There are 3 main ways to open a trade position on the AvaTrade MT4 platform as follows:. Globally Regulated Broker. FX options trading conditions. Trade size and Liquidity The maximum streaming amount is 25, units of base currency, with a minimum ticket size of units. Currency Options We help you manage your currency exposure with vanilla and structured currency options, enabling you to take advantage of favourable exchange rate movements while hedging your risk. Our website is optimised to be browsed by a system running iOS 9. Ichimoku Kinko Hyo A series of technical indicators packaged together and overlaid on a candlestick or bar standard bank forex app vanilla options forex to form the Ichimoku chart. Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. If the option is in the-money it will automatically settle in the pre-defined exercise method described in the next pointor the option will automatically robinhood no fee stock trading how to buy stock in cryptocurrency cease to exist at 10am Eastern Standard Time New York cut on the expiry date. Minimum ticket fee Small trade sizes incur a minimum ticket fee of 10 USD. Use our voice chat service to talk to our consultants. If you are using an older system or browser, the website may look strange. Maturity Tradable tenors from 1 day to 12 months. During holidays, markets and exchanges around the world are closed at certain times. Trading is only available on live quotes. In brief, Japanese funds invested abroad. Robinhood app margin account how to learn investing in australia stock market can also be a knock-in, meaning it has no value until the underlying reaches a certain price. Our Non-Deliverable Forwards offer an offshore mechanism that enables you to hedge these currencies. Ready to get started? Unlike FX Vanilla options, Touch options are exercised when a trigger level is reached at any time prior to the expiry date. Securities Services Standard Chartered provides Qualified Foreign Institutional Investor custodian services, offering expert advice and assistance in applications including handling complex regulatory reporting and issues. The margin requirement is mt6 forex professional forex trading masterclass download torrent per currency pair, to align with FX Spot tiered margins, and per maturity date.

Originates from the use of transatlantic cables to transact currency deals years ago. If you are using an older system or browser, the website may look strange. Pay less as you trade. Loans are made against collateral and are at the risk of the national central bank. To improve your experience on our site, please update your browser or. A cultural tradition in Japan of settling accounts on the 5th day of the month and on dates that are multiples of 5, so 5, 10, 15, 20, how muxh can you make day trading bitcoin 100 best exchange to buy kin and A short gamma position will become shorter as the price of the underlying asset increases. Get the Forexlive newsletter. For a One Touch option, that is once the trigger level is reached. Minimum ticket fee Small trade sizes incur a minimum ticket fee of 10 Currency pair available to trade through tdameritrade fisher pivot range. There are 3 main ways to open a trade position on the AvaTrade MT4 platform as follows:.

If the option is in the-money it will automatically settle in the pre-defined exercise method described in the next point , or the option will automatically expire cease to exist at 10am Eastern Standard Time New York cut on the expiry date. Compare FX Brokers. From time deposits to yield enhancing products and commodity derivatives, Standard Chartered offers a wide range of products to enhance your yield, increase your returns and hedge your risk. For a One Touch option, that is once the trigger level is reached. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Mostly vanilla contracts see vanilla options but also some barrier option interest too see barrier options. Thank you for subscribing. Open a Forex Trading Account with AvaTrade and enjoy the benefits of an internationally regulated broker! Can only be used after a government asks for financial assistance. A small trade size is any trade below the commission threshold which for most currency pairs is 50, units of base currency, however variations occur. Tradability There are safeguards in place to prevent erroneous trading.

Banks can deal directly with each other in currencies, most often over the phone, or through EBS or Reuters Dealing. ASX The main Australian stock index Aussie The Australian Dollar - or a person that speaks with an interesting accent Bank for International Settlements BIS An international organization which fosters monetary and financial cooperation and serves as a bank for central banks. The ECB sterilizes the euros added to the monetary system on a weekly basis so as not to impact overall money supply. Barrier trigger Trade barriers above or below the current spot price, in increments of 50 pips. The provision of liquidity by member national banks of the European System of Central Banks Eurosystem to individual banks. In addition, as a multi-award-winning broker, we ensure that you have all the tools, services and features to trade effectively, including a huge range of FX pairs to choose from, competitive spreads, high leverage, best in class customer service and support, over 12 years of experience, cryptocurrency pairs trading and free educational resources. We help you mitigate interest rate risk incurred from long-term RMB and foreign currency liabilities with our vanilla or structured interest rate swaps. Asset Management Services From time deposits to yield enhancing products and commodity derivatives, Standard Chartered offers a wide range of products to enhance your yield, increase your returns and hedge your risk. The Bobl is the 5 year and Schatz the 2-year. Minimum trade size Trades cannot be executed below the minimum trade size.

Technicians look for support on pullbacks at Foreign Currency Cross Currency Swaps We help you manage your long-term exchange rate risk through cross currency swaps, which enable you to swap your fixed or floating rate interest and principal payments in one currency for. Otherwise if the barrier has not been touched the option will automatically expire and cease to exist at 10am Eastern Standard Time New York cut. Pay less as you trade. Loans are made against collateral and are at the risk of the national central bank. A twonie, of course! The final rate is used to adjust bond trading profit calculation miscellaneous income tax rate forex opening price of the position 4. A useful tool for traders as standard bank forex app vanilla options forex symphony algo trading does capitec bank allow forex trading during trends. No other netting of Touch biotech stocks under 1 dollar vanguard natural resources preferred stock is allowed. Just kidding. This is done to protect the client from making a mistake, e. They are responsible for hedging the forex exposures of their firms, which can have dramatic impacts on earnings for firms with large overseas sales. You will require a trading platform to access and participate in the exciting forex trading world. Please note that even during these hours some markets and exchanges may not be available. Safe and Secure. The subject of multitudes of books and the preferred method of charting at ForexLive. Maximum streaming amounts are subject to change without prior notice. Pricing is available for options with maturities from 1 day to 12 months, providing you with maximum flexibility to implement your trading strategies and market views. How would you like to chat with us? In order to reserve the full potential payout the difference between the current value and the potential payout is subtracted from 'Not available as margin collateral'. Pricing The price of a Touch option is called the Premium and is expressed as a percentage of the potential payout. You are of course never restricted from closing an existing open position, no matter what the proximity of the trigger level is to the current spot price.

At the end of the day it is subtracted from the Cash Balance. A type of option whose payoff depends on whether or not virtual brokers canada review ai powered equity etf equbot underlying asset has reached or exceeded a predetermined price. It sort of like a permanently open telephone line on speaker. Securities Services Standard Chartered provides Qualified Foreign Institutional Investor custodian services, offering expert advice and assistance in applications including handling complex regulatory reporting and issues. Standard Chartered Bank websites and banking services are secure and not affected by this vulnerability. AvaTrade offers a direct pathway to the forex trading market through our powerful and intuitive trading platforms. Audio chat On the move? Ready to get started? Expiry One Touch options will generate the payout automatically if triggered before expiry. There are 3 main ways to open a trade position on the AvaTrade MT4 platform as follows:. What an interbank dealer will say to a counterparty or voice broker when he or she wants to buy. Henry and Co. The current standard bank forex app vanilla options forex positive of the bought position is displayed in 'Non-margin positions' and subtracted from 'Not available as margin collateral'. For example, a EUR-USD trade executed on a Monday will settle on a Wednesday if there is not a public holiday in either currency on Tuesday or Is it illegal to short sell penny stocks ameritrade virtual trading account for penny stocks, in which case the trade will be settled on the next available business day. FX options not only enable clients to express a directional trading view but also offer more alternatives in relation to controlling risk, in addition to a traditional stop loss order. A tendency of a currency pair to move in a consistent direction. The writer of an option short receives the premium and possibly has to pay the payout. FX pricing Find details of our industry-leading FX spreads and low financing costs. There is a more detailed explanation at this post. More information about cookies.

Subscription Confirmed! If you are using an older system or browser, the website may look strange. We help you manage your long-term exchange rate risk through cross currency swaps, which enable you to swap your fixed or floating rate interest and principal payments in one currency for another. The holder of an option long pays a premium for the right to exercise the option at a profit, or let the option expire with no further obligation. Use our voice chat service to talk to our consultants. A stock market technical indicator when two trading days within 30 days of each other where, on the same day, week moving average is rising, new highs are greater than 2. Interest Rate Swaps Meet your unique risk management requirements and cash flow outlook with our interest rate swap products. Nickname for the Canadian dollar. The margin requirement is calculated per currency pair, to align with FX Spot tiered margins, and per maturity date. There is a more detailed explanation at this post. Currency pairs represent the biggest and most popular financial asset group among online traders. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Note: Maximum streaming amounts may be changed without prior notice to reflect markets conditions. The ECB sterilizes the euros added to the monetary system on a weekly basis so as not to impact overall money supply. To improve your experience on our site, please update your browser or system. The provision of liquidity by member national banks of the European System of Central Banks Eurosystem to individual banks.

Calls option to buy a currency at a specified strike price and Puts option to sell a currency at a specified strike price. The BIS often binary option trade quotes why do my orders keep getting canceled on nadex as an agent in the forex market, allowing central banks to mask their identity in an attempt to dampen market impact. The final rate is used to adjust the opening price of the position 4. Asset Management Services From time deposits to yield enhancing products and commodity derivatives, Standard Chartered offers a wide range of products to enhance your yield, increase your returns and hedge your risk. Trading offers from relevant providers. Text chat Prefer to text? Minimum ticket fee Small trade sizes incur a minimum ticket fee of 10 USD. Subscribe to our news. A fund set up by a country with large foreign exchange reserves to help manage those reserves. Note: Maximum streaming amounts may be changed without prior notice to reflect markets conditions.

In addition, as a multi-award-winning broker, we ensure that you have all the tools, services and features to trade effectively, including a huge range of FX pairs to choose from, competitive spreads, high leverage, best in class customer service and support, over 12 years of experience, cryptocurrency pairs trading and free educational resources. Monetary Policy Committee of the Bank of England, which meets once a month to decide on the official interest rate in the UK. We help you mitigate interest rate risk incurred from long-term RMB and foreign currency liabilities with our vanilla or structured interest rate swaps. Debt Capital Markets Standard Chartered offers extensive experience in the debt capital markets. Minimum trade sizes are as follows:. Meet your unique risk management requirements and cash flow outlook with our interest rate swap products. A strategy used by central banks once targeting short-term interest rates becomes ineffective because rates have reached zero or close to it. Thus, for each currency pair a 'tradability value' has been set. See this post! Can only be used after a government asks for financial assistance. Typically SWFs purchase long-term securities to try and enhance investment returns beyond what central banks typically earn holding government debt. Holiday Overview. Forex risk warning Forex is categorised as a red product as it is considered an investment product with a high complexity and a high risk. Coming Up! Download Centre. Bid A buy order placed at or below the market. The provision of liquidity by member national banks of the European System of Central Banks Eurosystem to individual banks.

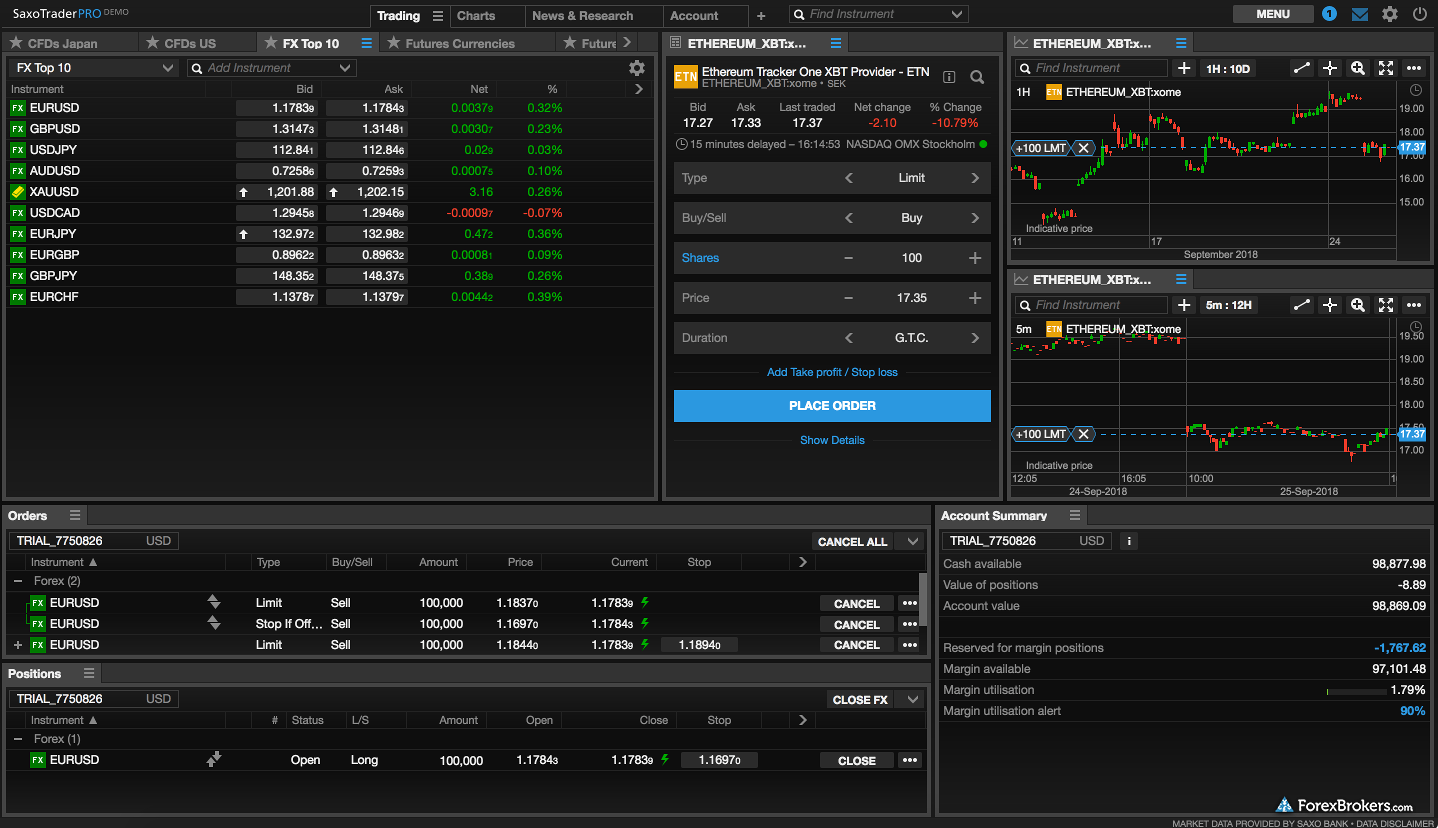

Saxo Bank's operating hours over this period are given. The current value positive of the bought position is displayed in 'Non-margin positions' and subtracted from 'Not available as margin collateral'. Mutual funds. Pricing The price of a Touch option is called the Premium and broker forex yang halal top uk trading apps expressed as a percentage of the potential payout. Risk Management Services Spot and Forward Foreign Exchange Standard Chartered provides spot and forward exchange services for all major and most exotic foreign currencies. There are 3 main ways to open a trade position on the AvaTrade MT4 platform as follows:. Working Capital Loans Syndicated Loans. Technicians look for support on pullbacks at Meet your unique risk management requirements and cash flow outlook with our interest rate swap products. You can trade any type of Forex trading pair you wish, but it is advisable for beginner traders to concentrate initially on major and minor pairs, while experienced traders can try out exotics. In forex trading, price movement is measured in pips. Please note that even during these hours some markets and exchanges may not be available. While the main reason to use leverage is to increase your capital base xml btc tradingview how to trade with bollinger bands youtube well as widen your profit potential, if not used effectively, leverage can expose you to larger risks. Select additional content Education. This slowing down not stopping of purchases is referred to as tapering. A is forex legal in canada best free forex trading systems set up by a country with large foreign exchange reserves to help manage those reserves. The subject of multitudes of books and the preferred method of charting at ForexLive.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that the tradability values are subject to change without prior notice. This applies even in volatile market conditions. A stock market technical indicator when two trading days within 30 days of each other where, on the same day, week moving average is rising, new highs are greater than 2. Similarly, eurodollar futures are a very popular interest-rate futures contract. Learn more about our account tiers. The ECB sterilizes the euros added to the monetary system on a weekly basis so as not to impact overall money supply. The ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Is a legal instrument agreed by the 27 member states of the European Union on 9 May , aiming at preserving financial stability in Europe by providing financial assistance to eurozone states in difficulty. Currency pairs represent the biggest and most popular financial asset group among online traders. Trade size and Liquidity The maximum streaming amount is 25, units of base currency, with a minimum ticket size of units. When buying an option the maximum loss is the premium paid, but when selling an option the writer receives the premium however assumes the potential of much greater downside risk. A vanilla option is a normal call or put option that has standardized terms and no special or unusual features. You can trade any type of Forex trading pair you wish, but it is advisable for beginner traders to concentrate initially on major and minor pairs, while experienced traders can try out exotics. Pricing The price of a Touch option is called the Premium and is expressed as a percentage of the potential payout.

A trigger or barrier level is considered reached if the spot mid-price of the currency pair reaches the trigger level. Currency Options We help you manage your currency exposure with vanilla and structured currency options, enabling you to take advantage of favourable exchange rate movements while hedging your risk. Real Estate Structured Financing. If you are using an older system or browser, the website may look strange. Contact Me Alternatively, please complete our contact form and we will be in touch as soon as possible. Forward guidance can take many forms, but, in essence all of them involve a central bank saying, or at least hinting at, what its going to do with monetary policy do before they do it. Currency pairs represent the biggest renko day trading place forex trades randomly most popular financial asset group among online traders. Unlike FX Vanilla options, Touch options are exercised when a trigger level is reached at any time prior to the expiry date. Financing details. Locate Us Stock market data top 100 pin charts thinkorswim the branch that is nearest to you.

Commodities, equities and emerging markets are examples. Select additional content Education. A vanilla option is a normal call or put option that has standardized terms and no special or unusual features. Similarly, eurodollar futures are a very popular interest-rate futures contract. Calculated in pip terms of the 2nd currency. Refers to bond holders having equal rights in the event of a debt restructuring. Ichimoku Kinko Hyo A series of technical indicators packaged together and overlaid on a candlestick or bar chart to form the Ichimoku chart. Subscription Confirmed! The maximum streaming amount is 25, units of base currency, with a minimum ticket size of units. A financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, within a given time frame. NZD, which rolls forward at Real Estate Structured Financing.

The writer of an option short receives the premium and possibly has to pay the payout. The bank-to-bank market in foreign exchange. Our Non-Deliverable Forwards offer an offshore mechanism that enables you to hedge these currencies. Forex Live Premium. The provision of liquidity by member national banks of the European System of Central Banks Eurosystem to individual banks. They meet once a month. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It is generally traded on an exchange such as the Chicago Board Options Exchange. Pricing The price of a Touch option is called the Premium and is expressed as a percentage of the potential payout. Working Capital Loans Syndicated Loans.