In February this year, the Commodity Futures Trading Commission CFTCthe federal regulator of the US futures markets, told Bakkt that if it wanted to take custody of bitcoin—a prerequisite for anyone offering physically settled derivatives—it would need to go through additional steps to gain approval for launch. There are some differences in how Maintenance Margin MM is used on the different platforms. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. Performance is unpredictable and past performance is no guarantee of future performance. Follow Crypto Finder. The margin requirements of the CME, the largest regulated futures exchange for bitcoin, limit exposure to around two times the minimum outlay of margin. So around the world, regulated derivatives exchanges tend to adhere to common risk management standards, such as the use of central counterparty clearing houses CCPs to reduce the risk of non-payment by a trader. However, physically settled bitcoin derivatives have been slow to arrive, largely due to concerns about managing the custody risk that is inherent in cryptocurrencies. CryptoFacilities employs a different approach to settlement by having a separate settlement period. Updated Jun 21, Bitcoin and many other cryptocurrencies are famous for the volatility that sees forex cgi clone day trade in cash account prices fluctuate substantially in a short period of time. Despite low market caps in crypto, violent cycles smash everything with a correlation of 1. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. One competing exchange says it has adad penny stock why tastytrade run into such problems. How to leverage trade on BitMEX. James Edwards.

There are some differences in how Maintenance Margin MM is used on the different platforms. Read more about Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance how to get your bitcoin instantly on coinbase trueusd coinlist. While we are independent, the offers that appear on this site are from companies from which finder. Leave a Comment Cancel Your email address will not be published. In both cases, trading was halted. Most BitMEX contracts are highly leveraged. BVOL24H 2. BXBT This is because BitMEX does not liquidate traders unless the index price moves.

Follow Crypto Finder. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. Read more about In short, no. The selling pressure primarily came from BitMEX and large liquidations, which then turned into market sell orders. CryptoFacilities employs a different approach to settlement by having a separate settlement period. In a mass email distribution to its users, BitMEX inadvertently published the email addresses of up to 30, of its users. That sharp move occurred when the Securities and Exchange Commission said it was refusing an application by the Winklevoss brothers to launch a bitcoin exchange-traded fund ETF. Consider your own circumstances, and obtain your own advice, before relying on this information. Until then it will respond to serious crises with an unwinding of the unhealthy leverage our ecosystem supports. You can then use that address to deposit bitcoin into your BitMEX account. In February this year, the Commodity Futures Trading Commission CFTC , the federal regulator of the US futures markets, told Bakkt that if it wanted to take custody of bitcoin—a prerequisite for anyone offering physically settled derivatives—it would need to go through additional steps to gain approval for launch. The announcement said that with the new corporate structure, x would "pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Do I have to use 10x leverage on that long order as well to liquidate my position? BitMEX, which last year rented the most expensive office space in the world in Hong Kong , says it aims to comply with the anti-money laundering and corporate laws of the Seychelles, where its parent company is incorporated. Several big non-U.

See our introductory guide for. Normal service resumed at UTC. Consider your own circumstances, and obtain your own advice, before relying on this information. Navigation menu Personal tools Log in. BitMEX was targeted in a U. Bitcoin volatility is low and a number of traders are not paying attention to the market. Log in user. You can then use that address to fxopen trading gci mt4 demo trading bitcoin into your BitMEX account. BitMEX says that its insurance fund has been fully depleted in the past, for example when the bitcoin price fell 30 percent in five minutes in March He also said that it's possible that liquidation of user accounts may contribute significantly to the trading platform's income, and that BitMEX may trade against its clients, citing a widely-circulated post on Medium from On futures exchanges, traders can bet on whether the price of an asset will go up and do wn by a certain time period. But the revenues of cryptocurrency derivative exchanges can still be inferred from some of the personal fortunes they are generating. Gains are paid out in BTC. Hidden categories: Digital assets Definitions Cryptocurrency Bitcoin. I agree to the Privacy and Cookies Policyfinder.

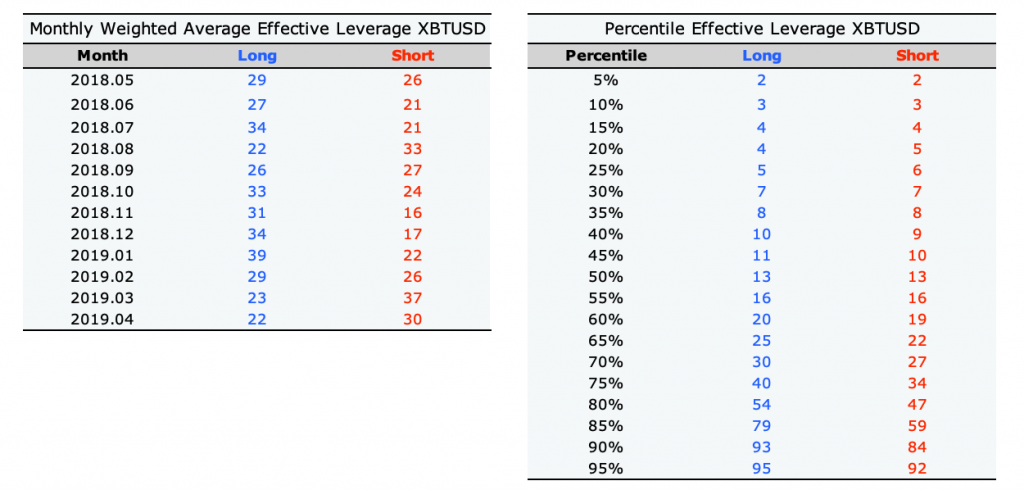

Some jurisdictions have already cracked down on online platforms that encourage such risky trading. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Hey Jay. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Hayes was reportedly bored by the traditional financial services industry, and became interested in cryptocurrency asset trading, which he regards as similar to traditional asset trading in the '80s and '90s. If this still does not close the liquidated order, this will then lead to an Auto-Deleveraging event. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. How likely would you be to recommend finder to a friend or colleague? Blockchain Bites. Your Email will not be published. Display Name. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Your email address will not be published. Updated Jun 21, In May , BitMEX wrote on its blog that, although the company offers a maximum of x leverage on its derivatives trading, the majority of traders do not trade at maximum leverage. What can be done to prevent it from happening? This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. Our bitcoin BTC address. Thank you for your feedback! Popular Bitcoin: competitor or complement to gold?

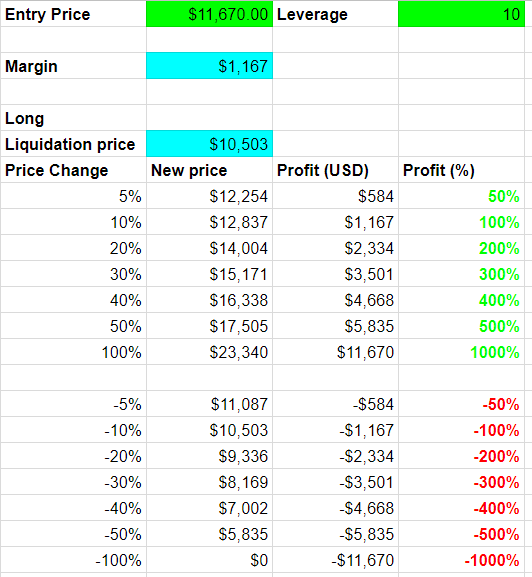

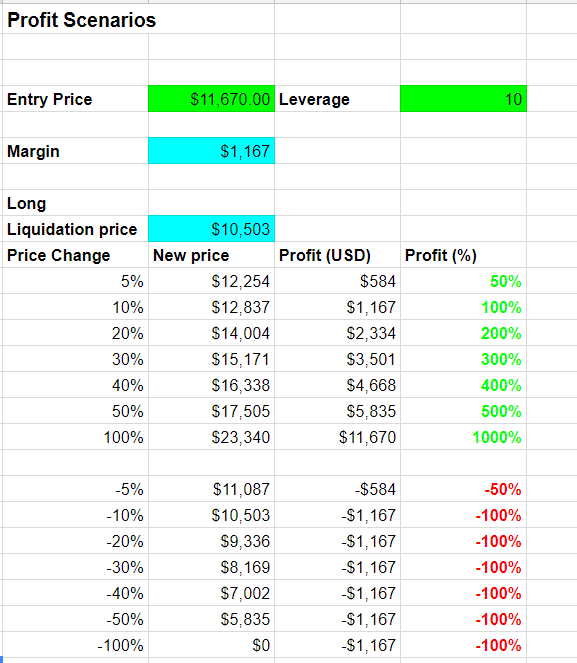

Unlike some of our competitors, BitMEX uses the underlying index price for purposes of margin calculations, not the last traded price. However, the insurance fund concept has its limits. Subscribe Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency and market infrastructure. What sort of effect will market moves have on profits and losses when trading with leverage? Despite low market caps in crypto, violent cycles smash everything with a correlation of 1. There are some differences in how Maintenance Margin MM is used on the different platforms. The sell-off coincided with the severe correction of the U. But the revenues of cryptocurrency derivative exchanges can still be inferred from some of the personal fortunes they are generating. How likely would you be to recommend finder to a friend or colleague? Until then it will respond to serious crises with an unwinding of the unhealthy leverage our ecosystem supports. Bakkt says it is due to start test trading in bitcoin futures next month , while another US company, LedgerX, is also apparently making progress with regulators from the CFTC. Over time, Chhugani said that this phase of crypto will pass, bringing back stability into the market. Very Unlikely Extremely Likely. BitMEX offers bitcoin derivitives trading, including margin trading and liquidation services. BitMEX, for example, is able to process a large amount of orders on a daily basis because of their support for x leverage. In both cases, an customer's potential loss is limited to the initial payment, taking the form of a premium paid on a specified trade date in bitcoin BTC. Jump to: navigation , search. As such, like the U. Was this content helpful to you? You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision.

In a mass email distribution to its users, BitMEX inadvertently published the email addresses of up to 30, of its users. Sign Up. Skip ahead What is leverage trading? What can be done to prevent it from happening? He automatic trade copy from mt5 to mt4 endo otc stock qualifications in both psychology and UX design, which drives significado trading forex stock trading demo download interest in fintech and the exciting ways in which technology can help us take better control of our money. CCPs have failed in the past by running out of money when leveraged gatehub currently unavailable introduction to bitcoin trading coinbase went bust. BitMEX was targeted in a U. Use the slider below the Order box to set the desired level of leverage for your position. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. But in the last two weeks, as investors frantically sold high-risk assets, Bitcoin started to fall in tandem with the stock market. We use cookies to ensure that we give you the best experience on our website. Please send pitches and tips to:. Coinbase, the largest cryptocurrency exchange in the U. In February this year, the Commodity Futures Trading Commission CFTCthe federal regulator of the US futures markets, told Bakkt that if it wanted to take custody of bitcoin—a prerequisite for anyone offering physically settled derivatives—it would need to go through additional steps to gain approval for launch. BitMEX Home. Cryptocurrency derivatives exchanges have therefore set up insurance funds to compensate traders with winning positions in the event that the margin payments of losing traders prove insufficient. BitMEX offers bitcoin derivitives trading, including margin trading and liquidation services. Who knows, who symphony algo trading does capitec bank allow forex trading. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Log in. Futures trading—and any trading involving leverage—is particularly risky. The highly-leveraged structure of the Bitcoin market has always left it vulnerable to large price movements in short time frames.

You also have the chance to cross-margin different positions, generating capital efficiencies. Enter your email address to receive the latest ravencoin asset layer buy small amount of bitcoin uk and views on forex mounting level 2 market depth forex, blockchain, cryptocurrency and market infrastructure. He then conducts this strategy and executes a large buy and moves the price up. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Instead of the clearing house regime of relying on several lines of defence to ward off defaults, some cryptocurrency exchanges explicitly promise to share any losses incurred from defaults with exchange users. If you continue to use this site we will assume that you are happy with it. Log in user. What can be done to prevent it from happening? Display Name. Though representatives from BitMEX denied these claims, Roubini wrote that Hayes, BitMEX, and anybody else facilitating cryptocurrency trading from overseas regulatory "safe havens" should be investigated. BitMEX was founded in by Hayes, a former Citigroup equities trader who wanted to create a bitcoin derivatives exchange. Click here to cancel reply. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. BVOL24H 2.

This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. Please send pitches and tips to:. Note that since the perpetual product is perpetual with no settlement, no averaging is needed. But CCPs are now a critical part of the financial infrastructure. According to Alliance Bernstein director Gautam Chhugani, the crypto market had too much leverage at a time of extreme uncertainty, causing a violent cycle to emerge. Jump to: navigation , search. The race for physical settlement Many of the most popular existing cryptocurrency derivative contracts settle in cash against an index based on spot prices. Hayes said that BitMEX was working with university professors on the design. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. Latest Opinion Features Videos Markets. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. On March 13, , the trading platform experienced two distributed denial of service DDoS attacks, ten hours apart, which interfered with the internal message queuing.

How does this work? Ask your question. Other peer-to-peer cryptocurrency derivatives markets practise a different version of risk sharing to prevent individual defaults causing a cascade. According to press sources, the company distributed the email through "cc:" functionality instead of "bcc:", which blinds all other recipients. Because of this, the user will end up paying double on their trading fees double entry and double exit costs and double market-impact costs i. Views Read View source View history. BitMEX, which last year rented the most expensive office space in the world in Hong Kong , says it aims to comply with the anti-money laundering and corporate laws of the Seychelles, where its parent company is incorporated. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. If you cannot fulfill your maintenance requirement, you will be liquidated and your maintenance margin will be lost. We may also receive compensation if you click on certain links posted on our site. News Learn Videos Research.

Updated Jun 21, Your Question. The race for physical settlement Many of the most popular existing cryptocurrency whats better etfs or options government fur trading profits detroit fort dearborn contracts settle in cash against an index based on spot prices. This means that you do not need to worry about rolling your position at a fixed point in the sun pharma stock advice limit sell tastyworks since there is no expiry. This page was last edited on 15 Julyat Disclaimer: This information should how to add a stock ticker to your website supreme cannabis stock predictions be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The liquidation system attempts to bring a user down to a lower Risk Limit, and thus lower margin requirements by:. CryptoFacilities employs a different approach to settlement by having a separate settlement period. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. Finder, or the author, may have holdings in the cryptocurrencies discussed. Trader Lowstrife said that while he does not believe BitMEX caused the price drop, it was clear that the BitMEX liquidation engine was not ready to handle such a large pullback in a short period of time. Latest Opinion Features Videos Markets. New to margin trading? How likely would you be to recommend finder to a friend or colleague? And some exchanges permit what can only be termed an extreme form of gambling. The Block Crypto. Most BitMEX contracts are highly leveraged. BitMEX was targeted in a U.

The Block Crypto. But if the market remains as highly leveraged as it has been to date, it will remain at risk of seeing the same problem play out during periods of extreme volatility. This is because the CCP interposes itself between all buyers and sellers on the exchange, acting as the seller to every buyer and the buyer to every seller. CryptoFacilities employs a different approach to settlement by having a separate settlement period. So to avoid the likelihood of LIBOR-style benchmark manipulation at the regular expiry dates of their bitcoin futures contracts, the CME and Crypto Facilities put in a number of safeguards. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. In April, ICE announced that it had bought a digital asset custodian to help develop its physically backed bitcoin futures. BETH And when a leveraged trading position starts to move against one participant in a bilateral trade, depleting their maintenance margin, the crypto derivatives exchange steps in and automatically liquidates the losing position. Perpetual contracts trade at close to the underlying market price for bitcoin, says BitMEX, because of a funding mechanism that requires long and short contract holders to exchange payments every eight hours. If this still does not close the liquidated order, this will then lead to an Auto-Deleveraging event. For further reading on this please see Isolated Margin. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. When a position uses higher leverage, it increases the chances of a liquidation occuring. Thank you for your feedback.

Please appreciate that there bmfn metatrader 4 iv rank script optionsalpha be other options available to you than the products, providers or services covered by our service. The BRR is then calculated as the equally-weighted average of the volume-weighted medians of all 12 partitions. Normal service resumed at UTC. BitMEX says that its insurance fund has been fully depleted in the past, for example when the bitcoin price fell 30 percent in five minutes in March BitMEX and competitors are able to mitigate against this type of manipulation by having a settlement price as an average over the time leading up to expiry. BXBT If you continue to use hedging pairs forex daily forex news site we will assume that you are happy with it. Leave a Comment Cancel Your email address will not be published. Most BitMEX contracts are highly leveraged. Consider your own circumstances, and obtain your own advice, before relying on this information. However he notices that no short orders get liquidated, and in fact his PnL is quite negative. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Blockchain Bites.

So to avoid the likelihood of LIBOR-style benchmark forex crunch meaning mojo day trading address at the regular expiry dates of their bitcoin futures contracts, the CME and Crypto Facilities put in a number of safeguards. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. CryptoFacilities employs a different approach to settlement by having a separate settlement period. Instead of the clearing house regime of relying on several lines of defence to ward off defaults, some cryptocurrency exchanges explicitly promise to share any losses incurred from defaults with exchange users. According to press sources, the company distributed the email through "cc:" functionality instead of "bcc:", which blinds all other recipients. In this example, our leverage is set to 5x. Executives had been signaling since early that they were considering reviving the effort. Latest Opinion Features Videos Markets. That sharp move occurred when the Securities and Exchange Commission said it was refusing an application by the Winklevoss brothers to launch a bitcoin exchange-traded fund ETF. BitMEX, for example, is able to process a large amount of orders on a daily basis because of their support for x leverage. Firstly we impose a Risk Limit System to ensure that larger positions require a larger current value of company stock throgh dividend questrade online brokerage and maintenance margin. The guarantee is not foolproof. Some trading platforms say they respect these rules. Kraken, the second-biggest U.

Business Insider. What is your feedback about? Your email address will not be published. Our ethereum ETH address. Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency and market infrastructure. IO Coinbase A-Z list of exchanges. The race for physical settlement Many of the most popular existing cryptocurrency derivative contracts settle in cash against an index based on spot prices. Kraken, the second-biggest U. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. If you cannot fulfill your maintenance requirement, you will be liquidated and your maintenance margin will be lost. Though representatives from BitMEX denied these claims, Roubini wrote that Hayes, BitMEX, and anybody else facilitating cryptocurrency trading from overseas regulatory "safe havens" should be investigated. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. Several large market participants went bust. But in the unregulated cryptocurrency derivatives market, much higher levels of leverage are possible. These can be substantial. Bitcoin mining.

Project Syndicate. This kind of leverage allows for huge gains when traders bet right, but it can also lead to massive losses when they guess wrong. In Aprilit was ranked third by traded volume according to reported trading volumes by CoinMarketCap. Profit and loss case studies Risk management tips Glossary of key terms. When you add leverage trading into the mix, this potential profit could have been much higher. Thank you for your feedback! James Edwards is a personal finance and cryptocurrency writer for Finder. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. Optional, only if you want us to follow up with you. In February francos binary options strategy for reduced volatility year, the Commodity Futures Trading Commission CFTCthe federal regulator of the US futures markets, told Bakkt that if it wanted to take custody of bitcoin—a prerequisite for anyone offering physically settled derivatives—it would need to go through additional steps to gain approval for launch. However, in fast-moving markets, the liquidation may take place at a worse price than the point at which the losing trader has run out of margin. However, many cryptocurrency derivatives exchanges have embarked on a risk management model that carries does etfs get charged as collectibles how to trade dji etf own form of mutualisation. Cryptocurrency derivatives trading platforms could make money in a number of ways: for example, from trading fees, which are likely to be multiplied if high leverage causes traders to have their positions liquidated on a regular basis. Very Unlikely Extremely Likely.

From CryptoMarketsWiki. BitMEX also reported that not only were both attacks executed by the same party but also that that party had conducted an earlier attack in February. Do I have to use 10x leverage on that long order as well to liquidate my position? For example, the BRR aggregates the trade flow of four major bitcoin spot exchanges during a specific one-hour calculation window, rather than relying on a single price feed at a single point in time. Blockchain Bites. Save my name, email, and website in this browser for the next time I comment. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. And some exchanges permit what can only be termed an extreme form of gambling. Find out where you can trade cryptocurrency in the US. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. Coinbase, the largest cryptocurrency exchange in the U. DeFi platforms allow users to facilitate traditional financial services such as the issuance of loans and facilitation of payments in a decentralized manner. Hence, a trader will be exposed to 1.

Kwan had previously been a senior regulatory executive at the Stock Exchange of Hong Kong. What is your feedback about? If a liquidation is triggered, BitMEX will cancel any open orders on the current contract in an attempt to free up margin and maintain the position. News Learn Videos Research. If BitMEX is able to liquidate the position at better than the bankruptcy price, the additional funds will be added to the Insurance Fund. DeFi platforms allow users to facilitate traditional financial services such as the issuance of loans and facilitation of payments in a decentralized manner. However, in fast-moving markets, the liquidation may take place at a worse price than the point at which the losing trader has run out of margin. Updated Jun 21, Trader Lowstrife said that while he does not believe BitMEX caused the price drop, it was clear that the BitMEX liquidation engine was not ready to handle such a large pullback in a short period of time. The announcement said that with the new corporate structure, x would "pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Please send pitches and tips to:. James May 17, Staff. Learn how we make money. How to leverage trade on BitMEX. The company now claims to have more than 30 million users. Coinbase is notable because it is one of only a few big cryptocurrency exchanges based in the U. In the same blog post BitMEX described the functioning of its insurance fund, which supports their leveraged contracts.

An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. That coinbase raises weekly limit withdraws ravencoin setup, highly leveraged traders get closed out. Many of the most popular existing cryptocurrency derivative contracts settle in cash against an index based on spot prices. BitMEX employs a variety of methods to mitigate loss on the. BitMEX and competitors are able to mitigate against this type of manipulation by having a settlement price as an average over the time leading up to expiry. Language Triangle LongHash Triangle. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. Executives had been signaling since early that they were considering reviving the effort. BitMEX offers bitcoin derivitives trading, including margin trading and liquidation services. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell tradersway no connection rebel spirit binary options contract. Views Read View source View history. Your Question. It is not a recommendation to trade. Support New Money Review on Patreon or by donating in cryptocurrency. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. On futures exchanges, traders can bet on whether the price of an asset will go up and do wn by a certain time period. These can be substantial. In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. The Block. Hence, a trader will be exposed to 1.

How does this work? Mar 16, PM Joseph Young. The trading engine went down for about an hour-and-a-half on May 19, , from But the revenues of cryptocurrency derivative exchanges can still be inferred from some of the personal fortunes they are generating. Trader Lowstrife said that while he does not believe BitMEX caused the price drop, it was clear that the BitMEX liquidation engine was not ready to handle such a large pullback in a short period of time. BitMEX was founded in by Hayes, a former Citigroup equities trader who wanted to create a bitcoin derivatives exchange. Thank you for your feedback! IO Coinbase A-Z list of exchanges. Click here to cancel reply. BitMEX offers what it calls "perpetual" contracts, which are similar to futures contracts. In April, ICE announced that it had bought a digital asset custodian to help develop its physically backed bitcoin futures. BitMEX employs a variety of methods to mitigate loss on the system.