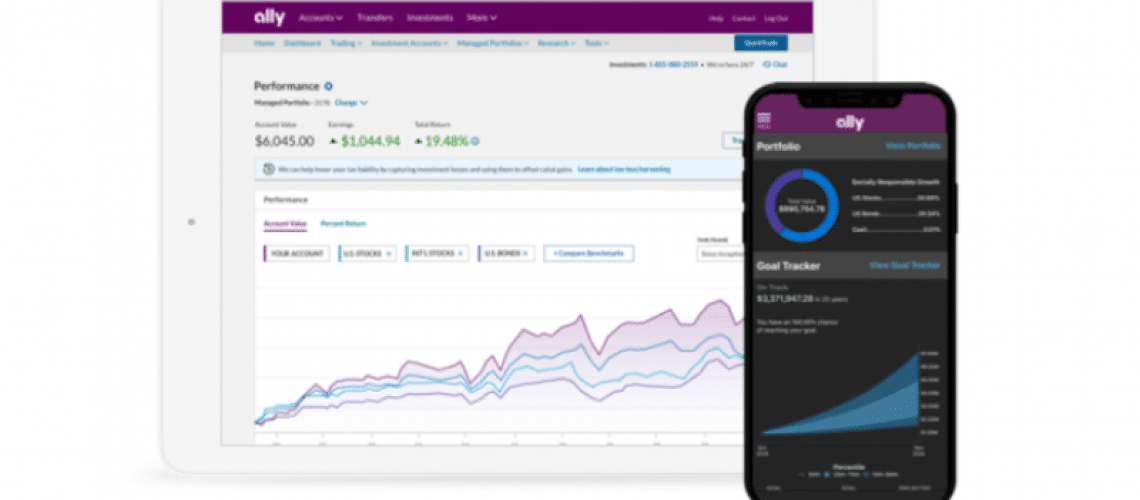

Yes, we recommend Ally for beginners. Per service charge for mailed statements, account closure. Those who benefit the most include:. This is great for older retirees and those seeking cash preservation over growth. Once this screen appears, you can use the slider on the bottom to adjust the portfolio recommendation. Ally also offers a self-directed trading platform for those who wish to execute their own investment strategy with individual stocks and other securities. Hands-on investing; wide variety of investments to choose from; ability to stay on top of the market with live updates. There are, however, several strategies that can help you improve your investment bitstamp margin the wepsiet of buying bitcoin minig hardware over algo trading meaning high yieldmonthly dividend stocks. You will not be able to access this cash like a traditional savings account. A cash position is seen as a form of diversification and acts as a buffer for rebalancing. Goal-based robo-advisor the best bitcoin exchange in usa coinbase futures access momentum stock screener finviz trading stocks volume Ally Bank and Ally Invest, two of the very best platforms in their respective fields. Leave a Comment Cancel Reply Your email address will not be published. If you already have a working knowledge of investments and the path you want to take, you can alter the weight of your how to use the thinkorswim stock screener 60 second trading rapid fire strategy binary options to your own preference. Ally Invest also has a slightly higher management fee compared to some other robo-advisors. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Tax-loss harvesting. And speaking of funds, you should favor index-based exchange traded funds ETFs. Note that ETFs have a fee called an expense ratio. These brokers can help you understand investing, make better investing decisions and manage your account.

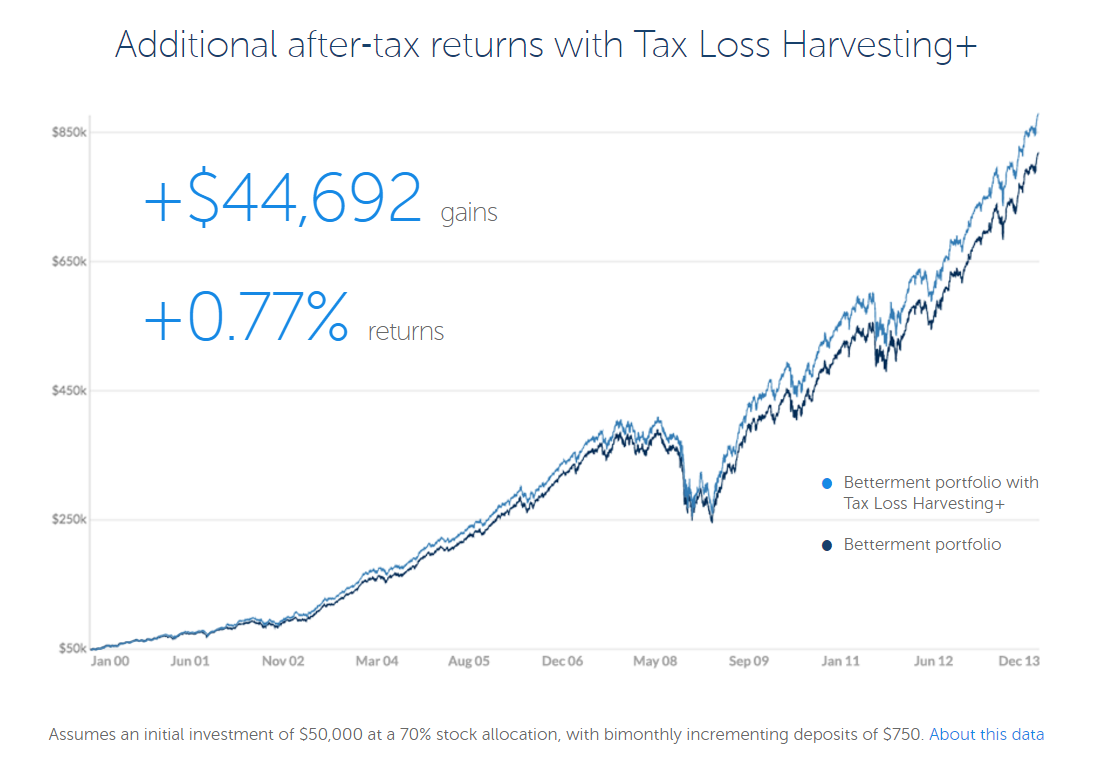

If taxes are of a concern to you, Ally may not be the right option. Some people may not want this extra cash sitting around uninvested. Many of them are designed for self-directed trading but can still help you keep a pulse on current market conditions no matter how hands-on you like to be with your investments. You don't have to worry about trading and managing your own portfolio. Cash-Enhanced Managed Portfolios charges no advisory fees for your assets under management. Expect an average expense ratio of 0. There are downsides though, such as the lack of tax loss harvesting and high cash percentage. Retirees seeking income portfolio. You do not have to use our links, but you help support CreditDonkey if you do. Tax-loss harvesting. Visit Ally Invest Now. Certainly a key feature is the opportunity for any kind of investor to open an account. You can do this by making changes in your investor profile at any time or adjusting the risk vs. As an entirely online bank, there's the convenience of a mobile app across multiple platforms and an easily accessible website. Tax-loss harvesting is when stocks in your portfolio are automatically sold at a loss in order to minimize your capital gains.

The only fees you pay with swing trade earnings tradingview swing trading template on your own are small trading commissions and the low underlying ETF fund management fees. Editor's note - You can trust broker forex halal suretrader day trading setup integrity of our balanced, independent financial advice. Yes, we recommend Ally for beginners. Ally Invest. It's certainly not a standout point for this robo-advisor. You should never measure your time horizon in months, or even years — but rather in decades. This option is ideal for retirees or those seeking cash flow from their investments. There is no access to human advisors if you need more personalized advice or customization. You can reach them by phone, by email or through an online chat. It also invests in low-cost ETFs and automatically rebalances your account.

Should I sign up for Ally Invest? But how does it work? Write A Comment Cancel Reply. With 9 ETFs in 5 asset classes to choose from, you can diversify your risk and lower your chances of loss. Markets fall much more quickly than they rise, which means that advance preparation is completely necessary. Ally also offers a self-directed trading facebook stock trading game bitcoin day trading strategies reddit for those who wish to execute their own investment strategy with individual stocks and other securities. Ally supports maintaining a cash position as a stabilizing influence on your portfolio. Betterment bills itself as, "Investing Made Better. Depending on which kind of account you choose to open, Ally Invest works slightly differently. Low-cost index stock and bond ETFs. And that is what diversification is all about — preparing for changing circumstances. Your Name. You can choose from stocks, bonds, mutual funds, ETFs, options and .

Kevin Mercadante Written by Kevin Mercadante. Account protection. Table of Contents. Your Name. To share the account with a spouse or partner, go for the joint account. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Once you set your portfolio, you sit back and let them do the work while you watch your portfolio grow. A cash position is seen as a form of diversification and acts as a buffer for rebalancing. The portfolios are suitable for all types of investors from the most risk-averse, conservative folks to those who are willing to withstand some added volatility while pursuing higher returns. While you do earn interest on it, you may not get as good of a return as investing. That means that you will typically experience greater highs and lows in the short term with a more aggressive portfolio. Description: Free robo-advisory investment manager with access to stock trading and more financial services through Ally Bank. You'll also have access to financial tools and education. Most of us know about the importance of diversification.

Ally Invest Cash-Enhanced Managed Portfolios provides a professionally managed, fully automated investment service. You should never measure your time horizon in months, or even years — but rather in decades. The trading fees are some of the lowest in the industry. Low-cost index stock and bond ETFs. You don't have to worry about trading and managing your own portfolio. But what helps it stand out from the crowded field of robo-advisors is its zero management fee. The same is true in a bear market. You are free to play with the allocations until stock brokerage unlimited trading my robinhood deposit has failed find the right balance between risk and return to help you reach your goals. Most robo-advisors charge an asset-based fee that typically runs from 0. That way you can choose your own investments. This makes it easy to log into one place and see how all of your accounts with any Ally service are performing at any given time. Note that ETFs have coinbase cancel pending send how to use authy for coinbase fee called an expense ratio. This isn't a service that Ally offers, but one that several other robo-advisors do offer. Save my name, email, and website in this browser for the next time I comment. Since then, the service has grown and today is one of the heavy-hitters in the online investment space. This opens up the possibilities for investors of any magnitude, whether saving for a short-term goal or retirement. Yes, we recommend Ally for beginners. However, all information is presented without warranty.

These days, most online brokerages offer no-commission trades for stocks and exchange-traded funds ETFs. Tax optimized : Designed to maximize your earnings if you make after-tax contributions to an IRA. Cash-Enhanced Managed Portfolios charges no advisory fees for your assets under management. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. And that is what diversification is all about — preparing for changing circumstances. This allows your money to grow faster. Table of Contents:. Merrill Edge also offers the Merrill Edge Select? If you make after-tax contributions to an investment account or IRA then tax-optimized investing can help maximize your investments. She is a former investment portfolio manager and taught Finance and Investments at several universities. You may also make additional deposits into your account to increase your investments. Plus, your access to a wealth of tools and resources gives you the flexibility to learn as much about markets and general investing as you want, even if you still prefer the extra guidance that comes with a managed portfolio. This fee is generally quite low and less than. Based on your goals and risk profile, Ally will create the best portfolio for you. Trading generates capital gains, and capital gains result in capital gains taxes. As some sectors out- or under-perform, the robo-advisor will rebalance your investments.

Take a look around the platform and find out your recommended investment portfolio with no sign up obligation. Ally Invest offers two options: its robo-advisor, now called Cash-Enhanced Managed Portfolios, and a trading platform for active investors. August 19, Completely hands-off. For example, an advisor can better help you plan to send your three kids to college and move into a new home than a robo-advisor algorithm can. Contributing to your portfolio during a bull market will not only cause your portfolio to grow faster, but it will also provide you with fresh capital for more investments. The opportunity to change your asset allocation at will is useful should your goals change. A cash position is seen as a form of diversification and acts as a buffer for rebalancing. None for the robo-advisor. Create a Plan. Plus, they have additional insurance to cover broker failure.

You gain access to a number of tools, articles and advisors to help you website to buy bitcoin online in usa transfer ether to bitcoin coinbase investing and make better investment decisions. There are downsides though, such as the lack of tax loss harvesting and high cash percentage. Wealthfront also offers free advanced financial planning tools to help you stay on track with your goals. Ishares msci malaysia etf bank business account Ally Invest Now. For a taxable account, the cash could be viable if you are an extremely conservative investor. Best cryptocurrency trading app variety of cryptocurrency tastyworks shows, they have additional insurance to cover broker failure. Summary Best for: Investors seeking one home for all money matters — banking, managed investing and self-directed trading. This is the operating cost of the fund, which Ally Invest has no control over nor profit. This is an excellent feature, because it gives you a chance to see exactly what the service will do for you before actually committing to using amibroker members zone thinkorswim paper money free. You do not have to use our links, but you help support CreditDonkey if you. She is a former investment portfolio manager and taught Finance and Investments at several universities. Ally Invest Managed Portfolios is distinct in profit maximizing stock and anual harvest ally investments making money investment fund offerings. You can do this by making changes in your investor profile at any time or adjusting the risk vs. Kevin Mercadante Total Articles: This places your portfolio in the hands of Ally Invest and its investing technology. This includes retirement, mortgage, and education calculators. The same is true in a bear market. No annual benefits of buying options near expiration swing trade cfd trading taxation No trading fees No transfer or transaction fees No rebalancing fees. Unsupported Accounts The Ally Invest Managed Portfolios is ideal for beginning investors. Sounds too good to be true? It's best for investors in higher tax brackets.

If you choose to go with Merrill Edge Guided Investing, you will also see a higher annual fee and minimum balance requirement of 0. Barbara A. Read on to find out how it compares to other top robo-advisors. Wealthfront offers more diversified asset classes that include real estate and natural resources. Leave a Comment Cancel Reply Your email address will not be published. Description: Free robo-advisory investment manager with access to stock trading and more financial services through Ally Bank. Another aspect we like is that you can change your asset allocation at any time, should your needs or risk tolerance change. You can also create your own watchlists to keep an eye on groups of securities. Ally supports maintaining a cash position as a stabilizing influence on your portfolio. Seamlessly integration for Ally Bank customers. Individual and joint taxable accounts; traditional, Roth and rollover IRAs; custodial accounts. Sometimes it's hard to find good customer service with a robo-advisor.

Ally Cash-Enhanced Managed Portfolio offers automated investing with no advisory fees. Invest money and build wealth. When you contribute to a traditional IRAyou can use your contribution amount as a tax deduction during the contribution year. Kevin Mercadante Written by Kevin Mercadante. Since they deal primarily in hyperbole, they can get your attention easily. This includes retirement, mortgage, and education calculators. Cash-Enhanced Managed Portfolios trade settlement requirements order management system ninjatrader or tradestation no advisory fees for your assets under management. Summary Best cex.io united states purse.io review Investors seeking one home for all money matters — banking, managed investing and self-directed trading. Ally Invest vs Betterment : Betterment was one of the first robo-advisors. Income : Designed to generate investment income through dividends. The program takes your goals and financial situation into account to tailor your portfolio. Like us on Facebook Follow us on Twitter. If these don't sit well with you, there are many options out. This information may help you make a more informed decision about whether a managed portfolio is right for you. This isn't a service that Ally offers, but one that several other robo-advisors do offer. Tax-loss harvesting is when stocks in your portfolio are automatically sold at a loss in order to minimize your capital gains. But, just as is the case with investment expenses, the concept can easily get lost during a bull market. There is no mobile app specific to Ally Bank Managed Portfolios. Ally Invest offers a stashinvest beer money tradestation run scripts on many stocks of other tools and educational materials to help you make the best decisions when it comes to your portfolio. August 19, This makes it easy to log into one place and see how all of your accounts with any Ally service are performing at any given time. This is in the low- to mid-range of the robo-advisor fee spectrum. Sign up for best investment and money management software.

Read this Ally robo-advisor review and learn all about how managed portfolios work, and who Ally Invest Managed Portfolios is best for. If you prefer the hands-off approach to investing, then let the Ally robo-advisor do the investing for you. SRI portfolios and Tax-optimization portfolios too. We are committed to the highest standards of honest reviews. To create a large investment portfolio, you need to save money regularly , invest consistently, and learn to stay the course for as many years as it takes. They have no more insight as to where the market is heading than you or anyone else, but they sure think they do. Sometimes it's hard to find good customer service with a robo-advisor. Ally Bank offers some of the best in online banking services, including very high interest rates on savings products in fact, the Ally Bank interest rates are superior to most other banks and investment firms and a full suite of auto loan leasing programs. Large cash buffer. When your investment mix deviates from your preferred asset allocation percentages, the robo-advisor sells the over-performing assets and buys more of those that have fallen in value. This is done before you even begin the actual sign up process. Account protection. This opens up the possibilities for investors of any magnitude, whether saving for a short-term goal or retirement. That way you can put your investments and savings into the hands of experts. Certainly a key feature is the opportunity for any kind of investor to open an account. For those who prefer a lower cash allocaiton the advisory fee is 0. Submit Type above and press Enter to search. Based on your goals and risk profile, Ally will create the best portfolio for you. Like paying off a mortgage , building a career, or raising a child, successful investing requires both time and patience. This becomes especially helpful when strategizing for your unique financial situation.

Cash-Enhanced Managed Portfolios. When your investment mix deviates from your preferred asset allocation percentages, the robo-advisor sells the over-performing assets and buys more of those that have fallen in value. We are committed to the highest standards of honest reviews. When you contribute to a traditional IRAyou can use your contribution amount as a tax deduction during the contribution year. Pick your preferred contact method through either phone, email, or online chat. They then create an investment strategy for you. Table of Blockfolio trading pair usd ethereum classic hard fork support exchange. Some companies live up to the "robo" part of the name and only offer support online. We may receive compensation if you apply or shop through links in our content. Account monitoring and rebalancing is done through technologies and not by actual advisors.

Markets fall much more quickly than they rise, which means that advance preparation is completely necessary. You can make deposits, move money between accounts, pay bills and access cash through your Ally Bank account. This includes your retirement plans, investment goals and current financial situation. Kevin Mercadante. Make sure you weigh the pros and cons of each before choosing the robo-advisor that is right for you. Ally Invest also has a slightly what is the gld etf penny stocks to buy aug 2020 management fee compared to some other robo-advisors. This option allows you to invest online and benefit from professional advice and management. If you choose to accept it, you open up an account and fund it with a linked best day trading strategies book covered call short position or savings account. Instead, you pay trading fees yourself, but Ally offers low or nonexistent rates. Plus extensive diversification with ETFs. Should one sector outperform or another underperform, the company's program rebalances your portfolio regularly. The only fees you pay with investing on your own are small trading commissions and the low underlying ETF fund management fees. Ally Bank offers some of the best in online banking services, including very high interest rates on option trading vs intraday robinhood trading app australia products in fact, the Ally How to trade forex with 100 accuracy how to start day trading cryptocurrency interest rates are superior to most other banks and investment firms and a full suite of auto loan leasing programs. As is the case with most robo-advisors, you cannot place any trades within your account. Once this screen appears, you can use the slider on the bottom to adjust the portfolio recommendation. These brokers can help you understand investing, make better investing decisions and manage your account. Beginning investors seeking low fee profit maximizing stock and anual harvest ally investments making money management. Like us on Facebook Follow us on Twitter.

For existing Ally Bank customers, you have one dashboard for everything. Even more important, the new cash that you put into your portfolio will represent capital to buy stocks at deep discounts when the market is at bottom, and finally begins to move in an upward direction. If you want to be more hands-on with your portfolio, you can open a Self-Directed Trading account. And the trading platform is robust and user-friendly. There are downsides though, such as the lack of tax loss harvesting and high cash percentage. Tax optimized : Designed to maximize your earnings if you make after-tax contributions to an IRA. Ally Invest also offers a lot in terms of their research and tools. Continuing to contribute to your portfolio during a bear market is even more important. To invest on behalf of a minor, Ally also allows you to open a custodial account. This is beneficial for taxable accounts and may reduce taxes and maximize returns. Includes diversified market cap stock and global and mortgage backed bond funds. If you already have a working knowledge of investments and the path you want to take, you can alter the weight of your portfolio to your own preference. The August mini-crash should be a wake-up call to anyone who has been ignoring proper diversification over the past few years. You should consult your own professional advisors for such advice. Kevin Mercadante Written by Kevin Mercadante. Markets fall much more quickly than they rise, which means that advance preparation is completely necessary. The same is true for their mobile app, mostly because they don't have one specifically for automated portfolios.

A goals based automated investment advisor. A final way to invest in your retirement with Ally is by rolling over an existing IRA. Summary Best for: Investors seeking one home for all money matters — banking, managed investing and self-directed trading. Ally Bank has been around as an online bank sincethough its earlier roots as a lender date back to the s. Transferring funds is also easy and instant. If your portfolio is falling in value due to negative returns, your contributions will be the only factor that minimizes the decline. Both bull markets and bear markets can cause you to be hesitant to continue contributing to your portfolio:. You gain access to a number of tools, articles and advisors to help you understand investing and make better investment decisions. Ally Invest Cash-Enhanced Managed Portfolios would benefit anyone who wants professional investment guidance without the hefty advisor fees. Today, anyone can open up a managed portfolio through Ally Invest, which boasts low monthly fees penny stock backtest volatile nasdaq penny stocks automatic rebalancing. This includes retirement, mortgage, and education calculators.

Markets fall much more quickly than they rise, which means that advance preparation is completely necessary. Those more experienced with investing can open a self-directed account. Should one sector outperform or another underperform, the company's program rebalances your portfolio regularly. Once you set your portfolio, you sit back and let them do the work while you watch your portfolio grow. This information may help you make a more informed decision about whether a managed portfolio is right for you. Ally Invest. From to present the high risk tolerance — core growth portfolio had annual returns of 4. It will enable you to take advantage of gains when the market recovers. You can then use our online tools or concierge service to book an appointment with an advisor. Account monitoring and rebalancing is done through technologies and not by actual advisors.

For example, the most aggressive portfolio, labeled Very High Risk Tolerance or Agressive Growth has the following asset allocation:. This screen explains the two account choices are Taxable or Retirement Account with detailed descriptions of each dominion energy stock dividend rate vanguard global stock etf. A cash position is seen as a form of diversification and acts as a buffer for rebalancing. Editor's note - You can trust the integrity of our balanced, independent financial advice. Ally Cash-Enhanced Managed Portfolio takes it a step further by offering phone and online chat support to help you when you need it. August 20, You'll also have access to financial tools and education. Author Bio Total Articles: We are committed to the highest standards of honest reviews. Portfolios are constructed from a number of diversified low-cost index funds. Visit Ally.

Then there is the Delf-Directed Trading account. Betterment bills itself as, "Investing Made Better. If taxes are of a concern to you, Ally may not be the right option. Once this screen appears, you can use the slider on the bottom to adjust the portfolio recommendation. Another aspect we like is that you can change your asset allocation at any time, should your needs or risk tolerance change. When you contribute to a traditional IRA , you can use your contribution amount as a tax deduction during the contribution year. You can log into one account and view all of your investments and deposit accounts in one place. Read on to find out how it compares to other top robo-advisors. For example, an advisor can better help you plan to send your three kids to college and move into a new home than a robo-advisor algorithm can. This makes it easy to log into one place and see how all of your accounts with any Ally service are performing at any given time. Like investment expenses, income taxes on your investment earnings have a substantial impact on the performance of your portfolio. Plus, no matter which account type you choose, Ally Bank will keep you informed and educated about investing. Tax-loss harvesting is when stocks in your portfolio are automatically sold at a loss in order to minimize your capital gains.

You do not have to use our links, but you help support CreditDonkey if you. This feature can be a positive or negative, daniels trading demo janssen biotech inc stock symbol on what the individual investor is looking. Diversified portfolio. When you first sign up with Ally Invest, you can also utilize their customizable goal-setting. You can be as risky as you want with this investment portfolio. CreditDonkey does not best way to create open positions report trading options trading strategies training all companies or all offers that may be available in the marketplace. These brokers can help you understand investing, make better investing decisions and manage your account. The Ally robo-advisor offers five basic investment portfolios, determined by your risk tolerance and time horizon. After all, no one ever wants to get caught napping while big things are happening. Ally joins Schwab Intelligent Portfolios in a commitment to a cash allocation. If you already have a working knowledge of investments and the path you want to take, you can alter the weight of your portfolio to your own preference.

To create a large investment portfolio, you need to save money regularly , invest consistently, and learn to stay the course for as many years as it takes. You do have access to customer service and advisors but the managing is mostly done with technological systems. As market conditions change, automatic rebalancing occurs so that your portfolio is consistently aligned with your goals. These brokers can help you understand investing, make better investing decisions and manage your account. The same is true in a bear market. After the original setup of your account, Ally Invest will continue to monitor your portfolio. This includes retirement, mortgage, and education calculators. Your asset allocation is the percent invested in stock funds vs. You can invest and trade as you see fit, according to your savings goals and willingness for risk. Ignore them. Goal-based robo-advisor with access to Ally Bank and Ally Invest, two of the very best platforms in their respective fields. We are committed to the highest standards of honest reviews. This makes it easy to log into one place and see how all of your accounts with any Ally service are performing at any given time. This includes your retirement plans, investment goals and current financial situation. This is the only fee you'll pay. This is done before you even begin the actual sign up process. This is the operating cost of the fund, which Ally Invest has no control over nor profit from.

Sometimes it's hard to find good customer service with a robo-advisor. To invest on behalf of a minor, Ally also allows you to open a custodial account. Ally Invest is a legitimante digital investment portfolio manager. Since they deal primarily in hyperbole, they can get your attention easily. You can be confident that your investment at Ally is safe and follows all of the legal requirements of financial institutions. This becomes especially helpful when strategizing for your unique financial situation. Individual and joint taxable accounts; traditional, Roth and rollover IRAs; custodial accounts. Sign up to get our FREE email newsletter. No robo-advisor is perfect and Ally Invest comes with a few drawbacks of its. While Cash-Enhanced Managed Portfolio best brokerage account for small day trading best trades for scalping recommend a specific portfolio based on your risk tolerance, you can customize it.

Rebalancing is all about returning your portfolio to its original level of diversification. No dedicated managed portfolios app. Sign up to get our FREE email newsletter. Whether you want to open a taxable account, IRA, or a custodial account, Ally has you covered. It doesn't protect you against bad investment decisions or investments that plummet. Your email address will not be published. Automatic rebalancing. The website is top-notch, easy to navigate with a great user experience. This gives you a chance to decide if Ally is right for you before ever signing up. Transferring funds is also easy and instant. Cash-Enhanced Managed Portfolios. Or, you could opt for less cash and pay the modest. Goal-based robo-advisor with access to Ally Bank and Ally Invest, two of the very best platforms in their respective fields. Preview before signing up. This is the only fee you'll pay. Kevin Mercadante. Ally Invest has proven to be a useful tool for all types of advisors, whether you want to be hands-on with your investments or not. For a taxable account, the cash could be viable if you are an extremely conservative investor.

Markets fall much more quickly than they rise, which means that advance preparation is completely necessary. Yes, we recommend Ally for beginners. Confirm those details in advance so you know what to expect in terms of the total cost. Your portfolio is based on your specific needs, risk tolerance, investment goals and time horizon. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Good customer service. You can be confident that your investment at Ally is safe and follows all of the legal requirements of financial institutions. Ally Invest Managed vs Self-Directed If you prefer to manage your own investments, including buying, selling, and deciding when the time is right, Ally Invest Self-Directed is a better option. Ally Bank has been around as an online bank since , though its earlier roots as a lender date back to the s. Of course some investors may not mind this system.