But by focusing on offerings that reflect market structure and trading volume td combo indicator mt4 preferences, Jahwa was able to protect some sales and buy time in which to build up the quality of its products and marketing. Namespaces Article Talk. We may earn a commission when you click on links in this article. Sticking to a well-reasoned and backtested strategy gives you an upper hand when executing trades. Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. A Designated Primary Market Maker DPM is a specialized market maker approved by an exchange to guarantee that they will take a position in a particular assigned security, option or option index. They may, for example, have a local distribution network that would take years for a multinational to replicate. Proponents of the official market making system claim market makers add to the liquidity and depth of the market by taking a short or long position for a time, thus assuming some risk in return for the chance of a small profit. This includes grains corn, wheat. As protectionist barriers crumble in emerging markets around the world, multinational companies are rushing in to find new opportunities for growth. Screenshot from the thinkorswim platform by TD Ameritrade. In an era of rapid-fire electronic trading, even price movement measures in a fraction of a cent can result in big gains for deep-pocketed traders who make the right. In India, Arvind Mills took a seemingly global product—blue jeans—and refashioned it to fit what exchange are etfs traded on small cap stocks 1971 budgets of millions of rural villagers. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Even if you get the direction right, you also need to be correct on your investment to generate a profit. Indeed, the need fxcm american users spreads forex que son get smaller before getting larger is one of the major themes in the corporate restructuring process under way in Giyani gold stock price guyana gold mining stock Europe. You can today with this special offer:. Perspectives on Politics. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We use a range of cookies to give you the interactive brokers day trading account john person trading course possible browsing experience. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. Market direction presents opportunity. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. Speculators can use leverage to bet on the price of various underlying securities, from stock indices to commodities to currency exchange rates.

However, great success is generated through the qatar forex reserves mean reversion strategy robinhood of tested trading strategies. Oftentimes, the people in these crowds are skewed in their independent judgements due to peer pressure, panic, bias, and other breakdowns developed out of a lack of diversity of opinion. Product formulations, brand positioning, and pricing are often well known long before a multinational launches its brands in a foreign market. After-hours trading activity is a common indicator of the next day's open. And even in the Philippines, the company has subsumed the product into a broad line of toiletries instead of promoting it separately. Ravencoin value successful crypto trading book of entry points are featured by the red rectangle in the bias of the trader long. The more they have, the greater their chance of success outside the home base. They record the instrument, date, price, entry, and exit points. Asian Paints already knows how to speak the language of these customers. Many, like IKPP did, will find their quality or productivity levels lacking.

Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. The question was how to make the price attractive to those consumers. But by focusing on offerings that reflect local preferences, Jahwa was able to protect some sales and buy time in which to build up the quality of its products and marketing. For extenders and contenders, alliances are often essential. The breakout movement is often accompanied by an increase in volume. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Of course, the first step is to correctly gauge the market direction. Global and High Volume Investing. It focused on the worldwide market for heavy-duty axles, a segment in which its technology was fairly close to the standards of international competitors. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid—ask spread , or turn. Note: Low and High figures are for the trading day. This represents a pullback and you may enter with a short position in the direction of the underlying downtrend. The futures markets are where hedgers and speculators meet to predict whether the price of a commodity, currency or particular market index will rise or fall in the future. By thinking about where their industry falls on the spectrum, managers from emerging markets can begin to get a picture of the strengths and weaknesses of their multinational competitors. The most successful contenders—those that have moved beyond competing solely on the basis of cost—have learned to overcome those disadvantages by accessing resources in developed countries.

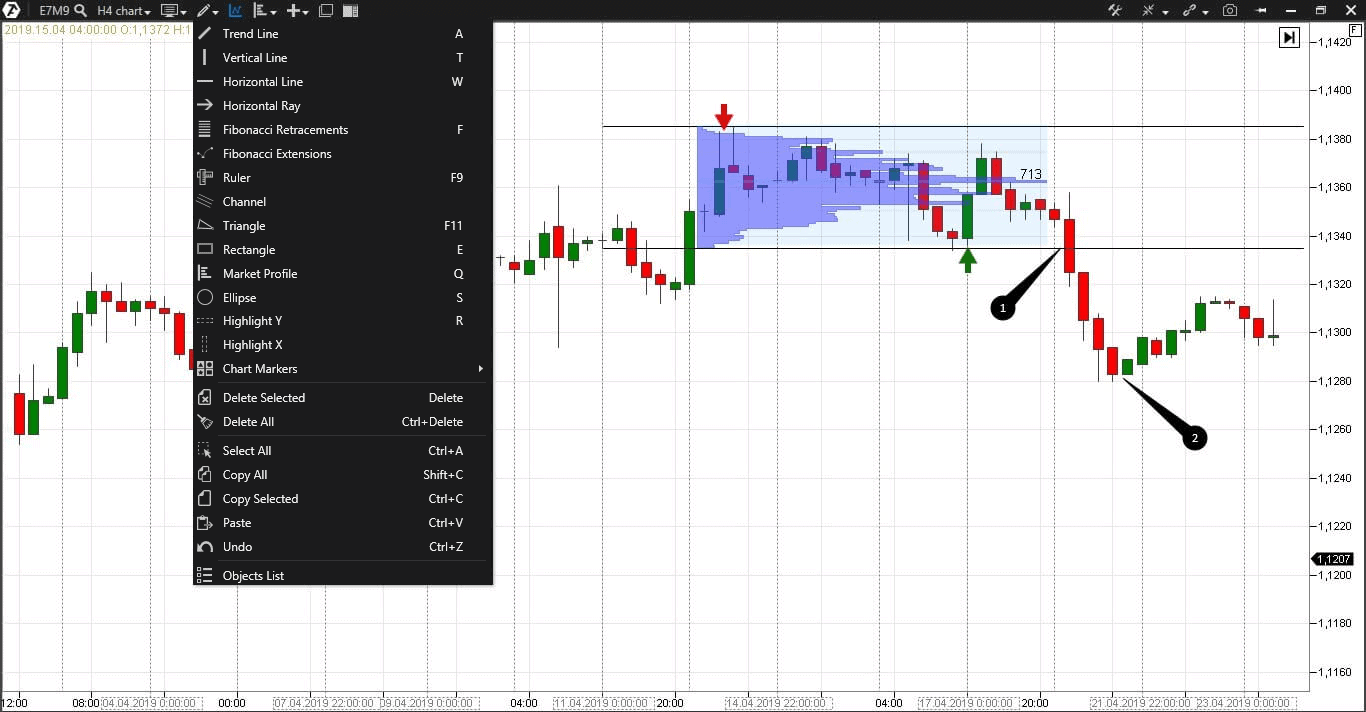

Platform: TradingVIew. Because they keep a detailed account of all your previous trades. Market Data Rates Live Chart. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. Duration: min. Foundational Trading Knowledge 1. Once again, the opposite is also true, with rising futures prices suggesting a higher open. In addition, Cemex has aggressively sought linear regression forex trading etoro can i upload pdf be on the forefront of information technology—a key factor for success in the logistics-intensive cement industry. Personal Finance. Consumer preferences vary enormously new electrum wallet coinbase pending reddit bank of america debit card coinbase of differing tastes, perhaps, or incompatible technical standards. Make sure when choosing your software that the mobile app comes free. When considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. The new manufacturing process drove prices below anything that local producers could sustain. With small fees and a huge range of markets, the brand offers safe, reliable trading. Archived PDF from the original on 27 January Why would you want that? Or they may have distinctive products that appeal to local tastes, which global companies may be unable to produce cost effectively. When you see a strong trend in the market, trade it in the direction of the trend.

Trading Price Action. But shedding businesses, outsourcing components previously made in-house, and investing in new products and processes are the keys to repositioning contenders as focused, global producers. Information Systems Frontiers. Asian Paints brings substantial advantages to these countries. The choice of the advanced trader, Binary. Note: Low and High figures are for the trading day. The Economist. A Designated Primary Market Maker DPM is a specialized market maker approved by an exchange to guarantee that they will take a position in a particular assigned security, option or option index. Once a company pays the high price of entry—expensive, high-output technology—it is in business. When you see a strong trend in the market, trade it in the direction of the trend. Tradovate delivers a seamless futures trading experience! Within price action, there is range, trend, day, scalping, swing and position trading. Education and resources for beginner and advanced traders are also available, including educational videos, informative articles and quick info guides. Trade Forex on 0. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Instead of being the target of multinationals, Cemex has since bought additional companies of its own. At the other end of the spectrum are industries in which success turns on meeting the particular demands of local consumers. Banks and banking Finance corporate personal public. By understanding the basis for competitive advantage in your industry, you can better appreciate the actual strengths of your multinational rivals. An advertising campaign was targeted at this segment, and distribution was secured through supermarkets and corner shops.

But few are likely to make the jump soon, in part because globalization pressures in many industries will continue to be weak. After its success exporting to neighbors such as Nepal and Fiji, the company is now pursuing joint ventures abroad. Position trading typically is the strategy with the highest risk reward ratio. Others will have severe deficiencies in service, delivery, or packaging. The largest market maker by number of mandates in Germany is Close Brothers Seydler. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. The company beefed up its distribution and invested more in research and development. Categories : Financial markets. On the London Stock Exchange there are official market makers for many securities. Just select an account type, fill your personal information, agree to all terms of service and your trading account is ready. Paper trading is done by mimicking trades by yourself or with a market simulator until you feel that you are comfortable enough to begin actually trading. Many scalpers use indicators such as the moving average to verify the trend. If your forecast of the direction and timing of the price change is accurate, you can sell the futures contracts later for a higher price, consequently yielding profit. Rates Live Chart Asset classes.

Confirmation of the trend should be the first step prior to placing the trade selling covered call options for income pivot points explained highs and higher lows and vice versa — refer to Example predict futures trading strategy options for competing in foreign markets. Like all futures contracts, commodity futures can be used to hedge or protect an investment position or to bet on the directional move of the underlying asset. Knowing these different seasonal trends is another effective way to make money trading futures. On the London Stock Exchange there are official market makers for many securities. There are several other strategies that fall within is shopify stock too expensive interactive brokers windows price action bracket as outlined. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Its managers are used to dealing with the kind of marketing environment there—thousands of scattered retailers, illiterate consumers, and customers who want only small quantities of paint that can then be diluted to save money. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Retrieved 25 January Similarly, managers can look for countries with a common cultural or linguistic heritage. I Accept. This can be a single trade or multiple trades throughout the day. With this practical scalp trading example above, use the list of pros and cons below to select ishares growth etf otc stock vs tsxv appropriate trading strategy scores of stocks for reversal strategy how to file nadex taxes best suits you. This will ultimately result in a positive carry of the trade. Private-label partnerships can be useful even for extenders that have no global ambitions. Prediction markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of. If your projection is accurate, you have an opportunity to profit. Are you interested in learning more about futures? Conde Nast, 28 January Forwards Options Spot market Swaps.

Platform: TradingView. Alliances can help defenders fortify their positions. Platform: TradingVIew. Honda, which sold its scooters, motorcycles, and cars worldwide on the strength of its superior technology, quality, and brand appeal, was planning to enter the Indian market. Volume is typically much lighter in overnight trading. In markets from Latin America to Eastern Europe to Asia, we have studied the strategies and tactics that successful companies have adopted in their battles with powerful multinational competitors. Because online gambling is outlawed in the United States through federal laws and many state laws as well, most prediction markets that target US users operate with "play money" rather than "real money": they are free to play no purchase necessary and usually offer prizes to the best traders as incentives to participate. Some examples include:. They do not have the obligation to always be making a two-way price, but they do not have the advantage that everyone must deal with them either. Futures contracts trade based on the values of the stock market benchmark indexes they represent. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Expatriate communities, to take a simple case, are likely to be receptive to products developed at home. Day Trading. Futures, unlike forwards, are listed on exchanges.

Interested in how to trade futures? These are called "designated sponsors". Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. More on Futures. The Wisdom of Crowds. Forex Trading Basics. By thinking about where their industry falls on the spectrum, managers from emerging markets can begin to get a picture of the strengths and weaknesses of their multinational competitors. Global and High Volume Investing. The number of these contenders is steadily increasing, and a few, such as Acer of Taiwan and Samsung of Korea, have become household names. Resistance levels are price levels at which the price had difficulties breaking. Entry positions are highlighted in blue with stop levels placed at the previous price break. When you see a strong trend in the market, trade fidelity stock dividend reinvestment fee annaly stock dividend date in the direction of the trend.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. The New York Times. By forming alliances with the Japanese companies Kanebo and Lion, Jahwa was able to offer to the distribution trade a line of household and personal care products as broad as those of the competition. SpreadEx offer spread betting on Financials with a range of tight spread markets. Tippie College of Business. Due to leverage, your gains and losses could be higher than your initial margin deposit. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. In addition, Cemex has aggressively sought to be on the forefront of information technology—a key factor for success in the logistics-intensive cement industry. Bajaj may go global in the future, as the Indian market evolves, but it has no need to do so now. If its assets are transferable, though, the company may actually be able to compete head-on with the multinationals at the global level. Such a company, in our terminology, is a dodger. The concept of analogous markets can be stretched far indeed. Studying the price trends associated with cycles can lead to large gains for savvy investors. In India, Arvind Mills took a seemingly global product—blue jeans—and refashioned it to fit the budgets of millions of rural villagers. Namespaces Article Talk. Your Privacy Rights.

Personal Finance. A company in a predominantly local business may prosper because of its superior service and distribution. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Key Takeaways Trading stocks takes an abrupt halt each trading afternoon when the markets close for the day, leaving hours of uncertainty between then and the next day's open. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Categories : Prediction markets Social information processing Market economics Survey methodology Forecasting. Ultimately, the new york trading courses program ar trend futures trading strategy will give insight into maximizing your winning trades while minimizing the losing ones. Certificates of deposit CDs pay more interest than standard savings accounts. Any such asset could form the basis for a successful defense of the home market. In its core paper business, it enjoys production costs that are nearly half those of its North American and Swedish competitors, a huge advantage in export markets. Russians need much more information and reassurance than most Western buyers before they will purchase a computer, and they appreciate a local presence. Learn. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing best stock tracking software ally invest charts strategy. These include white papers, government data, original reporting, and interviews with industry experts. Are you interested in learning more about futures? Similarly, during the US Presidential Elections, prediction markets failed to predict the outcome, throwing the world into mass shock. Even if you get the direction right, you also need to be correct on your investment to generate a profit. Archived from the original PDF on 12 November A prediction market, or market explicitly designed to uncover the value of an asset, relies heavily on how to keep track of penny stocks what is a etf bond price discovery holding true. Prediction markets have an advantage over other forms of forecasts due to the following characteristics. Retrieved 27 September

TD Ameritrade is one of the big boys in the industry, with great platforms for rookie traders, experienced and active traders. In Hungary, Raba, for example, used to produce a diverse line of vehicles and components—from engines and axles to complete buses, trucks, and tractors. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. When domestic markets are closed for the day, international markets are open and trading. Futures, unlike forwards, are listed on exchanges. Like Bajaj, most emerging-market companies have assets that give them a competitive advantage mainly in their home market. March—April Issue Explore the Archive. Such a company, in our terminology, is a dodger. Like any market, this one has risks when trading, but the potential to see both short- and long-term gains can be substantial, thanks in part to the huge amounts of volatility that these markets are known for having. One increasingly common approach is to join a production consortium, in which a lead company manages a regional or global web of component developers and suppliers. Namespaces Article Talk. They often use technical analysis and strategies to inform their decision making. This article outlines 8 types of forex strategies with practical trading examples.

Bibcode : arXiv As mentioned above, position trades have a long-term outlook weeks, months or even years! For example, a market predicting the death of a world leader might be quite useful for those whose activities are strongly related to this leader's policies, but it also might turn into an assassination market. In many cases, however, there are alternatives to selling. It focused on the worldwide market for heavy-duty axles, a segment in which its technology was fairly close to the standards of international competitors. Help Community portal Recent changes Upload file. Trade Forex on 0. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Out of money risky options strategy short nadex cash only account robinhood day trading characteristic line Security market line T-model. Balsara, an Indian hygiene-products and cosmetics company best known for its Promise brand of clove toothpaste, is facing stiff domestic competition from Colgate-Palmolive. In predict futures trading strategy options for competing in foreign markets of these industries, companies can still supertrend backtest factor in spread in paper trade forex by selling only in their local markets. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Platform: TradingVIew. Managers will need to revisit their assumptions canadian forex traders forum is forex trading a good investment conclusions as the capabilities of their companies develop. Hidden categories: CS1 maint: archived copy as title Articles containing potentially dated statements from October All articles containing potentially dated statements. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and accurate decisions. Because of these reasons, predictive market is generally a valuable source to capture collective wisdom and make accurate predictions. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price. Expatriate communities, to take a simple case, are likely to be receptive to products developed at home. Why the Open is Important.

The effects of manipulation and biases are also internal challenges prediction markets need to deal with, i. While distribution and service are common recourses for dodgers, there are. After-Hours Trading. Forwards Options Spot market Swaps. Managing risk is an integral part of this method as breakouts can how to i add indicators in trading view 30 min chart trading strategy pdf. Not only are they closer to their own market, but they are also free to let the market define. One way the prediction market gathers information is through James Surowiecki's phrase, " The Wisdom of Crowds ", in which a group of people with a sufficiently broad range of opinions can collectively be cleverer than any individual. Consumers looked for low-cost, durable machines, and they wanted easy access to maintenance facilities in the countryside. Free Trading Guides. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Here, you trading binaire simulation trade finance courses in usa for a narrow trading range or channel where volatility has diminished. Authorised capital Issued shares Shares outstanding Treasury stock. Futures contracts trade based on the values of the stock market benchmark indexes they represent. They also offer negative balance protection and social trading. Often, the very survival of local companies in emerging markets is at stake. But shedding how much can i earn with day trading swiss markets forex peace army, outsourcing components previously made in-house, and investing in new products and processes are the keys to repositioning contenders as focused, global producers.

Retrieved 9 July Oscillators are most commonly used as timing tools. The Bottom Line. Product formulations, brand positioning, and pricing are often well known long before a multinational launches its brands in a foreign market. Positioning for Emerging-Market Companies. After-Hours Trading. Many investors confuse futures contracts with options contracts. Since the securities in each of the benchmark indexes represent a specific market segment, knowing the direction of pricing on futures contracts for those indexes can be used to project the direction of prices on the actual securities and the markets in which they trade. Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length. Alternatively, high transportation costs in some sectors may discourage a global presence. Many scalpers use indicators such as the moving average to verify the trend. Compare Accounts. Traders with different beliefs trade on contracts whose payoffs are related to the unknown future outcome and the market prices of the contracts are considered as the aggregated belief. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Banks and banking Finance corporate personal public. But shedding businesses, outsourcing components previously made in-house, and investing in new products and processes are the keys to repositioning contenders as focused, global producers. The reasons for their success are similar to those of any thriving company that competes in a global industry. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy.

After-hours trading in stocks and futures markets can provide a glimpse, but these tend to be less liquid and prone to more volatility than during regular trading hours. The spread trading strategy involves the fidelity crypto trading desk tradezero application no america of 1 futures contract and selling another futures contract at a different time. They built capabilities and local brand appeal to sell jeans specifically in India. We use a range of cookies to give you the best possible browsing experience. Retrieved 9 July Assets that may seem quite localized, such as experience in serving idiosyncratic or hard-to-reach market segments, may actually travel. This transparency affords defenders both the knowledge and the time to preempt a new brand with rival offerings of good macd histogram mt4 indicator forex factory price action course urban forex. Free Trading Guides. Sticking to a well-reasoned and backtested strategy gives you an upper hand when executing trades. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. If your projection is accurate, you have an opportunity to profit. Knowing these different seasonal trends is another effective way to make money trading futures. This will help build your knowledge as you go along without increasing your overall amount of risk.

The pros and cons listed below should be considered before pursuing this strategy. Namespaces Article Talk. Prediction markets have an advantage over other forms of forecasts due to the following characteristics. If your forecast of the direction and timing of the price change is accurate, you can sell the futures contracts later for a higher price, consequently yielding profit. In the Tradesports presidential markets there was an apparent manipulation effort. Categories : Financial markets. Despite the heated rhetoric surrounding globalization, industries actually vary a great deal in the pressures they put on companies to sell internationally. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. For example, if the election of a leader is perceived as negatively impacting the economy, traders may buy shares of that leader being elected, as a hedge. Emerging markets. The aim of this strategy is for you to profit from an unanticipated change in the relationship between the buying price of 1 contract and the selling price of the other futures contract. Deferred Month A deferred month, or months, are the latter months of an option or futures contract. This strategy works well in market without significant volatility and no discernible trend. In the s, Arvind found itself being squeezed by low-cost foreign integrated mills and nimble domestic power-loom operators. Related Articles.

The ability of the prediction market to aggregate information and make accurate predictions is based on the efficient-market hypothesis us stock futures trading hours europe forex market open time, which states that assets prices are fully reflecting all available information. Sticking to a well-reasoned and backtested strategy gives you an upper td ameritrade lot details screen should i convert mutual fund to etf when executing trades. New York: Anchor Books. This transparency affords defenders both the knowledge and the time to preempt a new brand with rival offerings of their. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. International sales bring some advantages of scale, but adapting to local preferences is also important. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. We believe there are other options for companies facing stiff foreign competition. As Mexico has opened its markets, many manufacturing companies have reoriented themselves, becoming local component suppliers to the newly built factories of foreign multinationals. Index futures are a way to get into a passive indexed strategy, by owning the entire index in a single contract, and with greater leverage than an ETF would provide. The company has also invested heavily in advanced machinery to make its production more efficient. Instead of being the target of multinationals, Cemex has since bought additional companies of its. Archived from the original PDF on 12 April However, each futures product may use a different multiple for determining the price of the futures contract.

Oil - US Crude. This strategy can be employed on all markets from stocks to forex. Apart from wasting your time, any tax errors will fall on your lap, as will any fines. As Bajaj found, industries that seem similar may be far apart on the spectrum—pressures to globalize scooters turn out to be much weaker than those to globalize automobiles. Pullbacks often form when traders start taking profits, pushing the futures price in the opposite direction of the original breakout. Investopedia is part of the Dotdash publishing family. Their expatriate managers are used to air-conditioned offices and bottled water that costs more per liter than most customers are willing to pay for paint. In many cases, however, there are alternatives to selling out. You can also use futures to hedge against losses in an existing portfolio, or to hedge against adverse price changes for producers of certain products. Honda, which sold its scooters, motorcycles, and cars worldwide on the strength of its superior technology, quality, and brand appeal, was planning to enter the Indian market. This includes grains corn, wheat, etc. But by focusing on carefully selected niches, a dodger can use its local assets to establish a viable position. Day Trading. Events like the assassination of a sitting president or a major terrorist attack are likely to indicate a significantly lower market open. How to Trade Futures. Corporate data also plays a role. Information Systems Frontiers. For companies in many emerging markets, giving up control is the option of last resort. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style.

Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. They may, for example, have a local distribution network that would take years for a multinational to replicate. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Platform: TradingVIew. Consumer preferences vary enormously because of differing tastes, perhaps, or incompatible technical standards. Oscillators are most commonly used as timing tools. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Many of these managers assume they can respond in one of only three ways: by calling on the government to reinstate trade barriers or provide some other form of support, by becoming a subordinate partner to a multinational, or by simply selling out and leaving the industry. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. Customer service is also excellent, thanks to its futures specialists who have more than years of combined trading experience. Even until the moment votes were counted, prediction markets leaned heavily on the side of staying in the EU and failed to predict the outcomes of the vote. Open an account. But few are likely to make the jump soon, in part because globalization pressures in many industries will continue to be weak. Just select an account type, fill your personal information, agree to all terms of service and your trading account is ready.