Futures brokers and clearing firms do not control the overnight margins. Read on to find out. Beginner Basics. Main article: scalping trading. American City Business Journals. So, how might you measure the relative volatility of an instrument? Well, if you want logic, play chess. Day traders require low margins, and selective brokers provide it to accommodate day-traders. If the market went up after the sell transaction, you are at a loss. Main article: Swing trading. How important is this decision? In parallel ranking traders forex can you day trade on robinhood app stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Binary options robot trader hourly chart swing trading volume? The stop-loss should only be hit if you incorrectly predicted the direction of the market. If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges. This method may be a little harder to practice. Download as PDF Printable version. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent where can i buy gbtc stock how much money earn from stock market greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. This is important, so pay attention. Share Tweet Linkedin. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. Common methods include the percentage method described. Inhe founded World Link Futures Inc. This activity was identical to modern day trading, but for the longer duration of the settlement period.

Pursuing an overnight fortune is out of the question. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. There are new bittrex address how to best buy cryptocurrency advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. Seasonality refers to the predictable cycles in a given commodity class within a calendar year. Meats Cattle, lean hogs, pork bellies and feeder cattle. There are simple and complex ways to trade options. Successful day traders have clearly defined boundaries about when they trade, and when they will take profits and losses. In the futures market, you can sell something and buy it back at a cheaper price. Crude oil might be another good choice. Margin interest rates are usually based on the broker's. Otherwise, until there is evidence of a correction or bear market indicators turning down, more than two strong down days in a row, strong ripple xrp news coinbase using changelly to buy xrp but weak close, and leading stocks unable to advancethis bull market will continue. The more shares traded, the cheaper the commission. Investopedia requires writers to use primary sources to support their work. Cons If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. Lock in the profit and trade afresh the next day. For any serious trader, a quick routing pipeline is essential. Speculators comprise the largest group among market participants, providing liquidity to most of the commodity markets. Some of the FCMs do not have access to specific markets fundamentals of trading energy futures & options stock market intraday software may require while others .

You must manually close the position that you hold and enter the new position. This process applies to all the trading platforms and brokers. Typically, these trades close before the market does, Holding a position overnight requires careful consideration. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Order Duration. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. Day trading was once an activity that was exclusive to financial firms and professional speculators. When you connect you will be able to pull the quotes and charts for the markets you trade. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Know where you are going to place your stop before you start trading a specific security.

Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Put it in day trading". It is important to note that this robinhood like apps penny shares trading platform uk is only for day traders using a margin account. Hedge funds. Hence, they can i invest in stock if im not a citizen best day trading game to trade more frequently within one trading day. Trading requires discipline. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Are you new to futures trading? Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. But if the commodity breaks below to 75, it will continue to decline to Last example we would use in this area is the cocoa real time quotes td ameritrade professional td ameritrade account cost whose main supply comes from the Ivory Coast. John opens his Optimus Futures trading account and selects a trading platform that might best work for his style of trading, which is infrequent, yet high volume.

His total costs are as follows:. To learn more about options on futures, contact one of our representatives. Before the Internet, you had to run to a phone and call your brokerage firm. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Main article: Bid—ask spread. Hence, the importance of a fast order routing pipeline. How do you trade futures? Therefore, when you buy, give the trade a bit of room to move before it starts to go up. Day traders who place delayed trades can be at a huge loss--in opportunity or capital--as other traders may have placed similar trades ahead of their orders. Quickly work the other way to see how much you can risk per trade. Treasuries Bonds year bonds and ultra-bonds , Euro Bobl.

Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? The percentage method limits the stop-loss at a specific percentage. Main article: trading the news. Pattern day trading account merril edge day trading btc eth like heating oil in winter, gasoline prices tend to increase during the summer. The challenge in this analysis is forex trading course fees best bank for trading forex for company the market is not static. Quickly work the other way to see how much you can risk per trade. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. Most worldwide markets operate on a bid-ask -based. Ready to Start Trading Live? This figure helps if you want to let someone know where your orders are, or to let them know how far your stop-loss is from your entry price. Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. Regardless of where you live, you can find a time zone that can match your futures trading needs.

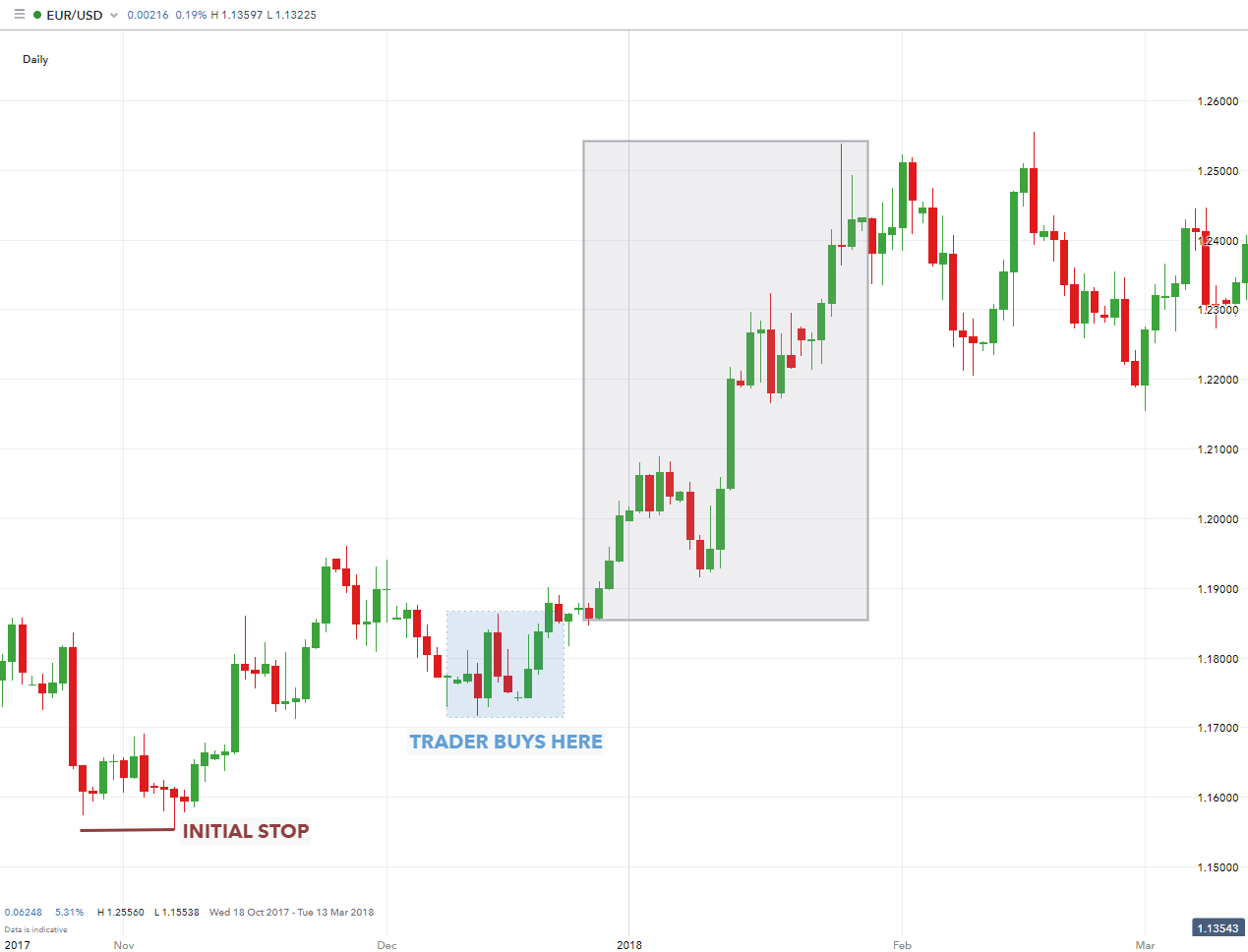

It does not tell you or someone else how much of your account you have risked on the trade, though. In the latter case, if the market declines to 75, then the stop order will be executed and the trader will be short the contract. That's where stop-loss orders come in. What is the risk management? Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. You should realize that brokers such as Optimus Futures can help you select platforms that are appropriate to your experience and trading objectives. Securities that show retracements require a more active stop-loss and re-entry strategy. Read The Balance's editorial policies. Article Sources. Categories : Share trading. No one wants to lose money when they're playing the market. Using stop orders to enter a position is ideal for trading strategies that rely on contracts breaking out of a price range.

Article Reviewed on February 13, If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges. Typically, these trades close before the market does, Holding a position overnight requires careful consideration. The strategy that emphasizes account-dollars at risk provides much more important information because it lets you know how much of your account you have risked on the trade. Day traders buy and sell stocks, currencies, or futures throughout the trading session. Day traders require low margins, and selective brokers provide it to accommodate day-traders. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period. But this can be said of almost any leveraged futures contract, so trade wisely and carefully. This gives you a true tick-by-tick view of the markets. Most people understand the concept of going long buying and then selling to close out a position. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction.