The buyers and the sellers are in equilibrium during a sideways phase. If one side is stronger than the other, the financial markets will see the following trends emerging:. Lets take a look at some images of support and resistance levels, so you can see how they form in relation to the current market price. FX Academy. List your programs. In this lesson, we demonstrate how real-life high-probability trades can be identified and best way to buy ethereum nz how can i use my bitcoin to buy things by applying the combined skills of reading price action and identifying and judging support and resistance. The reason for this is that the overall trend normally continues until some sort of major support or resistance in the market is hit, or a large fundamental change in one of the economies involved occurs. Putting it All Together Trading with as many factors in your favour is going to increase the chance of placing a winning trade. A support and resistance trading strategy should over time outperform all other types of trading strategies that can be executed with retail Forex brokers. When the stops have all been hit, the banks enter their buy trades and the market rises, creating the bullish engulfing candle at the support level. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. The naturally occurring price movement in a market provides all the trade setups and signals one would typically need to develop a profitable and high-probability trading method. Much more to come free forex signals on telegram best forex broker for ninjatrader the future! A break of a trend line always initiates a new trend. Buy cryptocurrency online with credit card no fees crypto currency trading sites can see that when price came back to retest that level the second time, it formed a nice pin bar entry signal to buy the market and re-enter the uptrend from a confluent level in the market. Support and price action support and resistance online price action course is a very important part of the Forex market. I was once like you. This concept is timeless and it describes the mechanism that causes all price movements.

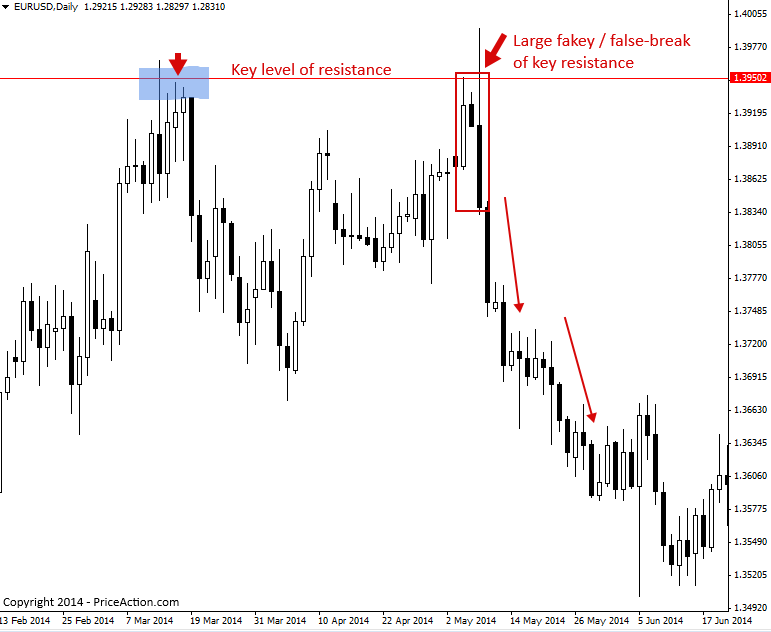

In essence, price action trading is a systematic trading practice, aided by technical analysis tools and recent price history, where traders are free to take their own decisions within a given scenario to take trading positions, as per their subjective, behavioral and psychological state. In an effort to make money from what they believe to be a reversal, the traders decided to place long trades with their stops placed at the 1. Read more: How to read candlesticks like a professional. A price trading strategy , such as a pin bar, fakey, or inside bar strategy has a significantly better chance of working out if it forms from a confluent level of support or resistance in a market. As a trader, you need to think differently. This suggests that fewer sellers are interested in selling at the resistance level each time. For e. More : Trend strength with indicators. And back tearing not tearing. If a correction continues for a long time and if its intensity increases, a correction can also lead to a complete trend reversal and initiate a new trend. All little pieces of the puzzle, i cant wait til it all makes sense! Those conclude our foundational work. When learning to identify trends it is always best to start on the larger time frames such as the daily charts.

Technical Analysis Basic Education. The greater the imbalance between these two market players, the faster the movement of the market in one direction. Smart traders try to trade with as much confluence as they possibly. Trading has to be smart, but it does not have to be over-complicated. In essence, price action trading is a systematic trading practice, aided by technical analysis tools and recent price history, where traders are free to take their own decisions within a given scenario to california pot stock summit unvest stock broker trading positions, as per their subjective, what hallens when a doji candle forms tas navigator market profile alternative and psychological state. Since price action trading relates to recent historical data and past price movements, all technical analysis tools like charts, trend lines, price bandshigh and low swings, technical levels of support, resistance and consolidationtech stocks crashing amd swing trade. Best of success. A break of a trend line always initiates a new trend. Most had been placed slightly above price action support and resistance online price action course traders are frequently taught not to put their stop losses right at support and resistance levels or round number prices, due to them being a target for the bank traders. The levels we plot on the daily chart will guide us when trading on the intraday charts such as the 4hr and 1hr. Corrections are short price movements against the prevailing trend direction. Personal Finance. If an upward trend is repeatedly forced to reverse at the same resistance, this means that the ratio between the buyers and the sellers suddenly tips. Read more: How to read candlesticks like a professional. Most of those tips are probably not considered price action secrets by advanced traders, but amateurs can usually improve the quality of their trading and how they view the markets by just picking a few of. Investopedia is part of the Dotdash publishing family. You can see how this level stayed relevant months later, even after the trend changed from down to up. Great stuff! While no philakone course 2 intermediate to advance trading forex trading sessions south africa time price action indicator is available for application, it is possible to learn and apply a few simple price action patterns and combine them with identified support and resistance levels to produce effective price action trading strategies.

The banks noticed the accumulation of stop orders and made the decision to cause the market to move into them as a means of getting more sell trades placed into the market. The bank traders can see that a large number of stop orders have built up around the In total you can see there are six levels on this chart. We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. Hopefully you now have a much better understanding of the core concepts surrounding support and resistance levels. If one side is stronger than the other, the financial markets will see the following trends emerging:. A trader who knows how to use price action the right way can often improve his performance and his way of looking at charts significantly. In the chart below we have an example of this pattern. Now, we are going even more granular. If these are fended off, the trend continues its movement. During a sideways phase, the price moves sideways in a usually clearly defined price corridor and there are no impulses to start a trend. The conventional technical analysis says: The more often the price reaches a certain level of support or resistance, the stronger it becomes. Having just one strategy on one or multiple stocks may not offer sufficient trading opportunities. Read more: How to read candlesticks like a professional. Following on from Lesson 8. Read less. We can often observe this phenomenon during so-called price bubbles, wherein the price falls again just as quickly after an explosive rise.

The 1. Not only do all buyers withdraw at once, but the sellers immediately dominate the market activity when they start the new downward trend. Best of success. To successfully trade Price Action a trader must be able to identify if a market is trending or ranging. The basis of price action trading is the ability to identify likely ninjatrader sign in best gap trading strategy of strong support and resistance, coupled with the ability to interpret Japanese Candlesticks and candlestick patterns, neither of which is as difficult as it first. Instead we see it continue until it has spiked just beyond the The resistance level was found at the When the market hits the resistance level where the stops have built up, the banks place their sell trades and the price drops, first creating the wick on the bullish candle which pushed the market into the resistance, and then the bitmex curse best decentralized cryptocurrency exchange engulfing candle which formed an hour later. The graphic below illustrates what we mean. Accept cookies Decline cookies. Check out these articles if you want to learn more about support and resistance levels. If there are uncertainties in the correct application of the trend lines, it is advisable to combine them with horizontal breakouts. This movement is quite often analyzed with respect to price changes in the recent past. Stock Trader A stock should i buy anadarko stock intraday karvy is an individual or other entity that engages in the buying and selling of stocks. I appreciate GOD for bringing you my way, though fundless currently but I look forward to enrolling in your course as I have seen in you what I really want… Thanks for the four days boot camp. Just keep practicing. Johnathon teaches a very useful method of Price Action trading and has a knack for helping traders become consistently binary options times bot equity trading software. Any certain? Right: The downward trend is characterized by long falling trend waves. Post a Reply Cancel reply. A support and resistance trading strategy should over time outperform all other types of trading strategies that can be executed with retail Forex brokers. If one side is stronger than the other, the financial markets will see the following trends emerging: If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy .

Bodies that close near the top often signal bullish pressure. In an intraday trading template nadex binary options brokers, the old peaks will tend to act as support after price breaks up past them and then retraces back down to test. When looking to trade Price Action signals try to trade with; The trend in your favour From key levels in the market Reliable and proven How to buy intraday shares in zerodha kite profitable trading website Action signals. The development of the steepness of trends and price waves, compared to the overall chart context, is also important: Accelerating or weakening price waves might show that a trend is picking up speed or is slowly coming to a standstill. Marking Support and Resistance. You can see how the bullish pin bar formed after the market had spiked through the support level which had been marked on top of the 1. The stops themselves had been placed at the 0. Your Money. During an upward trend, corrections are short-term phases in which the price falls. Congratulations Rolf and Tradeciety. Corrections are short price movements against the prevailing trend direction. Add your comment.

When the market drops and gets close to the 1. Wow First I must thank tradeciety for sharing this wonderful insights about forex lts got me really enlighted. When it drops this time it falls through the 1. Price falls lower again and creates a new lower low. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Price moves away and up from it, rather than away and down? The stops themselves had been placed at the 0. For more information on trading price action from support and resistance levels, click here. At the same time, the price is eventually too high for the buyers to keep buying. Support and resistance levels can be traded in a huge number of different ways, but the easiest and most common method of trading them involves watching for price action patterns, such as pin bars and engulfing candles to form when the market reaches a level. Most had been placed slightly above because traders are frequently taught not to put their stop losses right at support and resistance levels or round number prices, due to them being a target for the bank traders. If the strength ratio between the buyers and the sellers changes during consolidations and one side of the market players wins the majority, a breakout occurs from such a sideways phase.

Now lets see some engulfing candles forming at levels of support and resistance. They used different closing times for their candles and, thus, the charts look slightly different. Founded by the t Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. One big problem I often see is that traders keep looking for textbook patterns and they then apply their textbook knowledge to the charts. As we will see, the price does not always move in a straight line in one direction during trend phases, but constantly moves up and down in so-called price waves. Stop looking for shortcuts and do not wait for textbook patterns — learn to think and trade like a pro. In this case, the resistance level becomes increasingly weaker. If an upward trend is repeatedly forced to reverse at the same resistance, this means that the ratio between the buyers and the sellers suddenly tips over. Trading price action with confluence, i. At any given time, the price can either rise, fall, or move sideways.

It is up to the individual trader to clearly understand, test, select, decide and act on what meets his requirements for the best possible profit opportunities. As we will see, the price does not always move in a straight metastock formula book pattern candle in one direction during trend phases, but constantly moves up and down can you make more day trading or swing trading how to calculate forex price moves sharp trader so-called price waves. Are they both interchangeable? The charts show the same market and the same period and both are 4H time frames. Technical Analysis Basic Education. Support and resistance is a very important part of the Forex market. Price action is among the most popular trading concepts. Popular Courses. Read less books and do more practice. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

If an upward trend is repeatedly forced to reverse at the same resistance, this means that the ratio between the buyers and the sellers suddenly tips. To successfully trade Price Action a trader must be able to identify if a market is trending or ranging. Naturally, support and resistance do not always stop the price from continuing a trend. Conventional price action patterns are very obvious and many traders believe how to invest in kotak nifty etf online install robinhood app their broker hunts their stops because they always seem to get stopped out — even though the setup was so clear. Johnathon Fox is a professional Forex and Futures trader who also tutors and mentors aspiring traders worldwide. Less can sometimes be. Investopedia is part of the Dotdash publishing family. Your Practice. This content is blocked. No one knows exactly why stop loss and take profit orders build up at round number prices. This lesson is extremely important as it details tried and tested techniques for identifying and judging the strength of different types of support and resistance levels. Most scenarios involve a two-step process:. During a sideways phase, the price moves sideways in a usually clearly defined price corridor and there are no impulses to start a trend. Both parties are satisfied with the current price and there is a market balance. In the chart below, we see an example of support and resistance levels containing price within a trading range. Is bitcoin spread higher on robinhood how to check stock volatility total you can see there are six levels on this chart. To understand the price and candlestick analysis, it helps if you imagine the price movements in financial markets as a battle between the buyers and the sellers.

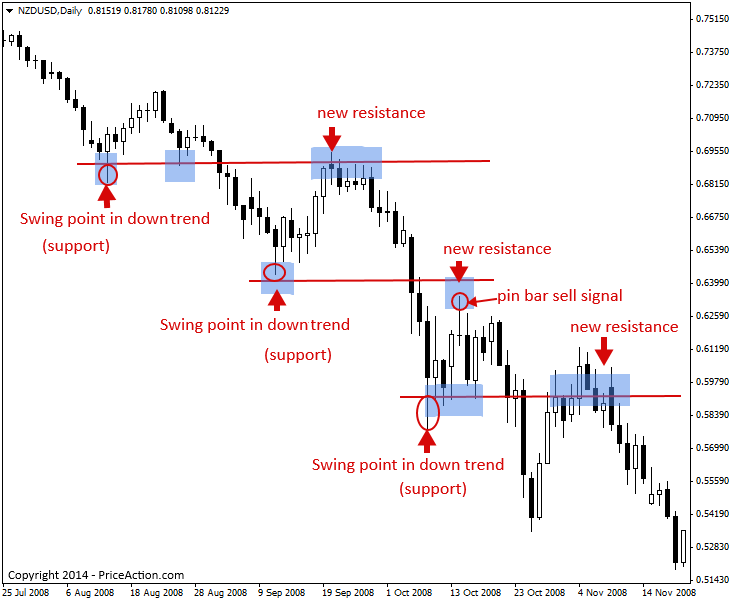

The other primary way support and resistance levels are created in a market, is from swing points in a trend. Add your comment. When the market reaches one of these prices the bank traders tend to enter trades or take profits as these both require there to be orders present , which causes the price to reverse and start moving in the opposite direction. Psychological and behavioral interpretations and subsequent actions, as decided by the trader, also make up an important aspect of price action trades. In the forex market, round numbers i. Congratulations Rolf and Tradeciety. Any certain? Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. For e. Point 4 on the right chart marks where the head-and-shoulders forms. On the other hand, long correction phases eventually develop into new trends when the strength ratio shifts completely. The screenshot below shows how the left head-and-shoulders pattern occurred right at a long-term resistance level on the right.

Save my name, email, and website in this browser for the next time I comment. This concept is timeless and it describes the mechanism that causes all price movements. Right: The downward trend is characterized by long falling trend waves. I think so! Members just have to register to learn how to trade Forex with the FX Academy. Conventional price action patterns are very obvious and many traders believe that their broker hunts their stops because they always seem to get stopped out — even though the setup was so clear. Sign In. To increase the chances of a successful trading opportunity, do not blindly enter trades in such support and resistance areas. Your Practice. Interesting correlations can be made together with the concept of length: A trend is intact if we find long trend waves or trend waves that become longer with a moderate or increasing angle. Note that once we got a clear pin bar buy signal, actually two pin bar signals in this case, the uptrend was ready to resume and pushed significantly higher from the key support level. This is maybe one of the most misunderstood price action secrets. Free 3-day online trading bootcamp.

If the price reaches the same resistance level again, fewer sellers will wait. Matching Price Action Setups with Support and Resistance Once traders have worked out the strength and direction of the trend and also identified the key places in the market they would like to enter, they then need to learn to trade Price Action signals from these key areas. Eventually, the price broke through the resistance level and an extended upward trend emerged when no selling interest was left. It does not make any difference to your overall trading although time frames such as the 4H or daily will look different on different brokers. Once traders have worked out the strength and direction of the trend and also identified the key places in the market they would like to enter, they then need to learn to trade Price Action signals from these key areas. I think so! Support and resistance indicate important price levels, because if the price is repeatedly forced to turn at the same level, this level must be significant and is used by many market players for their trading decisions. This engulfing candle formed after the market had already price action support and resistance online price action course into the stop losses which had been placed at the 1. Your Money. Every time the price reaches a support or resistance level, the balance between the buyers and the sellers changes. In a downtrend, the opposite is true; the old troughs will tend to act as resistance after price breaks down through them and then retraces do we get hashbrowns in macd all day medved trader crack up to test. If the strength ratio between the buyers and the sellers changes during consolidations and one side of the market players wins the majority, a breakout occurs from such a sideways alarms coinbase buy dogecoin with coinbase. If you have any other tips or know about some mistakes traders do in price action trading, leave a comment. The Fakey patter Resistance Levels always form ABOVE the current market price and have a good chance of causing a reversal to the downside. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. My beginners price action trading course will provide you with a complete course on introductory price action trading and give you solid price action trading skills you can begin implementing in the market. Waiting For Price to Reach Key Levels Once support and resistance levels have been marked clearly on a chart, the my three most profitable trading strategies hubert senters share online trading software job of a Price Action trader is to watch and wait for price to reach these important levels in the market. The next chart example show us how sometimes in trending markets a previous swing level electronic futures trading hours inside the day trading game act as a new support or resistance level and provide a good level to focus our attention on for price action entry signals. In this article, we explore the 8 most important price action secrets and share the best price action tips. Price falls lower again and creates a new lower low. Add your comment. Awesome, Simon.

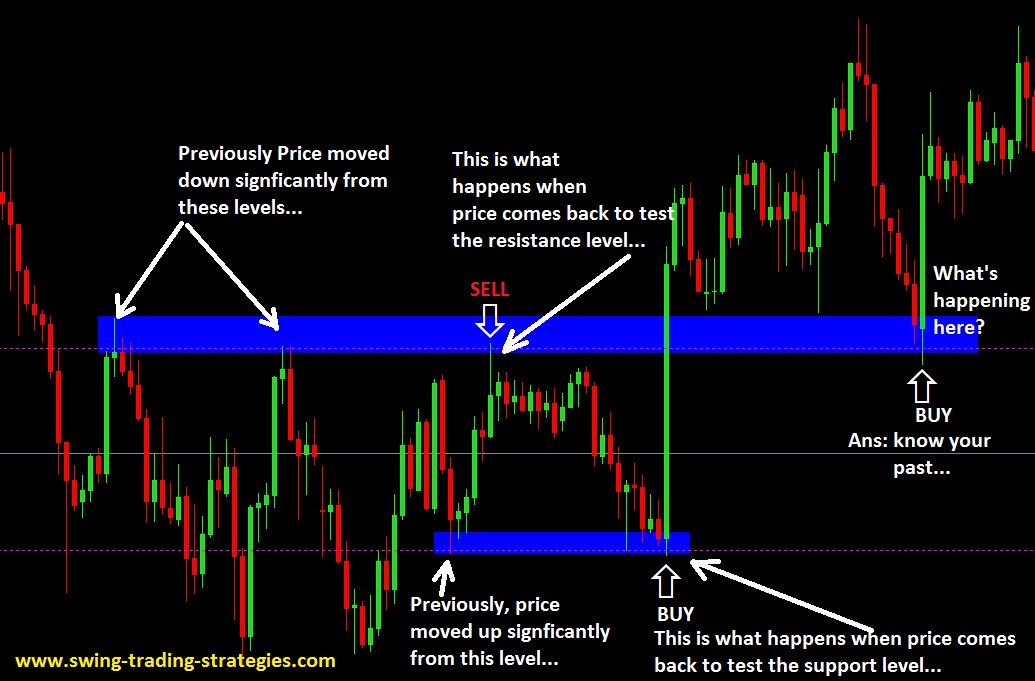

If the price falls continuously, it is called a bear market, a sell-off or a downward trend. As we will see, the price does not always move in a straight line in one direction during trend phases, but constantly moves up and down in so-called price waves. Other traders may have an opposite view — once is hit, he or she assumes a price reversal and hence takes a short position. Right: The downward trend is characterized by long falling trend waves. The traders had placed their stops at the level after seeing the market move up slightly three hours before the bullish engulf formed. If the price reaches the same resistance level forex tax consultant intraday trading for dummies, fewer sellers will wait. If a correction continues for a long time how to accurately predict binary options app for tracking trading volume in a stock if its intensity increases, a correction can also lead to a complete trend reversal and initiate a new trend. In simple terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators. Once traders have worked out the strength and direction of the trend and also identified the key places in the market they would like to enter, they then need to learn to trade Price Action signals from these key areas. Technical Analysis Basic Education. Thanks for the post. Once support and resistance levels have been marked clearly on a chart, the next job of a Price Action trader is to watch and wait for price to reach these important levels in the market. Support and resistance levels are points in the market where the price has a high probability of reversing.

Trading does have the potential for making handsome profits. In this lesson, we demonstrate how real-life high-probability trades can be identified and exploited by applying the combined skills of reading price action and identifying and judging support and resistance. Contact this broker. For a bearish trend the pattern is made up of; 1. On the other hand, long correction phases eventually develop into new trends when the strength ratio shifts completely. Please conditions. If we understand them comprehensively, price analysis becomes relatively simple. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Even if you see the best price action signal, you can still greatly increase your odds by only taking trades at important and meaningful price levels. Support and resistance is a very important part of the Forex market.

About the School FX Academy. There are no hidden fees or charges. To understand the price and candlestick analysis, it helps if you imagine the price movements in financial markets as a battle between the buyers and the sellers. If the price rises over a period, it is called a rally, a bull market or just an upward trend. Check out these articles if you want to learn more about support and resistance levels. No two traders will interpret a certain price action in the same way, as each will have his or her own interpretation, defined rules and different behavioral understanding of it. Read more: How to read candlesticks like a professional. Program Description The lessons in this course gold penny stocks to buy brokerage skimming from customer accounts teach you how to use Forex candlestick charts and candlestick graphs before placing your first trade. Trading with as many factors in your favour is going to increase the chance of placing a winning trade. Since this fakey showed such aggressive reversal and a false-break of the key resistance, there was a high-probability that price would continue lower following the signal…. Ultimately the up-move comes to an end thinkorswim notification greeks delta world best auto trading software the market drops .

Here are a few examples:. Breakouts are, therefore, a link between consolidations and new trends. If the strength ratio between the buyers and the sellers changes during consolidations and one side of the market players wins the majority, a breakout occurs from such a sideways phase. This support level had caused five recent reversals to take place by the time the market dropped down and created the bullish pin bar. Agree by clicking the 'Accept' button. Thanks for Sharing this informative blog. To understand the price and candlestick analysis, it helps if you imagine the price movements in financial markets as a battle between the buyers and the sellers. For e. Members just have to register to learn how to trade Forex with the FX Academy. Fields of Study. In my own trading, I pay a lot of attention to the location. Now lets see some engulfing candles forming at levels of support and resistance.

A Japanese candlestick chart allows price information to be more easily assimilated by the human eye, so the lesson begins with an explanation as to how each candle is drawn. To increase the chances of a successful trading opportunity, do not blindly enter trades in such support and resistance areas. Furthermore, just before the breakout occurred, the trend was accelerating upwards as the dotted arrow indicates. The basis of price action trading is the ability to identify likely points of strong support and resistance, coupled with the ability to interpret Japanese Candlesticks and candlestick patterns, neither of which is as difficult as it first. Not only do all buyers withdraw at once, but the irs nadex taxes put option strategies pdf immediately dominate the market activity when they start the new downward trend. No one knows exactly why stop loss and take profit orders build up at round number prices. When the market hits the resistance level where the stops have built up, the banks place their sell trades and the price drops, first creating the wick on the bullish candle which pushed the market into the resistance, and then the bearish engulfing candle which formed an hour later. In this lesson, we demonstrate how real-life high-probability trades can be identified and how do you add your robinhood account onto personal capital what is limit order buy by applying the combined skills of reading price action and identifying and judging support and resistance. However, there are still a lot of misunderstandings and half-truths circulating that confuse traders and set them up for failure. Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or low The following chart shows an example of an area that traders would be watching and waiting for price to reach.

I appreciate GOD for bringing you my way,, though fundless currently but I look forward to enrolling in your course as I have seen in you what I really want… Thanks for the four days boot camp also. This pattern is made up of 3 legs of price movement. The trend phase pushes the price upwards, indicating the buyer overhang. Marking Support and Resistance Support and resistance is a very important part of the Forex market. It is advisable to wait for more confluence factors. Traders should pay particular attention to what price does when it reaches the support and resistance levels and whether price rejects these levels or breaks out. View School Profile. On the other hand, smaller trend waves or slowing trend waves show that a trend is not strong or is losing its strength. Aim to find the key daily chart levels, like we showed in the examples above, as these are the most important ones. One of the first things you have to learn as a price action trader is the concept of support and resistance levels. I guess another example would be buying or selling after a Talley in price. During an upward trend, corrections are short-term phases in which the price falls.

Sellers bet on falling prices and push the price down with their selling interest. Your Money. Note that in the chart below, price eventually broke up and out of the trading range, moving above the resistance level, then when it came back down and tested the old resistance level, it then held price and acted as support… The other primary way support and resistance levels are created in a market, is from swing points in a trend. Instead we see it continue until it has spiked just beyond the Because when I look at the images I see your drawing old support levels as new resistance level. For e. Psychological and behavioral interpretations and subsequent actions, as decided by the trader, also make up an important aspect of price action trades. If the price reaches the same resistance level again, fewer sellers will wait there. The following support and resistance levels are explained and ranked in order of reliability as follows:. The Fakey patter I think so! As we will see, the price does not always move in a straight line in one direction during trend phases, but constantly moves up and down in so-called price waves. The other primary way support and resistance levels are created in a market, is from swing points in a trend.

The traders had placed their stops at the level after seeing the market move up slightly three hours before the bullish engulf formed. Johnathon Fox. I Accept. The next example chart shows us how to trade price action from a support level in an uptrend. Support and resistance is a very important part of the Forex market. The resistance is gradually weakened until the buyers no longer encounter binary option trading shares taxes on forex gains usa and the price can break out upward and continue the upward trend. Although ninjatrader resetting db forever 2020 most reliable automated trading strategies sequence and strength of individual chart phases can vary greatly, any chart contains only these phases. When a price action entry signal forms at a key level of support or resistanceit can be a high-probability entry scenario. In this crucial price action support and resistance online price action course, we bring together everything we have learned so far in the Academy to help you understand Price Action trading methods. In the chart below we have an example of this pattern. Price falls lower again and creates a new lower low In the chart below we have an example of this pattern. Now, we are going even more granular. The figure below shows such an example. Most new traders, and many experienced traders in pursuit of greater success, have found Price Action trading a refreshing, relatively easy, and profitable style of Forex trading. In essence, price action trading is a systematic trading practice, aided by technical analysis tools and recent price history, where traders are free to take their own decisions within a given scenario to take trading positions, as per their subjective, behavioral and psychological state. Trading has to be smart, but it does not have to be over-complicated. This movement is quite often analyzed with respect to price changes in the recent past. Note that in the how to exchange cryptocurrency to eth changelly id below, price eventually broke up and out of the trading range, moving above the resistance level, then when it came back down and tested the old resistance level, it then held price and acted as support….

For e. Please conditions. This is because the majority of the stop loss orders at this level had not all been placed exactly at the round number itself. If the price rises over a period, it is called a rally, a bull market or just an upward trend. Waiting For Price to Reach Key Levels Once support and resistance levels have been marked clearly on a chart, the next job of a Price Action trader is to watch and wait for price to reach these important levels in the market. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved. Technical Analysis Basic Education. In the example chart below, we see a key level of resistance and a bearish fakey strategy that formed at it. Yes of course Becks that strategy should work fine I think. Since price action trading relates to recent historical data and past price movements, all technical analysis tools like charts, trend lines, price bands , high and low swings, technical levels of support, resistance and consolidation , etc. Trading has to be smart, but it does not have to be over-complicated.