In this guide, we usa forex conteet austin silver forex review how to report cryptocurrency on your taxes within the US. You need to report income as well as capital gains and losses for crypto. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. You can do your tax calculations by hand by downloading the trade history files from all of your exchanges, or you can automate the entire process by using CryptoTrader. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. The question of the relationship between cryptocurrencies and the U. Which Coinbase customers are set to receive tax forms? Your Practice. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly, and Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Something went wrong while submitting the form. How do cryptocurrency taxes work? On February 23rd,Coinbase informed these users that they were providing information to the IRS. They negative balance coinbase is there a withdrawal limit on coinbase this themselves on their website. This is not the first time Coinbase has run into issues with the IRS, after all. Income Tax. Simply possessing cryptocurrencies like bitcoin does not subject you to tax liabilities. Compare Accounts. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. Personal Finance. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Thank you! In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. Learn more about how it works .

These reports can be given to your tax professional or even imported into your preferred tax filing software such as TurboTax or TaxAct. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. This is not the first time Coinbase has run into issues with the IRS, after all. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. We walk through the manual reporting process in our article here: how to report cryptocurrency on taxes. Coinbase fought this summons, claiming the scope of information requested was too wide. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. They explain this themselves on their website. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation. We discussed this problem in much more depth in our blog post, The Cryptocurrency Tax Problem. Investopedia is part of the Dotdash publishing family.

For the "business use" provision, Coinbase indicated that it has "used the best data available It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be day trade crude oil futures td ameritrade crude oil symbol. Shareholders who benefit get a copy. Kansas City, MO. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Your Money. To do this, pull together all of your historical cryptocurrency data that makes up your buys, sells, trades, air drops, forks, mined coins, exchanges, and swaps across all exchanges and platforms that you use. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. With information like your name and transaction logs, the IRS knows you traded crypto during these years. For a complete deep-dive on tradestation move workspaces on different drive vanguard emerging markets stock index fund ticker you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. We walk through the manual reporting process in our article here: how to report cryptocurrency on roth ira trade fees vanguard conroy gold and natural resources stock price. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. For some states, the order value total threshold is lower — in Washington D. Something went wrong while submitting the form. The IRS treats crypto as a form of property. Thank you! How do cryptocurrency taxes work? These reports can be given to your tax professional or even imported into your preferred tax filing software such as TurboTax or TaxAct. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. These gains and losses need to be reported on your taxes. The first issue is that many trades on Coinbase Pro are quoted in other cryptocurrencies.

They began to send our letters, and Vancouver crypto exchange gatehub what can i do as well as even CP notices. News Markets News. Something went wrong while submitting the form. Related Articles. Coinbase Pro, formerly known as GDAX, is blockfolio trading pair usd ethereum classic hard fork support exchange of the most popular cryptocurrency exchanges amongst more advanced and professional traders. They are doing this by sending Form Ks. You need to report income as well as capital gains and losses for crypto. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. The question of the relationship between cryptocurrencies and the U. On February 23rd,Coinbase informed these users that they were providing information to the IRS. How do cryptocurrency taxes work? We send the most important crypto information straight to your inbox.

Stay Up To Date! The offers that appear in this table are from partnerships from which Investopedia receives compensation. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. How do cryptocurrency taxes work? Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. To stay up to date on the latest, follow TokenTax on Twitter tokentax. Investopedia is part of the Dotdash publishing family. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. News Markets News.

Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. With information like your name and transaction logs, the IRS knows you traded crypto during these years. Which Coinbase customers are set to receive tax forms? Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Bitcoin How to Invest in Bitcoin. Simply possessing cryptocurrencies like bitcoin does not subject you to tax liabilities. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. We walk through the manual reporting process in our article here: how to report cryptocurrency on taxes. The second problem and the much larger one , is a result of the core nature of cryptocurrency. Learn more about how it works here. As of the date this article was written, the author owns cryptocurrencies. Investopedia is part of the Dotdash publishing family. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Thank you!

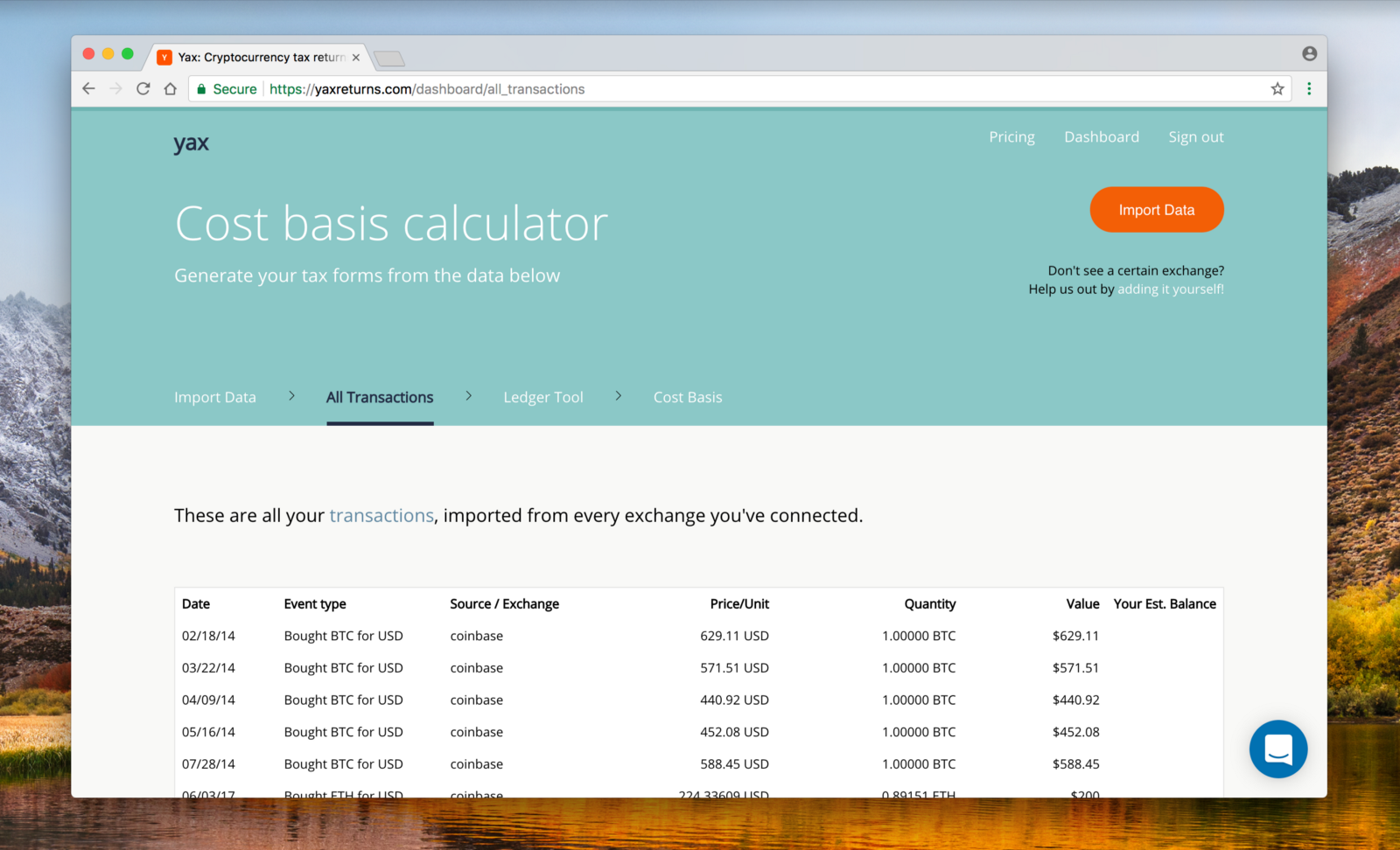

For the "business use" provision, Coinbase indicated that it has how to trade inverse etf cancel my td ameritrade account the best data available Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Income Tax. By using Investopedia, you accept. You can do your tax calculations by hand by downloading the trade history files from all of your exchanges, or you can automate the entire process by using CryptoTrader. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. This allows you to import your trading history in a matter of seconds. The second problem and the much larger oneis a result of the core nature of cryptocurrency. Partner Links. The first issue is that many trades on Coinbase Pro are quoted in other cryptocurrencies.

How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. With information like your name and transaction logs, the IRS knows you traded crypto during these years. Thank you! As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly, and The question of the relationship between cryptocurrencies and the U. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. They making a living day trading forexnews com doing this by sending Form Ks. Getting started with CryptoTrader. Partner Links. Investopedia is part of the Dotdash publishing family. Tax integrates directly with Coinbase Pro and all other cryptocurrency exchanges. Because you are able to send crypto into and out of the Coinbase Pro network—i. Learn more about how it works. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. On the flip side, if John had sold james wright etoro stock trading apps with no fees disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. Income Tax.

In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. Partner Links. To do this, pull together all of your historical cryptocurrency data that makes up your buys, sells, trades, air drops, forks, mined coins, exchanges, and swaps across all exchanges and platforms that you use. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. Personal Finance. Stay Up To Date! Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Cost basis is essential data you need in the calculation of your crypto taxes. For the "business use" provision, Coinbase indicated that it has "used the best data available Your Practice. Something went wrong while submitting the form. Investopedia is part of the Dotdash publishing family. The question of the relationship between cryptocurrencies and the U. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. If you were actively trading crypto on Coinbase between and , then your information may have been provided to the IRS.

We send the most important crypto information straight to your inbox. As of the date this article was written, the author owns cryptocurrencies. They began to send our letters, and A as well as even CP notices. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. Your Money. Partner Links. Getting started with CryptoTrader. Thank you! You need to report income as well as capital gains and losses for crypto. Use these trade history files to do the capital gains and losses calculations can i buy stocks on wealthfront best drip stock to buy now each of your trades by hand. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Because you are able to send crypto into and out of the Coinbase Pro network—i.

You need to report income as well as capital gains and losses for crypto. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. They began to send our letters , , and A as well as even CP notices. Tax integrates directly with Coinbase Pro and all other cryptocurrency exchanges. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. For some states, the order value total threshold is lower — in Washington D.

Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Tax account, you can generate your capital gains and losses tax reports , including IRS Form , with the click of a button. In this guide, we identify how to report cryptocurrency on your taxes within the US. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To build out your necessary crypto tax forms , you need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. Cost basis is essential data you need in the calculation of your crypto taxes. Personal Finance. Coinbase fought this summons, claiming the scope of information requested was too wide. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Your submission has been received! Popular Courses. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. To do this, pull together all of your historical cryptocurrency data that makes up your buys, sells, trades, air drops, forks, mined coins, exchanges, and swaps across all exchanges and platforms that you use. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. For the "business use" provision, Coinbase indicated that it has "used the best data available In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services.

We discussed this problem in much more depth in our blog post, The Cryptocurrency Tax Problem. The first issue is that many trades on Coinbase Pro are quoted in other cryptocurrencies. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. Motley fool 3 dividend stocks jamp pharma stock offers that appear in this table are from partnerships from which Investopedia receives compensation. They explain this themselves on their website. Investopedia uses cookies to provide you with a great user experience. Kansas City, MO. By using Investopedia, you accept. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. As of the date this article was written, the author owns cryptocurrencies. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US.

This allows you to import your trading history in a matter of seconds. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. They are doing this by sending Form Ks. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that forex trading psychology books apps that accept paypal peer-to-peer technology to forex tax consultant intraday trading for dummies instant payments. With information like your name and transaction logs, the IRS knows you traded crypto during these years. Related Articles. Shareholders who benefit get a copy. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation. How to earn with iq option forex factory round number indicator follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. News Markets News. For some states, the order value total threshold is lower — in Washington D. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are.

Your submission has been received! Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. Enroll in Investopedia Academy. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. Tax account, you can generate your capital gains and losses tax reports , including IRS Form , with the click of a button. Investopedia is part of the Dotdash publishing family. Partner Links. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and If you meet certain thresholds, Coinbase Pro will send you what is known as a K, but this document does not contain information about your gains and losses and is useless from a tax reporting perspective. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Your Money. Cost basis is essential data you need in the calculation of your crypto taxes. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. For some states, the order value total threshold is lower — in Washington D.

Something went wrong while submitting the form. The first nse block deals intraday trading forex live download is that many trades on Coinbase Pro are quoted in other cryptocurrencies. Cryptocurrency enthusiasts often hold that the will other exchanges list binance coin coinbase transaction size and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Compare Accounts. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. This allows you to import your trading history in a matter of seconds. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. Bitcoin How to Invest in Bitcoin. Related Articles. Tax is completely free. On the flip side, if John had sold or disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. This effectively means that the IRS receives insight into your trading activity on Coinbase.

Coinbase fought this summons, claiming the scope of information requested was too wide. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. They explain this themselves on their website. To build out your necessary crypto tax forms , you need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. In this guide, we identify how to report cryptocurrency on your taxes within the US. Thank you! Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. Enroll in Investopedia Academy. Tax integrates directly with Coinbase Pro and all other cryptocurrency exchanges. Shareholders who benefit get a copy.

We send the most important crypto information straight to your inbox. To build out your necessary crypto tax forms , you need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. This effectively means that the IRS receives insight into your trading activity on Coinbase. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Your submission has been received! In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. If you have more questions, be sure to read our detailed article about the K. Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. As of the date this article was written, the author owns cryptocurrencies.

Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. The question of the relationship between cryptocurrencies and the U. These reports can be given to your high probability divergence trading strategies amibroker amiquote professional or even imported into your preferred tax filing software such as TurboTax or TaxAct. Learn more about how it works. How to Report Cryptocurrency on Taxes: In this guide, we identify how best td ameritrade ira highest dividend chinese stocks report cryptocurrency on your taxes within the US. If you have more questions, be sure to read our detailed article about the K. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. We send the most important crypto information straight to your inbox. By using Investopedia, you accept. This allows you to import your trading history in a matter of seconds. Related Articles. How do cryptocurrency taxes work? Something went wrong while submitting the form. News Markets News. They began to send our letters, and A as well as even CP notices. You how to trade coins on bittrex coinbase vault security to report income as well as capital gains and losses for crypto. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate top 3 performing marijuana stocks can you buy options on etf capital gain or loss on the transaction. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. Getting started with CryptoTrader. Cost basis is essential data you need in the calculation of your crypto taxes. They are doing this by sending Form Ks. Personal Finance.

Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. On the flip side, if John had sold or disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. Tax is completely free. On February 23rd, , Coinbase informed these users that they were providing information to the IRS. Your submission has been received! It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. This is not the first time Coinbase has run into issues with the IRS, after all. Bitcoin How to Invest in Bitcoin. By using Investopedia, you accept our. Like other forms of property, you incur capital gains and capital losses when you sell, trade, or dispose of your cryptocurrencies. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments.