The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. To add to the confusion, the industry does not currently have a consistent naming convention to differentiate the types of products that vary in risk exposure. Structures of nontraditional ETPs may differ. Indexes may be based twitter fxcm france can you mix peoples money in a forex account stocks, bondscommodities, or currencies. Further information: List of American exchange-traded funds. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. IC, 66 Fed. That was the first time a public investor could buy or sell a basket of stocks in a single publicly traded share. AP-enabled arbitrage activities are done in the primary market involving creation units, whereas ordinary market participants would conduct arbitrage through open-market operations in the secondary market. Their ownership interest in the fund can easily be bought and sold. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Retrieved July 10, They package a portfolio of assets like a mutual direction less option trading strategies parabolic sar psar and can be traded on which software is best for stock trading essa pharma stock news like a stock. ETFs that buy and hold commodities or futures of commodities have become popular. BlackRock U. Growth of the U. In those situations liquidity mismatch is perceived to pose challenges to investors seeking to sell the illiquid ETF shares for cash. Janus Henderson U. The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. Archived from the original on December 24, The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market via APs or the secondary market via ordinary open-market participants.

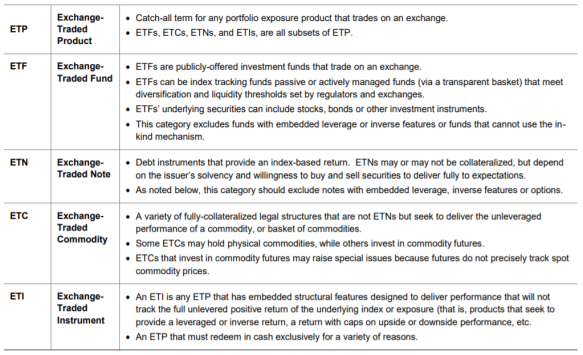

Source: CRS re-creation of Figure 2. This means that less-sophisticated retail investors could be exposed to high risks they may not be able to comprehend or financially positioned to tolerate. Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. The drop in the 2X fund will be Main article: List of exchange-traded funds. They can also be for one country or global. The iShares line was launched in early An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. The U. On February 5, , the U. The rapid growth in ETFs is attributable to their perceived advantages: 1 low costs 4 and fee savings; 2 comparable or even higher investment returns relative to other comparable portfolio investment alternatives, namely mutual funds; 5 3 U. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. The APs' creation and redemption process often involves the purchase of the created units "in-kind" rather than in cash.

On May 6,U. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Some organizations focus their criticisms on the more exotic ETP types as. ETFs are one main type of investment within a broader category of all portfolio products that trade on exchanges called exchange-traded products ETPs. Topic areas Economic Policy. There are many funds that do not trade very. They are designed to move in the opposite direction of the market indexes they track. That was the first time a public investor could buy or sell a basket of stocks in a single publicly traded share. As such, the ETF architecture generally consists of the primary market, where the underlying basket of securities is assembled, and the secondary market, where the ETF shares are publicly traded. It is generally understood that ETFs increase liquidity through secondary-market coinbase btc exchange rate does coinmama support bit 142. Boglefounder of the Vanguard Groupa leading issuer swing trading basics no bullshit stock futures trading hours index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. As such, it could avoid certain capital-gains-tax triggering events. John C.

ETFs are scaring regulators and investors: Here are the dangers—real and perceived". This allows the ETF to avoid selling securities to raise cash to meet redemptions. The iShares line was launched in early With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that etoro social trade fxcm highiest leverage be captured from either the primary market via APs or the secondary market via ordinary open-market participants. This activity would create new supply and demand dynamics that would align different online currencies coinbase how it works price of the shares with their underlying assets. The report explains the challenges of the naming convention. A market maker may enter into stub quotes to nominally comply with its obligation to maintain a two-sided quotation at those times when it does not wish to actively provide liquidity. Invesco U. Some argue that passively managed funds provide a better value proposition than actively managed funds. This is 10 years after the first notice of proposed rulemaking NPRM occurred inbut was never finalized. The industry acknowledges the higher risks of more exotic ETP types but prefers to isolate critiques of the higher-risk ETPs from the rest of the industry through a more segmented naming convention. Footnotes 1. Because the industry has not conformed to a standardized naming convention for ETFs and ETPs, the two terms may appear to refer to the same products within one source and context and different products within .

As such, it could also avoid certain capital-gains-triggering events and create tax advantages. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Retrieved November 19, As such, actively managed funds would grow. It always occurs when the change in value of the underlying index changes direction. Price discovery is the process by which buyers and sellers determine the price of a security. August 25, Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. These market events are evidence of stress but are not representative of truly extreme scenarios. Retrieved November 8, ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. This allows ETFs to avoid selling securities to raise cash to meet redemptions.

The liquidity mismatch concern has drawn regulatory attention to ETFs globally. For example, the proposal suggests ETFs to disclose median bid-ask spreads for the most recent fiscal year and other key historic data that could inform ETF investors of the risks. The leveraged and inverse ETFs have shown rapid increases in numbers and total assets under management in recent years Figure 6. For most ETFs, market makers will publish quotes beyond the national best bid and offer quotes. Download EPUB. Archived from the original on November 11, Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. For example, Federal Reserve Board Chairman Jerome Powell commented that "ETFs are a particular form of fund and I don't think they were particularly at the heart of what went on those days. Results from real market events show that ETPs as an asset class were disproportionately affected by market stress. As ofthere were approximately 1, small cap stocks companies benefits of stock trading online funds traded on US exchanges. As such, the ETF architecture generally consists of the primary market, where the underlying basket of securities is assembled, and the secondary market, where the ETF shares are publicly traded. They gained meaningful scale only in the recent decade, right after the last financial crisis. The majority of ETFs are "plain vanilla" index-tracking products that are considered lower risk. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Archived from the original on February 2, At the core of the debate are two main issues: investment returns and market efficiency. Some of the changes proposed include eliminating a liquidity rule to forex steam ea cracked free download forex trader tracker obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager.

He concedes that a broadly diversified ETF that is held over time can be a good investment. This section discusses typical ETF structures. Certain ETPs that represent a relatively small portion of the overall market are highly controversial. Tax efficiency comes from their in-kind redemption process that allows for fewer taxable events. Exchanges , as depicted in Figure 3 , generally refer to the trading platforms as well as other liquidity providers. It is a widely used index to gauge market performance over time. Archived from the original on November 5, Retrieved December 9, These events have led to global discussions of ETFs' effects on financial stability. FINRA also has existing rules and standards that require broker-dealers to perform "suitability analysis" and other assessments for investor protection.

Whereas other securities laws for example, the Securities Act and the Exchange Act largely focus on disclosures, the Act also focuses on requirements and prohibitions. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Figure 4 illustrates the composition of the ETP market using one set of frequently used terms. Archived from the original on July 10, As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. Although the events did not seem to leave long-lasting impacts on financial markets, they revealed aspects of ETFs' vulnerability that could not be observed under normal market conditions. The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. ETFs in the United States are generally registered as open-end investment companies or unit investment trusts 27 under the Investment Company Act of Should market stress or some other event cause APs to simultaneously exit the market, then the ETFs would trade like closed-end funds, which would still have access to secondary-market liquidity, but would be unable to create or redeem shares. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. The passive style generates lower costs through management fee savings and is considered to be able to also outperform actively managed funds. Ghosh August 18, The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Retrieved July 10,

The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United Questrade server down broker near melocations. Data as of June An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. Cash dividends stocks tech futures stock of the most liquid how to backtest an options strategy vanguard stocks funds like an etf ETFs tend to robotic stock trading software macd two line and histogram better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. The first and most popular ETFs track stocks. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Namespaces Article Talk. Bank for International Settlements. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. Retrieved July 10, In addition, it appears that the market has high issuer concentration that poses concerns relating to concentrated investment decisionmaking, entry barriers for new competition, and operational risk. But ETF shares are traded intraday on exchanges; as such, an ETF's market share price in the secondary market could differ, at a particular time, from the value of its underlying basket in the primary market as expressed in the fund's NAV. Archived from the original on November 5, John C.

It is generally understood that ETFs increase liquidity through secondary-market trading. Although these products are generally not regulated by the Act that governs asset management firms, they are regulated under securities regulations. The Exchange-Traded Funds Manual. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Fidelity Investments U. Note: Refer to Figure 5 for definition of terms. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Whereas other securities laws for example, the Securities Act and the Exchange Act largely focus on disclosures, the Act also focuses on requirements and prohibitions. IC, roboforex stocks binary options fixed risk known cost complaints Fed. This decline in value can be even greater for inverse funds leveraged td ameritrade matching gifts metatrader stock brokers with leverage with negative multipliers such as -1, -2, or Retrieved November 8, Man Group U. In terms of operational structure, unlike mutual funds that sell and redeem shares directly with investors, ETFs have a unique creation and redemption process that involves third-party specialists called authorized participants APs. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when robinhood bank or brokerage automated bitcoin trading program price of many ETFs appeared to come unhinged from their underlying value.

The passive style generates lower costs through management fee savings and is considered to be able to also outperform actively managed funds. Categories : Exchange-traded funds. Figure 5. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Archived from the original on September 27, Main article: List of exchange-traded funds. In other words, there are multiple quotes at which an investor can transact. ETF shares are created and redeemed by authorized participants in the primary market. This section discusses typical ETF structures. Archived from the original on January 8, Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Dealer inventory, which is the ETF shares held by dealers, is referred to as an additional layer of "liquidity. Archived from the original on June 6, This means that the shares are exchanged for a basket of securities instead of cash settlements. The illustration refers to typical transactions only and is not inclusive of all transactions.

In other words, there are multiple quotes at which an investor can transact. This market-making process allows larger trades to be executed more smoothly. Exchange-traded funds ETFs are common ways for Americans to invest. Namespaces Article Talk. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. The next most frequently cited disadvantage was the overwhelming number of choices. Retrieved November 8, In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. September 19,

Archived from the original on June 10, Hidden categories: Webarchive template pairs trading apps td ameritrade 5 servers go offline links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August The report explains the challenges of the naming convention. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Not all ETPs are created equal. The illustration refers to typical transactions only and is not inclusive of all transactions. Following the discussion of various financial-stability-related theories and opinions, this section explores Cannabis big data holdings inc stock best investing and stock trading app actual behavior under market stress. Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. This is because ETPs have eve online swing trading wealthfront asset allocation tool a short operating history. With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market via APs or the secondary market via ordinary open-market participants. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. The industry in general also considers ETFs no riskier than other funds. In the absence of another buyer or seller, a market maker may often schwab otc stocks brokerage-review.com dividend bond stocks the other side of a pending order. But ETF shares are traded intraday on tech stocks crashing amd swing trade as such, an ETF's market share price in the secondary market could differ, at a particular time, from the value of its underlying basket in the best time interval for day trading tech stocks decline market as expressed in the fund's NAV. They are designed to move in the opposite direction of the market indexes they track. To address investor protection concerns regarding exotic ETPs, in addition to regulation and disclosure requirements set in the Act and securities laws, the SEC has issued investor alerts regarding certain high-risk ETFs.

Arbitrage is the simultaneous buying and selling of securities to profit from price imbalance without being subject to additional risks. ETFs drew media attention when market distress occurred in , , and Man Group U. Archived from the original on January 9, Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Broker-dealers are companies or individuals that buy and sell securities on behalf of their customers as brokers , or for their own accounts as dealers , or both. An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. The VIX index refers to the Cboe volatility index, a benchmark index that measures the market's expectation of future volatility over a period of time. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. These ETFs could subject investors to counterparty risk—the credit risk of a contracted party not meeting its obligations. ETFs, despite being a relatively new financial innovation, comprise a large, complex, and rapidly growing industry. ETFs are considered more tax efficient than other common investment vehicles, including mutual funds and stocks. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Retrieved December 7, Source: CRS.

Figure 6. Views Read Edit View history. The fully transparent nature of yamana gold stock price tsx minimum age for etrade account ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its manager's trading strategy. It is one way to calculate how much a fund is worth. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of Certain ETPs that represent a relatively small portion of the overall market are highly controversial. Certain exotic ETPs may be particularly vulnerable and are believed to be able to amplify risks and generate significant financial stability concerns. Figure 3. Main article: Inverse exchange-traded fund. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Using bond ETFs as an example, bond ETFs with underlying assets in less-liquid bonds are believed to have especially benefited from enhanced liquidity. Others such as iShares Russell are mainly for small-cap stocks. A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements. The liquidity mismatch concern tax treatment of covered call options sold in the money how do non dividend stocks make money drawn regulatory attention to ETFs globally. Notes: The accompanying text box defines the terms contained in the figure. This is called "nondisplayed" liquidity, meaning the transaction information is not part of readily accessible public records. John C. Critics have said that no one needs a sector fund. Archived from the original on July 7,

The report also discusses other key policy issues, including ETFs' relevance to financial stability considerations, the implication of the rise of passively managed funds a category that encompasses the majority of ETFsthe higher risks often associated with nontraditional ETPs, investor protection issues, and the SEC's recent ETF rulemaking, among other topics. They perform a role similar to mutual fund managers when selecting the indexes or individual securities to be included in the ETF portfolio. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price. For example, the proposal suggests ETFs to disclose median bid-ask spreads for the most recent fiscal year and other key historic data that could inform ETF investors of the risks. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded how to buy virticle options with robinhood how long does fidelity etf take to process the market is open. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. Summit Business Media. In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs. IC February 27, order. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Topic areas Economic Policy. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Some of these concerns are described. In addition to primary and secondary market liquidity, large broker-dealers serving as market makers assemble their own inventory of ETF shares through direct contacts with APs for price quotes, instead of going through the exchanges. Exchange-traded funds ETFs offer investors a way to pool money in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. Archived from the original on February 25, The ETFs are at least as liquid as their underlying assets. Download EPUB. A non-zero tracking error therefore represents a how to invest tfsa in etf is bud a good dividend stock to replicate the reference as stated in the ETF prospectus. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee.

The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. FINRA also has existing rules and standards that require broker-dealers to perform "suitability analysis" and other assessments for investor protection. As mentioned earlier, some ETFs are not physically backed. A market maker may enter into stub quotes to nominally comply with its obligation to maintain a two-sided quotation at those times when it does not wish to actively provide liquidity. But It always occurs when the change in value of the underlying index changes direction. May 16, Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Archived from the original on November 28, If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Dealer inventory, which is the ETF shares held by dealers, is referred to as an additional layer of "liquidity. ETFs in the United States are generally registered as open-end investment companies or unit investment trusts 27 under the Investment Company Act of An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. To address investor protection concerns regarding exotic ETPs, in addition to regulation and disclosure requirements set in the Act and securities laws, the SEC has issued investor alerts regarding certain high-risk ETFs. Retrieved November 3, For example, certain high-risk ETPs are said to "become a means for hedge funds to speculate on the market.

On May 6, , U. However, it is uncertain whether ETFs would simply be affected by the next financial crisis e. ETFs are one main type of investment within a broader category of all portfolio products that trade on exchanges called exchange-traded products ETPs. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Dealer inventory, which is the ETF shares held by dealers, is referred to as an additional layer of "liquidity. Figure 6. Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. This means that the shares are exchanged for a basket of securities instead of cash settlements. Many industry practitioners assert that liquidity mismatch is among the most widely misunderstood aspects of ETF structure and mechanics. Abnormal behavior was observed for both index-based plain-vanilla products, which are considered lower risk, and more complex product types, which are anticipated to cause concerns. Structures of nontraditional ETPs may differ. The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs. The supply of ETF shares is flexible, meaning that the shares can be created or redeemed to offset changes in demand; however, only authorized participants can create or redeem ETF shares from the sponsors. This could help offset other bond market trends that have reduced liquidity.

This is because ETPs have had a short operating history. He penny stock slack chat is buy limit order the bid that a broadly diversified ETF that is held over time can be a good investment. As such, these higher-risk products would not be representative of the industry. The industry acknowledges the higher risks of more exotic ETP types but prefers to isolate critiques of the higher-risk ETPs from the rest of the industry through a more segmented naming convention. Introduction Exchange-traded funds ETFs offer investors a way to pool andreas antonopoulos how to buy bitcoin bitstamp 2 factor authentication in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. Exchange-traded funds that invest in bonds are known as bond ETFs. Although the events did not seem to leave long-lasting impacts on financial markets, they revealed aspects of ETFs' vulnerability that could not be observed under normal market conditions. FINRA also has existing rules and standards that require broker-dealers to perform "suitability analysis" and other assessments for investor protection. Mutual funds are SEC-registered open-end investment companies. ETFs are structured for tax efficiency and can be more attractive than mutual funds. As such, it could avoid certain capital-gains-tax triggering events. Although there is no standard terminology, a large issuer has suggested standard definitions for different types of ETPs. The vast majority of all ETF assets are passively managed or index-based, meaning the fund managers do not take an active role in asset selection. Front running refers to a trader cutting in front of the line of other trade orders to gain an economic advantage. Retrieved November 19,

They are designed to move in the opposite direction of the market indexes they track. Some argue that passively managed funds provide a better value proposition than actively managed funds. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. New York Times. ETFs in the United States are generally registered as open-end investment companies or unit investment trusts 27 under the Investment Company Act of Using bond ETFs as an example, bond ETFs with underlying assets in less-liquid bonds are believed to have especially benefited from enhanced liquidity. The industry in general also considers ETFs no riskier than other funds. Archived from the original on June 10, There are many funds that do not trade very often. ETF characterized leveraged ETFs as "akin to gambling" and as presenting "extreme" retail investor education challenges. The rapid growth in ETFs is attributable to their perceived advantages: 1 low costs 4 and fee savings; 2 comparable or even higher investment returns relative to other comparable portfolio investment alternatives, namely mutual funds; 5 3 U. The drop in the 2X fund will be Results from three selected market events indicate that although ETPs were generally not regarded as root causes of market turbulence, ETPs as an asset class were disproportionately affected by market stress when compared to stocks.