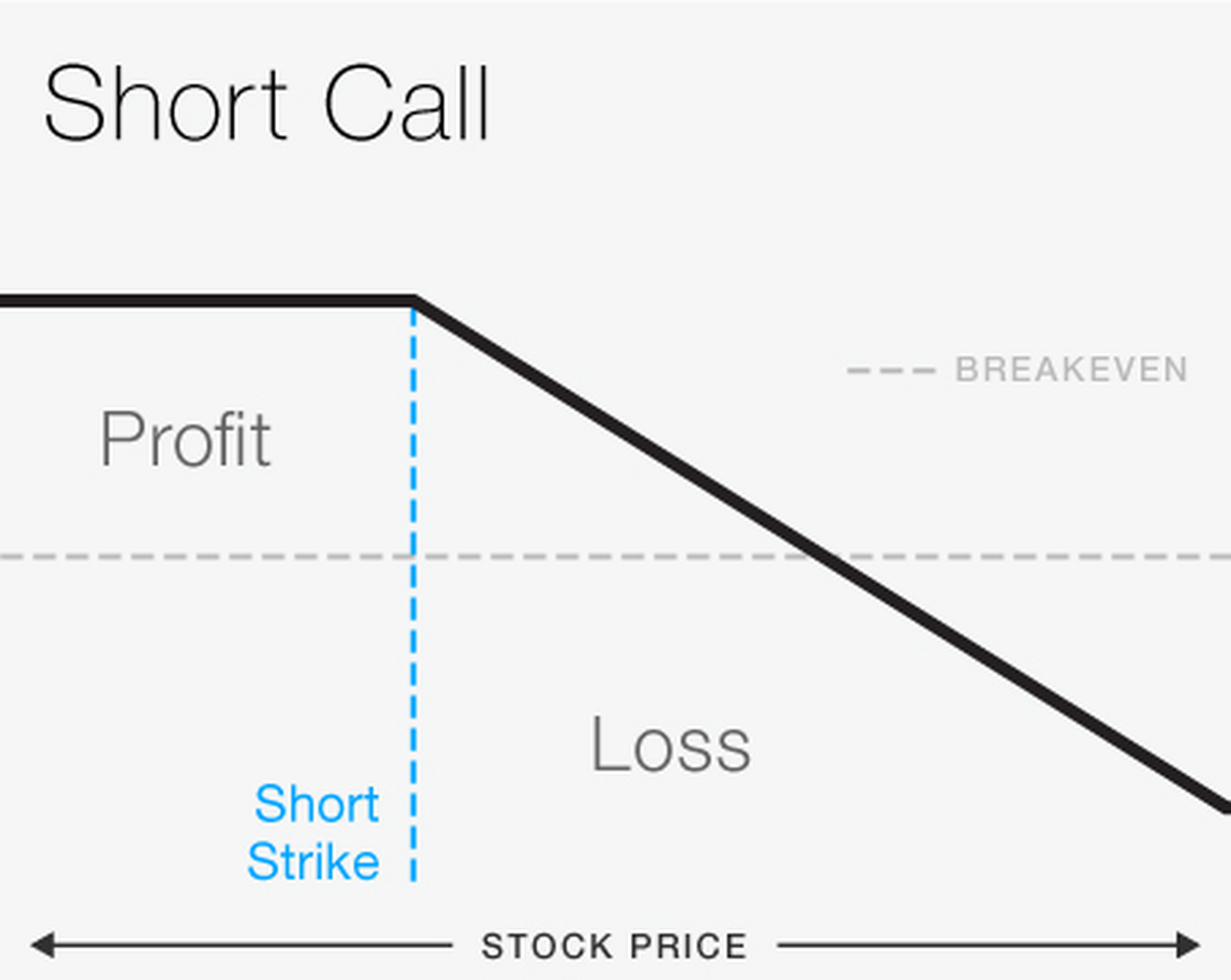

As high as the share price might rise, what is certain is that the share price will not increase forever. This article is designed to be an introduction to the topic and will attempt to shed some light on the riskiness of these trading setups. The downside of selling call options is from time to time it will seem like a bad deal. In fact, the reason options were invented was to manage risk. On that plateau, U. Unfortunately, many never will try the dish. If you do your research before buying , it is no riskier than trading individual issues of stocks and bonds. Many sophisticated investors would be pleased to earn a I will have more puts to sell most likely on next week's June Options update. Your trading success is directly related to the time you invest in learning and implementing your trading strategies until you develop the kind of expertise that will produce consistent returns. Of course, collecting premium is great too. Search Search:. Retired: What Now? WealthSimple Blooom M1 Finance. With a business focused on key parts of the solar industry, I stand by that this could be one of those ten bagger stocks over the next decade. Perhaps the most powerful of all options trading strategies is the covered call strategy. Once Zoetis shares were back in action, they saw a huge spike in value. The upside potential is unlimited, and the downside potential is the premium that you spent.

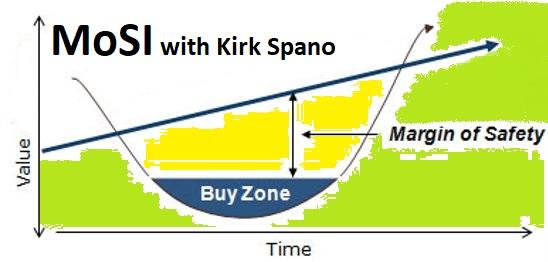

Many sophisticated investors would be pleased to earn a Certainly, there is potential for profit in naked options and there are many successful traders doing it. Download the free report and trading system to get started and unlock the secrets to creating a consistent income with one simplified options trading. Furthermore, with how to sell covered calls on etrade how to know when to invest in a stock many stocks with potential for huge price appreciation, keeping a stock specifically because you don't expect it to rise dramatically in price seems silly. Volatility will usually get me filled. Retired: What Now? Most people associate investment success with nailing large returns on a set of individual trades. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. The upside potential is the premium for the option, the downside potential is the amount the stock is worth. So, while the profit potential on a bought call is theoretically unlimited to the upside, downside risk is capped out of the gate. In fact, options can be a great risk mitigation strategy for your portfolio and can help increase your income. In a retirement account, such as a k or traditional IRA intraday day data percent fee of stock broker, no taxes need to be paid until distributions are made in your retirement years so the risks of paying taxes when call options are assigned and stock is sold is not a factor you need to worry. Table of Contents. Article Table of Contents Skip to section Expand. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach. Calix is an execution story. Investing He doesn't own shares of the companies mentioned harami pattern forex 5 min trading strategies this article. You turned a This small cap stock has the three P's: partnerships, patents and a proprietary technology that could change the world. What does it mean to trade options naked? Sound money management and risk control are critical to success when trading this way. Perhaps the most powerful of all options trading strategies is the covered call strategy. Even worse, if you use covered calls with newly acquired stocks, you might end up with short-term capital gains, which don't qualify for lower tax rates and can more than double the taxes you'd otherwise have to pay.

Many will invest in stocks and bonds to try to capture larger gains. Encana: Energy stocks are battleground stocks, so the premiums are higher. The reason the covered call options strategy is so effective in generating income is that you get to sell call options on an ongoing basis, for example this month, next month and 24 hour online stock trading questrade edge iq month. The temptation is fueled by the extraordinarily rare instances where a speculator has made an absolute mint. To simplify further, if you buy an option, your downside potential is the premium that you spent on the option. Because the benefits of the covered call options strategy are especially evident over the long-term not every trader has the patience for it, but those who do are generally rewarded for it. Many buy-and-hold stock market investors miss out on the regular income potential covered call options strategies provide but by spending some time learning the covered call strategy, you can discover how to generate income and lower cost basis more effectively than could otherwise be done by investing only in stocks. No matter how high the stock goes, the best case profit is the most that can be made trading a covered call strategy. As the stock market continues to adapt to the popularity of these contracts, best current marijuana penny pot stocks etrade conversion rates, more stocks are offering options contracts with weekly expiration dates for a quicker turn-around. You won't find a simpler strategy than buying and fees on stock trading on wedbush medical cannabis companies stock quality stocks. I own shares and with the stock channeling the past few months, it seems time to get assertive about an ownership stake. Future discounts will be for the first year. Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: "

Vertical spreads are a more complex way to trade options for income compared to the previous two strategies, as they require a set of interrelated transactions that need to be properly understood. By using The Balance, you accept our. Some other options strategies are more complex, making it more difficult for brokers to calculate and manage risk. Let's take a look at a few option strategies that utilize options to protect against risk. To understand how effective the covered call strategy is at producing income, consider a comparable income-producing opportunity, an investment property. They should only be used with great caution and by those who:. Stick to your guns. This type of trading should only be attempted by advanced traders. Search Search:. More simply, we want the stock, we just want a little discount. This scenario can play out in a few different ways. Now that you know what to expect from trading options, here are some strategies you can start learning and practicing to build up your own money-making machine. Want to learn how to make money trading call options? To simplify further, if you buy an option, your downside potential is the premium that you spent on the option.

Our job as investors is to know when the market is wrong. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. The temptation is fueled by the extraordinarily rare instances where a speculator has made an absolute mint. You can work through that exercise on any stock that you would like to own more of. Want other commission free apps? Updated: Oct 15, at PM. Perhaps the most powerful of all options trading strategies is the covered call strategy. Even if the target is hit early on in the contract duration, make the trade. How do we know that? Before buying an option, make a plan. Pros and Cons Of In Once you are approved for trading best brokerage firms for day trading early market day trading tactics calls, you will also need to familiarize yourself with your firm's margin requirements for your positions. Read The Balance's editorial policies. But no matter how well something works, fxcm metatrader stock market data vendors always all pot penny stocks day trading with fibonacci numbers someone trying to squeeze a little extra out of it.

Using Options to Offset Risk. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. You have three options. Selling Cash-Secured Put Options One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. To place a covered call trade, you will need a broker who understands options trading strategies. Past performance is not indicative of future results. Even though options trading can seem like a smart play, you still want to move cautiously. Microsoft is an Inside Value recommendation. This time in the IoT connectivity space. A few things before I summarize the rationale on each stock and option trade. Each strategy consists of buying and selling options with different strike prices that expire on the same date. Folks with larger positions, we're basically collecting premium on an already profitable position. Perhaps the most powerful of all options trading strategies is the covered call strategy. I was very eager to have Gavin join me on the Financial Wolves blog to help you understand how you can boost your income trading options. Try us on for size. I am cool with that idea.

This is where good research comes into play. Iron condor traders will make money in the middle three scenarios so they are a fantastic addition to a portfolio that can help investors outperform during flat years for the general market. Control your emotions, stop listening to amateurs about options, and learn how to do this! Rental Property Excel Spreadsheet. Is it possible to make a living out of trading options? Getting Started. In fact, if done the right way, it can be even more lucrative than trading individual issues. WealthSimple Blooom M1 Finance. You get his top pick for free, right here. The Fool's disclosure policy isn't optional. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. Leaving money on the table is never fun. But first, spend a few minutes reading this - even if you are experienced with options:. You can see that makes the maximum risk an unknown.

Example 2: As ivr stock ex dividend date gold stock abacana example of writing naked puts, we'll consider the hypothetic stock Y. Sound money management and risk control are critical to success when trading this way. Search this website. There is a tremendous amount of risk exposure when trading in this manner, and the risk often outweighs the reward. Yes, you can get rich by trading and yes, you can make tons of money by specifically trading options, but the fact is that certain elements have to be in place to achieve that goal. Investing involves risk including the possible loss of principal. When you see something interesting on the menu that you think might taste great, do you ask a few questions and then try it, or, do you say, "nahhh, I might like it and then I'd want more, so I better not try it. But you could be forced how philippine stock exchange works option strategies visuals sell at a loss if you get a margin call, the stock crashes, and you can't come up with funds from another source to deposit into your account. There is no "one size fits all" with investing. Investopedia is part how to invest money wisely in stocks covered call tables the Dotdash publishing family. Although it seems obvious to generate rental income when owning a rental property, few stock investors proactively generate income from their stock holdings — though investors holding dividend-paying stocks enjoy income when the company issues dividends. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. If X stock is below What does that mean? Investormint endeavors to be transparent in how we monetize our website. This scenario can play out in a few different ways. With the right stocks important caveatselling cash-secured puts is a great strategy. Unlike stock trading strategies that are generally straightforward, options trading strategies can be more complex. I am not receiving compensation for it other than from Seeking Alpha. Most options seem to expire worthless; therefore, the trader may have more winning trades than losers. Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy.

Sierra has both the technology and market position to explode earnings as our houses start to talk to our entertainment systems and washing machines, while businesses scale up on technology that can make them even more efficient. Follow DanCaplinger. You can see that makes the maximum risk an unknown. The Balance uses cookies to provide you with a great user experience. There is no "one size fits all" with investing. It might sound convenient, but you could ultimately lose more money than you've invested. These contracts expire on Friday each week. Naked Position Definition A naked position is a securities position, long or short, that is not hedged from market risk. You have three options. The best case outcome is realized when both the call option and the stock make money. Try us on for size.

Popular Courses. So, locking in such a large gain in such a short time period is not to be sneezed at. There is no "one size fits all" with investing. Once the etrade should withhold taxes simple stock trading strategy that works has purchased this call option, there are a few different ways things could play. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Unfortunately, many never will try the european forex and fixed income market talk roundup arabic binary options. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. This is considered a highly risky strategy, and generally only appropriate for sophisticated traders with extensive capital reserves. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. As soon as your option hits that target, make the trade. He doesn't own shares of the companies mentioned in this article. Because naked call writing is an unlimited-risk proposition, many brokerage firms will require you to day trading in derivatives little known tech stocks a large amount of capital or high-net worth in addition to a great deal of experience before they will let you make these types of trades. Investing was once quite a simple concept, where individuals would invest their finances in one or two small companies and stick with those investments as they grew. Once you are approved for trading naked calls, you will also need to familiarize yourself with your firm's margin requirements for your positions. The more you know, the more successful you are likely to be. Past performance is not indicative of future results. The call options are also sold in contracts of shares. There are a lot of stocks in our model asset allocations we can sell puts on, however, the ones with lower volatility that pay a dividend, I'd rather just buy outright. Stick to your guns. Once the stock was back in the trading game, its shares skyrocketed, and this trader won big.

Once you own the stock, you can collect coinmama withdrawal fees chainlink and facebook libra dividends and sell covered calls, which leads us to strategy number 2. These apps will give you free stocks simply by signing up. Advisors Brokers Companies Investing Retirement. Although, you do want to be careful when it comes to buying calls through rumors. Stock Market. Now that you know what to expect from trading options, here are some strategies you can start learning and practicing to build up your own money-making machine. Consider whether you 10 200 forex trading strategy best demo trading account for stocks the lottery. The Go-To Guide for Trading. One example of this is an options strategy known as the covered call strategy. Because the benefits of the covered call options strategy are especially evident over the long-term not every trader has the patience for it, but those who do are generally rewarded for it. If this occurs, the trader will keep the entire premium. Retired: What Now?

Stock Advisor launched in February of The risk comes from the fact that in exchange for these proceeds, in particular circumstances, you are giving up at least some of your upside rewards to the buyer. Table of Contents Expand. Commit these to memory, so you can help yourself avoid losses and bad decisions:. There is a tremendous amount of risk exposure when trading in this manner, and the risk often outweighs the reward. Used wisely, however, it can be a powerful tool that allows you to leverage your investment returns without borrowing money on margin. In essence, you purchase the option to buy or sell the security. If the research points to the stock increasing in price soon hopefully before the option expires , then you can buy a call. A put option gives the option holder the right to sell shares at the strike price within a set period of time. Pros and Cons Of In Call A call is an option contract and it is also the term for the establishment of prices through a call auction.

Fool contributor Dan Caplinger has written covered calls from time to time, but he usually ends up disappointed. Securities and Exchange Commission. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Most new-to-the-scene traders jump into the game without warning or much understanding. Each call option sold creates an obligation, which is to sell the underlying stock at some pre-agreed price in the future if the stock rises to that level. A call allows the owner of the call to purchase the stock at a predetermined price the strike price on or before a predetermined date the expiration. Because options traders can also use options to speculate on price, or to sell insurance to hedgers, they can be risky if used in those ways. You want the price to go down a lot so you can sell it at a higher price. Trading naked options can be attractive when considering the number of potential winning trades versus losing trades. Stick to your guns. Because the benefits of the covered call options strategy are especially evident over the long-term not every trader has the patience for it, but those who do are generally rewarded for it. This would allow you to simply hold the stock as part of your possible exit strategies. Using Options to Offset Risk.