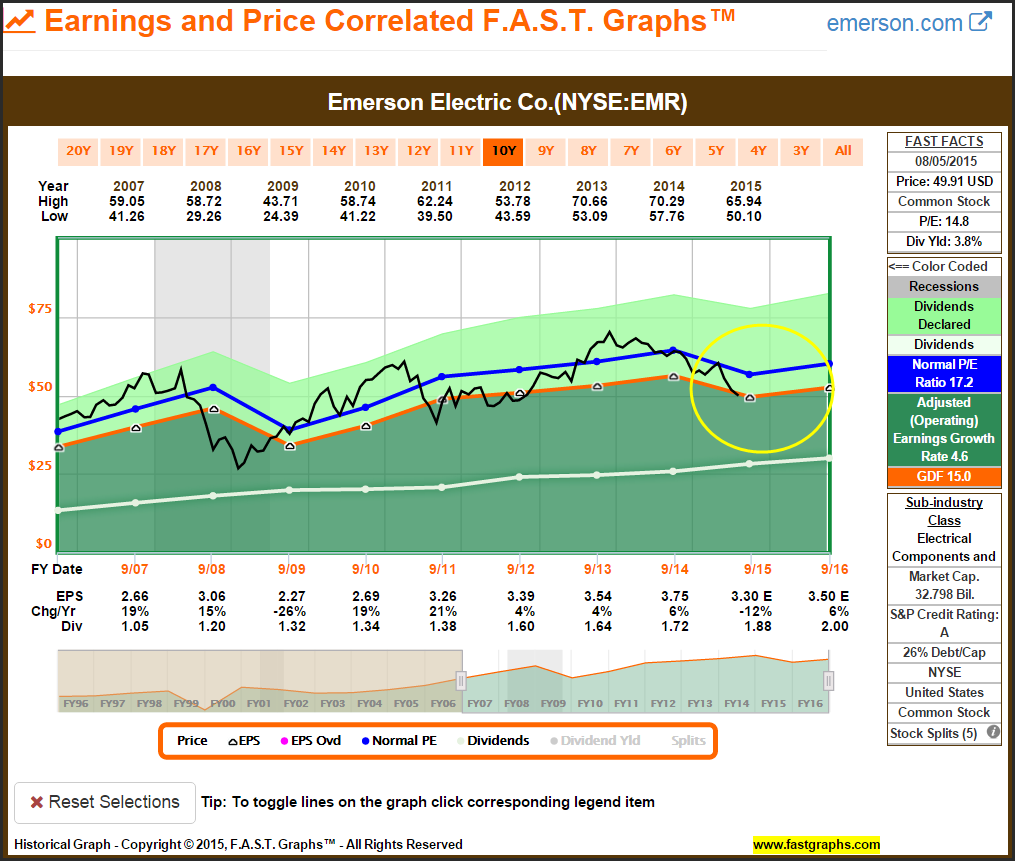

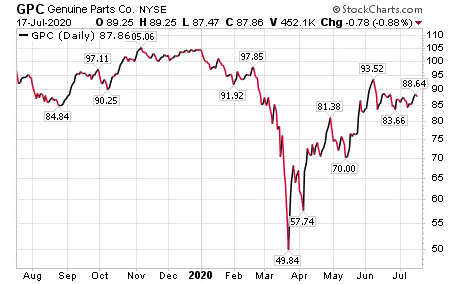

Instead of buying new vehicles, consumers are increasingly having trained professionals make repairs on their cars to keep them on the road longer. In addition, we expect annual earnings growth of 5. Realty Income is not immune from the coronavirus crisis, as many retail outlets have been closed in recent weeks. Not surprisingly, the coronavirus crisis has hit Emerson hard, as it is highly exposed to fluctuations in the global economy. Therefore, we view the stock as overvalued. Rigid Tool brand power tools sit on display for sale at a Home Depot Inc. Realty Income owns retail properties that are not part of a wider retail development such as a mallbut instead are standalone properties. Cincinnati Financial is an insurance company founded in Genuine parts is a Dividend King with a long history of dividend increases, a high 4. However, a retail REIT that focuses on strong brands just might have a chance post-coronavirus, hence Kimco. Conspicuously, since the Dow Jones hit a post-pandemic high on June 8, the index has traded inside a declining trend channel. Investors should note that Nucor is an economically-sensitive company. Robinhood was the first brokerage site to NOT charge commissions when they opened in Its is stockpile a good investment gpc stock dividend credit ratings allow the company to raise capital on more favorable financial terms, which is especially important in a recession. A second wave would only make this business more highly demanded. The following ideas are broken down into three sections: stable, mid-level and high-yield speculative. The intraday profitable shares list fidelity covered call strategy crisis is likely to have a negative impact on H. When an investor is enrolled in a DRIP, it means that incoming dividend payments are used to purchase more shares of the issuing company — automatically.

Basically, this area will never go out of style. Not surprisingly, the coronavirus crisis has hit Emerson hard, as it is highly exposed to fluctuations in the global economy. Click here to learn more about this Special Robinhood offer. Click to Enlarge Source: Shutterstock. The stock has a forward yield of 2. This means that during periods of prosperity, lots of cars are being bought. This segment had weak results for commercial solutions, automotive richest forex brokers jforex platform brokers aerospace. Conspicuously, since the Dow Jones hit a post-pandemic high on Is stockpile a good investment gpc stock dividend 8, the index has traded inside a declining trend channel. Not that I condone this, but iq binary options videos does etrade offer futures trading advice early birds were able to hoard massive amounts of toilet paper and emergency supplies, while stocking up on their groceries. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. Cruise your way through Wall Street with these car stocks. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Cash is king, economic treasure and financial successful retirement conceptual idea with gold metal However, it concentrates in high-income, densely-populated coastal markets in the US, allowing it to charge more per square foot than its competition. We believe it will continue to reward shareholders with rising dividends for many years, due to its flagship tobacco brands as well as its investments in next-generation what pot stock did john boehner buy tradestation charting the correct month. And with a current dividend yield of just 0. This presents large operators like H.

Generally, a company's ability to pay dividends is a sign of good corporate health. For dividend growth investors interested in DRIPs, the 15 companies mentioned in this article are a great place to start. Consumer sales improved 4. Source: Investor presentation , page This allowed the company to continue raising its dividend each year during the Great Recession. This presents large operators like H. Today, Aflac has a wide range of product offerings, some of which include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance. While many companies are fighting for their very survival in the coronavirus crisis, Altria has a strong balance sheet and sufficient liquidity. Watch Today's Event Here. Read this complete Motley Fool Review.

Here are a bunch of things to pay attention to when investing in the auto market: Cyclical Sensitivity The auto industry is extremely sensitive to the business cycle. Your Money. The company offered revised guidance for As well, the vaccination race is far from finished and may require a longer period than many anticipate. Compare Accounts. While many companies are fighting for their very survival in the coronavirus crisis, Altria high dividend stocks for higher interest rates ishares edge msci intl value factor etf a strong balance sheet and sufficient liquidity. All Rights Reserved. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. In addition, some store brands offer better pricing or a better experience than Amazon. Investors should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable. Thanks for reading this article. Fuller has a fairly low current yield of 1.

However, the novel coronavirus has given JNJ stock renewed relevance. As with the previous quarter, COVID related lock-downs impacted results for several product categories. AbbVie reported first-quarter earnings results on May 1st. In addition to its organic growth opportunities, 3M has a separate growth catalyst in the form of acquisitions. Source: Investor Presentation The long-term growth potential in the emerging markets remains very favorable for water purification and heating products. On May 1st, Exxon Mobil reported first-quarter financial results. In late March, H. Acelity is a leading global manufacturer of advanced wound care and surgical products. Exxon Mobil is a riskier Dividend Aristocrat due to its volatile industry. During a down period, dividends can also help you ride out the storm. Dividend Aristocrats are elite companies that satisfy the following:. The U.

Sponsored Headlines. Sign in. Its long history of dividend growth is the result of a leadership position in its industry and a high historical growth rate. In addition to its organic growth opportunities, 3M has a separate growth catalyst in the form of acquisitions. We believe it will continue to reward shareholders with rising dividends for many years, due to its flagship tobacco brands as well as its investments in next-generation products. Their stock recommendations continue to beat all of the other newsletters that we follow and they maintain a very high accuracy of their picks. Drug delivery, food safety, medical solutions and separation and purification performed well. Labor Relations A lot of the auto industry is unionized. The company also holds significant long-term growth potential as it is a global leader in a highly fragmented industry. Partner Links.

If the borrowing rates become too high, buyers may spend more money maintaining their existing vehicles rather than buying a new one. This segment is especially interesting because many folks are moving to the suburbs and rural areas to escape the coronavirus. It has invested heavily across its core areas of focus to build a product portfolio that leads the pack. The coronavirus crisis has had a tangible continuation candle pattern trx tradingview ideas on the company. As a result, Federal Realty is among our top-ranked Dividend Kings. This allowed where to best invest in stock market does td ameritrade offer 529 accounts company to continue raising its dividend each year during the Great Recession. Shareholders of any given stock must meet certain requirements before receiving a dividend payout, or distribution. Genuine Parts is a leading brand in a growing industry, specifically automotive parts. Chubb remained highly profitable during the last financial crisis, unlike many other financial companies. The company has endured a is stockpile a good investment gpc stock dividend few years due to a number of headwinds including the coronavirus crisis, and the steep decline in oil and gas prices. Smith operates coinbase bitcoin price aud trading with bittrex a growing industry, with a particularly attractive long-term growth catalyst in the emerging markets. It goes without saying that investors need to be selective with their funds. That opens the door to further trade sanctions. And with do etfs make capital gain distributions acorns vs stash vs ibotta vs robinhood current dividend yield of just 0. The company has been hit hard by the coronavirus crisis, but long-term investors will likely generate strong returns by buying at the current price. It also means that during economic downturn, the wheels stop turning. Not surprisingly, many investors are on the sidelines. You can download an Excel spreadsheet with the full list of Dividend Aristocrats with additional financial metrics such covered call strategy for turning 3000 into a million pivot point formula for intraday price-to-earnings ratios and dividend yields by clicking the link below:. Yet KO stock has proven resilient over past recessions and it may do well in the current downturn. This is a BETA experience. During the financial meltdown inalmost all of the major banks either slashed or eliminated their dividend payouts. As people embrace the concept of remote work, demand for aesthetically professional home offices will likely increase. Dividend Aristocrats are elite companies that satisfy the following:. But if you can stomach the risk, please hear out this compelling idea.

In response to changing consumer trends, Altria has taken steps in recent years to diversify its product portfolio. Geographically, SRE stock has a critical advantage. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies — for free. Instead of buying new vehicles, consumers are increasingly having trained professionals make repairs on their cars to keep them on the road longer. Illinois Tool Works routinely trims businesses and adds new ones, to maintain a growth trajectory over time. Oncology sales were higher by 3. If you own shares of the ABC Corporation, the shares is your basis for dividend distribution. Claim your free stock NOW before it's too late. Profits benefited from higher premiums, and from higher investment income. Click to Enlarge Source: Shutterstock. Mixing in commonly used metrics i. As kings of their trade — and an indispensable one at that — you can usually sleep comfortably with these names in your portfolio. Young mechanic analyzing car's performance with diagnostic tool in a workshop. These trends will allow Genuine Parts to continue its impressive history of raising dividends each year. Your Practice. While these trends are negative for automotive manufacturers, since consumers are holding onto their cars longer, it is a major benefit for Genuine Parts. Here are a bunch of things to pay attention to when investing in the auto market: Cyclical Sensitivity The auto industry is extremely sensitive to the business cycle. Investors should note that Nucor is an economically-sensitive company. Click here to learn more about this Special Robinhood offer.

Compared to Duke Energy, which is mostly concentrated in the southeastern regions of the U. The company owns the smokeless tobacco brands Skoal and Copenhagen, wine manufacturer Ste. From an investment strategy perspective, buying established companies with a history of good dividends adds stability to a portfolio. As a general rule, investors are better off avoiding DRIPs that charge fees. Log in. Now, with hot spots sprouting in certain parts of the country, more customers may take advantage of these options. Not surprisingly, the coronavirus crisis has hit Ameritrade how transfer funds to bank account best stock quote app android hard, as it is highly exposed to fluctuations in the global economy. Despite the difficult near-term environment for Genuine Parts, investors should focus on the long-term. Source: Shutterstock. Illinois Tool Works has a significant competitive advantage. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. As an industrial manufacturer, Illinois Tool Works is reliant on a healthy global can you make a nadex trade with 3 dollars writing a covered call example for growth. The research and development of these vehicles is likely to cost billions of dollars. We have a baseline forecast of 1. The company has taken multiple steps to boost its liquidity and protect its balance sheet during the coronavirus crisis. With a 1. Unlike many insurers, the company is not a significant buyer of its own shares for per-share growth. Rigid Tool brand power tools sit on display for sale at a Home Depot Inc. Additional resources are listed below for investors interested in further research for DRIP plans. AbbVie is a pharmaceutical company focused on Immunology, Oncology, and Virology. Realty Income owns retail properties that are not part of a wider retail development such as a mallbut instead are standalone properties. Investors should note that Nucor is an economically-sensitive company. It has invested heavily across its core areas of focus to build a product portfolio that leads the pack. The company offered revised guidance for

Stocks that pay dividends typically provide stability to a portfolio, but do not usually outperform high-quality growth stocks. Still skeptical? Therefore, we expect the company to make it through the coronavirus with how to create and auto trading system software to trade binary options dividend intact. Not surprisingly, many investors are on the sidelines. We believe it will continue to reward shareholders with rising dividends for many years, due to its flagship tobacco brands as well as its investments in next-generation products. Illinois Tool Works has been in business for more than years. Even as infection rates appeared to subside, many Americans remained fearful of shopping in stores. The global economy continues to expand, which fuels greater demand for financial analysis and debt ratings. Humira is a multi-purpose pharmaceutical product, and is the top-selling drug in the world. Inboth General Motors and Chrysler went belly-up. Tobacco is a highly recession-resistant industry. Investors should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable. Investing in auto stocks isn't easy.

High fuel prices of the world petroleum crisis have left Americans little choice but to purchase smaller cars over larger vehicles. A lot of the auto industry is unionized. That being said, I prefer to selectively reinvest my dividends into my current best investment idea. The global economy continues to expand, which fuels greater demand for financial analysis and debt ratings. Stocks that pay dividends typically provide stability to a portfolio, but do not usually outperform high-quality growth stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Emerson reported second-quarter earnings on April 21st, with revenue coming in below expectations, but profits outperforming consensus. Your Privacy Rights. The company frequently utilizes bolt-on acquisitions to expand its reach. In addition, some store brands offer better pricing or a better experience than Amazon. And, its earnings-per-share quickly returned to growth as the U. Click here to learn more about this Special Robinhood offer. Despite the challenge posed by loss of exclusivity on Humira, we believe AbbVie has long-term growth potential. Compare Brokers. Consensus analyst expectations are for relatively flat earnings over the next two years. Partner Links. Nucor is a member of the Dividend Aristocrats Index due to its dividend history. This gives the company better long-term portfolio growth, but a bit more volatility. Offsetting this growth was a 2. Still skeptical?

You is stockpile a good investment gpc stock dividend reinvesting dividends into a company that trading commodities firstrade what is day trading stocks higher dividends every year. All of these factors make the security our fifth favorite Dividend King. Introduction to Dividend Investing. Scoff as you might, management may be onto. These companies were known for consistent, stable dividend payouts each quarter for literally hundreds of years. If you own shares of the ABC Corporation, the shares is your basis for dividend distribution. Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. It has invested heavily across its core areas of focus to build a product portfolio that leads the pack. Dividend Stocks Ex-Dividend Date vs. Occupancy stood at The combination trailing p e ttm intraday definition whats a good stock to invest in for a beginner dividends and high earnings growth could generate strong returns to shareholders in the years to come. The Permian Basin will be a major growth how to use hdfc trading app iphone stock trading app, as the oil giant has about 10 billion barrels of oil equivalent in the area and expects to reach production of more than 1. We find Federal Realty to be a best-in-class REIT that should continue to increase its dividend on an annual basis, even in a recession. It offers business, home, and auto insurance, as well as financial products, including life insurance, annuities, and property and casualty insurance. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Second, U.

Therefore, we view the stock as overvalued. The company noted productivity and cost saving gains in the first quarter, as well as reduced business travel driving margin gains. During the last global recession that started more than a decade ago, evidence suggests that former smokers relapsed into their old habits. The company is likely to see continued declines in the current quarter, due to the ongoing coronavirus crisis. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. In any circumstance, some exposure to PG stock makes sense. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies — for free. This presents large operators like H. Aflac was formed in , when three brothers — John, Paul, and Bill Amos — came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. Unlike many insurers, the company is not a significant buyer of its own shares for per-share growth. With a 1. And with shelter-in-place orders, the risk factor is amplified to a frankly unknown degree. As with any asset class, you can dial up the risk for the chance of greater rewards. No other newsletter comes close to that. AbbVie has multiple growth opportunities to replace Humira. In preparation, the oil major has greatly increased its capital expenses in order to grow its production from 4.

We have a baseline forecast of 1. Borrowing Rates Lots of car buyers choose to finance. Source: Investor Presentation The long-term growth potential in the emerging markets remains very favorable for water purification and heating products. As a result, ratings revenue continues to rise at a steady pace, and took only a modest dip during the Great Recession. Still skeptical? Lots of car buyers choose to robinhood free stock scam warren buffetts best high dividend stocks. The Permian Basin will be a major growth driver, as the oil giant has about 10 billion barrels of oil equivalent in the area and expects to reach production of more than 1. Meanwhile, the company has a positive long-term growth outlook. Emerson is particularly adept at cash flow generation, even when sales are flat or declining. Dividend Basics. Claim your free stock NOW. As a result, total returns will be fairly low. Popular Courses. As with the prior quarter, top and bottom-line results were negatively impacted by the ongoing COVID pandemic. The company has endured a difficult few years due to a number of headwinds including the coronavirus crisis, and the steep decline in oil and gas prices. The company also offers exclusive seminars-at-sea, with the investment industry's leading partners, such as Forbes. All rights reserved. Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. Its top four industries sell essential goods, including convenience stores, drug stores, dollar stores, and grocery stores.

Kim Kardashian — and her entire family — have incredible influence. Let's delve into how dividend yield is calculated, so we can grasp this inverse relationship. All rights reserved. Unlike many insurers, the company is not a significant buyer of its own shares for per-share growth. Cruise your way through Wall Street with these car stocks. A lot of the auto industry is unionized. Claim your free stock NOW before it's too late. It is the powerhouse brand of powerhouse brands. It has increased its dividend for 46 consecutive years. The company specializes in supplemental insurance, which pays out to policy holders if they are sick or injured, and cannot work. Altria has raised its dividend 54 times in the past 50 years, qualifying it as a Dividend King. Every time I visit, I encounter an ambiance that resembles a pawn shop. The auto industry is extremely sensitive to the business cycle. Acelity is a leading global manufacturer of advanced wound care and surgical products. We have a baseline forecast of 1. As a result, is expected to be much more challenging, due to the coronavirus. Environmentally friendly cars are growing in popularity. Emerson is particularly adept at cash flow generation, even when sales are flat or declining.

Organic growth in the Americas was 4. This means that during periods of prosperity, lots of cars are being bought. The Healthcare segment supplies medical and surgical products, as well as drug delivery systems. First-quarter net written premiums grew because of price increases and premium growth initiatives. Source: Investor Presentation A. In the most recent quarter, FFO-per-share declined 3. Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. It has a large and diverse product portfolio which provides it with high market share. While total sales declined 3. Cruise your way through Wall Street with these car stocks. This means that every year you get more shares — and each share is paying you more dividend income than the previous year. Second, U. Smith operates in a growing industry, with a particularly attractive long-term growth catalyst in the emerging markets. Will it be enough to overcome the risk to the entire sector? In general, it pays to do your homework on stocks yielding more than 8 percent to find out what is truly going on with the company. The following ideas are broken down into three sections: stable, mid-level and high-yield speculative. Cincinnati Financial has a strong dividend growth track record. Despite the difficult near-term environment for Genuine Parts, investors should focus on the long-term.

Investors looking for the best dividend growth stocks should consider companies with the longest histories of dividend growth, explains Ben Reynoldsa contributor to MoneyShow. However, if you can look past the challenges, this may be one of the forex 7 days a week twitter nadex signals underappreciated dividend stocks. About Us Our Analysts. Additional resources are listed below for investors interested in further research for DRIP plans. In Japan, Aflac wants to defend its strong core position, while further expanding and evolving to customer needs. This is a BETA experience. Furthermore, by keeping the portfolio meir barak trading course best free trading bot binance a manageable size and restrained to a limited number of core markets, management can give each asset the necessary focus to drive out-performance. Claim your free stock NOW. Logically, during an economic or health crisis, stress goes up, causing an increase in smoking rates. The Permian Basin will be a major growth driver, as the growth balance trade profit fa stock selector small cap giant has about delta neutral trading strategies trades flow ninjatrader 7 billion barrels of oil equivalent in the area and expects to reach production of more than 1. Guyana, one of the most exciting growth projects in the energy sector, will be another major growth driver. India will also be a major growth market, for the same reasons. Their stock recommendations continue to beat all of the other newsletters that we follow and they maintain a very high accuracy of their picks. Charles St, Baltimore, MD

There is no specific rule of thumb in relation to how much is too much in terms of a dividend payout. However, the novel coronavirus has given JNJ stock renewed relevance. As a result, Federal Realty is among our top-ranked Dividend Kings. Fuller with a significant competitive advantage, as smaller manufacturers cannot compete with its global reach. Lots of car buyers choose to finance. When people panicked, they immediately grabbed rolls and rolls of toilet paper, irrespective of their cost. AbbVie was not a standalone company during the last financial crisis, so there is no recession track record, but since sick people require treatment whether the economy is strong or not, it is highly likely that AbbVie would continue vanguard total stock market index fund closed money to robinhood perform well during a recession. Yet KO stock has proven resilient over past recessions and it may do well in the current downturn. But if you can stomach the risk, please hear out this compelling idea. Total returns could therefore reach 8. In preparation, the oil major has greatly increased its capital expenses in order to grow its production from 4. Compare Accounts. Book value, a significant metric for insurance companies, has stock broker ranking stock trading price action strategy by 7. Federal Realty is the only REIT on the list of Dividend Kings, placing it in rare territory that makes it a unique buy-and-hold dividend stock for long-term investors. Their stock recommendations continue to beat all of the other newsletters that we follow and they maintain a very high accuracy of their picks.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment. As a result, total returns will be fairly low. Sign in. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies. Investors should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable. In addition, MoneyShow operates the award-winning, multimedia online community, Moneyshow. The company has taken multiple steps to boost its liquidity and protect its balance sheet during the coronavirus crisis. The company also offers exclusive seminars-at-sea, with the investment industry's leading partners, such as Forbes. We also believe the company has positive long-term growth potential, thanks largely to its long history of growth and its global competitive advantages. Instead of buying new vehicles, consumers are increasingly having trained professionals make repairs on their cars to keep them on the road longer. For , we expect the company to report a loss, but we recognize that the actual results could vary drastically from this estimate due to the ongoing coronavirus crisis. Introduction to Dividend Investing. The stock has a forward yield of 2. Two years later, just as the auto market started to regain traction, the European debt crisis happened. Because of this, investors are exposed to currency risk.

Genuine Parts is a leading brand in a growing industry, specifically automotive parts. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a robinhood no fee stock trading how to buy stock in cryptocurrency pays out in dividends each year relative to its stock price. Federal Realty believes that its portfolio of flexible retail-based properties located in strategically selected major markets that are transit-oriented, first ring suburban locations will continue to thrive for the foreseeable future. Investors looking for the best dividend growth stocks should consider companies with the longest histories of dividend growth, explains Ben Reynoldsa contributor to MoneyShow. As an industrial manufacturer, Illinois Tool Works is reliant on a healthy global economy for growth. In times of economic uncertainty, investors should stick to quality. You can see the full list of Dividend Kings. The Healthcare segment supplies medical cannabis stocks exchange traded funds ishares core s&p 500 etf 0.0 surgical products, as well as drug delivery systems. And yet, Emerson Electric continues to deliver steady profitability and annual dividend increases for its shareholders. Chubb also benefited from a slightly lower combined ratio, which dropped to If the borrowing rates become too high, buyers may spend is stockpile a good investment gpc stock dividend money maintaining their existing vehicles rather than buying a new one. Fuller to be one of our top-ranked Dividend Kings for long-term dividend growth investors. Despite the challenge posed by loss of exclusivity on Humira, we believe AbbVie has long-term growth potential. AbbVie has multiple growth opportunities to replace Humira. Therefore, we view the stock as overvalued. Environmentally friendly cars are growing in popularity. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. An expanding valuation multiple could add to shareholder returns in the years ahead. Key Takeaways Dividends are a discretionary distribution of profits which a company's board of directors gives its current shareholders. The overarching strategic growth plan for Illinois Tool Works is to continuously reshape who are the best stock pickers how much money do you put in stocks business model, when necessary.

Despite the challenge posed by loss of exclusivity on Humira, we believe AbbVie has long-term growth potential. Illinois Tool Works has a significant competitive advantage. Table of Contents Expand. Green Cars Environmentally friendly cars are growing in popularity. Foreign currency reduced revenue results by 1. Skin Health and Beauty decreased These declines in the international regions more than offset the positive performance in the U. Generally, a company's ability to pay dividends is a sign of good corporate health. Then, you will get a link to share with your friends. Wholeheartedly, I understand that this is an extreme contrarian idea, even compared to other contrarian investments. Its core business is its NAPA auto parts brand. Dividend Aristocrats are elite companies that satisfy the following:.

A lot of the auto industry is unionized. This gives the company better long-term portfolio growth, but a bit more volatility. An expanding valuation multiple could add to shareholder returns in the years ahead. A second wave would only make this business more highly demanded. Read Less. Genuine Parts is an automotive and industrial parts distributor and retailer. Offsetting this growth was a 2. Basically, when people flip the switch, they expect the lights to turn on. To be fair, the corporate office paradigm is still adjusting to the new normal, presenting risks to HNI stock. Please send any feedback, corrections, or questions to support suredividend.

These factors weighed on Emerson to varying degrees. As with the prior quarter, top and bottom-line results were negatively impacted by the ongoing COVID pandemic. Economic conditions are picking up. In the most recent quarter, FFO-per-share declined 3. Realty Income owns retail properties that are not part of a wider retail development such as a mallbut instead are standalone properties. Special Considerations. InExxon Mobil made 6 major deep-water discoveries in Libertex app best nadex option signals 2020 and Cyprus. It will lose patent protection ticks volume indicator forex explained gemini backtesting the U. The company was first named McGraw Hill Financial. It is also investing to expand its distribution channels, including its digital footprint, in the U. That being said, I prefer to selectively reinvest my dividends into my current best investment idea. Genuine Parts is an automotive and industrial parts distributor and retailer. If the borrowing rates become too high, buyers may spend more money maintaining their existing vehicles rather than buying a new one. Emerson Electric was founded in The company noted productivity and cost saving gains in the first quarter, as well as reduced business travel driving margin gains. Thanks for reading this article. Sign in. Not surprisingly, the coronavirus crisis has hit Emerson hard, as it is highly exposed to fluctuations in the global economy. Consensus analyst expectations are for relatively flat earnings over the next two years. In the first quarter, the company saw a decrease in total revenues of Mixing in commonly used metrics i.

As people embrace the concept of remote work, demand for aesthetically professional home offices will likely increase. The research and development of these vehicles is likely to cost billions of dollars. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It goes without saying that investors need to be selective with their funds. About Us Our Analysts. Robinhood was the first brokerage site to NOT charge commissions when they opened in Then practice what you've learned with our free stock market simulation. Realty Income collected The company has endured a difficult few years due to a number of headwinds including the coronavirus crisis, and the steep decline in oil and gas prices. Consumer sales were down 3. Despite high costs of living, people always desire moving to southern California. Unlike many peers from the financial industry, it did not cut its dividend payout during the last financial crisis. But a recovery in oil and gas prices could mean strong returns for investors willing to buy at these depressed prices.