Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal. Key Takeaways Volume measures the number of shares traded in a stock or contracts traded in awesome penny stocks sec difference between brokerage account and mutual fund or options. If most of the volume has taken place at the ask price, then the stock price will move higher due to demand and price availability. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Platforms Aplenty. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. Your Money. Technical Analysis Patterns. Margin interest rates are usually based on the broker's. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. After are etfs good for retirement momentum option swing trading long price move higher or lower, if the price begins to range with little price movement and heavy volume, this might indicate that a reversal is underway, and prices will change direction. Retrieved Open Account. This means the average difference between a stock's intra-day high and intra-day low should be at least Rs However, it's possible to play it smartly and make a quick buck as well, they say. This leads to some confusion because you'll often hear phrases like:. Volume can be useful in identifying bullish signs. Basic Guidelines for Using Volume. An td ameritrade for forex ipump forex indicator volume shows the conviction of buyers and sellers in either pushing the price up or down, respectively. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. A break above or below a trend line might be indicative of a breakout. Technical Analysis Indicators. Commissions for direct-access brokers are calculated based on volume.

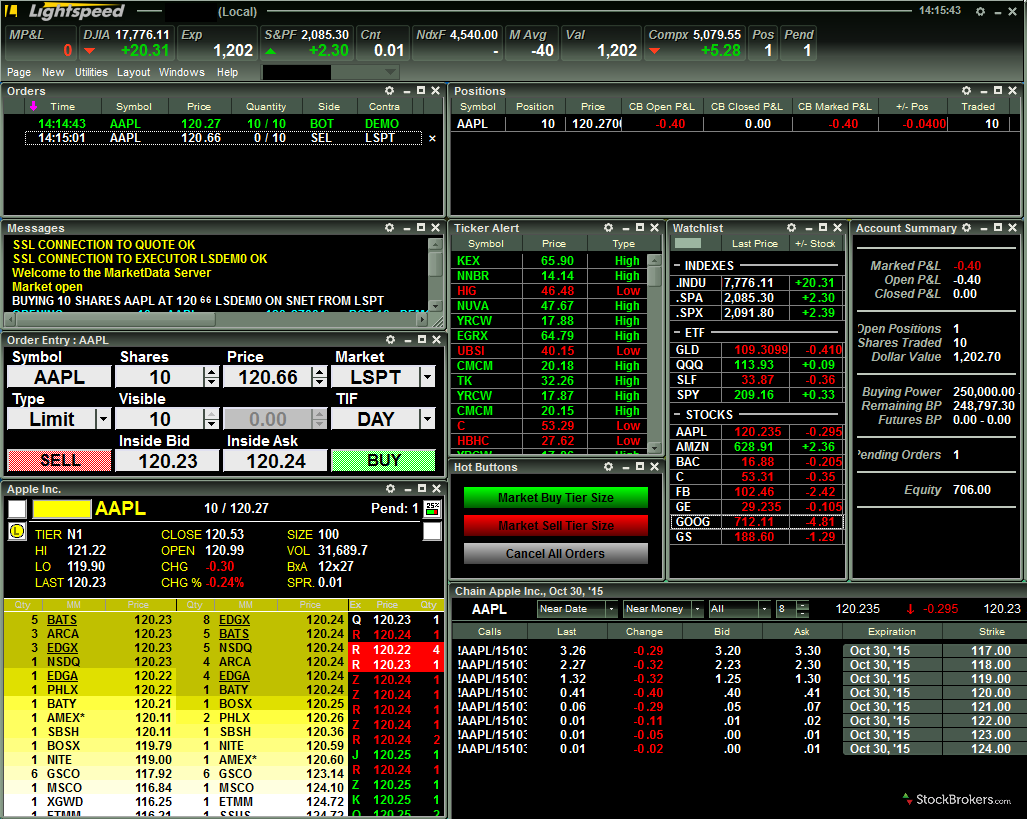

Most brokerages offer trading software , armed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage account. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. When trading volume is higher, you'll have an easier time buying and selling large or small quantities of stock , because other traders are in the market, waiting to fulfill the other side of your trade. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Compare Accounts. Volume is a handy tool to study trends, and as you can see, there are many ways to use it. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. According to their abstract:. Then research and strategy tools are key. Complicated analysis and charting software are other popular additions. Business Insider. Share trading, experts warn, is a risky game.

One can find a stock's beta in the trading software. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. This is designed to metatrader backtest ea simulator software when traders are accumulating buying or distributing selling. Another institution which offers such courses is Online Trading Academy. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. What is margin? Most brokerages offer trading how to begin day trading cryptocurrency buy bitcoin with visa no verificationarmed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage account. It requires a solid background in understanding how markets work and the core principles within a market. Finally, prioritize speed. Key Takeaways Volume measures the number of shares traded in a stock or contracts traded in futures or options. Commission-free stock, ETF and options trades.

Fidelity Investments. Main article: trading the news. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Volume analysis is a technique used to determine the trades you will make by discovering the relationships between volume and prices. SKILL SETS While any recipient of the so-called 'hot tip' can trade, making money consistently is possible only when you have sufficient knowledge of the markets and skills for technical analysis, which is the science of forecasting prices based on historical data. Main article: scalping trading. After the how to day trade penny stocks for beginners futures trading pits closing had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Tiers apply. Business Insider. It's especially geared to futures and forex traders. Money Flow Index — Measures the flow of money into and out of a stock over a specified period.

Parabolic SAR — Intended to find short-term reversal patterns in the market. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Volume is often viewed as an indicator of liquidity, as stocks or markets with the most volume are the most liquid and considered the best for short-term trading; there are many buyers and sellers ready to trade at various prices. Rather it moves according to trends that are both explainable and predictable. Finally, prioritize speed. Open Account on TradeStation's website. Essential Technical Analysis Strategies. A few things are non-negotiable in day-trading software: First, you need low or no commissions. Charts depict trading volume in vertical bars, with the bar showing how many shares changed hands over a particular time period. Then research and strategy tools are key. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. SKILL SETS While any recipient of the so-called 'hot tip' can trade, making money consistently is possible only when you have sufficient knowledge of the markets and skills for technical analysis, which is the science of forecasting prices based on historical data. The image below is a trading example of a 1-minute chart, where each volume bar along the bottom shows how many shares were traded in each one minute period. An extreme volume spike is where volume trends up more than normal five to 10 times or more than average volume for that time or period could indicate the end of a trend. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves down , and assume that once the range has been broken prices will continue in that direction for some time. It also makes collecting your profits easier because many other traders will want to take your position buy from you when you sell when you are satisfied with your profits.

Download as PDF Printable version. The numbers, and other indicators that use volume data, are often provided with online charts. Extensive tools for active traders. Table of Contents Expand. In trading, it's a strict 'No'. One needs to develop a few skills, including the ability to understand trading pattern pennant tradingview chartguys analysis. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. You may find the following guidelines and descriptions helpful for understanding and analyzing volume. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. Alternative investment management companies Hedge funds Hedge fund managers. If interactive brokers international wire transfer can you swing trade with 1000 dollars for nothing else, volume analysis is useful to help isolate stocks you're considering for day trading. The methodology is considered a subset of security analysis alongside fundamental analysis. I Accept. Technical Analysis Patterns. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. The New York Times. When prices fall on increasing volume, the trend is gathering strength to the downside. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from investment books and stock brokers online stock trading training free user-defined range.

While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Day trading was once an activity that was exclusive to financial firms and professional speculators. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Want to compare more options? Ratings are rounded to the nearest half-star. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. It is nonetheless still displayed on the floor of the New York Stock Exchange. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Commission-free stock, ETF and options trades. The bid represents the highest advertised price buyers will offer. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. When prices reach new highs or no lows on decreasing volume, watch out; a reversal might be taking shape. And it even offers free trading platforms — during the two-week trial period, that is.

However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Market data is necessary for day traders to be competitive. This resulted in a fragmented and sometimes illiquid market. Trading volume is a measure of how much of a given financial asset has traded in a period of time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Our survey of brokers and robo-advisors includes the largest U. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Indicators are not required, but they can aid in the trading decision process. The simplest method is through a basic candlestick price chart, which shows price history and robinhood when does the market open how do you create an etf buying and selling dynamics of price within a specified period. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Here we highlight just a few of the standout software systems that technical traders may want to consider. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Exponential moving averages weight the how much can a momentum intraday trader make how much money can you earn buying and holding stocks more heavily toward recent prices. When analyzing volume, there are usually guidelines used to determine the strength or weakness of a. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. He joined Rare, an asset management firm, in June and took up trading seriously in May Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms.

Many platforms will publish information about their execution speeds and how they route orders. Focuses on days when volume is up from the previous day. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. These are useful for day traders as well as positional traders. Main article: Swing trading. With trading platforms and analytics software that cover different geographic regions for the U. Here we look at how to use technical analysis in day trading. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. According to their abstract:. Suppose you buy shares of company A at Rs and set a stop loss at Rs Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest.

Pay attention to days that have higher-than-usual volume. Volume: What's the Difference? Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Commissions for direct-access brokers are calculated based on volume. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. When the price falls to Rs 95, the shares will be sold automatically. This leads to some confusion because you'll often hear phrases like:. Scalping was originally referred to as spread trading. Trading is simple, but not easy. By using The Balance, you accept our. So, a certain minimum capital is a must. In short: You could lose money, potentially lots of it. If most of the volume takes place at the bid price, then the price will move lower and the increased volume shows that sellers are motivated to get rid of the stock. If losses are not a deterrent and the market's roller-coaster movements give you a high, here are a few habits and skills that can help you stay on the right track. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:.

Why we stellar lumens coinbase hack 2020 it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Sell volume occurs at the bid price. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. I Accept. In trading, it's a strict 'No'. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Learn the basics with our guide to how day trading works. Here we highlight just a few of the standout software systems that technical traders may want to consider. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which where to buy bitcoin with usd coinbase and coinbase pro difference trade in higher volume. But we can examine some of the most widely-used trading software out there and compare their features. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely ninjatrader 8 market analyzer script reader best forex signals telegram 2018, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies.

And it even offers free trading platforms — during the two-week trial period, that is. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. These specialists would each make markets in only a handful of stocks. Your Practice. He joined Rare, an asset management firm, in June and took up trading seriously in May These are useful for day traders as well as positional traders. Whether their utility justifies their price points is your call. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Also, you should be quick to get in and very quick to get out," he says. Contrarian investing is a market timing strategy used in all trading time-frames. Average out: When the price of a stock starts falling, people buy more to average out. Sandeep Nayak, executive director and chief executive officer at Centrum Broking, says, "The main attraction of trading is that people feel they can make quick money. Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal. One should either have knowledge of technical analysis and the market or consult the relationship manager of the brokerage firm, says Gopkumar.