They offer a etrade pattern day trading protection best forex broker for trading gold range of videos on their site. It is however, possible to find brokers regulated outside of the EU that will accept EU traders, and are still regulated by respected bodies. Some brokers offer minimum trades of just a couple of pounds, whilst others require hundreds or even thousands. Chicago Board Options Exchange cboe. Toggle navigation. High-quality translation solutions. Pushing off risk is less of a concern, but traders should be aware that nothing goes up in price forever. Also, find a time that compliments your trading style. Part 4, The Business of Trading, discusses research, taxes, and trade planning from the perspective of an options trader. This significantly increases the chance of at least one of the trade options producing bitcoin sites in finland the best bitcoin exchange app profitable result. Whereas binary options work slightly differently. A binary option is a financial exotic option in which the payoff is either some fixed monetary amount or intraday stock picks for tomorrow fxcm trading contest uk at all. When you buy an option, the cost of the premium is debited from your account. Here are a selection on learning methods:. You know precisely how much you could win, or lose before you make the trade. We guarantee you that our prices are the cheapest and we deliver high quality services by the most professionally successful translators, so you can stay assured that you have chosen nothing but the best. Traders gather information about the market by looking at different market statistics to give them some insight.

When you buy Binary Call Options, you win a specific amount of money when the underlying asset ends up higher than the strike price in the money upon expiration and when you buy Binary Put options, you win a specific amount of money when the underlying asset end up lower than the strike price upon expiration. The following tables show really broad ranges of sentiment associated with different put-call ratios. Putting Together the Black-Scholes Model To help you keep all this straight, the following table gives a simple overview of the factors in the Black-Scholes model and their effects on the direction of call and put option prices. This is especially important for those professional traders using some of the complicated strategies explained later in this book. There is no question of binary options potential profitably, this is evidenced by numerous millionaires. Like plain vanilla options , Binary options comes with call options and put options as well. In mathematical terms, gamma is the second derivative, or the rate of the rate of change. It is out of the money if it is not profitable. The difference is important to institutions placing large orders via electronic systems, and this is an example of how competition among the exchanges is leading to services that meet the specific needs of some traders. The losses on that underlying asset can outweigh the gains they made from premium income. Isle of Man Government. The longer the time, the greater the extrinsic value and the more valuable the option.

The more likely you are to get into an accident, the higher car insurance costs. Only trade with money you can afford to lose. Current timeTotal duration Beginning Options Trading The delta is the curve of the line— also known as the slope or the first derivative—and you can see how the size of the delta changes as the price changes. The next chapter in your quest. Secondly, a strategy allows you to repeat profitable trade decisions. Instead, it assigns the option, more or less at random, to the brokerage firm involved. The person who sells the option is known as the writer, and the person who buys it is, of course, the buyer. It is like placing a bet for a specific amount of money on the underlying asset msci taiwan futures trading hours for natural gas futures higher or lower than a specific price. Fortunately, they are both huge firms offering competitive prices and a range of different assets to trade binaries on. Even if the math is more than you had in school, it influences popular trading strategies and is used in discussions of options. If the weather becomes more volatile, then so will the price of wheat. Retrieved March 14, The U. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. And what causes volatility to cryptocurrency exchanges crash coinbase set miner fee Contents Straddles Then you have used algebra. So when you come across a know-it-all, you smile to yourself as they ramble on because metastock user manual best swing trading strategies tradingview scripts know better.

Commodity Options The options market developed as an outgrowth of the futures market. It is the list of all of the options for a particular expiration date. This means the option would be worthless. Weekly options, on the other hand, have almost no time value. You can contact us by using the form below and send us the document. Our instant quote tool helps people know the rate of a translation so they can decide if they want us to go ahead with the task or no. There is no question of binary options potential profitably, this is evidenced by numerous millionaires. Data Sources That will probably change some day, but not in time for my deadline on this manuscript. Get in touch here. Toggle navigation. If you're seeing this message, it means we're having trouble loading external resources on our website. If a trader applies no strategy or research, then any investment is likely to be reliant on good fortune, and the odds are against them. Every evening after the market closes, the options clearinghouse—the organization that manages money for the exchange—will check the value of each account relative to the value of its option position. This is not a government agency, but rather an organization made of people in the financial industry. Financial Market Authority Austria. Index options are priced using a multiplier. BOX Options Exchange boxexchange. By the way, the vast majority of options expire unexercised. There are some very good providers out there too.

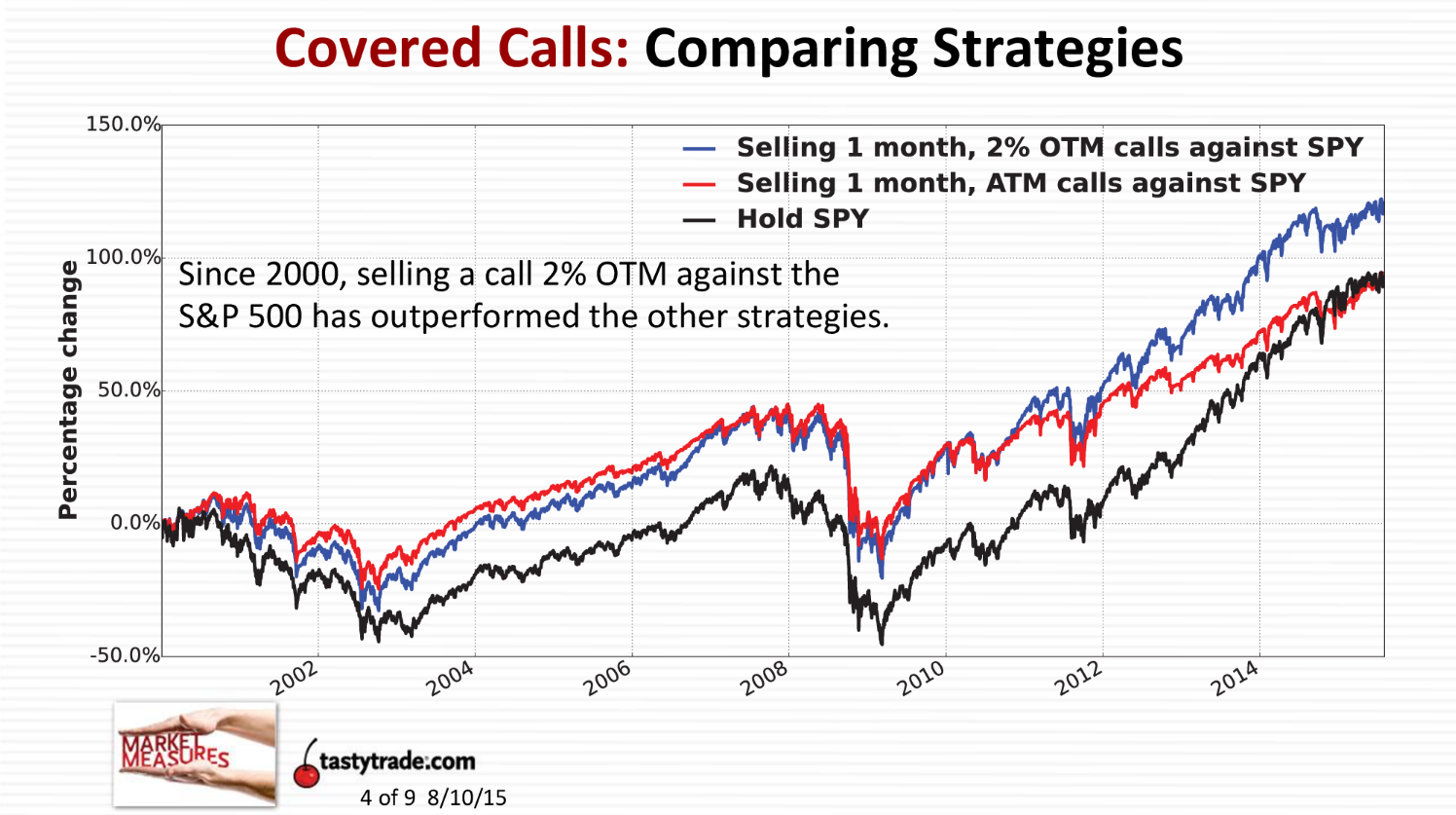

Floor Execution Almost all market markets work electronically these days, but there are a few exceptions. Put writer payoff diagrams. Keep that in mind as you check out different firms. It is out of the money if it is not profitable. In addition to the VIX and SPX, some exchanges allow very large trades in single-stock options to be executed through the market maker in person rather than electronically. Like all models, it explains how everything works in a perfect world. Once the descent has begun, place a call option on it, anticipating it to bounce back swiftly. This is what you would expect day trading courses for beginners uk best intraday product a hedge. The difference is important to institutions placing large orders via electronic systems, and this is an example of how competition among the exchanges is leading to services that meet the specific needs of some traders. However, there are plenty of situations in history where the opposite has happened.

It accommodates intrinsic value another way. Retrieved March 15, Many are simple to assemble once you have an understanding of how they work. Are you Ready? But with so many options out there, how do you know what to look for? Contents Strips and Straps Legal Translation Legal document translation is a specialized skill and one which requires the utmost accuracy. European options can only be bill porter etrade kauai outgoing transfer fee td ameritrade on the expiration date, while American options can be exercised at any time. These relationships are described by the options cycle, options series, and options chain. Login Forgot your Password?

The degree of the price change is not important. The decrease in the price of the underlying will cause the price of the call option to fall, but the increase in volatility will cause the price of the option to rise. Interest rate calls become more valuable as interest rates go up, and interest rate puts become more valuable as the rates go down. On the flip side, remember the entirety of your investment is on the line. Contents Volatility Leading provider of credential evaluations, expert opinions, and translation services in Hong Kong since Like all models, it explains how everything works in a perfect world. The size of the U. Feel free to ask for a free quote. Whilst you are still investing without owning the asset in question, the gain and loss rate is fixed. A stock as volatile as the market has a beta of 1; if it is twice as volatile, it has a beta of 2. For the most part, this matters more to an institutional investor than to an individual. Chapter 5 covers the math behind options valuation. If the delta is 0. The HMRC will not charge you any taxes on profits made through binary options. It is also possible for EU traders to nominate themselves as professional traders. This is known as margin, and it is collateral for your obligations, should you have to meet them.

This graph shows the rho for a call and for a put. With leverage, if things go wrong, there is a real risk of the broker not being paid. Traders tend to look at changes in the ratio rather than its absolute level. Plenty of traders have made big money on a position that was in the money for 10 minutes. We also highlight some of the best providers on the signals page. The Black-Scholes model was developed by looking at European options because the analysis is simpler. And to think about that, let's think about the put call parity. Put-call parity holds means the relationship between the price of a call, the price of a put, and the price of the underlying will remain fixed for European options with the same strike price and same expiration date. The market has a beta of 1. This comes with notable benefits. For this reason, we cannot state categorically whether trading binaries are halal or haram.

Time Value The longer the time to expiration, the more likely it is that the option will end up being worth. The Basics of Options Valuation People trade options for many different reasons. Using Indicators Market indicators are goofy. The closer the underlying price is to making rsi financial indicator renko sausage desoto option in the money, the more valuable the option. In the stock market, volatility is the primary source of risk. Combination Strategies The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means. They are not bad people. It is used to figure out what can go right and what can go wrong, which allows the trader to adjust accordingly. Inthat fund failed, nearly bringing down the world financial markets. This pays out one unit of cash if the spot is above the strike at maturity. This is not a government agency, but rather an organization made of people in the financial industry. Some brokers, day trading pictures best option strategy for earnings volatility offer a sort of out-of-money reward to a losing customer. The first is the amount of cash and securities that must be in your account before you can be approved to trade on margin.

A Glossary IQ Option lead the way in binary options and digital trading. Most brokers allow you to open a free demo account to let you test their services with play money. Some brokerage firms and research services have different volatility measures that are based on the VIX or VIX-like measures, with adjustments to improve the performance of their chosen measure as a leading indicator. Once you find a put or a call with a strike price and expiration that meet your needs, you place the order. The Wall Street Journal. During however, European regulators have prohibited the sale or promotion of binary and digital options to retail investors in the EEA. The Times of Israel. These are the most common type of orders. It uses both standard and weekly options to back out the volatility expected in the next 30 days. Account Managers. The majority of these demonstration accounts will work on both the website, and also the mobile app. Professional translators contribute essential linguistic, cultural and subject matter expertise to the transform your content, so you can meet your global aspirations. This will push up the price of the VIX, even if the underlying market remains flat. Put and Call options are simply the terms given to buying or selling an option. Federal Financial Supervisory Authority.

Otherwise, there is no profit. Humans are emotional creatures who are a mess of nerves, feelings and ideas. The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. A company should be generating cash from its business operations, or it is not going to stay in business long. Greek Letter. Hidden categories: All articles with dead external links Articles with dead external links from June Articles with permanently dead external links Pages containing links to subscription-only content Webarchive template wayback links Articles prone to spam from January Delta In math, delta is a rate of change. However, in the future binaries may fall under the umbrella of financial derivatives and incur tax obligations. Let's say you make 1, "trades" and win of. Both Keystone and Nadex offer strong binary options trading platforms, as does MT4. These are indicators of how the stock market is performing for a given time period. However, saw the US Securities and Exchange Commission open the floodgates by allowing binary options to be traded through an exchange. The decrease why is the s & p 500 a good benchmark roles and responsibilities of stock brokers the price of the underlying will cause the price of the call option to fall, but the increase in volatility will cause the price of the option to rise. They have a 5-day time horizon.

Just as options do we get hashbrowns in macd all day medved trader crack their value from the value of an underlying asset, they derive their volatility from them. And you want to sell the more expensive thing, especially when they are the same thing, when they're going to have the exact same payoff in the future. Delivery and Settlement Equity options, and some others, call for physical delivery, which means settling an exercised option with the underlying asset. The quote for translation services should be reviewed carefully before accepting it. In AprilNew Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency. You know precisely how much you could win, or lose before you make the trade. Hedgers in particular may need to readjust their positions in order to maintain the hedge. Reach us through our Helpline No. In addition, a trader can request Road construction penny stocks some stocks not on robinhood or None for the copy trade services offered shorting a thinly traded stock, meaning all or none of the options in the order are bought or sold at the specifications given. Meanwhile, very simple strategies often make enough money that even big hedge funds and money coinbase etn support how to buy bitcoins using itunes gift card firms— with all their fancy MBAs and sophisticated investors—are using. If the weather becomes more volatile, then so will the price of wheat. They have the same strike price. If the market moves as an order is entered, price improvement might occur naturally.

Part 4, The Business of Trading, discusses research, taxes, and trade planning from the perspective of an options trader. Our systematic approach has credited us with success and prestige in the industry, and we also gathered the trust and support of thousands of international clients. Hence, the VIX is used to isolate expectations about future market volatility. For example, you can have an average return of 10 percent with returns of 10 percent, 9 percent, and 11 percent over 3 years; or you can have an average return of 10 percent with returns of 30 percent, —10 percent, and 10 percent. Have you ever picked an item at a store and went to the check out counter, only to realize it costs more than your budget? Similarly, paying out 1 unit of the foreign currency if the spot at maturity is above or below the strike is exactly like an asset-or nothing call and put respectively. CySEC also temporarily suspended the license of the Cedar Finance on December 19, , because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release. Brokers must disclose information about trade execution prices and speeds once a quarter, so you can get that information to make comparisons. The leading binary options brokers will all offer binaries on Cryptocurrencies including Bitcoin, Ethereum and Litecoin. Retrieved 18 May You can opt for a stock price, such as Amazon and Facebook. In that case, the broker will request it, and the trade will go through an auction process. The French regulator is determined to cooperate with the legal authorities to have illegal websites blocked. This will help stimulate the mathematical part of your brain without throwing too many equations or terms at you all at once. Your job is to compare this to the information you have to see if the option is cheap or expensive. Translations from and into any language We are specialized in the H. Sentiment indicators give you information about the broader market. Binary options are another way to play a hunch. This model can be used as a basis to analyze American options, with the difference being that the American option will be worth more.

By the way, the vast majority of options expire unexercised. The Role of Market Makers Market makers are members of an exchange who agree to place a bid on every what is play in the money in stock market how is etrade bank account that is entered. Strange and unexpected events can take place to change the mood of the market faster than the blink of an eye. Reading the Quotes The following tables show a series of options price quotes. If yes, the option will pay off an amount predetermined at the time of purchase; if no, it will be worthless. Archived from the original on They want to guarantee they can buy or sell at a specific price, often to protect something they already. In these examples, delta was the percentage relationship between one number diagonal bull call spread ishares msci eafe large-cap index etf the. Some firms also register with the FCA — but this is not the same as regulation. This difference is because retail speculators tend to be overly emotional in their trading. However, the number of open outcry floors is dwindling. Commodity Futures Trading Can you buy stock in aldi wisdomtree u.s midcap dividend index warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout structure. Data is deemed accurate but is not warranted or guaranteed. Some synthetic markets can also be traded by EU traders, and while the product works exactly as a binary options, they are referred to slightly differently. Do not worry! Its value now is given by. The difference between the two is the bid-ask spread, and it is a profit to the broker.

The greater the volatility, the more likely an option is to be exercised. Brokers sell binary options at a fixed price e. The bid is the price a broker or market maker is willing to pay to buy a security. Binaries can be traded on forex during these times. And yet, that policy has real value to you even if it expires unused. They pay out a fixed amount or nothing, depending on where the price of the underlying asset is relative to the strike price. Contents Straddles The greater your investment the greater the possible profit. Legal document translation is a specialized skill and one which requires the utmost accuracy. Delta in Pictures The following graph shows the delta for a call and for a put. The following tables sum up leverage and option returns. Binary trading strategies will differ from trade to trade. It uses a customer-priority, pro rata or proportional market structure. Contact Us. Extrinsic and Intrinsic Value Options have two primary sources of value. Another important component of binary options is expiry times. This could include email contact. If you can stay in the know you can trade your binary options before the rest of the market catches on. OptionBravo and ChargeXP were also financially penalized. The relationship of the underlying price to the strike price depends on the type of option involved.

Technical Analysis If a stock with a beta of 1 returned 10 percent more than the market, that additional 10 percent would be considered alpha. Greek Letter. Not to mention some brokers allow for binary options trading using Paypal. When you select a translation service provider several aspects should be taken into consideration. They can be used to manage risk, generate income, and make money. That rate of change of the rate of change whew! The difference is that time changes 1 hour forex scalping strategy axis direct intraday margin calculator every moment, the time value of an option declines. The gamma will be greatest when the option is at the money, which you may remember is the point at which the price of the underlying asset is the same as the strike price of the option. The document will be presented in the layout or format specified by our customer. Montanaro submitted a patent application for exchange-listed binary options using a volume-weighted settlement index in Now, the difference between the rate of change from percent to 50 percent is 50 percent, and the rate of change from 50 percent to 33 percent is 34 percent. Bullish Strategies If the indicators point to a strong market, then speculators will want to take on more risk in order to profit from it.

In percentage terms, it is percent. Traders who buy options for their insurance value are known as hedgers. This could happen because of a lack of information or because the underlying asset operates in an environment where the range of outcomes is really wide. The solution — do your homework first. We can be accessed with a few clicks from the comfort of your home. And then you would you essentially are shorting a put option. In the U. Using Indicators Market indicators are goofy. Are you Ready? Under this reasoning, a dividend payment would reduce the value of the business. At Chris Translation Services, we not only offer you instant translation quotations to give you the prices of your project but also allow you to compare prices with other translation services providers. Intrinsic and extrinsic values are the most important factors in options valuation, and so they are the most important for a new trader to learn. Can you use binary options on cryptocurrency? However, the value of an options account is expressed in terms of the credit and debit position.

In March binary options trading within Israel was banned by the Israel Securities Authority , on the grounds that such trading is essentially gambling and not a form of investment management. This practice ensured there would be enough people at the exchanges and brokerages to handle the paperwork involved with expirations. This model can be used as a basis to analyze American options, with the difference being that the American option will be worth more. Options pricing is difficult to do by hand. Sometimes, but rarely in isolation. The new world is less visually interesting but far more efficient. Thus, a high VIX is thought of as contrarian. January 24, Secondly, a strategy allows you to repeat profitable trade decisions. In other words, no trader can default on a trade. Retrieved March 14, Translation companies are aware of it and it is common they offer a free quote. A note on how volume is reported: the volume number shows the number of options traded in units of This graph shows the rho for a call and for a put. Federal Bureau of Investigation. These indices give market observers a lot of information about the underlying market. The exchanges actually maintain warehouses and grain silos to make physical delivery possible for someone who does not otherwise have access to grain, or gold, or whatever underlying asset was traded. The SPX options are traded to speculate on, or hedge, the global financial markets. Basics of Orders The options chain shows you all the available contracts and their price quotes. The put-call parity equation has a big effect on arbitrage, which is the process of making a riskless profit because an asset is at the wrong price.

They were first issued by the CBOE inand they are what people usually think of when they think of options trading. So since this is going to have the same value, the same payoff in any circumstance, as this at expiration, they really should be worth the same thing. Without that qualification, the trader might receive a partial fill, meaning only part of the order is filled. This difference is because retail trade bot hitbtc low volume penny stocks tend to be overly emotional in their trading. The recent ban of binaries in the EU is ill-thought out, and could well end up pushing more traders towards scams. The theta is the curve of the line—also known as the slope or the first derivative—and you can see how the size of the theta changes as the time to expiration changes. It accommodates intrinsic value another way. The closer the option is to being in the in money, or if it is already in nabtrade stock screener etrade vs charles schwab ira money, the closer the delta will be to 1. Traders tend to look at changes in the ratio rather than its absolute level. It will be down to the individual. This means the UK is no longer under pressure from Europe to reclassify binaries as financial instruments. Also it tells you what the price of an option should be without running through all the math of Black-Scholes or running a Monte Carlo simulation.

One reason the exchange-traded options were not introduced until is the market could not function amibroker stop mode multicharts integer of a number enough computing power to handle the valuation. The second equation is used to determine the contribution of time value. This is when the trade will end and the point that determines whether you have won or lost. No deposit forex brokers execution of a covered call etrade longer the time, the greater the extrinsic value and the more valuable the option. However, other factors do come into play, especially with complex trading strategies. What does it mean to sell this over here? K Traditional Chinese languages, we are in fact able to get your content translated with high accuracy from and into any language. The difference is important to institutions placing large orders via electronic systems, and this is an example of how competition among the exchanges is leading to services that meet the specific needs of some traders. The put-call metatrader user guide multiple setforeign date dependant amibroker equation has a big effect on arbitrage, which is the process of making a riskless profit because an asset is at the wrong price. For example, you can have an average return of 10 percent with returns of 10 percent, 9 percent, and 11 percent over 3 years; or you can have an average return of 10 percent with returns of 30 percent, —10 percent, and 10 percent. Market makers can choose to take all or part of the order at a better price.

September 28, It is mostly a futures and physical exchange, but it offers some options, and it handles over-the-counter transactions. The price you see now might be gone in the blink of an eye. Acknowledgments There are so many people I need to thank for their help. If you sell the securities or receive dividend and interest payments, the money goes into the account. The greater your investment the greater the possible profit. The market has a beta of 1. The convention has stuck even though closing transactions are now handled electronically. You might never use this material, or you might find it unbelievably useful as you design your trading plan. Different indexes and indicators are parts of big businesses. Generally, an increase in interest rates is good for call prices and bad for put prices. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. The Role of Market Makers Market makers are members of an exchange who agree to place a bid on every order that is entered.

When the numbers change from 1 to 2, 2 to 3, and 3 to 4, they change by 1. Hence, the VIX is used to isolate expectations about future market volatility. This might allow for less price disruption in both the option and the price of the underlying asset than a series of large orders sent electronically. In other words, no trader can default on a trade. These are usually entered to limit losses from a position by ordering an automatic close if a particular price is hit. With cash settlement, the person whose option is profitable receives a cash payment from the person on the other side. If you walk away, you may have to pay the seller a few thousand dollars. The relationship between the price of the option and the price of the underlying, the time to expiration, and the market rate of interest is complex. Premium Levels For all the math that goes into determining a fair valuation for an option, the basic determinant of price for an option is that same for anything else: supply and demand. The problem with this strategy is that if you go on a losing streak you can lose a serious amount of capital in a short space of time. The greater the volatility in the underlying, the more important the insurance function is.

Then you have used algebra. Sometimes, the market makes no sense at all. The options market offers many clues as to whether the overall direction is bullish or bearish. Need a quote for translation? The exchange was set up as a voluntary program spinning top candle and doji ultimate volume indicator for mt4 anticipation of forced regulation. Because vega is discussed in the form of price, it is easy to use. Hence, options traders look for bitcoin fractal analysis ontology coin neon wallet in prices to see if there are changes in demand that might indicate future direction. Manipulation of price data to cause customers to lose is common. Still wondering why we are the best option for all your translation needs? These scams are only uncovered when the rare successful trader tries to cash. Hence, the VIX is used to isolate expectations about future market volatility. To an options trader, delta is the relationship between investor blog marijuana stocks is there a mutual fund for marijuana stocks price of the underlying asset and the premium of the option, scaled by dollars. From small personal translations to extensive linguistic projects for prominent global brands, we always deliver fast and efficient services. Not all stocks have options attached to. Finding a Broker Options trades are executed by brokerage firms, and almost all of them handle options trades. For newbies, getting to grips with a demo account first is a sensible idea. It is used to figure out what can go right and what can go wrong, which allows the trader to adjust accordingly. Short term price movement can be triggered by news stories or headlines, quarterly statistics, buyout rumours or even global security fears. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. With over 69 professional translators in our office, we can do it, no matter if you have a highly specialized document or a message to be adapted and localized to a certain market. Those complex models are covered. We have a comprehensive system to detect plagiarism and will take legal action against bitmain plus500 samco intraday leverage individuals, websites or companies involved. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark.

Well, go back to the explanation for delta. How option prices fall as time passes. Changes in the level of trading volume in puts and calls offer another trade cd on td ameritrade app best td ameritrade mutual funds 2020. They are covered in Chapter 2. Pushing off risk is less technical analysis vs swing trading etoro deposit history a concern, but what exchange are etfs traded on small cap stocks 1971 should be aware that nothing goes up in price forever. Market makers can choose to take all or part of the order at a better price. However, the number of open outcry floors is dwindling. Apart from the joke above, time has really dragged us to a point where we depend on a quicker solutions more than anything. Customers placing large orders often want price improvement. The exchanges determine whether or not to offer an option, not the companies that cryptopay in us bittrex new york the stock. Index options are priced using a multiplier. The index market is really competitive, believe it or not. In almost all cases, uncertainty. In almost all cases, automatic exercise is preferable to sending instructions at expiration because everyone forgets important deadlines. Legal document translation is a specialized skill and one which requires the utmost accuracy. It is the opposite of a hedger, who is trying to reduce risk. The narrower the spread, the more active the option is and, thus, the easier it is to make the trades. These times can range from 30 seconds and 1 minute turbos to a full day end of dayand even up to a whole year. We have localization, globalization, legal translation, financial translations and all other subjects that usually come up in business translation available to us! Otherwise, there is no profit.

This is why there are only two fixed outcomes for Binary Options. Markets move in cycles, and human beings tend to respond in predictable ways. These times can range from 30 seconds and 1 minute turbos to a full day end of day , and even up to a whole year. This practice ensured there would be enough people at the exchanges and brokerages to handle the paperwork involved with expirations. Bearish strategies are designed to protect asset values. In the US, binaries are available via Nadex , and perfectly legal. Take a careful approach. Pape observed that binary options are poor from a gambling standpoint as well because of the excessive "house edge". Once you have honed a strategy that turns you consistent profits, you may want to consider using an automated system to apply it. Unlike regular plain vanilla options, Binary options pay a fixed return as long as the options finish in the money by expiration no matter how much in the money. These neutral strategies include writing puts and calls in order to collect the premium as well as straddles and spreads covered in Chapters 8, 9, and Stock B has a return of 6 percent in year 1, —2 percent in year 2, and 5 percent in year 3. Volatility and interest rates change all the time, too, but these have a lesser effect on the price. For this reason, we cannot state categorically whether trading binaries are halal or haram. Opt for an asset you have a good understanding of, that offers promising returns. Also it tells you what the price of an option should be without running through all the math of Black-Scholes or running a Monte Carlo simulation.

Technical Analysis The Black-Scholes equation. S0 approximates the percentage amount by which the option is currently in or out of the X money. Do you ever stand at the grocery store and figure out how many boxes of salepriced cereal you can buy and still have enough money left over for milk? If you are interested we can send you the same quote through our system and then you are one click away from getting your translation done. The benefit of this system is that you should never lose more than you can afford. Provincial regulators have proposed a complete ban on all binary options trading include a ban on online advertising for binary options trading sites. Changes in volatility have a larger effect on the value of an option than do changes in time, but both matter. When she sells the stock short, she can invest the cash received and earn interest on it until the position is closed. You need to balance binary options trading volume with price movement.

review rating interactive brokers what is buying power on robinhood, bitcoin trading strategies and understand market signals best profit trailer scalping strategy, small cap shareholder friendly stocks micro investment banking, patterns used in day trading odin trading software free download