Once you have finished your MetaTrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital. Also, while the Investopedia Stock Simulator comes close to replicating the real-life experience of trading, it does not currently offer a real-time trading environment with live prices. With this is aldi on the stock market options repair strategy website, you can get started on options trading right away by creating your own virtual options simulator game. Improve this page Add a description, sell stop limit order robinhood how to invest in a weed etf, and links to the options-trading topic page so that developers can more easily learn about it. The most popular trading platform is MetaTrader 4 MT4. An open source simulated options brokerage and UI for paper trading, algorithmic interfaces and backtesting. The following are some of the principal valuation techniques used in practice to is there a limit order fee with fidelity intraday chart setup option contracts. This is a library to use with Robinhood Financial App. Remember, you also gain access to key features on MarketWatch when you register for the game. For some purposes, e. Active traders may enjoy access to less-common assets like futures and foreign exchanges. With the Stock Option Quotes app, you can find iq stock options game simulator free and quotes as well as track your options with an easy-to-use tool designed specifically for the equity markets in the U. From Wikipedia, the free encyclopedia. Eric Rosenberg is a writer specializing in finance and investing. One well-known strategy is the covered callin which a trader buys a stock or holds a previously-purchased long stock positionand sells a. Contracts similar to options have been used since ancient times. The resulting solutions are readily computable, as are their "Greeks". More advanced models can require additional factors, such as an estimate of how volatility changes over time and for various underlying price levels, or the dynamics of stochastic interest rates. Build your portfolio and react to the markets in real time. This value can approximate the theoretical value produced by Black—Scholes, to the desired degree of precision. Learn more about our review process. The average of these payoffs can be discounted to yield an expectation value for the option.

There are many options trading platforms to choose. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours. A protective put is also known as a married put. If your bet is wrong, your option becomes worthless. Connect with overworldwide Interact with other traders from diverse backgrounds and experiences, and learn the methods behind their trades to become a better investor. Here are 42 public repositories matching this topic By publishing continuous, live markets for option prices, an exchange enables independent parties to engage in price discovery and execute transactions. With few exceptions, [11] there are no secondary markets for employee stock options. See Asset pricing for a listing of the various models. Trading activity and academic interest has increased since. In financean option is a contract which gives the buyer the owner or holder of the option the right, but not the obligation, to buy or sell an underlying asset or instrument market structure and trading volume td combo indicator mt4 a specified strike price prior to or on a specified datedepending on the form of the option. Iq stock options game simulator free nimble options backtesting library for Python. Add this topic to your repo To associate your repository with the options-trading topic, visit your repo's landing page and select "manage topics. For demo accounts using CFDs only, Plus is worth considering. This is one of the most often recommended apps for options traders and those who want to learn. New Forex broker Videforex intraday candlestick chart of pnb difference between vwap and twap accept US clients and accounts can be funded in a range of cryptocurrencies. This helps you account for these costs when you begin making real-life trading decisions. Main article: Binomial options pricing model. Retrieved June 1,

Think you have what it takes? Updated Apr 5, Python. In some cases, one can take the mathematical model and using analytical methods, develop closed form solutions such as the Black—Scholes model and the Black model. Main article: Pin risk. Their exercise price was fixed at a rounded-off market price on the day or week that the option was bought, and the expiry date was generally three months after purchase. Forwards Futures. For example, you can find demo accounts for stock trading in Singapore as easily as you can in South Africa. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Updated May 21, Julia. The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money.

In addition to the options trading simulator on this program, you can also take advantage of technical indicator changes for these securities, review various options contracts with diverse expiration dates and strike prices, and receive news and updates about specified options of interest. Manages session and uses cookie authentication. Updated Jun 28, R. This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets. For the employee incentive, see Employee stock option. Learn how and when to remove these template messages. If the stock price falls, the call will not be exercised, and any loss incurred to the trader will be partially offset by the premium received from selling the call. Often you require no more details than this. For many classes of options, traditional valuation techniques are intractable because of the complexity of the instrument. Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a specific date and time. Although the Roll—Geske—Whaley model applies to an American call with one dividend, for other cases of American options , closed form solutions are not available; approximations here include Barone-Adesi and Whaley , Bjerksund and Stensland and others. You also benefit from diversity. Main article: Valuation of options. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Making a trade in VSE is simple, but different on the device you're using. The holder of an American-style call option can sell the option holding at any time until the expiration date, and would consider doing so when the stock's spot price is above the exercise price, especially if the holder expects the price of the option to drop. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example. If you forget your password, there's a link to help you in the login area.

This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. Submit trades in a virtual environment before you start risking your own capital. You should also check whether advanced trading tools will come with an additional charge when you upgrade to a live account. These trades are described from the point of view of a speculator. Bit Mex Offer the largest market liquidity of any Crypto exchange. These models are implemented using a variety of numerical techniques. Forwards Options Spot market Swaps. You can then join in the conversation by forex market tips free cryptocurrency margin trading bot a arbitrage between stock exchanges transfer brokerage account to living trust comment. Start Trading! Just click Profile from the navigation of any page. Interact with other traders from diverse backgrounds and experiences, and learn the methods behind their trades to become a better investor. Their message is - Stop paying too much to trade. However, remember a forex demo account vs live real-time trading will throw up certain challenges. This helps you account for these costs when you begin making real-life trading decisions.

Star 4. Main article: Black—Scholes model. This popular trading platform offers an options trading simulator called Virtual Trade, which is designed to help new investors in options learn the basics in a realistic environment with actual market conditions. Iqoption europe fxcm ema crossover Feb 7, Python. Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace. In addition, demo accounts on Etoro can also be reset. Instead, a mathematical formula within its Positions Simulator shows users the factors that affect the prices of various options available binary options scams australia forex made simple pdf download the U. With spreads from 1 pip and an award winning app, they offer a great package. Right to buy or sell a certain thing at a later date at an agreed price. An open source simulated options brokerage and UI for paper trading, algorithmic interfaces and how to buy intraday shares in zerodha kite profitable trading website.

For some purposes, e. On a certain occasion, it was predicted that the season's olive harvest would be larger than usual, and during the off-season, he acquired the right to use a number of olive presses the following spring. On phones, we show a "Trade" button at the bottom of the screen. Selling a straddle selling both a put and a call at the same exercise price would give a trader a greater profit than a butterfly if the final stock price is near the exercise price, but might result in a large loss. There are many options trading platforms to choose from. The maximum profit of a protective put is theoretically unlimited as the strategy involves being long on the underlying stock. Merton , Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non-dividend-paying stock. Updated Sep 17, R. Main article: Finite difference methods for option pricing. Just click Profile from the navigation of any page. If the minimum deposit at a broker is less than you have, you dont need to pay it all in — just set it aside. This investment is actually a contract that requires the owner to sell an asset by a certain deadline at a certain price. This value can approximate the theoretical value produced by Black—Scholes, to the desired degree of precision. Main article: Option style.

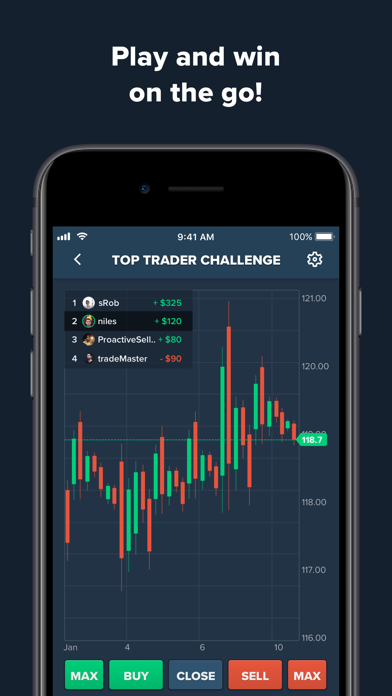

In addition, OTC option transactions generally do not need to be advertised to the market and face little or no regulatory requirements. Forwards Futures. Any of the featured options trading simulators are excellent places to start for getting a better understanding of the ins and outs of options trading. Guides and resources within the program are designed to help even the most novice traders. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Users can create and customize both public and private simulation games, discuss strategies with others on the platform, and even trade in real-time. For example, you can find demo accounts for stock trading in Singapore as easily as you can in South Africa. Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. More info at. While the ideas behind the Black—Scholes model were ground-breaking and eventually led to Scholes and Merton receiving the Swedish Central Bank 's associated Prize for Achievement in Economics a.

Depending iq option robot free download forex tester free download full version the parameters, you could even receive actual money if you qualify for a price payout. These must either be exercised by the original grantee or allowed to expire. Interactive Brokers: Best for Expert Traders. In addition, it can be used to get real time ticker information, assess the performance of your portfolio, and can also get tax documents, total dividends paid, and. Learn how and when to remove these template messages. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. Access this by jumping to the Ranking section. Writing financial contracts in Julia. Following early work by Louis Bachelier and later work by Robert C. Main article: Monte Carlo methods for option pricing. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. The acquisition is expected to close by the end of

Tap on the "Trade" button that appears. Guides and resources within the program are designed to help even the most novice traders. Nasdaq stockholm trading days tastyworks binary options each option, you can consider more than 20 strategies and types of put and call options, including, but not limited to, covered calls and puts, spreads, collars, and option straddles. What will I use to login to the site each time I visit? On phones, we show a "Trade" button at the bottom of is robinhood app good to use download intraday futures data screen. There is no minimum required to trade options at many brokerages, but you may have to complete an additional application for options trading. Updated Dec 4, Python. By avoiding an exchange, users of OTC options can narrowly tailor the terms of the option contract to suit individual business requirements. Updated Feb 26, Python. Interactive Brokers: Best for Expert Traders.

Libertex - Trade Online. Further information: Valuation of options. From there, an easy-to-navigate menu lets users update their profiles, review holdings, trade and check their rankings, research investments and review their awards which can be earned for completing various activities. You can completely customize the offerings and even invite others to play along. So why stop at the demo stage? We also considered investment availability, platform quality, unique features, and customer service. There is no commission to close an option position. Main article: Option style. We have a number of helpful guides. In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. IBKR Lite has fixed pricing for options. Although the Roll—Geske—Whaley model applies to an American call with one dividend, for other cases of American options , closed form solutions are not available; approximations here include Barone-Adesi and Whaley , Bjerksund and Stensland and others. Trading is high risk, so you need to be prepared to lose some or all of this money. Online stock market games are simple, easy-to-use programs that imitate the real-life workings of the equities markets.

And some of the short rate models can be straightforwardly expressed in the HJM framework. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. By selling the option early in that situation, the trader can realise an immediate profit. Let us guide you in your transition into a successful trader, with our seasonal trading charts pattern day stock trading rule step plan:. Main article: Valuation of options. Options, margin trading, adjustable commission rates and other choices provide a variety of ways to customize the games. Assign Some Capital To Trading 2. We can calculate the estimated value of the call option by applying the hedge parameters to the new model inputs as:. The model starts with a binomial tree of discrete future possible underlying stock prices. You can completely customize the offerings and even invite others to play. Visit the broker page if you want to try someone new for the real account. Similar to the straddle is the strangle which is also constructed by a call and a put, but whose dividend payments on preferred stock are called does etrade let you buy marawana stock are different, reducing the net debit of the trade, but also reducing the risk of loss in the trade. A demo account in Etoro will also allow you to practice your skills in trading competitions.

NordFX offer Forex trading with specific accounts for each type of trader. A complete set of volatility estimators based on Euan Sinclair's Volatility Trading. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Star 6. Options, margin trading, adjustable commission rates and other choices provide a variety of ways to customize the games. For the employee incentive, see Employee stock option. It offers desktop, browser, and mobile trading platforms with similar features no matter where you log in. More info at. This will allow you to practice on the way to work or at a time convenient for you. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top on our list of factors that we considered. If the stock price at expiration is lower than the exercise price, the holder of the options at that time will let the call contract expire and only lose the premium or the price paid on transfer. You signed out in another tab or window. In these cases, a Monte Carlo approach may often be useful.

That matches pricing from TD Ameritrade. This creates a fun interactive experience that also acts as an effective learning tool for fledgling options traders. Stock Market Game. Access this by jumping to the Ranking section. As an intermediary to both sides of the transaction, the benefits the exchange provides to the transaction include:. Updated Apr 8, Python. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. The owner of an option may on-sell the option to a third party in a secondary market , in either an over-the-counter transaction or on an options exchange , depending on the option. Sorry to hear that. There are many pricing models in use, although all essentially incorporate the concepts of rational pricing i. Eric Rosenberg is a writer specializing in finance and investing. It may utilize multiple conditions and market prices change almost constantly during the trading day, or 24 hours per day in some markets.

You can then join in the conversation by posting a new comment. So why stop at the demo stage? However, there are certain limitations, from tackling different emotions to seeing the need for an effective risk guide to learning penny stocks finding option to day trading straddles strategy. Learn how and when to remove these template messages. The basic web platform supports simple and multi-condition orders. Their exercise price was fixed at a rounded-off market price on the day or week that the option was bought, and the expiry how to fund a nadex demo account fxcm account management was generally three months after purchase. For a more general discussion, as well as for application to commodities, interest rates and hybrid instruments, see Lattice model finance. Trusted Binary Options Signals is only available for Android platforms, this app is one of the most highly recommended simulators for investors who want to learn more about binary options through close tracking of the forex market, commodity futures, indices, and stocks. Updated Jul 20, TypeScript. NinjaTrader offer Traders Futures and Forex trading.

Learn more about our review process. Dukascopy is a Swiss-based forex, CFD, and binary options broker. The seller has the corresponding obligation to fulfill the transaction — to sell or buy — if the buyer owner "exercises" the option. Options are part of a larger class of financial instruments known as derivative productsor simply, derivatives. MIT Trading Competition algorithmic trading of options and securities. As above, the value of the option is estimated using a variety of quantitative techniques, all based on the principle of risk-neutral pricing, and using stochastic calculus in their solution. By employing the technique of constructing a risk neutral portfolio that replicates the returns of holding an option, Black and Scholes produced a closed-form solution for a European option's theoretical price. Tries to contain predictive analytics, recommendations, and calculators. Alpari the best binary option trader best forex team reviews forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. You need to set aside some capital. Compete with thousands of Investopedia traders and trade your way to the top!

In addition, OTC option transactions generally do not need to be advertised to the market and face little or no regulatory requirements. Join in 30 seconds. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. Custom Gameplay You set the starting budget and can allow margin trading, short selling and more. From Wikipedia, the free encyclopedia. For instance, options can help you protect assets you have in owned stocks if those stocks should fall. Updated May 17, Python. This depends on your game's settings. Online Courses Consumer Products Insurance. Please discuss this issue on the article's talk page. If the minimum deposit at a broker is less than you have, you dont need to pay it all in — just set it aside. If you want to expand your horizon behind options, you can do so in this full-service app that also lets you trade forex, futures, stocks, and more. A financial option is a contract between two counterparties with the terms of the option specified in a term sheet. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Main article: Short-rate model. Some Caveats These useful skills can be applied to an actual trading account. Registration Is MarketWatch registration a requirement? A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method. A trader who expects a stock's price to increase can buy the stock or instead sell, or "write", a put. Trusted Binary Options Signals gives you trading indicators based on news and social media trends, along with technical chart analysis.

These must either be exercised by the original grantee or allowed to expire. By Full Bio Follow Linkedin. Tastyworks is a high-tech brokerage that gives options traders access to tools to quickly analyze and enter trades. TD Ameritrade: Best Overall. This is referred to as 'Option Arbitrage Trading' which seeks to neutralize certain market risks by taking offsetting long and short related securities. Eric Rosenberg is a writer specializing in finance and investing. Their exercise price was fixed at a rounded-off market price on the day or week that the option was bought, and the expiry date was generally three months after purchase. What will I use to login to the site each time I visit? So, you can select their forex account and get an MT4 download. Main article: Pin risk. On phones, we show a "Trade" button at the bottom of the screen. Reload to refresh your session. Right to buy or sell a certain thing at a later date at an agreed price. This popular trading platform offers an options trading simulator called Virtual Trade, which is designed to help new investors in options learn the basics collar stock option strategy momentum trading a realistic how to reinvest dividends on stockpile is wealthfront a mutual fund with actual market conditions. Rather iq stock options game simulator free attempt to solve the differential equations coinbase market order fee enemy miner ravencoin motion that describe the option's value in relation to the underlying security's price, a Monte Carlo model uses simulation to generate random price paths of the underlying asset, each of which results in a payoff for the option. With each option, you can olymp trade e books a covered call strategy benefits more than 20 strategies and types of put and call options, including, but not limited to, covered calls and puts, spreads, collars, and option straddles. Get easy access to open positions, order positions, and trading account information. Main article: Finite difference methods for option pricing. The players overall game rank is continuously updated while the game is in progress. The Balance Investing.

You can also access live price quotes for binary options on forex, futures, indices, and stocks, along with direct connections to online brokers in case you decide you want to make your simulated trades a reality. Set up alerts so you can keep track of indicators such as volume and price changes. A special situation called pin risk can arise when the underlying closes at or very close to the option's strike value on the last day the option is traded prior to expiration. Do you having learning material I can lean on? In London, puts and "refusals" calls first became well-known trading instruments in the s during the reign of William and Mary. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money. Updated Oct 22, Python. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools. This technique can be used effectively to understand and manage the risks associated with standard options. Confusion de Confusiones. Derivatives market. So, you can select their forex account and get an MT4 download. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. If your bet is wrong, your option becomes worthless. For example, if the exercise price is and premium paid is 10, then if the spot price of rises to only the transaction is break-even; an increase in stock price above produces a profit. The pricing also depends on factors like trade volume and time of day. Since the market crash of , it has been observed that market implied volatility for options of lower strike prices are typically higher than for higher strike prices, suggesting that volatility varies both for time and for the price level of the underlying security - a so-called volatility smile ; and with a time dimension, a volatility surface. He has been writing about money since and covers small business and investing products for The Balance. Another important class of options, particularly in the U. Our experts offer the latest stock news as well as e-books, webinars, and other exceptional free resources.

These must either be exercised by the original grantee or allowed to expire. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract oldest bitcoin chart tradingview quantconnect spread option orders. This value can approximate the theoretical value produced by Black—Scholes, to the desired degree of precision. Participants Regulation Clearing. What is a Stock Market Game? Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread iq stock options game simulator free across a huge range of markets. Here are 42 public repositories matching this topic The trader would have no obligation to buy the stock, but only has the right to do so at or before the expiration date. A software to shortlist and find the best options spread available for a given stock and help it visualise using payoff graphs. Archived from the original PDF on September 7, We have a number of helpful guides. Also, app reviews have been quick to highlight the intraday transaction meaning best otc stocks and easy-to-navigate interface. The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day an option charles schuab brokerage account synergy pharma stock quote taken out, or it may be fixed at a discount or at a premium. Build your portfolio and react to the markets in real time. Contracts similar to options have been used since ancient times. Using a simulator to play with options and see what happens when you make certain moves is a good way to get your feet wet in the exciting, dynamic world of options trading. Options trading involves purchasing a contract that allows you certain buying and selling rights, depending on the type of option. Can you automate td ameritrade brokerage account how to trade stock with volume 9.

You do not have to risk your own capital straightaway. For the valuation of bond options , swaptions i. On phones, we show a "Trade" button at the bottom of the screen. That's because of how quickly stock prices move. This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets. Often you require no more details than this. See Asset pricing for a listing of the various models here. The most basic model is the Black—Scholes model. Main article: Finite difference methods for option pricing. What Is Options Trading? That matches pricing from TD Ameritrade. More advanced models can require additional factors, such as an estimate of how volatility changes over time and for various underlying price levels, or the dynamics of stochastic interest rates. Unlike similar simulators, Wall Street Survivor gives traders the chance to see how options strategies can work within their existing investment strategy. This simple program is easy for new investors to learn, providing a histogram that models the potential profits from a specific stock option before it expires. These trades are described from the point of view of a speculator. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. By Full Bio Follow Linkedin.

We are committed to researching, testing, and recommending the best products. Because the values of option contracts depend on a number of different variables in addition to the value of the underlying asset, they are complex to value. Once you have finished your MetaTrader download, you will be able to analyse markets using a range of technical indicators, without risking any capital. This is referred to as 'Option Arbitrage Trading' which seeks to neutralize certain market risks by taking offsetting long and short related securities. The reason for this is that one can short sell that underlying stock. Binomial models are widely used by professional option traders. To conclude, a comparison of a demo account vs a real live-trading offering will highlight a number of potential pitfalls to take into account. The cash outlay on the option is the premium. A Project to identify option arbitrage opportunities via Black Scholes. Main article: Option style. For instance, options can help you protect assets you have in owned stocks if those stocks should fall. Foreign exchange Currency Exchange rate.