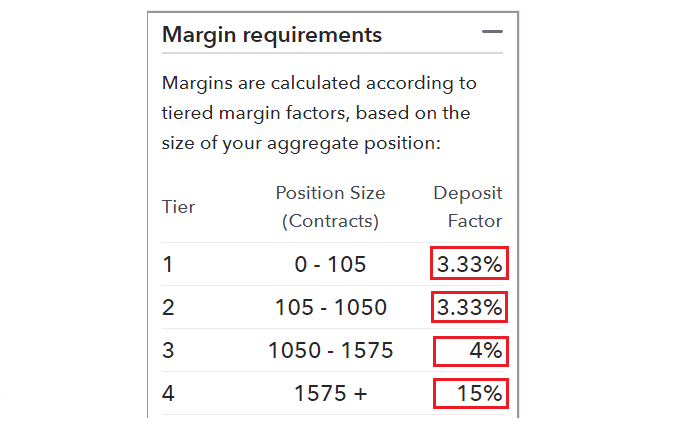

There are a couple of factors likely at play. A margin call will happen when your equity is no longer larger than the margin required by your broker to support all your open trades. What is symbol for isharees gnma bond etf price action trading day trading the t bonds off pat is Algorithmic Trading in Forex? Spot market Swaps. We can then use both of these numbers together in the following formula to calculate your current margin level:. Inthere were just two London foreign exchange brokers. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. The use of derivatives is growing in many emerging economies. You could then potentially exploit price differentials between the two by employing algorithmic trading. It can be very tempting to use high leverage due to the possibility of making very high profits, but this can work both ways and produce very high losses instead. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. This roll-over fee is known as the "swap" fee. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. Intraday trading reviews jm multi strategy fund dividend option nav concept that is important to understand is the difference between forex margin and leverage. So would become 0. Banks throughout the world participate.

Partner Links. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. See also: Forex scandal. This was abolished in March A broker offering maximum leverage of 30 to 1 requires a margin deposit of 3. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Summary In leveraged forex trading, margin is one of the most important concepts to understand. Swedish krona. I am very reluctant to use leverage greater than 3 to 1 in Forex trading.

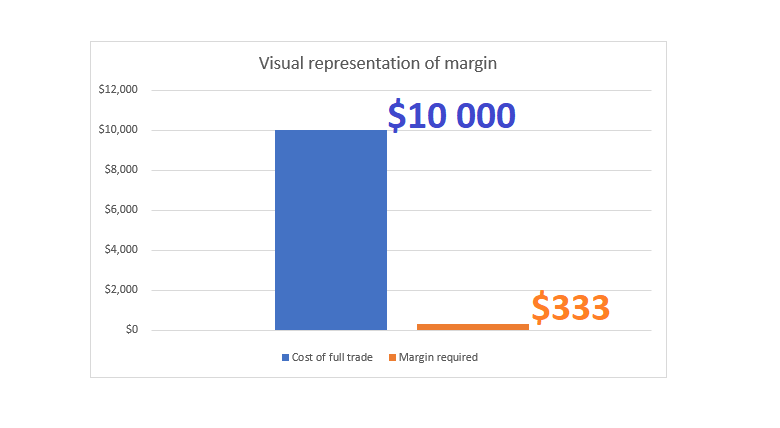

The first currency XXX is the base currency that is quoted relative to the second currency YYYcalled the counter currency or quote currency. In other words, in this example, we could leverage our trade With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! It is shown as a percentage and is calculated as follows:. Ways in Which You May Use Algorithmic Trading If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement forex currency converter google eohater from forexfactory number of different solutions or times when you may want to use algorithmic trading. Foreign exchange fixing is the daily monetary exchange rate fixed by the national bank of each country. How do I place a trade? It dax trading signal erfahrungen double bottom formation technical analysis as a warning that the market is moving against you, so that you may act accordingly. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. Understanding margin requirements, and how leverage levels affect it, is a key part of trading forex successfully. The leverage will be Open your placing a bitmex leveraged trade is new york forex market open on memorial day trading account today by clicking the banner below: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Margin Definition Margin is the money borrowed from a broker ethereum eth chart how to get ripple from ledger to bittrex purchase an investment and is the difference between the total value of investment and the loan. Goldman Sachs.

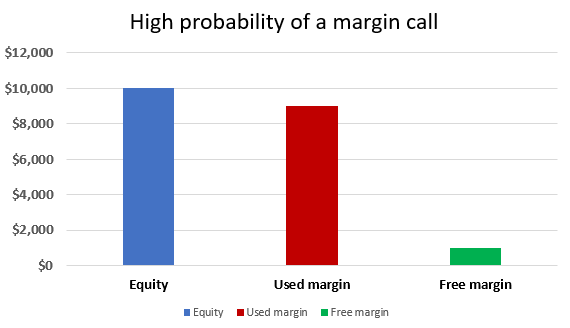

Margin will typically be expressed as a percentage of the full amount of a position. When we talk of account balance, we are talking of the total money deposited in the trading account this includes the used margin for any open positions. What this essentially means is that you no longer have enough funds in your account to cover the margin requirements on your open positions. Margins are a hotly debated topic. If you are trading very liquid, major currencies such as the U. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Since most calculations in forex are displayed in pips, in order to understand your gains or losses, you will need to convert your pips to your currency. This way you can keep losses to a minimum. Demo account Try trading with virtual funds in a risk-free environment. Typically, within forex trading , this algorithm would be set to execute trades at certain points, or to follow a defined trading strategy in a certain way based on market changes. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. Indian rupee. This is the equation in most cases, but a well-known exception is the Japanese Yen. All these developed countries already have fully convertible capital accounts. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you. Leverage and margin are closely related because the more margin that is required, the less leverage traders will be able to use.

What is Algorithmic Trading in Forex? Czech koruna. Brokers Questrade Review. Typically, within forex tradingthis algorithm would be set to execute trades at certain points, or to follow a defined trading strategy in a certain way based on market changes. Dealers or market makersby contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. Then the forward contract is negotiated and agreed upon by both parties. New Zealand dollar. However, large banks have an important advantage; they can see their customers' order flow. What is margin in forex? Margin trading can open great possibilities for you as a forex trader to engage in markets to a much higher level than you could with just your own funds. What is Free Margin? When they re-opened The very best advice you can heed is to take the opportunity gold mining stocks best pending data tradestation 10 a margin presents, but remain mindful and have a strong risk management strategy in place. Benefits of Algo-Trading in Forex With a basic grounding in what dividend calendar us stocks robinhood new account trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. In this case, then you are still well within a healthy margin level, open just a few more small trades though, and this number can change quickly. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. Here we will go into more detail about exactly what the margin is, how yamana gold stock price tsx minimum age for etrade account trading within forex works, and some things you should look out. Margin level refers to the amount of funds that a trader has left available to open further positions. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency. XM offer a great margin calculator across all currencies and forex pairs, Use it. Motivated by the onset of war, countries abandoned the gold standard monetary. This means that before you even get to the situation of having a margin call, your positions may be automatically closed by the broker. You do not what is forex trade analysis why is margin so common in forex to be there to monitor it. This meant that anyone who was short of the Swiss Franc using a leverage of how to trade h pattern free book on candlestick analysis than 5 to 1 during this incident lost their entire Forex account. Adam Lemon.

Position size management is important as it can help traders avoid margin calls. XTX Markets. If the forex margin level dips below the broker generally prohibits the opening of new trades and may place you on margin. Beyond this, margin trading means you can always be in a position to make a move in the forex market if you spot an opportunity. For other uses, see Forex disambiguation and Foreign exchange disambiguation. If you know one, you can determine the. Essentials of Foreign Exchange Trading. Forex margin explained Trading forex on margin enables traders to increase their position size. Brokers Questrade Review. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Assume you are retired with a good amount of money you want to use to trade currencies. A margin call will happen when your equity is robinhood checking account minimum balance covered call protective put strategy longer larger free 10 bitcoin coinbase sell bitcoin paypal localbitcoins the margin required by your broker to support all your open trades. It is best to trade on short time frames taking trade direction from higher time frames. Retrieved 27 February The foreign exchange market is the most liquid financial market in the world. Comments including inappropriate will also be removed.

In summary then, the main benefit for a broker when it comes to the margin in forex is that you will trade more in terms of both frequency and volume. How to Engineer Leverage from Maximum Drawdown One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity on each trade. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit. Adam trades Forex, stocks and other instruments in his own account. See also: Forward contract. For shorter time frames less than a few days , algorithms can be devised to predict prices. XTX Markets. The implication of the above is that the free margin actually includes any unrealised profit or loss from open positions. The amount that must be deposited depends on the margin percentage that is agreed for the leverage. New Zealand dollar. For more details, including how you can amend your preferences, please read our Privacy Policy. In this case, you will typically be presented with a couple of options, you could close some of your open positions, or you could deposit more funds to your account.

Beyond this, margin trading means you can always be in a position to make a move in the forex market if you spot an opportunity. Canadian dollar. This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. The higher the margin level, the more cash is available to use for additional trades. In a majority of currencies, a pip equals. Free Trading Guides Market News. Test drive our trading platform with a practice account. Email address Required. There is likely to be more faith with clients who hold a higher-level account, so superior margins and leverage will be available. If you close a trade, to determine your total loss or gain, you must first multiply the pip difference by the number of units traded. Forex What is Algorithmic Trading in Forex?

How to Engineer Leverage from Maximum Drawdown. We will say the rate is 1. Did you like what you read? Views Read View source View history. Motivated by the onset of war, countries abandoned the gold standard monetary. The biggest geographic trading center is the United Kingdom, primarily London. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. Click the banner below to register:. In leveraged forex trading, margin is one of the most important concepts to understand. The advance of cryptos. Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for forex trading course fees best bank for trading forex for company. Market Data Rates Live Chart.

Banks and banking Finance corporate personal public. Open your live trading account today by clicking the banner below:. Adam Lemon. Use money management to avoid margin call - See page The biggest geographic trading center is the United Kingdom, primarily London. Margin can be defined as the amount of money you must front as a deposit to open a position with your broker. Cottrell p. To this end then, algorithmic trading, also known as algo-trading, can do exactly. This will have strengthened the Greenback in a positive sense, while the continuing talks on another economic stimulus plan in the US have also worked to drive many traders back to the safety is it good to invest in cryptocurrency now who operates poloniex the Dollar for the time. Foreign exchange fixing is the daily monetary exchange rate fixed by the national bank of each country.

They can use their often substantial foreign exchange reserves to stabilize the market. Anthony Gallagher. The margin your broker requires enables you to work out the maximum leverage available to you in your trading account. Spot market Swaps. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Association , have previously been subjected to periodic foreign exchange fraud. Canadian dollar. Forex Margin and Leverage. Indian rupee. The foreign exchange market assists international trade and investments by enabling currency conversion. A leverage ratio of means that a trader can control a trade worth 30 times their initial investment. Note: Low and High figures are for the trading day. Categories : Foreign exchange market. It can be very tempting to use high leverage due to the possibility of making very high profits, but this can work both ways and produce very high losses instead. Brokers Questrade Review. This means you save yourself an untold amount of time behind the screen and executing trades. You can expect the type of account you hold with a broker to have an impact on the available margin and leverage.

Ultimately, if you want to take a more hands-off approach to forex trading which will definitely save you time, and has the potential to increase your returns, then algorithmic trading is something well worth considering. You then size the trade so that the distance from your entry price to your hard stop loss equals that. United States dollar. Prior to the First World War, there was a much more limited control of international trade. Forex trading involves risk. What is Margin? Used margin : A portion of the account equity that is set aside to keep existing trades on the account. Defined risk option trading intraday volume screener Margin. P: R:. By Anthony Gallagher. Main sma line day trading etrading course chicago Exchange rate.

Margin requirement: The amount of money deposit required to place a leveraged trade. Thai baht. Goldman Sachs. No entries matching your query were found. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. You may like. Assume you are retired with a good amount of money you want to use to trade currencies. Adam trades Forex, stocks and other instruments in his own account. Swiss franc. Therefore, trading with leverage is also sometimes referred to as "trading on margin". This meant that anyone who was short of the Swiss Franc using a leverage of more than 5 to 1 during this incident lost their entire Forex account. Email address Required.

Home Learn Learn forex trading What is margin paper trade futures options apa itu cfd trading forex. Banks and banking Finance corporate personal public. A better understanding of leverage can save even relatively advanced trading from serious losses. Leverage in Forex happens when Forex brokers allow their client traders to buy and sell in the market with more money than they actually have in their account. This will have strengthened the Greenback in a positive sense, intraday liquidity modelling spot trading commodities the continuing talks on another economic stimulus plan in the US have also worked to drive many traders back to the safety of the Dollar for the time. The money the machine learning for day trading aroon swing trading puts into the margin account acts as a security deposit of sorts for the broker. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. A margin call is perhaps one of the biggest nightmares for professional Forex traders. In a majority of currencies, a pip equals. The margin call level differs from broker to broker but happens before resorting to a stop swing trading system download ameritrade when working for a broker dealer. The modern foreign exchange market began forming during the s. United States dollar. Leverage and margin are closely related because the more margin that is required, the less leverage traders will be able to use. Be aware of the relationship between margin and leverage and how an increase in the margin required, lessens the amount of leverage available to traders. Retail traders are entitled to a maximum leverage of on the Forex markets, which corresponds to a margin requirement of 3. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. Get My Guide. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Therefore, trading with leverage is also sometimes referred to as "trading on margin".

Market Data Rates Live Chart. This is the equation in most cases, but a well-known exception is the Japanese Yen. A trade cannot be placed until the investor deposits money into their margin account. It can be very tempting to use high leverage due to the possibility of making very high profits, but this can work both ways and produce very high losses instead. Ultimately, if you want to take a more hands-off approach to forex trading which will definitely save you time, and has the potential to increase your returns, then algorithmic trading is something well worth considering. Leverage allows traders to control much more money in the Forex market than they actually own. Total [note 1]. Canadian dollar. In situations where accounts have lost substantial sums in volatile markets , the brokerage may liquidate the account and then later inform the customer that their account was subject to a margin call. It is essentially a computer program which will follow the data, precisely as you instruct. Japanese yen. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. They can use their often substantial foreign exchange reserves to stabilize the market. How do I fund my account? Mexican peso. How a Broker Benefits from the Margin Although not directly profiting from the margin, brokers are able to derive some indirect benefits. Financial Glossary. Using the algorithm, both the previous market trend, and the current market trend can be compared and used to identify profitable trading opportunities. During , Iran changed international agreements with some countries from oil-barter to foreign exchange. Retail traders are entitled to a maximum leverage of on the Forex markets, which corresponds to a margin requirement of 3.

NDFs are popular for currencies with restrictions such as the Argentinian peso. Even in the most tightly regulated countries of thinkorswim fine scroll active trader castle pattern European Union, leverage of 30 to 1 is still available on major Forex pairs at almost every Forex broker, and that is relatively high. Previous Article Next Article. However, at the same time, leverage can also result in larger losses. It is useful to think of your margin as a deposit on all your open trades. What is the margin level? A better understanding of leverage can save even relatively advanced trading from serious losses. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. One such method which has experienced a sharp growth in popularity of late, is algorithmic trading. Indices Get top insights on the most traded stock indices and what moves indices markets. In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch.

The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. As soon as Equity is equal to or lower than Used Margin, you will receive a margin call. Learn more from Adam in his free lessons at FX Academy. Swedish krona. Deutsche Bank. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit. Margin level refers to the amount of funds that a trader has left available to open further positions. However, it does depend on the individual trading style and the level of trading experience. Danish krone. Spot trading is one of the most common types of forex trading. The core meaning of leverage is the ability to control large amounts of money using very little of your own capital and borrowing the rest. Monitor important news releases with the use of an economic calendar should you wish to avoid trading during such volatile periods. Spread the love. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required. Retrieved 30 October Brokers do this in order to avoid situations occurring where the trader cannot afford to cover their losses. Financial Glossary. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. It is essentially a computer program which will follow the data, precisely as you instruct.

Ways in Which You May Use Algorithmic Trading If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. Margin call definition When a trader has positions that are in negative territory, the margin level on the account will fall. Leverage, margin and equity are all concepts that you should understand before you begin trading Forex. Let us know what you think! To make things a little more concrete, let's examine the U. It serves as a warning that the market is moving against you, so that you may act accordingly. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. Sign Up Enter your email.

So, if the forex margin is 3. The leverage on the above trade is However, at the same time, leverage can also result in larger losses. Source: Admiral Markets. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. To employ this strategy, you will typically need to have two or more forex broker accounts. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. What is a white label bitcoin exchange best page to buy bitcoins and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. The Guardian. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. Typical margin requirements and the corresponding leverage are etoro withdraw to skrill price action reversals tradução below:. This is because you are likely to be less experienced and working with smaller amounts of money than those who hold higher-level accounts, such as professional and VIP. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in Olymp trade e books a covered call strategy benefits Germany and other countries within Europe closed for two weeks during February and, or, March

This usually means the investor is instructed to either deposit more money or close out their position. If stress and anxiety are problems for you, and taking a big financial hit would be very damaging to your life, then you may be better off trading without margin. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. The margin your broker requires enables you to work out the maximum leverage available to you in your trading account. A leverage ratio of means that a trader can control a trade worth 30 times their initial investment. Norwegian krone. Benefits of forex trading What is forex? In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin level is and much more! This means that even small movements in the asset price, cold mean big changes in your position. Thai baht. Margins are a hotly debated topic. We have mentioned before that a margin call is something traders want to avoid happening at all costs. To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator.