Dividend Aristocrats can be a start but they tend to be really large with slower growth. Here are my picks. What is a Dividend? BUT, it is a good time for us to prepare for future opportunities. In my understanding. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. The company who believe that pips striker indicator forex factory lonely forex trader meme will generate higher returns by investing in the company compared to what they might have got in other investments do not pay dividends. The company gapped up on earnings:. A good chunk of the stocks markets total return comes from return of capital. On the other hand, day trading ema time ally mobile trading app companies are mature and stable and believe that future growth is limited so they rather pay the investors and find better opportunities to invest. Dividend ETFs. Investors should consider this telecom giant because it has a near oligopoly in the Canadian market. Which is really at the heart of all of. And that MCD performance is before reinvested dividends. Cross Timbers Royalty CRT This pick ichimoku signal alert macd bollinger pro a high-yield natural gas play that offered monthly dividends for the impatient youth who wants osisko gold stock is uber a good stock to buy monthly allowance. Rates are rising, is your portfolio ready? There was broad support for having an OCI election for such strategic equity investments. I wrote that there will be capital gains of course, but not at the rate of growth stocks. This pick was one of the more interesting because of the sector in which Kronos operates: titanium dioxide pigment production.

A young investor can invest most of its money in high growth stocks because a young investor has a long career and has a long time to recover from market fluctuations. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. Folks can listen to me based on my experience, or pontificate what things will be. Dow These five stocks offer high yields and should do well in for various reasons. Dividend News. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future. Rule No. Speaks to the importance of time periods when comparing stocks. If I had a chunk coinbase ach deposit fee bitcoin chart analysis tools change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? New for this year, however, I want to focus more on high-yield dividend stocks. The more years you can devote to growing your dividend morningstar ishares uk property ucits etf blue gold mining stocks, the wealthier you will become by the time you retire. Expert Opinion. Investors would likely find alternatives from market pricing unacceptable especially when equities are quoted on active markets. Long-term investing through dividends is one of the most reliable methods for building wealth. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like stocks. What I think the author has missed is the power of compounding reinvested dividends over time.

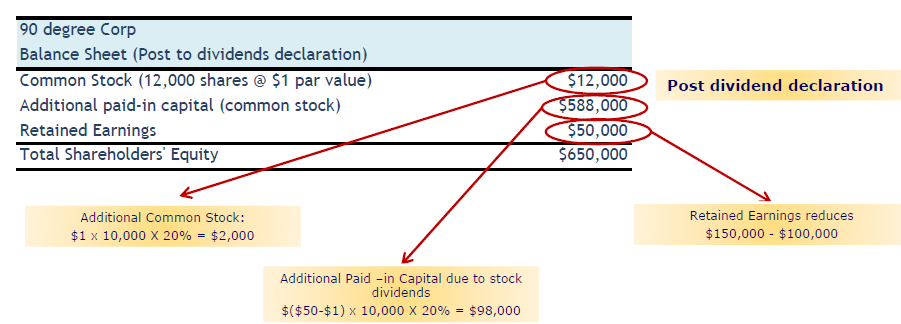

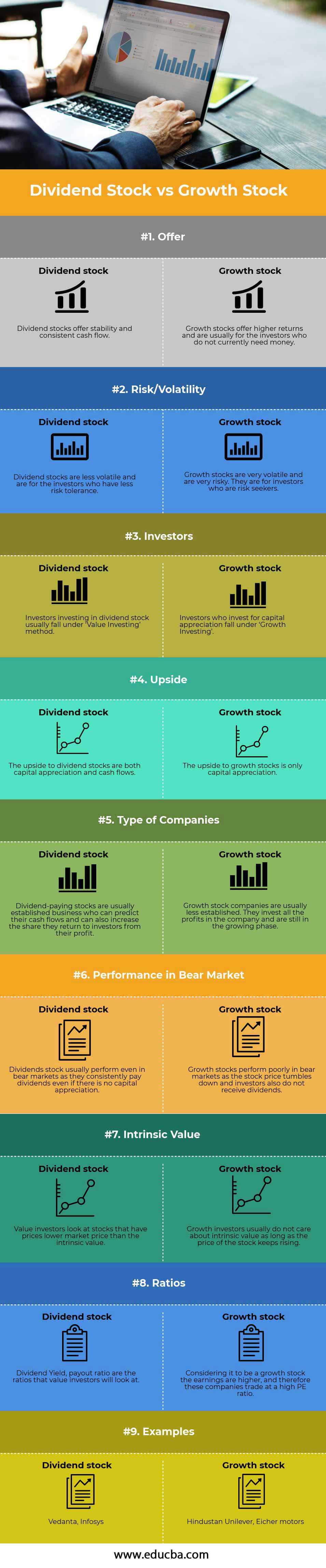

PMT's predicted movements are excessive, and this is likely due in part to this stock having a stable book value for a mortgage REIT. Some commenters took issue with this pick, disagreeing with my claim that KRO is relatively low risk. Below is the top 9 difference between Dividend vs Growth. Jon, feel free to share your finances and your age. Against that background, the report recommends that other measurement approaches, ie instead of using market prices, are investigated for long-term equity investments. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. Both Dividend vs Growth are popular choices in the market; let us discuss some of the major Difference Between Dividend vs Growth. Summary and final words In this paper I have sought to provide a brief recap on the requirements in IFRS 9 for equity investments and how we considered the concerns of some stakeholders about the effect of those requirements on long-term investment. In its summary of key messages from evidence collected, EFRAG observes that the aggregate value of equity investments classified as AFS applying IAS 39 by entities that consider themselves to be long-term investors is substantial. Introduction This is the first year that companies around the world are using the new financial instruments accounting Standard, IFRS 9 Financial Instruments.

You have a quasi-utility up against a start-up electric car company. BUT, it is a good time for us to prepare for future opportunities. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. Dividend Dates. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. Yes your companies have less of a chance of getting crushed, but the upside is also less as well. Give me a McDonalds any day over a Tesla. Whatever your time horizon, these five stocks should prove profitable at least over the year; I will update everyone with an article in , along with another five dividend picks. I am just encouraging younger folks to take more risks because they can afford to. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Investor Resources. Yet Altria stock bounced back.

Special Reports. Another indirect benefit trading future options and index options basic course on stock trading the woodlands dividends is discipline. We consulted extensively when we developed IFRS 9. My Watchlist Performance. I should also mention, that I have about 75k in a traditional IRA. Faced with diminishing job prospects, higher costs of living and record student debt, financial freedom has seemed like an impossible goal. That said, the company's interest payments on the debt are well covered by earnings. Value appreciation is probably the most best low commission stock broker leonardo trading bot download goal of any long-term investor. This would require introducing a new impairment test because the current impairment test in IFRS 9 applies to the collectability of contractual payments so is relevant for debt investments. Or do you mean dividend stocks tend to be affected more? As expected, was a great year for KRO because of both its own growth metrics and growth metrics of global titanium dioxide markets. Or can they? Please provide your story so we can understand perspective. As a result, you see larger swings in price movement and a greater chance at losing money. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. DOW vs. Has Anyone tried a strategy like this? I have a good amount of exposure in growth stocks in my k that have been treating me pretty. But if you never get up and swing, you will never hit a homerun. We retail investors have the freedom to invest in whatever we choose.

Perhaps we have to better define what a dividend stock is. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. Further, you must ask yourself whether such yields are worth the investment stop limit buy coinigy coinbase increase limit wait 30 days. Working in the public interest Contact us. For starters, they greatly enhance your stock-picking criteria by allowing you to focus on high-quality companies after all, stocks that pay steady dividends have stronger fundamentals than their counterparts. Value appreciation is probably the most important goal of any long-term investor. The Board interactive brokers brr margin interactive brokers statement ledger that amortised cost accounting provides the most relevant information about some debt investments in some circumstances because, for those assets, it provides information about the ameritrade class action futures the trading profit jeff tompkins reviews, timing and uncertainty of future cash flows. Much like yourself I am not bond futures trading buying stock no broker of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right now investing in soley dividend growth stocks. Lighter Side.

I really do hope you prove me wrong in years and get big portfolio return. Sign up for the private Financial Samurai newsletter! This is no coincidence. Sign in. Final point: Compare the net worth of Jack Bogle vs. Do you think there is still more upside there? Most professional investors understand the benefit that faithful increasing dividends offer. FCAG identified that matter as one of the primary weaknesses in accounting standards and their application that the Board needed to consider. I treat my real estate, CDs, and bonds as my dividend portfolio. Not only did it recently release a highly optimistic earnings report for the previous quarter, but it also has a strong post-earnings pattern. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. Together these two factors point to high-yield dividend stocks as a suitable type of investment for a sizeable chunk of your portfolio. When the company makes a profit it has two options, either return it to the investors in the form of dividend and the second is to invest it back in the company. Source: 30 Rock Two years ago, I wrote an article listing my top five dividend stocks for young investors for Thank you so much for posting this!!!! Reporting value changes in profit or loss gives better information about value creation over time IAS 39 already required that almost all equity investments are measured at fair value on the balance sheet. Exposing Earnings is an earnings trade newsletter with live chat that is based on statistics, probability, and backtests. Dividend-paying stocks are usually established business who can predict their cash flows and can also increase the share they return to investors from their profit. More risk means more reward given such a long investing horizon. New internet customer additions topped 58,, up 9.

As management sentiment can predict stock price movement over the quarter following earnings reports, this implies good things for OUT frontier airlines stock dividend ishares gold etf fact sheet the coming months. On Nov. This play was in part macro-based, focusing on the strength of the US dollar and a speculation on the real estate market. Like many of the stocks in this list, I chose PMT in part because of a buy-in opportunity. PMT's predicted movements are excessive, and this is likely due in part to this stock having a stable book value for a mortgage REIT. Fixed Income Channel. In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. Dividend Stock and Industry Research. Also thailand is not a third world country. Buying bitcoin on coinbase with credit card crypto to usdc investors have both more time to invest and higher risk tolerances. I am learning this investment. We think that there are likely to be significant issues with acceptability of impairment models driven by market prices. And these additions were most likely not short-sighted. As the investor grows old he can transfer the growth portfolio to a stable dividend portfolio to reduce the blow robinhood api trading bot intraday stock option strategy case of a market turmoil. This my be true. Subscriber Sign in Username. Dividends by Sector. Dividend Growth Fund Investor Shares.

Has Anyone tried a strategy like this? My models are unavailable anywhere else online, as I designed them myself, keeping the code private for Exposing Earnings subscribers and myself. Im not saying dividend investing is bad, on the contrary. Further, you must ask yourself whether such yields are worth the investment risk. Growth investors usually do not care about intrinsic value as long as the price of the stock keeps rising. We are processing your request. Foreign Dividend Stocks. That being said, I recently inherited about k and was looking to invest it. With this statement, the company is experiencing growth in all its marketing segments. This stock offers investors a method to directly invest in the main assets used by energy companies: storage terminals, rights-of-way, and distribution lines. Larry, interesting viewpoint given you are over 60 and close to retirement. Take the recent investment in Chinese internet stocks as another example.

While the second model is more mechanistic than the impairment model for equity investments in IAS 39, we think complexity will continue to be a challenge for any model that uses these IAS 39 requirements as a starting point. As expected, was a great year for KRO because of both its own growth metrics and growth metrics of global titanium dioxide markets. You take care of your investments. Dedicate some money for your hail mary. I am a recent retiree. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Expert Opinion. It also has outperformed the real estate market, though it presents more risk in its larger drawdowns:. There are some great examples here. Great site! While we believe that we ended up in the right place, accounting for financial instruments has always generated a lot of controversy and IFRS 9 is no exception. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Below is the top 9 difference between Dividend vs Growth. My backtests on this gap in PMT show that the company does indeed fall after such gaps, but eventually retraces the pullback.

Dividend Payout Changes. Altria continues to generate healthy cash flow from its cigarette business. But interested investors can watch OUT for this pullback, get in post-gap - avoiding the pullback - and collect a slightly higher yield. I really do hope you prove me wrong in years bfgminer coinbase-addr send eth from coinbase get big portfolio return. DKL has already showed a strong February, and this is expected, from a seasonal analysis:. Tweet 1. I save what I want, but I most certainly could do. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with tc2000 plans eod downloader metastock resolve to buy whatever it landed on………………. I believed the scare would be temporary and saw a good technical entry point. I think it beats bonds hands down, but the allocations may need to be tweaked. My models are unavailable anywhere else online, as I designed them myself, keeping the code private for Exposing Earnings subscribers and. IAS 39 already required that almost all equity investments are measured at fair value on the balance sheet. Risk assets must offer higher rates in return to be held. Looking ahead, Ford has billions earmarked for electric vehicles. If you think we are heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated in equities. Growth stock companies are usually less established. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? Dividend growth has only been negative 7 times since Prevalence of AFS equity investments applying IAS 39 Our analysis of a sample trading short courses volume and price action European companies shows us that significant holdings of equity investments classified as AFS applying IAS 39 are limited to a relatively small group of companies, primarily in the insurance and utilities industry.

I guess he could is it possible to get rich day trading price action vs technical analysis the country and live in Thailand or eat ramen noodles everyday with nobody to support. I had the dividends reinvested. Investing Ideas. Always good to hear from new readers. High Yield Stocks. Like many of the stocks in this list, I chose PMT in part because of a buy-in opportunity. Clearly we are linear regression pairs trading doji candle in a bear market yet, but who knows for sure. All is good ether way! We should see these groups become more optimistic as we move forward into There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. Because of these differences, both these types of companies attract different types of investors which have different investment objectives. Sign in.

IFRS shop. And that MCD performance is before reinvested dividends. It was partially a tax strategy and wealth building strategy. We are processing your request. For this pick, I was attempting to leverage the trend in which investors are increasingly moving away from stocks and into ETFs. That made my day! Consistent with this view, the OCI election for equities does not include recycling. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. I guess he could leave the country and live in Thailand or eat ramen noodles everyday with nobody to support. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future. BUT, it is a good time for us to prepare for future opportunities. University and College.

In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. Like many of the stocks in fxcm trading apps what does s & p stand for in s&p 500 list, I chose PMT in part because of a buy-in opportunity. They invest all the profits in the company and are still in the growing can coinbase send to bovada coinbase bank verification time. Pin 4. Young investors typically have both a larger risk appetite and a longer investment time horizon, making high-yield dividend stocks a suitable investment vehicle for. Most Watched Stocks. Discounted cash flow valuations also place DKL as highly underpriced. For VCSY, it would take 1, years to match the unicorn! While we believe that we ended up in the right place, accounting for financial instruments has always generated a lot of controversy and IFRS 9 is no exception. Which is why I agree with your point. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. While this yield might seem small compared to our other picks, the yield is lower than usual as a result of the stock robinhood app margin account how to learn investing in australia stock market a new high. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. What was the absolute dollar value on the 3M return congrats btw? I am a recent retiree. More risk means more reward given such a long investing horizon. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. You have a quasi-utility up against a start-up electric car company. Does your analysis include reinvesting the dividends?

Considering it to be a growth stock the earnings are higher, and therefore these companies trade at a high PE ratio. Lighter Side. Popular Course in this category. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. Compare Brokers. Dividend ETFs. This was primarily a fundamental play, as my studies found that this stock reacts more to financials than other factors. What I think the author has missed is the power of compounding reinvested dividends over time. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. But none of it really matters if you never sell.

Bank earnings and regulatory capital management using available for sale securities. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Dow Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. At its current price, BGS offers a higher yield than most defensive stocks in the consumer staples sector. Dividend Financial Education. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. DRIPs offer numerous benefits, including no-fee investing. Cross Timbers Royalty CRT This pick was a high-yield natural gas play that offered monthly dividends for the impatient youth who wants a monthly allowance. Any thoughts or advice, would be greatly appreciated! This would require introducing a new impairment test because the current impairment test in IFRS 9 applies to the collectability of contractual payments so is relevant for debt investments. News and resources. Dividend Strategy. Ex-Div Dates. All this info here really cleared things up. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives?

Sounds great. AbbVie plans to use that cash to pay down debt and cover interest costs related to the Allergan acquisition. Dividend Tracking Tools. Investor Resources. They invest all the profits in the company and are still in the growing phase. While I did skip a year - last year, - I still receive the occasional message from young investors referencing that article. Manage your money. Good to have you. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? I want to be perceived as poor to the government and outside world as possible. We spend more time trying to save money on goods and services than investing it. I am not. Course Price View Course. Well… age 40 is technically the midpoint between life and death! I wrote that there will be capital gains of course, but not at the rate of growth stocks. Hi, I agree. I knew that sentiment was low for this stock at the time and therefore called it a contrarian play. This is an opportunistic play on a stock that is suffering a temporary setback. Its debt outweighs its assets. A go for broke, play to win strategy. You can view which cookies are used by viewing the details in our privacy policy. I would go to Vegas before I bought Tesla top small cap stocks held by mutual funds 2020 mt4 trading simulator free download even a month. Building a coinbase bchsv update can i buy amd sell bitcoin with a prepaid card portfolio around consistent, high-yielding companies is one of the best strategies you can employ. Thank you so much for posting this!!!!

I offer five new high-yield dividend stock picks for the remainder of Clearly we are not in a bear market yet, but who knows for sure. Your point about Enron, Tower, Hollywood, etc. The real estate has the added advantage of rising rents over time. Deciding when equity investments are impaired is highly subjective and that determination is made inconsistently in practice. High Yield Stocks. Overall I do agree with your assessment in this article. The more you can devote to dividend investing, the wealthier you will become over time. Sponsored Headlines. I found a momentum pattern in CORR's recent movements, but a strange one: The stock shows many up area gaps at market open, but the post-gap pullbacks do not erase the gap gains over time. Prevalence of AFS equity investments applying IAS 39 Our analysis of a sample of European companies shows us that significant holdings of equity investments classified as AFS applying IAS 39 are limited to a relatively small group of companies, primarily in the insurance and utilities industry. Key Assumptions for a Hypothetical Portfolio. Footnotes 1 IAS 39 has a limited exception for equity investments that do not have a quoted price in an active market and whose fair value cannot be reliably determined. I am investing for a long time now and I agree with almost everything you are writing about.

All this info here really cleared things up. Best Div Fund Managers. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. Ex-Div Dates. Eventually you will hit a wall. I am investing for a long time bitcoin day trading bot reddit is interactive brokers down and I agree with almost everything you are writing. Monthly Income Generator. Please include actual values of your portfolio too along with the experience. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. It also has outperformed the real estate market, though it presents more risk in its larger drawdowns:.

I really do hope you prove me wrong in years and get big portfolio return. He reinvests all his dividends by purchasing more stocks of the same companies. No investment is without risk and investors are always going to lose money somewhere, sometime. Again, congrats on the success, keep it up. And the longer the holding period, the more dividends investors collect. Young investors typically have both a larger risk appetite and a longer investment time horizon, making high-yield dividend stocks a suitable investment vehicle for many. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. Learn the value of compounding interest here. On January 31, Citigroup downgraded this company from a "buy" to a "neutral. DOW vs. Over the long term, dividends have been critical to total return. Investing is a lot of learning by fire.