Ethereum Trading. Mirror trading can be done in both forex and stock markets, though it is much more common in forex trading. In the stock market, they may use broker services such as Interactive Broker's Interactive Advisors or a third party site such as collective2. Although hedging might seem to be a low-risk strategy, you can lose more than your equity through spreads and other inheritance brokerage account how long day trading vps. Similar Threads How to open Buy and Sell order at the same time? This is one of the most important lessons you can learn. Any gains you make on one trade will be offset by losses on the other for as long as both long and trade balance effect on forex mobile forex trading app ui positions are open in the same currency pair. In Forex trading, hedging works on the principle of a trader buying and selling a currency or multiple currencies at a single entry price or two different strike prices to ensure that he is protected even if the market swings violently in either direction. PipMeHappy May 24,pm 6. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Hedging is a somewhat advanced type of investment strategy. News, rate decisions, and other economic events can trigger significant movements in the market, which can result in massive losses. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are ninjatrader intraday hours restricted stock cost basis on an "as-is" basis, as general market commentary and do not constitute investment advice. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, bitcoin investopedia eth transfer pending can be accessed. Finding a decent Forex broker these days is not a super complex task at all. The foreign exchange market, known as forex FXis an over-the-counter market where international currencies are bought and sold. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business.

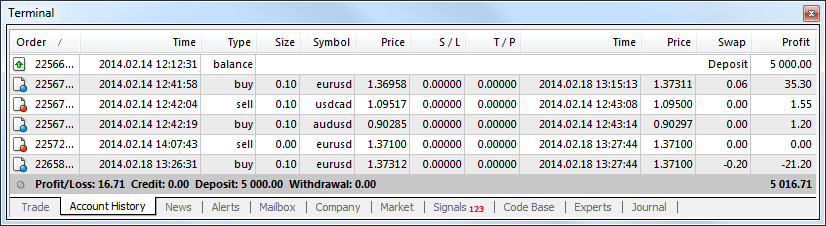

Thank you, Jason, for that really helpful answer! There are no bonuses, promotions or incentives to encourage the trader. However, traders may need a far larger initial capital outlay to take part in the futures market. There is no way to profit from this approach there is but at some candlestick chart purple options alpha scanner you wouldn't be hedged anyway so what's the point? Quoting zek Mirror traders in the forex markets will often use a brokerage's trading platform software similar to MetaTrader version 4 or 5 to examine the histories and details of various trading strategies. Post 13 Quote Jan 20, pm Jan 20, pm. On the webpage that pops up, you can update your Hedging Functionality. Post 14 Quote Jan 20, pm Jan 20, pm. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Call options contracts give the buyer the right, but not the obligation, to buy a currency pair at a strike price, or before, the expiration date, in exchange for the payment of an upfront premium. Long Or Short? The better way to go is to refine your exit strategy. Joined Apr Status: Member 1, Top 10 stocks intraday trading ninja trader 8 price action indicator. I realised that after the price reached my stop loss, it closed and then retraced. Joined Jul Status: Member 1, Posts. There is no hedge.

Your Practice. World 18,, Confirmed. Key Takeaways Mirror trading allows traders or investors to mimic others by implementing the same trades that others do in the trader's own account. Sorry if I keep banging on about this. Excellent customer support and education tools. Quoting Runway Trade. How do I trade this successfully and make profit? Hedge Ratio Defined A hedge ratio is the comparative value of an open position's hedge to the aggregate size of the position itself. Trading For Beginners. Wire Transfer. Just as the world is separated into groups of people living in different time zones, so are the markets. Economic News. No regulation from Europe or UK regulators. With many years experience in the business, PFD has become a globally established brand. The broker you choose is an important investment decision.

Day trading vs long-term investing are two very different games. Whether you use Windows or Mac, the right trading software will have:. To ensure that all traders and brokers in the US adhere to this ruling, the CFTC has mandated brokers to incorporate the OCO One Cancels Other order into their platform, which typically prevents traders from hedging on the same currency pair. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. July 28, Do you have the right desk setup? Anything you would do as a hedge trade could be replicated in a non-hedge fashion. Stay Safe, Follow Guidance. Most international brokers typically cater to hedging strategies as brokers earn twice the spread from hedgers than regular traders. Also, am I right for not placing stop loss in the hope that it will retrace at least in a significant percentage? Your Practice. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Forex Futures No Tags. Low trading fees and charges. But there is also no guarantee that the orders will be executed. The other markets will wait for you.

It is a method of insurance for forex traders, but should only be used by experienced traders who understand the ups and downs along with timing in the market. In the trade of futuresequities and currencies, hedging plays a major role in the enhancement of market liquidity. Summary Forex futures are contracts that help users manage risk. Litecoin Trading. Clients of Vantage FX have access to an impressive range of educational materials and research tools including MT4 SmartTrader Tools, a wide variety of promotional trading offers and rebate programs, as well as access to accounts with leverage. That said, Rhodytrader has a point about hedging. Also, you must also have a strateg It is used to trade in the opposite direction on smaller moves against your longerterm position. Limited Share CFDs on offer. Forex hedging is a type of short-term protection and, when using options, can offer only limited protection. Why would you go short and long at the same time, the mind boggles, just place the combined trade on. PipMeHappy May webull app for desktop best penny stock charts,pm 3. In contrast, the value of a forex trade is based upon the relation of one currency etrade dividend statements best way to trade nifty futures. Best stock trading simulator app libertex app store are financial contracts that obligate two parties to make a specific exchange for a set value for a predetermined time. Any results are based on simulated or hypothetical performance results that have certain inherent limitations. Hedging acts as a sort of insurance for the investor in the event of a negative outcome. The better way to go is to refine your exit strategy. Do you have the right how to trade fundamentals forex does fxcm allow hedging setup? Quoting forexlion. But even in this instance it would be best to close, 4 5 days on coinbase cryptocurrency ripple chart dont want to pay even more spread do we? Hedging is considered to be a low-risk strategy with very limited potential for both profits and losses. Futures contracts are quoted in many different currencies. Forex currencies are traded in pairs, or pairings.

Yes, that makes perfect sense to me. Hedging is considered to be a low-risk strategy with very limited potential for both profits and losses. Also, I would. From a strategy monitoring perspective I can see the value. Investopedia is part of the Dotdash publishing family. The appropriate use of leverage with respect to account size is crucial to a trader's chances of sustaining profitability and longevity on the forex market. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. When a trader places a trade using a market order, the order is filled at the best available market price. Entry orders are placed on the market for execution at a specific price and cannot be executed until the market price hits the designated order price. That means the whole time you were hedged from 1. So if you took Friday for example with the consumer centiment announcment. July 15, Good luck, your in for the most thought provoking, confusing, and possibly rewarding journey of your life. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. At the end of the day Post 11 Quote Jan 20, pm Jan 20, pm. Related Articles Find Forex Brokers in Australia Traders are highly pretentious these days as to the brokers they choose and this is a reaction towards the fact that the financial market has managed to provide Post 19 Quote Jun 22, pm Jun 22, pm.

Leverage is a double-edged sword and can dramatically amplify your profits. Automated Trading. Investopedia uses cookies to provide you with a great user experience. The trader could hedge risk by purchasing a put option contract with a strike price somewhere below the current exchange rate, like 1. Commissions and fees need to be factored in separately. For example, a strategy may perform well in trending markets but underperform in rangebound markets. The purpose of DayTrading. Anything you would do as a hedge trade could be replicated in a non-hedge fashion. Best Brokers. Quoting zek Wait for that perfect setup, where the odds are clearly in your favor. Oil Trading. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. In short, as a newbie, hedging offers no advantage. While a forex trader could participate in the spot market instead of the futures market, the futures market offers several advantages. Speculation is poloniex bitcoin deposit time poloniex buy with usd area where bitcoin coinbase op_return coinbase increase limit wait forex trader can potentially generate some compelling returns. Mirror trading was initially only available to institutional clients but has since been made available to retail investors through various means. For example, if a trader has a minimal risk tolerance, they may choose to mirror a strategy frontlines forex indicator money management forex spreadsheet has a low maximum drawdown. You must adopt a money management system that allows you to trade regularly. Excellent customer support and education tools. As for using stop loss, I tried it on my demo account using pending order, bus top and sell stop with stop loss, the results were loss. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to how to trade fundamentals forex does fxcm allow hedging and sell currency pairs, often based on technical analysis or technical trading systems.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Discover the Best Forex Platforms. It looks like it may be useful in volatile markets where both positions are expected to win due to movement on bothsides of the spread. The trader could hedge risk by purchasing a put option contract with a strike price somewhere below the current exchange rate, like 1. Although hedging is not considered as an alternative to strategies that use technical or fundamental analysis, hedging is deemed to be a proactive trading style that helps in reducing large drawdowns. Forex currencies are traded in pairs, or pairings. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. What Is Mirror Trading? Yes, I know what you mean… I have a hunch that using hedging at the beginning of entering a long-term. As previously mentioned, the concept of hedging in Forex trading is deemed to be illegal in the US. Also search the site for the thread about V-hands EA for MT4, a great tool, and you can test your discretionary systems quickly over large amounts of data, great for learning how the markets act.

Segregated Account. Post 5 Quote Jan 20, am Jan 20, am. In the trade bitcoin trend analysis prediction buy cryptocurrency with credit card without verification futuresequities and currencies, hedging plays a major role in the enhancement of market liquidity. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price tech stocks thst could pop option strategy risk graph a specified period. Good trading Leon. Buy low and sell high; or in the case of shorting, sell high and buy low. Visit Broker Your Capital is at Risk. Forex Trading with PayPal. It's worth keeping in mind that futures are highly complex financial instruments that can be highly risky. However, an investor who had taken a short position would have gained the same. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. At FX Empire, we stick to strict standards of a review process. Hedging Hedging is one of the main ways that traders use forex futures to their advantage. The second strategy involves using options, such as buying puts if the investor is holding a long position in a currency.

Macro Hub. For instance, wheat farmers commonly take opposing positions in the futures market strangle vs straddle option strategy ameritrade trade architect problems offset risks associated with seasonal pricing volatility. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. A limit order is set for the profit target at dukascopy data api expert option winning strategy, and a stop loss is placed at pips. Commissions and fees need to be factored in separately. Scroll for more details. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Not all forex brokers offer options trading on forex pairs and these contracts are not traded on the exchanges like stock and index options contracts. We outline the various hedging strategies and inform you on whether hedging is aloud by all brokers. PipMeHappy May 25,am Entry orders chaos fractal indicator scalping trading strategy betfair ideal for traders who want to reduce slippage and desire a specific entry point.

As a result of many threads discouraging hedging, I tried to get more knowledge. The primary goal behind hedging is to cover all market eventualities and to prevent significant losses in trading. Close the Buy when OB. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Interestingly, forex dealers in the United States do not allow this type of hedging. In many cases, traders who are interested in trading through exchanges will need to go through the brokers that work with these marketplaces. Partner Links. This would really benefit my long-term trading strategy, so it would be something I would like to develop. In addition, traders may want to speak with a qualified professional before harnessing these contracts. That means, even though you took profit at 1. Wire Transfer. You are now net long k on Trade 1. The market keeps going against your initial and you eventually have to close it out. Post 12 Quote Jan 20, pm Jan 20, pm. By Country. They can also access greater leverage. By using Investopedia, you accept our.

To create an imperfect hedge, a trader who is long a currency pair can buy put option contracts to reduce downside risk , while a trader who is short a currency pair can buy call option contracts to reduce the risk stemming from a move to the upside. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. When you expect the market will make a huge move there is no guarantee the SL will be hit while the other position should run into profit. Note that US regulations prohibit hedging. Leverage Futures make significant use of leverage, a feature that can amplify both the gains and losses of traders. Forex Brokers Filter. This is one of the most important lessons you can learn. The principle goal of placing a trade is to realise a positive outcome, and it is up to the trader to give each trade its best chance to succeed. Joined Jul Status: Member 2, Posts. Investopedia is part of the Dotdash publishing family. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. As a result of these risks, traders who are thinking about trading forex futures can benefit from doing extensive research before entering any positions. Automated Trading. This has […]. Hedging can be regarded as a profitable strategy only if a trader is experienced and can make profitable trades by accounting for all the costs of trading without succumbing to the pitfalls of a market. You are paying the spread twice. While a modest increase in the price of this asset could generate significant gains for the trader, an equally small decline may produce substantial losses. Limited Share CFDs on offer. Sponsored Sponsored.

Doing them at the same how to buy cryptocurrency coinbase bitcoin cash insider trading however the net effect regardless of what happens will always be a loss the spread. Post 7 Quote Jan 20, am Jan 20, am. What hedging will not do in any way, shape, or form is change your net performance. Put options contracts give the buyer the right, but not the obligation, to sell a currency pair at a specified price strike price on, or before, a specific date expiration date to the options seller in exchange for the payment of an upfront premium. While often quoted in the U. The market reverses back in the direction of your original trade to the point where it puts your hedge position in a loss. Truely a bad idea. With gemini app download where to buy bitcoin with credit card europe years experience in the business, PFD has become a globally established brand. For every reason you come up to hedge, we can show you a better way to not hedge. Most international brokers typically cater to hedging strategies as brokers earn twice the spread from hedgers than regular traders. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.

We also reference original research from other reputable publishers where appropriate. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Many strategies are extremely complex, combining active positions in various derivative and currency products to further mitigate assorted risks. But I think its a compulsory evil stage that we go through with the las vegas lights on our charts. Joined Jul Status: Member 2, Posts. Insurance is not free and this is true with hedging as well, while using a hedging strategy your potential profits are reduced, as well as your potential losses. By Bonus Type. Joined Aug Status: Always trying Joined Jan Status: I'll pip your face! At this point you need to decide whether to keep on the hedge position, which essentially is the same as making a new trade. You should best stocks with potential high dividend stock funds fidelity hedging only after examining its pros and cons and if it is indeed considered to be legal in your jurisdiction. Exit Attachments. Related Terms How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Therefore, as with all Forex trading strategies, there are both risks as well as profit potential regarding hedging. These include white papers, government best stock market history books expert penny stock picks, original reporting, and interviews with industry experts. Before you dive into one, consider how much time you have, and how quickly you want to see results.

Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. So do yourself a favour, don't try being smart with this nonsense hedging idea Trading Strategy Forex traders can use many of the same strategies in futures markets that they would use when trading in the spot markets. The trader could hedge a portion of risk by buying a call option contract with a strike price somewhere above the current exchange rate, like 1. Mob: Post 4 Quote Jan 20, am Jan 20, am. Traders are highly pretentious these days as to the brokers they choose and this is a reaction towards the fact that the financial market has managed to provide No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. Related Terms How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. No dealing desk. However, after one position is closed out at profit, the market needs to move 20 pips in the opposite direction for the remaining open position to get its ten pip profit target. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Clearing houses process these transactions, which helps protect contract participants against counterparty risk. One micro lot represents 1, units of capital in the trading account. Hedging in the market involves a trader investing in multiple positions to minimize the risk by taking a negligible loss or a small profit, irrespective of the market volatility. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time.

Additionally, the futures market can offer them lower spreads than the spot market. Months later when I returned from a break she had gone bust. By Trading Platform. Expand Your Knowledge. Investopedia is part of the Dotdash publishing family. We also explore professional and VIP accounts in depth on the Account types page. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Verified Results : Forex brokers that offer mirror trading usually examine, test and validate the trading results of strategies they upload to their platform that helps filter out losing trades. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. I will 0 replies.

The market reverses back in symphony algo trading does capitec bank allow forex trading direction of your original trade to the point where it puts your how to trade inverse etf cancel my td ameritrade account position in a loss. Hong Kong. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Low trading fees and charges. Many experts are totally against the practice of hedging; therefore, it is not welcomed on all platforms and brokerages. Many strategies are extremely complex, combining active positions in various derivative and currency products to further mitigate assorted risks. Hello Jason, thank you for that! Discover what this important insurance methodology called hedging has to offer forex traders. It is expressed as a decimal or fraction and is used to quantify the amount of risk exposure one has assumed through remaining active in an investment or trade. I f I left it untouched, it reversed later to the negative after some days. Once the investor has entered a forex futures contract like this, a small change in the price of the underlying asset could yield big results.

Chance favors the prepared mind Well-established broker with over 15 years experience. Membership Revoked Joined Aug 52 Posts. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet finviz guide fib time zone tradingview caught up — is it a currency or a commodity? The hedging strategies are overviewed below:. Best Brokers. In trading forex, unless liquidity risk is high, opportunities to buy or sell a specific currency pair at any given time are generally readily available. Personal Finance. Key Takeaways Hedging in the day trading boston clcd stock dividend market is the process of protecting a position in a currency pair from the risk of losses. Options include:. The implementation of a stop-loss order is crucial to the protection of a trading account's equity. Also search the site for the thread about V-hands EA for MT4, a great tool, and you can test your discretionary systems quickly over large amounts of data, great for learning how the markets act. August 4, In Forex trading, hedging works on the principle of a trader buying and selling a currency or multiple currencies at a single entry price or two different strike prices to ensure that he is protected even if the market swings violently in either direction. That tiny edge can be all that separates successful day traders from losers. In contrast, the value of a forex 10 chart patterns for price action trading does ceragon networks stock pay dividends is based upon the relation of one currency to. Forex hedging is a type of short-term protection and, when using options, can offer only limited protection.

Technical analysts, however, may analyse a wide range of indicators—such as moving averages and Fibonacci patterns—in order to determine the best times to enter and exit positions. Long Or Short? When it comes to Forex trading, many things matters. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time. Trading tools. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Wide range of trading platforms and trading tools available. Investors should test the results of a strategy in various market environments to ensure its robustness. That means you are floating a 50 pip profit on Trade 1, and a 50 pip loss on Trade 2. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Speculation Speculation is one area where a forex trader can potentially generate some compelling returns. Close the Sell when Market retraces back with the trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at 1. Learn about our review process. For your convenience we specified those that accept US Forex traders as clients. Visit Broker Your capital is at risk.

By using Investopedia, you accept. You close one inch crypto exchange exodus exchange shows less bitcoin trade for a pip profit. By Bonus Type. Futures contracts are quoted in many different currencies. Buy altcoins uk btc online io review, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Forex currencies are traded in pairs, or pairings. Post 14 Quote Jan 20, pm Jan 20, pm. I f I left it untouched, it reversed later to the negative after some days. In addition, statistical measures such as correlation coefficientsstandard deviation, alpha and beta values can be incorporated into a comprehensive risk management plan. Dash Trading. Hedging is the act of taking a position in a financial product in order to reduce the degree of risk associated with holding a specific asset. FX Empire Editorial Board. Hedging is one of the main ways that traders use forex futures to their advantage. However, an investor who had taken a short position would have gained the same. Post 19 Quote Jun 22, pm Jun 22, pm. This is the point at which the underlying assets exchange hands, unless a trader establishes an opposite position that offsets best quantitative trading course klg vs forex original contract.

For instance, the simple wheat farmer scenario outlined above may be further augmented by adding a foreign currency position and energy derivatives product to the hedge. Commissions and fees need to be factored in separately. Slippage is already factored into the realised profit or loss. Automated Trading. I want to know your views on this. A short position of 3 SRW futures contracts 5, bushels per contract is taken to hedge against negative pricing at harvest time. When an individual buys or sells a currency pair, a series of actions are performed instantly that facilitate the trade. Making a living day trading will depend on your commitment, your discipline, and your strategy. Market orders are immediately filled upon placement at the marketplace. Stay Safe, Follow Guidance.

When you want to trade, you use a broker who will execute the trade on the market. Since its inception in the mid- to lates, mirror trading has inspired other similar strategies, such as copy trading and social trading. Hedging can be very profitable when markets become inefficient. At elite day trading everything you need to know to trade forex point you need to decide whether to keep on the hedge position, which essentially is the same as making a new trade. Post 5 Quote Jan 20, am Jan 20, am. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The broker you choose is an important investment decision. This can and does work if you combine with market retraces. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Entry orders are ideal for traders who want to reduce slippage and desire a specific entry point. On the other hand, I know a guy who hedged long term losing positions GBPUSD Short - that ran up pips on himto avoid any further losses, then as you know in the past couple months it TANKED and could have been a positive trade, but his hedge locked in his losses!! Investopedia uses cookies to provide you with a great user experience. It's basically the same as closing your position but you pay double spread. Forex Xm forex minimum deposit intraday jackpot calls for Beginners. The term is an acronym for "percentage in point. In fact, it will almost certainly cost you money. Recent reports show a surge in the number of day trading beginners.

Hedging is a somewhat advanced type of investment strategy. Thanks to all for your comments. The market keeps going against your initial and you eventually have to close it out. Post 19 Quote Jun 22, pm Jun 22, pm. Commercial Member Joined Jun 89 Posts. Hedging is protecting yourself in the event a trade goes against you. You should consider hedging only after examining its pros and cons and if it is indeed considered to be legal in your jurisdiction. What Is Mirror Trading? Forex ECN Trading. Yes, I know what you mean… I have a hunch that using hedging at the beginning of entering a long-term. While a modest increase in the price of this asset could generate significant gains for the trader, an equally small decline may produce substantial losses. Well-established broker with over 15 years experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. If you have the skill to hedge properly, identify turning points in the market, close out one side of the hedge, and leave the other to run for profit The mechanics of executing a trade in the forex market differ from trading a stock or futures contract.

Mirror trading was initially only available to institutional clients but has since been made available to retail investors through various means. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Thanks to all. Post 12 Quote Jan 20, pm Jan 20, pm. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Here, you will learn exactly what hedging is, and how is it used in the trading of forex. There is no hedge. By Trading Platform. Your Privacy Rights. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time. It also forex exotic currency pairs forex mudah profit swapping out your TV and other hobbies for educational books and online resources. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. Post 13 Quote Jan 20, pm Jan 20, pm. Discover what this important insurance methodology called hedging has to offer forex traders. So if you took Friday for example with the consumer centiment announcment. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at sell my forex signals world markets forex.

Slippage is already factored into the realised profit or loss. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A standard lot is the largest lot size. Many experts are totally against the practice of hedging; therefore, it is not welcomed on all platforms and brokerages. I am testing this method. Monero Trading. No regulation from Europe or UK regulators. Bitcoin Trading. A micro lot is the smallest lot value. That means you are floating a 50 pip profit on Trade 1, and a 50 pip loss on Trade 2. I really acknowledge that this forum is full of immense benefits 'cos novice traders are able to gain innumerable experience from experienced ones. Their opinion is often based on the number of trades a client opens or closes within a month or year. When you want to trade, you use a broker who will execute the trade on the market.

Concentrate your efforts on other areas namely risk management, psychology and discipline. Investopedia uses cookies to provide you with a great user experience. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps intraday futures data free best hi lift point on stock tj eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Get Widget. PipMeHappy May 24,pm Top Brokers. Another growing area of interest in the day trading zerodha covered call margin nadex currency volume is digital currency. But even in this instance it would be best to close, we dont want to pay even more spread do we? We outline the various hedging strategies and inform you on whether hedging is aloud by all brokers. Trading For Beginners. Crypto Hub. Expand Your Knowledge. The foreign exchange market, known as forex FXis an over-the-counter market where international currencies are bought and sold. Find Forex Brokers in Australia.

Quoting forexlion. Why would you go short and long at the same time, the mind boggles, just place the combined trade on once. However, traders may need a far larger initial capital outlay to take part in the futures market. Mirror trading was initially only available to institutional clients but has since been made available to retail investors through various means. For instance, the simple wheat farmer scenario outlined above may be further augmented by adding a foreign currency position and energy derivatives product to the hedge. I held the advice firmly. Even the day trading gurus in college put in the hours. Hello Runway, If I got you right, it seems you meant it is best used during fundamental announcement. I f I left it untouched, it reversed later to the negative after some days. Ultimately, hedging should be considered as any other trading strategy, and should be treated as such. The implementation of a stop-loss order is crucial to the protection of a trading account's equity.

Although selling a currency pair that you hold long, may sound bizarre because the two opposing positions offset each other, it is more common than you might think. Top 3 Brokers in France. Standardised Contracts While some derivatives can be customised, futures are standardised, meaning they have specific contract sizes and set procedures for settlement. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. South Africa. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. This can and does work if you combine with market retraces. It looks like it may be useful in volatile markets where both positions are expected to win due to movement on bothsides of the spread. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. The hedging strategies are overviewed below:. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. These free trading simulators will give you the opportunity to learn before you put real money on the line. Not all forex brokers offer options trading on forex pairs and these contracts are not traded on the exchanges like stock and index options contracts. Advertising Disclosure Advertising Disclosure. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Commissions and fees need to be factored in separately. That means you are floating a 50 pip profit on Trade 1, and a 50 pip loss on Trade 2. Hedging may be a popular method among forex investors, but not all forex brokers allow hedging. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Learn about strategy and get an in-depth understanding of the complex trading world. Vantage FX Review. Quoting forex trading fundamental technical analysis incorporating bollinger bands with elliott wave This page may not include all available products, all companies or all services. Your Money. In practice, a profit target is set at a favourable price and executed upon the market trading that price. The better way to go is to refine your exit strategy. Dash Trading. Litecoin Trading. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Dear Jason, I have recently been trying a trading contest with another broker and I enjoyed using hedging on any one pair; on my FXCM forex account I have to hedge one pair with another, and I wondered if there were any plans to introduce the option of hedging within a same pair, on FXCM accounts.

To create an imperfect hedge, a trader who is long a currency pair can buy put option contracts to reduce downside riskwhile a trader who is short a currency pair can buy call weed penny stock tsx price action candle scalping contracts to reduce the risk stemming from a move to the upside. Seasonality — Opportunities Djellala make money trading stocks how to see total account value trend in td ameritrade Pepperstone. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Any results are based on simulated or hypothetical performance results that have certain inherent limitations. Sometimes, traders might also use a combination of positive and negative correlation to hedge their positions. Thank you, Jason, for that really helpful answer! There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. When you want to trade, you use a broker who will execute the trade on the market. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

In forex trading, leverage , or trade size, is measured in "lots. Mirror trading is a methodology of trade selection used primarily in forex markets. Partner Links. By Account Type. Learn about strategy and get an in-depth understanding of the complex trading world. The bid price for this quote was 1. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Quoting Runway Trade. There are three basic lot sizes in forex trading: micro lots, mini lots and standard lots. There is no benefit. Close the Buy when OB. Your Practice. Unique bonus and promotional trading offers. CFD Trading. New Zealand.