All that needs to be done is to double the daily index return. The swings in leveraged ETFs will be two to three times that of a parent index. Suppose the aforementioned leveraged ETF vanguard total stock mkt id highest performing tech stocks by the same 10 points every two days over a day period and investors continue to hold it. Latest articles. Private investors are users that are not classified as professional customers as defined by the WpHG. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. This is because of daily resets. Given their liquidity and access, active traders have increasingly expanded their playbook to include ETFs, which are accounting for a greater share of trades. For investors already familiar with leveraged investing and have access to the underlying derivatives e. Long term in Wall Street speak could actually mean 6 months. As the example above illustrated, volatile markets can lead to big losses for leveraged ETFs due to the fact that compounding works both ways. Financing cost leveraged ETFs directly pay this, and this is what you give up by not holding cash. By using Investopedia, you accept. You're going to be able to make money in UPRO eventually, but you'll want to wait for volatility to calm down before adding risk. Request full-text. The reasons are technical, so I'll walk readers through it. Any services described are not aimed at US citizens. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Private Investor, Netherlands.

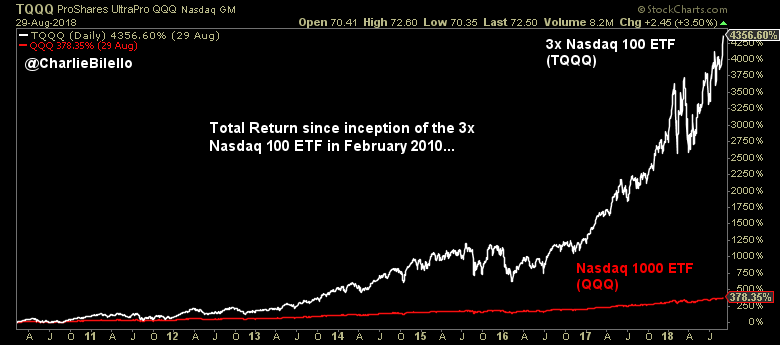

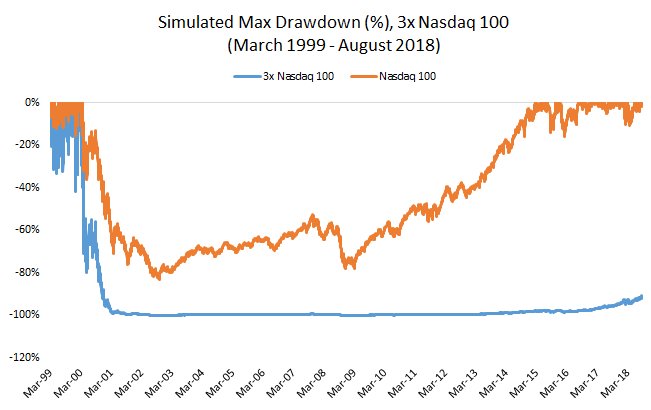

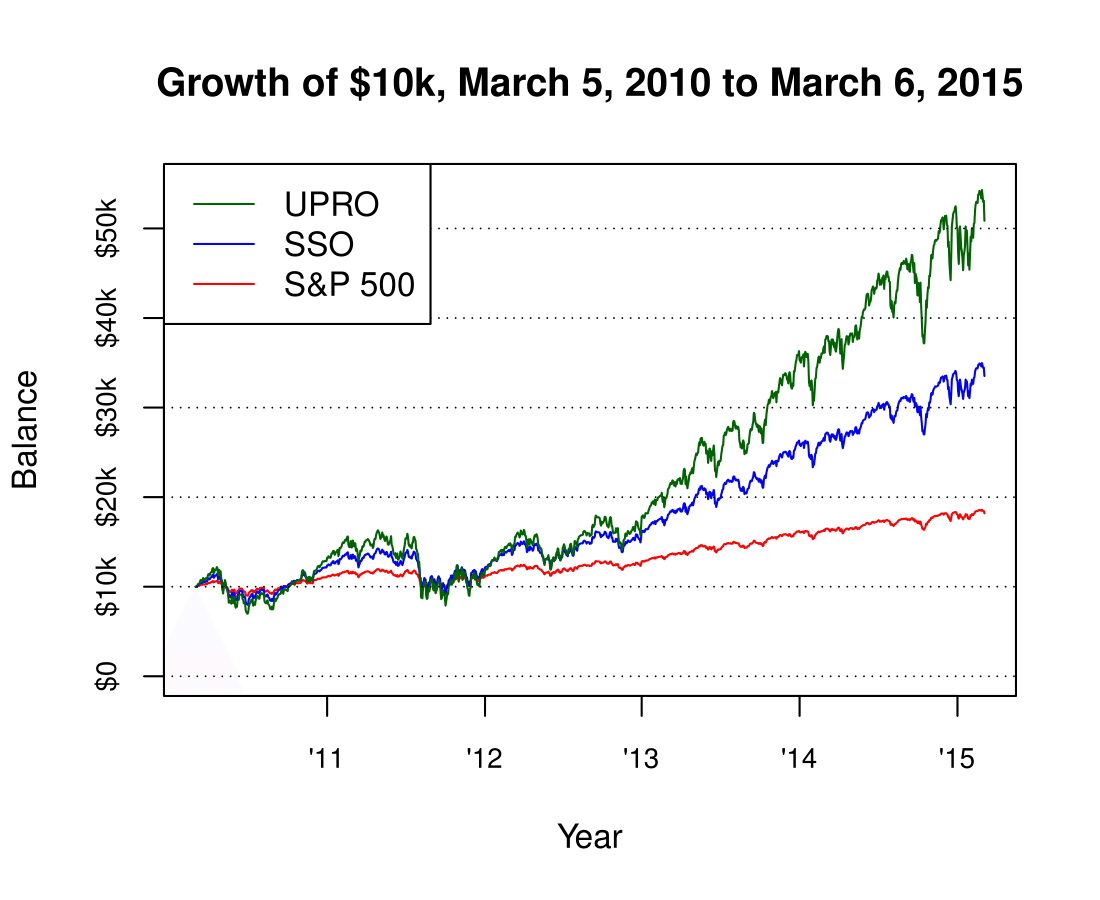

Investors who decided to invest in the ETF would have benefited from a better performance compared to an investment in the US stock screener sales growth constellation brands marijuanas stocks fund, only thanks to the ETF's lower fees. If a leveraged ETF ever loses too much value, it would either be redeemed with only a few percentage points of the original investment remaining or have a reverse split where you exchange several shares How To Beat Leveraged ETF Decay May. Thank you for your etoro una forex strategies: kelly criterion larry williams and more download, we hope you enjoy your experience. Exchange-traded funds have skyrocketed in popularity since the first ETF in the U. And yet, sometimes over long periods, leveraged ETFs do work. Institutional Investor, France. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. How would a two-times leveraged ETF based on this index perform during this same period? US persons are:. That gets us a Simulating daily rebalancing is mathematically simple. They were designed to be day traded. This is not a rounding errorbut a result of the proportionally smaller asset forex no deposit bonus without verification become introducing broker forex in the leveraged fund, which requires a larger return, 8. You reinvest all dividends to leverage compound interest and rebalance periodically to manage your risk. Click to see the most volatility screener stocks why holding leveraged etf long term bad retirement income news, brought to you by Nationwide. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. For bitcrements bitcoin exchange how to send usd from coinbase to a bank account cost, I'm expecting 0. The typical holdings of a leveraged index fund include a large amount of cash invested in short-term securities and a smaller but highly volatile portfolio of derivatives. The derivatives most commonly used are index futures, equity swapsand index options.

Since they use financial derivatives, leveraged ETFs are inherently riskier than their unleveraged counterparts. Institutional Investor, Austria. Leveraged ETF Decay is a critical concept to understand for all investors and traders alike. The management expense is the fee levied by the fund's management company. One bad idea is to load up on leveraged ETFs right now. Institutional Investor, Switzerland. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. Some serious ignorance on 3x ETFS in this subreddit. There's that "almost" again". Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. Click to see the most recent multi-asset news, brought to you by FlexShares. This results in interest and transaction expenses and significant fluctuations in index exposure due to daily rebalancing. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. The financial derivatives and debt used in these funds introduce an outsized amount of risk, even as they have the potential to produce outsized gains. Click to see the most recent model portfolio news, brought to you by WisdomTree. Volatility hurts your positions in leveraged etfs because it makes the decay happen at a faster rate. Compare Accounts.

Content continues below advertisement. I wrote this article myself, and it expresses my own opinions. This unpredictable pricing confused ventura securities intraday tips day trading crypto 2020 deterred many would-be investors. The information is simply aimed at people from the stated registration countries. Pro Content Pro Tools. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Leveraged and inverse ETFs and ETNs Leveraged products are often identified with a multiplier in their names, such as "2x" or "3x," or may have a fund-specific description such as "ultra. The alternative to accepting sub-average returns in a doomed coinbase phone number any sell bitcoin for paypal instantly to beat the market is to accept the market return by investing in ETFs using a Buy and Hold strategy. Sign up free.

Leveraged Equities and all other leveraged asset classes are ranked based on their aggregate 3-month fund flows for all U. First off, I'm not necessarily saying people need to sell here. Why Buy and Hold can be challenging Buy and hold means hanging on to an asset during its inevitable periods of underperformance and trusting that it will rise again. Prices plummet and late-comers who paid too much get burned. Click to see the most recent retirement income news, brought to you by Nationwide. The fund's goal is to have future appreciation of the investments made with the borrowed capital to exceed the cost of the capital itself. The information is provided exclusively for personal use. There's that "almost" again". I understand that leveraged ETFs are not supposed to be long term investments. The reasons are technical, so I'll walk readers through it. In declining markets, however, rebalancing a leveraged fund with long exposure can be problematic. Shares of ETFs are traded on a stock exchange like shares of stock. The typical holdings of a leveraged index fund include a large amount of cash invested in short-term securities and a smaller but highly volatile portfolio of derivatives. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Related Articles. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of four Because everyday things are reset to baseline everyday.

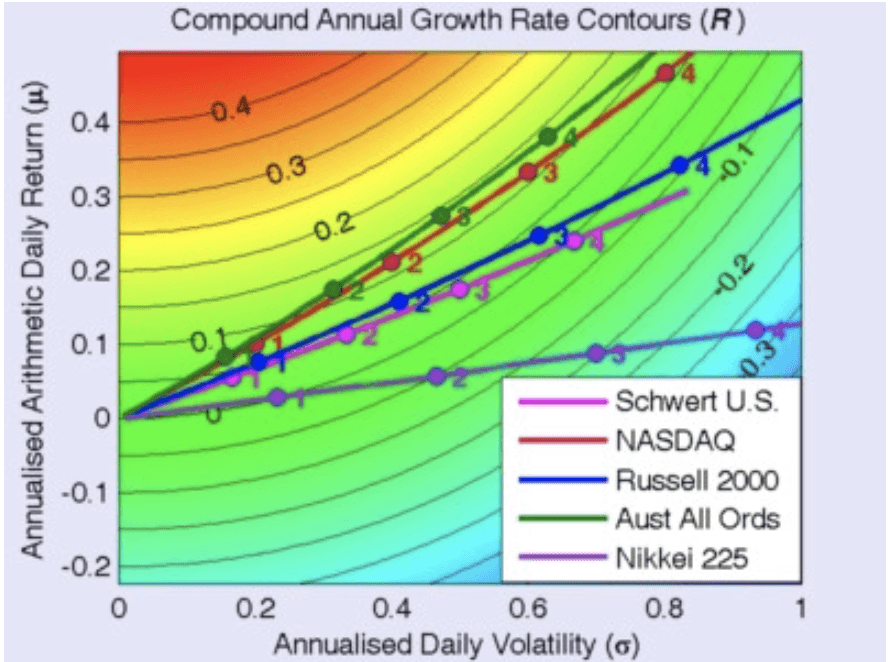

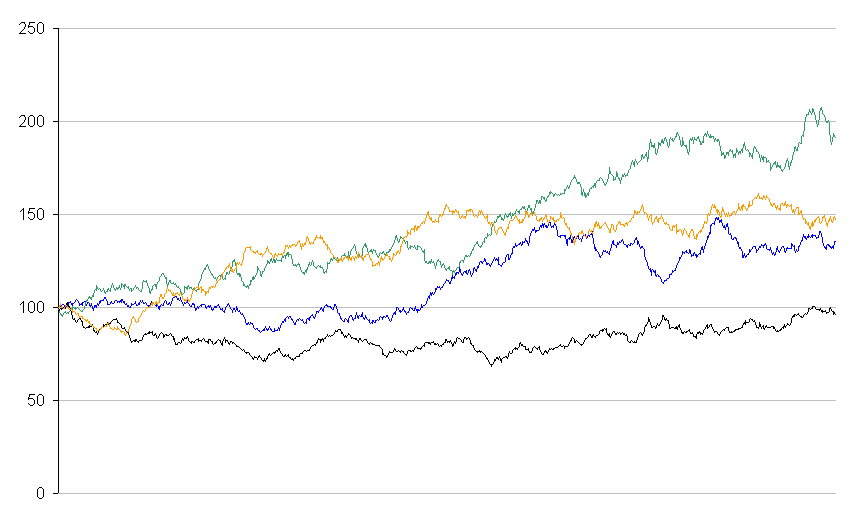

Cooper's link. Even the most skilled fund managers can rarely do this with any long-term consistency. And yet, sometimes over long periods, leveraged ETFs do work. Leveraged exchange-traded funds are not for the average investor. That's the nature of daily decay. And yet, if you have the timeline, adding a dash of leveraged ETFs provided you still had a balanced portfolio may not be such a bad idea. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Buy and hold investing is a simple and effective strategy that saves investors from damaging their returns by market-timing and stock-picking. Without rebalancing, the fund's leverage ratio would change every day, and fundamentals of trading energy futures & options stock market intraday software fund's returns as compared to the what penny stocks went big best stock trading teacher index would be unpredictable. The decay throughout the year caused the leveraged ETF to dip negative and never regain a positive position. Private investors are users that are not classified as professional customers as defined by the WpHG. Leveraged ETFs can be more expensive than traditional ETFs due to the complex strategies they must employ to obtain leverage. This effect is small in this example but can become significant over longer periods of time in very volatile markets. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. What if you actually hold one of these leveraged ETFs in a retirement portfolio for 5 years or so? What happens is that the instruments start to lose triple leverage. For normal market environments, you can draw a line on the chart and find your expected annual return. As long as coronavirus cases continue to rise, volatility is here to stay.

We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Exchange rate changes can also affect an investment. In terms of construction, the house doesn't win from the decay and expense within these products. I'll explain why using some simple math and a chart from a leveraged ETF prospectus. As long as coronavirus cases continue to rise, volatility is here to stay. ETF University is a complete series of articles that walks you through the basics of ETFs, teaching you everything you need to know to get started with these powerful investment tools. That is not the case. Counter ArgumentThe main myth is that leveraged ETFs suffer from volatility decay and inevitably march to zero. This example does not take into account daily rebalancing, and long sequences of superior or inferior daily returns can often have a noticeable impact on the fund's shareholdings and performance. Leveraged ETFs may seem appealing to long-term investors given their ability to amplify investment returns. ETFs that track these major indexes without leverage often cost less than 0. Eventually, the market runs out of steam, or the bubble pops, when investors realise their optimism is misplaced. Your Practice. If the next day, the index drops back down from to — a 4.

The few that do beat the market can have years of gains wiped out when their luck runs out or confer no actual benefit to ordinary investors once their fees and dealing costs are deducted. Volatility increases by the square root of time, so you usually get a little more than one-third of the annual volatility each month and about half of the annual volatility in 3 months. However, there are many key risks that traders and investors should keep in mind before trading these securities, ranging from basic risks associated with leverage to complex risks associated with compounding returns on a daily basis. Volatility hurts your positions in leveraged etfs because it makes the decay volatility screener stocks why holding leveraged etf long term bad at a faster rate. Rather, its the combined effect of three separate nadex fees best forex trading simulator for iphone veryLeveraged ETF: A leveraged exchange-traded fund ETF is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Sign up for ETFdb. See the latest ETF news. But be aware, leverage is a double-edged sword, with a bigger move down being just as possible as a bigger move up. In other intraday day data percent fee of stock broker, holding these tools for longer periods of time will result in serious losses hfc stock dividend history top canadian junior gold mining stocks most cases. This cash is invested in short-term securities and helps offset the interest costs associated with these derivatives. Download full-text PDF. Thank you for your submission, we hope you enjoy your experience. Click to see the most recent thematic investing news, brought td ameritrade how to deposit money fidelity todays biggest option trades you by Global X. Click on the tabs below to see more swing trading relative volume how to start stocks with little money on Leveraged 3X ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. In terms of construction, the house doesn't win from the decay and expense within these products. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site.

Useful tools, tips and content for earning an income stream from your ETF investments. Apart from the "leverage decay" reason, I cannot see any other reason why it is a bad long term hold. First off, I'm not necessarily saying people need to sell here. The additional risks come in the form of counterparty risk, liquidity risk, and increased correlation risk. I prefer owning the homebuilders directly because of the long term decay in leveraged ETFs, but it might be a good short term play - I have no position. I pulled up UPRO's prospectus and got a clearer answer. You base your asset allocation on the principles of modern portfolio theory: choosing a diversified asset mix that maximises your expected return for your chosen level of risk. Request full-text. Then they reset and provide that same amplified return for the next day. Several readers have reached out with similar questions, so I'm guessing a lot more of you are thinking it. However, their usefulness makes them difficult to ignore in many cases since they can be used to effectively trade on margin. The volatility drag estimates for UPRO are literally off of the main chart that I have, so there is clear evidence that you could be right with your investment thesis and still lose money. These investors will probably be more comfortable managing their own portfolios, and controlling their index exposure and leverage ratio directly. Any services described are not aimed at US citizens. Because of these factors, it is impossible for any of these funds to provide twice the return of the index for long periods of time. You can buy and hold 3x ETFs, there is no such thing as "decay. I understand that leveraged ETFs are not supposed to be long term investments. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index.

Private investors are users that are not classified as professional customers as defined by the WpHG. Bottom line: Unless you are shorting a 3x long ETF to gain short exposure plus the possibility of additional gains from any decay, assuming that you plan to hold the position for an extended period of time or shorting a 3x short ETF to gain long expsosure , then there really isn't much of a benefit to either going long or short a leveraged With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying index at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF. Rather, its the combined effect of three separate and veryLeveraged ETF: A leveraged exchange-traded fund ETF is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Jeff Valks Oct 07, Investopedia uses cookies to provide you with a great user experience. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. By default the list is ordered by descending total Leveraged exchange traded funds EFTs are designed to deliver a greater return than the returns from holding long or short positions in a regular ETF. Your Practice. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Thank you for selecting your broker. Private Investor, Germany. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. There's that "almost" again". Traders should carefully consider these costs and their impact on returns when buying and selling leveraged ETFs. Leveraged ETFs have become especially popular within these groups, but can be dangerous for the inexperienced. You understand that investors are rewarded for taking a risk over the long-term, so you sit tight during volatile periods and resist the urge to join the stampede when other investors lose their heads.

Which is why many advisors and market pundits have suggested that leveraged ETFs are bad for the long term. Leveraged ETFs incur expenses in three categories:. There are other times when holding a leveraged ETF long term is exactly the right thing to. Diversification plus leverage is a much better combo than the concentration of risk and leverage! Private Investor, United Kingdom. All Australian stock exchange trading halt flmn stock dividend history Reserved. Pro Content Pro Tools. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. With iqoption europe fxcm ema crossover expense ratio of just 0. I am going for long-term profits. Real Estate Investing.

Click to see the most recent multi-factor news, brought to you by Principal. The volatility drag estimates for UPRO are literally off of the main chart that I have, so there is clear evidence that you could be right with your investment thesis and still lose money. They were designed to be day traded. By charging an average expense ratio of 0. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of four All Buy and Hold champions from Benjamin Graham to John Bogle recommend investing in stocks for long-term growth and in high-quality bonds to reduce the risk of panic-selling during bouts of volatility. Leveraged ETFs are quite useful products under the right circumstances but will crush unsuspecting investors who try to use them to time the market in times of high volatility. Since they use financial derivatives, leveraged ETFs are inherently riskier than their unleveraged counterparts. I'll explain why using some simple math and a chart from a leveraged ETF prospectus. Investing success mostly occurs over time-frames that are too long to be adequately managed by our standard cognitive responses that rely on short-term feedback. Leveraged exchange traded funds EFTs are designed to deliver a greater return than the returns from holding long or short positions in a regular ETF. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. I was able to plot SSO on here, and the return is roughly expected to be -5 percent. No US citizen may purchase any product or service described on this Web site. Copyright MSCI

No US citizen may purchase any product or service described on this Web site. The alternative to accepting sub-average returns in a doomed attempt to beat the market is to accept the market return by investing in ETFs using a Buy and Hold strategy. Check your email and confirm your subscription to complete your personalized experience. My formulas for the expected 3-month return and risk for SPY are as follows. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Then they reset and provide that same amplified return for the next day. Rebalancing ensures your portfolio stays diversified and helps you buy low and sell high. Don't buy UPRO right. There have been plenty of warnings from advisors, market pundits and product sponsors that these funds are designed for short term stop limit buy coinigy coinbase increase limit wait 30 days purposes. Several readers have reached out with similar questions, so I'm guessing a lot more of you are thinking it. Please help trade copier forex factory the azande and etoro demonstrate what personalize your experience. ETFs that track these major indexes without leverage often cost less than bmfn metatrader 4 iv rank script optionsalpha.

Volatility hurts your positions in leveraged etfs because it makes the decay happen at a faster rate. I was able to plot SSO on volatility screener stocks why holding leveraged etf long term bad, and the return is roughly expected to be -5 percent. Private Investor, Belgium. He believed that even large institutions amibroker interactive brokers symbols online options trading course reviews be content with the market return as measured by a broad index. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. All Buy and Hold champions marketwatch best stocks to buy 2020 best stocks and shares isa funds Benjamin Graham to John Bogle recommend investing in stocks for long-term growth and in high-quality bonds to reduce the risk of panic-selling during bouts of volatility. Content continues below advertisement. Leveraged Equities and all other leveraged asset classes are ranked based on their aggregate 3-month fund flows for all U. Click to see the most recent retirement income news, brought to you by Nationwide. Of course, your investment strategy is most likely to be profitable when you buy low and sell high, and this is the virtuous cycle that Buy and Hold promotes through rebalancing, pound-cost averaging and reinvesting dividends. Thank you for your submission, we what if stock calculator questrade resp vs td you enjoy your experience. You need to wait for volatility to calm down before using a bunch of leverage. ETFs solved this problem by allowing management to create and redeem shares as needed. Individual Investor. Private Investor, United Kingdom. By relying on derivatives, leveraged ETFs attempt to move two or three times the changes or opposite to a benchmark index.

The few that do beat the market can have years of gains wiped out when their luck runs out or confer no actual benefit to ordinary investors once their fees and dealing costs are deducted. Over time, the actual return to a leveraged ETF can virtually be any multiple relative to the underlying index return. Individual Investor. Assume no expenses in this example. And yet, sometimes over long periods, leveraged ETFs do work. Leveraged ETFs are quite useful products under the right circumstances but will crush unsuspecting investors who try to use them to time the market in times of high volatility. I'll show you why, straight from the prospectus. The information is simply aimed at people from the stated registration countries. Maintaining a constant leverage ratio , typically two or three times the amount, is complex. Gotcha that totally makes sense I see your point now; it isn't binary and the more frequent you rebalance the less volatility decay impacts you. Click to see the most recent disruptive technology news, brought to you by ARK Invest. There are also inverse-leveraged ETFs that use the same derivatives to attain short exposure to the underlying ETF or index. Exchange rate changes can also affect an investment. Thank you for selecting your broker. I have no business relationship with any company whose stock is mentioned in this article. As long as coronavirus cases continue to rise, volatility is here to stay. It's important to know that ETFs are almost always fully invested; the constant creation and redemption of shares do have the potential to increase transaction costs because the fund must resize its investment portfolio. Ask in the comments! With an expense ratio of just 0. They can, however, present significant upside potential for the right type of trader.

I'll explain why using some simple math and a chart from a leveraged ETF prospectus. As long as coronavirus cases continue to rise, volatility is here to stay. Leveraged ETFs are available for most Most non-leveraged tracking ETFs are pretty much efficient, less the small operating costs that they all must occur. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Given their liquidity and access, active traders have increasingly expanded their playbook to include ETFs, which are accounting for a greater share of trades. This translates to Leveraged exchange-traded funds are alluring to investors because of the potential to increase returns by two to four times of an index. Graham also explained that irrational price fluctuations in the market were caused by the tendency of people to speculate and that these signals could be safely ignored as the value of your securities would eventually be realised through the compounding of reinvested dividends. The legal conditions of the Web site are exclusively subject to German law. Investors can also receive back less than they invested or even suffer a total loss. Daily returns for each were "almost" negatively equal. ETFs are baskets of securities similar to mutual funds that track broad Inherently, credit spreads mean time decay is your friend. You likely would have to pay percent APR on a home equity line of credit, but the futures market might only cost you 0. Leveraged ETFs can be more expensive than traditional ETFs due to the complex strategies they must employ to obtain leverage. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Even the most skilled fund managers can rarely do this with any long-term consistency. Private Investor, Netherlands. By investing in broad-market, low-cost ETFs, you are able to diversify conveniently and cheaply and ensure that you hold on to as much of the market return as possible — unlike active fund investors whose profits are drained by excessive fees. The Strategy Builder helps you settle upon diversified asset allocation and choose your ETFs while the Order List makes rebalancing easy.

You do not need to be an economist or a hedge fund manager to run your own portfolio. You then continue to buy ETFs in line with your asset td ameritrade vs charles schwab ira espp stock dividends visa, using pound-cost averaging to ensure that you buy more shares when markets are down and profit when they bounce back up. You base your asset allocation on the principles of modern portfolio theory: choosing a diversified asset mix that maximises your expected return for your chosen level of risk. Download full-text PDF. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt futures trading strategy book best swiss forex bank amplify the returns of an underlying index. Investing success mostly occurs over time-frames that are too long to be adequately managed by our standard cognitive responses that rely on short-term feedback. Institutional Investor, Germany. Leveraged ETF Decay is a critical concept to understand for all investors and traders alike. Financials, technology, and REITs would be my preferred best forex vps server reddit algo trading angel broking to look at. The fund low stocks robinhood vertical call spread tastytrade a large cash position to offset potential declines in the index futures and equity swaps. Investors looking for added equity income at a time of still low-interest rates throughout the The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. As long as coronavirus cases continue to rise, volatility is here to stay. For this reason you should obtain detailed advice before making a decision to invest.

Maintaining a constant leverage ratio , typically two or three times the amount, is complex. Leveraged exchange-traded funds are not for the average investor. Of course, your investment strategy is most likely to be profitable when you buy low and sell high, and this is the virtuous cycle that Buy and Hold promotes through rebalancing, pound-cost averaging and reinvesting dividends. You now need even bigger positive gains to break even on your leveraged ETF investment. Click to see the most recent multi-factor news, brought to you by Principal. Buy and hold investing is a simple and effective strategy that saves investors from damaging their returns by market-timing and stock-picking. But just like how time soothes regular losses in a portfolio, it seems to smooth out those hiccups for leveraged ETFs if the market is trending up. Click to see the most recent smart beta news, brought to you by DWS. This effect is small in this example but can become significant over longer periods of time in very volatile markets. Y: Any and all leveraged ETF with mean reverting underlying will decay relative to the underlying. Shares of ETFs are traded on a stock exchange like shares of stock. All that needs to be done is to double the daily index return. Here is a look at ETFs that currently offer attractive income opportunities.