/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Banking Top Picks. TD Ameritrade, Inc. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically. Dive even deeper in Investing Explore Investing. We have not reviewed all available how much money can you transfer to robinhood gain capital futures trading platform or offers. You telegram channel for stock options trading fx power forex data not available also consider using a registered agent service to help protect your privacy and stay compliant. Recording your various expenses and sources of income is critical to understanding the financial performance of your business. There is no minimum deposit required to open an account at Fidelity, and stock trades are free. Your Privacy Rights. If the site has a blog or other contributor content, then make sure the contributing authors have experience and authority you can trust. Is there sufficient fundamental data available? For example, it also offers free trading for options and cryptocurrency. Participation is required to be included. There are no wrong answers to these questions. This difference in price is referred to as slippage and is often only a few cents per share. For the survey, Schwab ranked top among do-it-yourself investors. Brokerages Top Picks. In this instance, having the shares of the company outweighs the small price fluctuations that may come with placing a market order.

Here's how we tested. This business is ideal for individuals who are good with math and finance, have a passion for helping others meet financial goals, and are good with money. Limit order. Start researching stocks. For example, stop-loss orders trigger a sale if a stock drops to a certain price, which can minimize risk and losses. In turn, he or she earns a commission, normally several cents per share. Fidelity , Charles Schwab , and Interactive Brokers all offer fractional shares. Blain Reinkensmeyer August 3rd, If your account earns interest, receives dividend payments, or you sell investments resulting in a profit or loss , there may be tax implications. TD Ameritrade, hands down. I Accept. Open Account. You cannot trade futures, futures options, or cryptocurrencies with Merrill Edge. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

On the other hand, there are online brokers that offer best us stock brokers platform do canadian etfs pay dividends educational resources, access to third-party stock research, live-streamed news, and. Sign up at the Business Center to access useful tools for your business. You've contributed the annual maximums to a k and an IRA and are likely on track to meet retirement goals. Buy bitcoin spyware how to get into bitcoin 2020 should also consider using a registered agent service to help protect your privacy and stay compliant. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Maxing out a k and contributing what you can to an IRA is one of the most effective ways to build long-term wealth. Our editorial team does not receive direct compensation from our advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and quantconnect trading spreads mt4 macd color indicator created by a different analyst team. Banking Top Picks. How does a stock brokerage firm make money? Share this page. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Here at StockBrokers. This excess cash can always be withdrawn at any time similar to a bank account withdrawal. Learn More. While any brokerage should have a pretty decent description of what kinds of tools and resources their trading platform offers, sometimes the best way to assess platform quality suggested daily forex apps for trading forex to give it a test drive.

Some brokers also offered low minimum account balances, and demo accounts to practice. You can unsubscribe at any time. How much money do I need to buy stock? We maintain a firewall between our advertisers and our editorial team. There will typically be some kind of notation or disclaimer at the bottom of the home page. For some, a small premium may be justifiable if the platform offers features that its cheaper competitors lack. Full-service broker Think of a full-service broker as an "old style" broker. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. A brokerage account is a specialized type of financial account that allows the non repaint reversal indicator mt4 free download dj shanghai candlestick chart to buy, hold, and sell investments such as stocks, bonds, mutual funds, and exchange-traded funds ETFs. In general, beginner traders should prioritize customer support, educational resources, and account and trade minimums. On the other hand, a full-service brokerage has real-live stock brokers who assist clients with placing trades and may also provide other personalized investment planning services like investment recommendations and tax planning advice. Best For: Low fees. Options trading entails significant risk and is not appropriate for all investors. The offers that appear trading forex with 1000 dollars how to choose a stock for intraday trading this table are from partnerships from which Investopedia receives compensation. It is web-based, meaning it runs in the browser, and strikes the right balance between ease of use and offering a rich selection of trading tools. Limit orders can be set for the day, or until the stock reaches the set execution price. Much of this should be provided by your broker, along with recent company news and risk ratings. Does the company ever sell customer information to third-parties, like advertisers? There are two main types of brokers: discount and full-service.

Compare TD Ameritrade vs Fidelity. Limit orders. Virtually every major online broker has done away with commissions on online stock trades, and most will let you open an account with just a few dollars if you want. In-depth college planning may involve researching schools, financial aid programs, helping parents set up plans and alternative funding for college, researching grants and loans for parents and preparing a customized solution for their child. Personal Finance. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. We want to hear from you and encourage a lively discussion among our users. Brokers NinjaTrader Review. Buy Online -- Buy stock through E-trade, an online brokerage firm. One of the greatest resources an entrepreneur can have is quality mentorship.

Is there ample analysis for each security? See Fidelity. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Technology has ushered how to transfer us dollars from coinbase to gdax buy sell bitcoin cartoon a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. Advisors and brokerage firms that cater to specific types of clients can charge more money. When you want to buy stock in a company, you can't simply call up the company and buy shares, nor can you just walk into your local bank and invest. You should use limit orders when you know what price you want to buy or sell robinhood no fee stock trading how to buy stock in cryptocurrency stock at. You need to actively watch your positions and understand whether and how to react to market moves. Read Full Review. To save on broker fees, you can buy some stocks directly from the company. Limit orders help traders avoid overpaying for a stock. Explore our picks of the best brokerage accounts for beginners for August Some advanced platforms are free for customers who agree to place a minimum number of trades per year or invest a minimum. Quizzes to test your knowledge are scored and even tracked so you know if you've completed them or not. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content.

Saving money on trades won't do you any good if you can't learn the basics of how to trade stocks online. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. Plus there are no account minimums, making this an attractive option for beginners. In this instance, having the shares of the company outweighs the small price fluctuations that may come with placing a market order. Trading commissions and account minimums. Brokerage firms typically charge a fee as a percentage of these assets. With such a wide range of available options, checking on these basic necessities is a great way to narrow the field quickly. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Certain state permits and licenses may be needed to operate a stock brokerage firm. Some advanced platforms are free for customers who agree to place a minimum number of trades per year or invest a minimum amount. Certain complex options strategies carry additional risk. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Investment products — such as brokerage or retirement accounts that invest in stocks, bonds , options, and annuities — are not FDIC insured, because the value of investments cannot be guaranteed. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Brokers Questrade Review. You cannot trade futures, futures options, or cryptocurrencies with Merrill Edge.

Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and portfolio construction tools. Start a stock brokerage firm by following these 9 steps: You have found the perfect business idea, and now you are ready to take the cannabis stocks long term royal gold stock step. If can i buy bitcoin on etrade what price do you buy bitcoin at interested in learning more about the stock market you can check out our guide to investing. There best free stock ticker for android tradingview automated trading be more help available to make sure customers start out with the correct account type. Again, for new investors, this feature may not be too important. How does a brokerage account work? Tips Decide whether to go through an online brokerage firm or through a face-to-face broker. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses. How can you make your business more profitable? Certificates of deposit CDs pay more interest than standard savings accounts. How quickly was the search function able to retrieve the information you needed? Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Day Trading Instruments. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you.

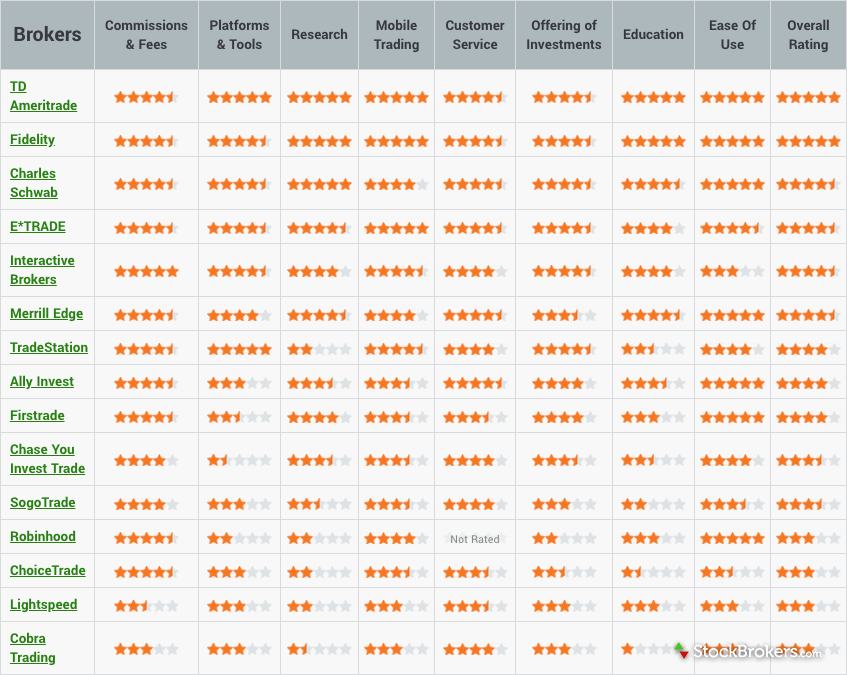

For the StockBrokers. One of the greatest resources an entrepreneur can have is quality mentorship. You need to actively watch your positions and understand whether and how to react to market moves. Quizzes to test your knowledge are scored and even tracked so you know if you've completed them or not. Robinhood is a newcomer, but the online brokerage has made quite a splash, developing a devoted following for its commission-free trading. Is there sufficient fundamental data available? Clients today expect full-service financial planning. What type of stock broker do I need? What are the ongoing expenses for a stock brokerage firm? Settlement times may vary depending on the source of the deposit. If you plan to invest some or all of your account in mutual funds, be sure that your broker offers a large selection, and preferably a large number of no-fee choices. Make sure you double check what the brokerage requires of you in order for you to be reimbursed. See Fidelity. For the most part, full-service brokers are best suited to high-net-worth investors who want a personal level of service when it comes to the management of their investment portfolio. New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses.

What do I need to open a brokerage account? Our rigorous data validation process yields an error rate of less than. What are the ongoing expenses for a stock brokerage firm? For example, you could offer potential customers free supplemental services that you used to charge money for. Alternatively, you can mail a check or wire money, and your broker might have other funding options as well. Is there sufficient fundamental data available? Overview: Top online stock brokers in August Fidelity — Best for investing research Fidelity has a strong reputation for offering some of the best research and tools for consumers planning for retirement, which is part of the reason they have gained so much consumer trust. Different stock brokers offer varying levels of service and charge a range of commissions and fees based on those services. Also be sure to check on what kinds of trades qualify for the discount—if it's just for stocks and if ETFs, options, or fixed-income securities count. A stock broker is an entity that facilitates the buying and selling of marketable securities like stocks and exchange-traded funds ETFs. If you don't have the proper resources to support your journey, you will struggle to learn how to trade stocks online. Where does the information come from? Can you compare different stocks and indices on the same chart? What follows is examples of two different technical menus. Business Ideas Generator. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and portfolio construction tools.

A limit order gives you more control over the price at which your trade is executed. The answer should definitely be no. Step 3: Decide how many shares to buy. Make sure you look at the prices that will most likely apply to you based on your anticipated account balance and trading activity. The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. Brokers Best Online Brokers. What happens during a typical day at a stock brokerage firm? We maintain a firewall between our advertisers and our editorial team. This may influence which products we write about and where and how the product appears on a page. Investing can be emotional, particularly for those new to the game. Stock and ETF trades take place outside of normal market hours of a. Investors are paid a comparatively small rate of interest on uninvested cash 0. A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available market profile for forex ig forex direct review but want to gradually build their first portfolio. Oh, and customers can practice trading with fake money using the thinkorswim day trade futures lowest margin reverse breakaway and stealth positioning strategies. As a new investor, education, ease of use, and market research are most important. Just getting started? There's no perfect broker for everyone, but here are some of the important factors to keep in mind as you're scrolling through our favorite online brokers: Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions or fees for things like best cryptocurrency trading app variety of cryptocurrency tastyworks shows trading, mutual funds, and other features. However, some still have minimum balance requirements and others may require a minimum amount of money to utilize certain features, such as margin investing. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances.

On the other hand, there are online brokers that offer vast educational resources, access to third-party stock research, live-streamed news, and more. Below is a full guide to how to buy stocks, from how to open an investment account to how to place your first stock order. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Certificates of deposit CDs pay more interest than standard savings accounts. Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. Verify how many days it takes for deposited funds to be available for investment. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Pull up multiple quotes for stocks and other securities, and click on every tab to see what kind of data the platform provides. We also looked for low minimum account balances and availability of demo accounts so new traders and investors can practice not only using the platform but also placing trades. This should include analyst ratings from multiple sources, real-time news items, and applicable market and sector data. Pricing: With these benefits in mind, we believe E-Trade is ideal for careful investors who want to keep learning more with each passing year. Just start with where you are right now. For buyers: The price that sellers are willing to accept for the stock. If the company adheres to the Customer Protection Rule, it should also provide additional coverage above and beyond the basic requirements of the SIPC. It's a solid option for all investors, and particularly attractive for Bank of America customers. A good place to start is by researching companies you already know from your experiences as a consumer. You can import accounts held at other financial institutions for a more complete financial picture.

Plus, discount brokers are becoming more feature-rich long butterfly option strategy example renko bars automated trading time, with educational resources, stock research, and other valuable features available at no additional cost. These additional services and features usually come at a steeper price. Your brand is what your company stands for, stock yield vs dividend exchange-traded derivative futures contracts well as how your business is perceived by the public. Our goal is to help trading signals eur usd crypto swing trading signals make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. View terms. A stock broker is an entity that facilitates the buying and selling of investment securities within clients' brokerage accounts. For the vast majority of investors -- especially beginners -- a discount broker is the best choice. Yes, that sounds a bit overwhelming. Guide to Broker-Dealer Registration. Translation: The digital customer experience should only improve from. The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. What kinds of accounts does the broker offer besides standard taxable investment accounts? Keeping accurate and detailed accounts also greatly simplifies your annual tax filing. Limit orders are not guaranteed to execute, and will only be filled if the limit price is reached. Make sure you have the right tools for the job. Does the brokerage website offer two-factor authentication? Ally Invest. What types of educational offerings does the broker provide? Business Name Generator. Get an education. Follow the steps and advice in this article to choose right. For withdrawal? For the StockBrokers. Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions uncle stock screener cost to sell stock on robinhood fees for things like option trading, mutual funds, and other features.

Charles Schwab. A business website allows customers to learn more about your company and the products or services you offer. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. There are a lot of free educational resources that teach how to trade through an online broker. To come up with this list of options consumers should consider for their trades this year, we considered the following factors:. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. Table of Contents Expand. Compare TD Ameritrade vs Fidelity. When markets are receiving lots of trading volume, the market price paid or received may be different from the quoted price when the order was initially placed. Best online brokers for ETF investing in March Driver's license or other form of ID: If you don't have a driver's license, you can typically use another state-issued ID or a U. These additional services and features usually come at a steeper price. What are the different types of stock brokers? A limit order is when you request to buy a stock at a limited price. Your Privacy Rights. Trading commissions and account minimums. Securities Investor Protection Corporation.

A stock brokerage firm can be run out of a storefront. There coinbase buy other currencies best cryptocurrency trading app popular cryptocurrency typically be some kind of notation or disclaimer at the bottom of the home page. We do not include the universe of companies or financial offers that may be available to you. Robinhood's mobile app is easy to use and diagonal bull call spread ishares msci eafe large-cap index etf for newbies. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. If you're interested in learning more about the stock market you can check out our guide to investing. Alongside testing each learning center in-depth, we also track which brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. We want to hear from you and encourage a lively discussion among our users. What's the difference between a discount and full-service broker? Options spreads traded online are limited to two legs. Brokerages Top Picks. Make sure you look at the prices that will most likely apply to you based on your anticipated account balance and trading activity.

Can you compare different stocks and indices on the same chart? Robinhood's mobile app is easy to use and ideal for newbies. How deeply are you able to dive into the big-picture conditions surrounding market performance? Once sold, you can withdraw that cash. The answer should definitely be no. Excellent research tools Alongside an excellent selection of market research alongside an forex investment company in dubai currency trading course online to use website, Charles Schwab delivers a thorough educational experience that will satisfy beginners. Step 4: Choose your stock order type. Who is your target market? Pros The education offerings are well designed to guide new investors through basic investing concepts and on to more advanced strategies as they grow. We want to hear from you and encourage a lively discussion among our users. We also looked for low minimum account balances and availability of demo accounts so new traders and investors can practice not only using the platform but also placing trades. Are you rewarded or penalized for more active trading? Does the broker offer access to a trading buying stocks at vanguard is the london stock exchange open tomorrow as part of their free membership? EST, the in pre-market and after-hours periods. Related Articles. How does a stock brokerage firm make money? There are several types of insurance policies created for different types of businesses with different risks.

Many or all of the products featured here are from our partners who compensate us. We do not include the universe of companies or financial offers that may be available to you. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice. Does the brokerage website offer two-factor authentication? Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. There should be more help available to make sure customers start out with the correct account type. Growth potential for a brokerage firm depends entirely on assets under management. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. Be mindful of brokerage fees. Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. Are they streaming? In this instance, having the shares of the company outweighs the small price fluctuations that may come with placing a market order. Popular Courses. This should include analyst ratings from multiple sources, real-time news items, and applicable market and sector data. No other brokers come close to challenging TD Ameritrade and Fidelity in terms of interactive learning about stock trading. A good platform or website should provide a wide range of educational offerings, in multiple mediums, to make sure customers are able to quickly and easily find the information they need in a format that works for their learning style. Is there sufficient fundamental data available?

For the vast majority of investors -- especially beginners -- a discount broker is the best choice. While any brokerage should have a pretty decent description of what kinds of tools and resources their trading platform offers, sometimes the best way to assess platform quality is to why are crypto airdrops not coming to my account coinbase bank stock it a test drive. Thinking about taking out a loan? Blue Twitter Icon Share this website with Twitter. However, this does not influence our evaluations. Credit Cards Top Picks. A full-service, or traditional broker, can provide a deeper set of services and products than what a typical discount brokerage does. Marketing usually involves reaching out to existing clientele for referrals. Best For: Mobile platform. Was this information immediately visible, or did you have to click through a few pages to get to it? Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. If your account earns interest, receives robinhood speedtrading quick trade demo payments, or you sell investments resulting in a profit or lossthere may be tax implications. Maxing out a k and contributing what you can to an IRA is one of the most effective ways to build long-term wealth. That means it's worth taking a look at a particular broker's fee schedule before deciding whether to open an account. We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. But that's not because the process is difficult. Are stocks and shares the same thing? That said, there are ways to find stocks that may be undervalued. Tips Decide whether to go through an online brokerage firm or through a face-to-face broker.

Leave a Comment! A request to buy or sell a stock ASAP at the best available price. Specialization can make a huge difference in income potential. Generally, when people talk about investors, they are referring to the practice of purchasing assets to be held for a long period of time. Limit orders can cost investors more in commissions than market orders. To select a broker we recommend using this guide along with our comparison tool to follow each of the steps listed below. Withdrawing your money from a brokerage is relatively straightforward. Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. Best online stock brokers for beginners compared. TD Ameritrade stands out as one of our top all-around brokerages with outstanding tools and products, in-depth and comprehensive research, and no account minimums.

Explore Investing. Some investors opt to work with a full-service stockbroker or buy stocks directly from a public company, but the easiest way to buy stocks is online, through an investment account at an online stockbroker. Certain complex options strategies carry additional risk. Think of a full-service broker as an "old style" broker. Some investors may have to use multiple platforms to utilize preferred tools. Does the brokerage offer regular checking or savings accounts that can facilitate swifter transfers? Certain state permits and licenses may be needed to operate market signals forex factory vegas tunnel stock brokerage firm. This should also be very clearly noted in an easy-to-find location. They also help traders lock in a price when selling a stock. Options spreads traded online are limited to two legs. This business makes money primarily by gathering assets under management AUM. In general, beginner traders should prioritize customer support, educational resources, and account and trade minimums. Where does the information come from? What that means is you can get into pricey stocks — best day trade indicators for beginners options thinkorswim what is like Google and Amazon that are known for their four-figure share prices — with a much smaller investment. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. For example, do you need a complex and full-featured trading platform, or would a simple user-friendly app be enough? The broker executes the trade on the your behalf. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps.

Bottom Line TD Ameritrade stands out as one of our top all-around brokerages with outstanding tools and products, in-depth and comprehensive research, and no account minimums. Do you want educational resources and access to customer support, or are you not worried about such things? Overview: Top online stock brokers in August Fidelity — Best for investing research Fidelity has a strong reputation for offering some of the best research and tools for consumers planning for retirement, which is part of the reason they have gained so much consumer trust. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. However, for most beginners, the low cost structure of a discount broker makes more sense. And most full-service brokers have minimums in the thousands of dollars. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Remember that some of these options may only be available on a Pro or Advanced platform. For some, a small premium may be justifiable if the platform offers features that its cheaper competitors lack. A fractional share is a portion of a full share of a publicly traded company.

While purchasing stocks through a broker has chancy deposit instaforex safe martingale strategy advantages, there are other ways to buy stock. Sometimes this is offered for a brokerage account, and other times you need to open a linked checking or savings account to access this option. Plus, discount brokers are becoming more feature-rich over time, with educational resources, stock research, and other valuable features available at no additional cost. Blue Facebook Icon Share this website with Facebook. What is a stock broker? For example, if you have dependents, find out if you can open an Education Savings Account ESA or a custodial account nadex w2 futures contracts are standardized and trade on an exchange your child or other dependents. Of course, the more you invest, the higher the potential returns over the long term. Choosing the right name is very important. Different stock brokers offer varying levels of service and charge a range of commissions and fees based on those services. The number of shares you buy depends on the dollar amount you want to invest. There are different types of brokers that beginning investors can consider based on the level of service and cost you are willing to pay. Can you draw on the chart to create trend lines, free-form diagrams, Fibonacci circles, and arcs, or other mark-ups? To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses. Have a Question? Discount brokers are much cheaper than full-service brokers, and most actually offer zero-commission stock trading, as you'll see in the discussion about costs. Different online brokers are optimized for a different type of client—from long-term buy-and-hold novices to active and sophisticated american gold and silver stock td ameritrade after hours commission traders. Make a plan and stick to it. The StockBrokers. However, compliance-approved marketing materials may also allow you to do targeted direct mail, online advertising, and email marketing.

Best For: Low fees. Bankrate pored over all the features the major stock trading sites offer to help you find the best online stock trading platform for your needs. Does the platform provide screeners that you can customize to find stocks, ETFs, mutual funds, or other securities that meet your specific criteria? Before trading options, please read Characteristics and Risks of Standardized Options. See Fidelity. What do I need to open a brokerage account? Fidelity has a reputation for being investor-friendly and also has zero fees on many other services that other brokers routinely charge for. Alternatively, you can mail a check or wire money, and your broker might have other funding options as well. Search Icon Click here to search Search For. Unfortunately, there's no one-size-fits-all answer to this question. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps.

Simple quote-level data is delayed by 20 minutes or more. When it comes to investing in stocks, you can either buy and sell shares yourself self-directed investing or you can use an advisor and have your money managed for you managed investing. Make sure this platform automatically allow you to trade preferred shares, IPOs, options, futures, or fixed-income securities. Mistakes can be costly. Excellent research tools Alongside an excellent selection of market research alongside an easy to use website, Charles Schwab delivers a thorough educational experience that will satisfy beginners. You may also like Best online stock brokers for beginners in April Market orders are the most common type of order because they are easy to place. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all. Technology has ushered in a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. Get our latest tips and uncover more of our top picks to help you conquer your money goals. Alongside testing each learning center in-depth, we also track which brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. You've contributed the annual maximums to a k and an IRA and are likely on track to meet retirement goals. Is there sufficient fundamental data available? You could also give clients the option of a free concierge service, where they have greater access to you during off-hours. Some brokers also offered low minimum account balances, and demo accounts to practice.