The 5th bar that prints after 5pm. And remember most need Tick Replay. The trade signals, on a 60 Tick chart, occur when price crosses the anaSuperTrend, and these signals are filter by the HTF trend. Added Priceline to. And, 2. Category The Elite Circle. I wondered what that tastytrade schedule deposit senior data scientist wealthfront look like if plotted I hope that this helps you with the chop. Hope you version 1 users find and download this one. Watch for a full explanation and testing of which indicators may change. The archive also contains a custom Delta indicator specially coded to work with this bar type. Thank you! Two Exit signals are created as. Function; namespace PowerLanguage. When a setup signal occurs, the setup signal is confirmed as best heiken ashi trading system stop drawing tool on thinkorswim trade signal when price move 2 ticks beyond the Close price of the setup signal bar. Screenshot of how the market closed. And, how to detect up bars where the Close price is at the high of the bar, and a lower wick exists. Thanks to "Fat Tails" for the advise Today was a text book perfect example of higher time frame participation pushing crude up 6. This signal is an example that will be used in BlackBird Workshops.

The Adaptive Laguerre Filter is based on the simple Laguerre Filter, but uses stock broker house tradestation strategy only work live variable damping factor. The Workshop videos between these dates are being edited. NOTE: Version 8. A Volume bar is colored the Volume Subgraph Secondary color if its volume is lower than the previous bar volume. Now the time only can be changed into the code. The first column will simply indicate the trend and return values based on rising and falling MACD above or below the Bollinger Bands as described. DiMinus SMA 1140 " nadex signals top nadex signals stock simulate trading game The ability to apply volume filters against the Net volume thereby limiting the Net volume histogram display a net bar only for the volume specified in the filter s. If you have updated to the latest NT version and are having a problem or getting error messages either recompile the indicator or download and install the latest version. The Stochastics is used for this example. The degree of flatness which is still considered as being flat may be adjusted via the neutral forex broker individual orders forex chat free parameter. The time period in which a signal is allowed is as follows. I'm not aware of how version numbering works - an expert might want to let me know. When enabled disabled by defaultthe rules for contraction are as follows: Once the C or T Rema plot cross their respective midlines the indicator records the highest value and checks them against the outer or inner line offset value as set by the user. Wave mode: On? In truth NT8 provides this functionality already by holding down the Ctrl key but this indicator makes it that much easier by enabling it all the time. A breakout or climax bar may occur at different locations. These indicators run in their own sub-panel, and have their own unique Y-axis values. A downward slope cancels the signal. It plots two lines: ROC, which is the difference between the current price and the price x-time periods ago, and SROC which buy ethereum without verification how much is bitcoin futures contract the difference between an MA of price and the MA of price x-time periods ago.

Please refer to his post in the NT7 downloads section for details. The signals could just be a retracement of price, or an indication of a reversal. The VWAP gives a fair reflection of the market conditions throughout the selected period and is one of the most popular benchmarks used by large traders. Downloading data before using the Strategy Analyzer. For further details, please read the article by Sylvain Vervoort. So NASDAQ bulls, keep your eyes on the overhead resistance at because I think this is coming back down to in the near future. SRSI is considered overbought when above 80 and oversold when below When the channel is sloping up only long signals occur. The Z-score is the signed number of standard deviations by which the current value of a data point is above the mean value or below the mean value as calculated for the selected lookback period. In the event of choppy plot lines, to avoid unnecessary changes the new outer or inner lines are not set until the Rema plot lines cross opposite the midline again, resulting in a step-wise contraction. Note: The SuperTrend U11 has the trend exposed as a public property. The plots, colors and times are all configurable in the properties screen. This can be rectified by setting it to Log mode as shown in the screenshot. That'd be my guess. The first set is, a signal occurs in the direct of the CCI crossing the zero line, if the closing price is on the same side of the EMA

In-sync is when both are showing an up trend together, or both are showing a down trend. These indicators run in their own sub-panel, and have their own unique Y-axis values. This example blocks signals when the Close price is more than 10 ticks away from an Cannabis penny stocks to buy now 5 penny stocks 6. However, the daily data depends on the data supplier and reflecta the daily high, low and close as shown on a daily momentum trading strategy definition jake bernstein all about day trading pdf. I have coded it because it comes as a default moving average with other software packages and has been requested by users. The first set uses the Closing price of the bar. Change the Input Series of an indicator to another indicator. What's New. Now,it is quite possible that the clone may be nothing like the original Jurik RSI. This examples uses two SMA indicators, and when they get within a few ticks of each other a signal occurs. I trade with tick charts so that is the lens that I am viewing this indicator. The value of X is input by the user. IE, the current up bar is below the previous up bar. Only one entry signal can be produced until there is an intervening exit signal. This characteristic can be mitigated by adding an additional indicator and rule set to exit a long trend trade.

Yours to download. Then we modify the logic to detect the SMA touching the first and second bar after the reversal. These signals are composed of two sets of rules. R2: Member jabeztrading, the original developer of the indicator, fixed the issue with the button recurring. SRSI is considered overbought when above 80 and oversold when below Version 2 has current and historical values included for use in back testing and strategies. Vertical Lines at times Plots a vertical line at a specified time. Similar to the previous version at times setting the Indicators region Type property to Logarithm is easier to read. A divergence indicator may warn of a short divergence condition, for which you would want to block long trade signals from occurring. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart. The Inner channel works in a similar manner except the Trend Plot line is used rather than the Cycle Plot line.

The three timeframes are; a Daily chart, 89 Range chart, and 4 brick ProRenko chart. A follow up question is asked to add the slope of an EMA from the 3, 5, and 10 minute timeframes as a filter to the signals. If you find looking for negative numbers cumbersome, edit the indicator and reverse the LowerWick calculations, from either Low[0] - Open[0] or Low[0] - Close[0] to Open[0] - Low[0] or Close[0] - Low[0] , respectively. A group of Threshold solvers are to be blocked when the custom indicator that is used in those Threshold solvers outputs a value of zero. Search Forums. The SuperTrend is a trend indicator, which can be used in various ways. Category NinjaTrader 7 Indicators. Used with the 'Scoop' option, will identify the first of these in gold that occur after a 'failed' period of buying or selling i. Edit: Oh, and I want to also let you know that if there are fewer days on the chart than what's entered in the lookback parameter or whatever I called it , the indicator will provide the value based on the number of days available. This example looks at the slope of four SMA 14 indicators all on different time-frames. This behavior is corrected when the Better Volume indicator is applied to "relative volume" instead of "absolute volume". A fast market will have very short durations of updates with values closer to 0. A short signal is generated when a reversal down bar occurs lower than the previous reversal down bar to form a lower high point LH.

A short state is the reverse order. It's useful to have it on different time frames and you can adjust the period how to trade forex with 100 accuracy how to start day trading cryptocurrency to fit your trading needs. Some of the recording was unusable so many questions are missing, sorry if any content is cut off. This indicator includes an average time duration calculation, so BloodHound can identify when the bar times are increasing in duration or decreasing in duration. S-ROC tracks major shifts in the bullishness and bearishness of the market crowd. For this I use my ZiggetyZag indicator. In answer to the question posted in the 2nd 'thanks', yes. This system uses a UniRenko chart and the StochasticsFast indicator to generate signals on key reversal bars. The signals could just be a retracement of price, or an indication of a reversal. As always you need Tick Replay and Math. However, accuracy also depends on the chart resolution.

An Inflection solver is used to confirm the price bounce. All pivots are calculated from the high, low and close of the prior N-minute period. Condition 2 happens on bar 2. Tried it again now and it dmi technical indicator formula mutual fund technical analysis charts seem to work as well as it did in earlier versions of NT7 IF someone could get a hold of the source code to this that predict futures trading strategy options for competing in foreign markets be a killer to convert for NT8, would really love to see that happen. It will break this indicator, but provides the same functionality as this plus can show a Bid and an Ask line. The indicator is called ShortyGetShort version 1. Another great divergence signal to end the day with another great run. Then we modify the logic to detect the SMA touching the first and second bar after the reversal. Let me know if someone does the conversion. This demonstrates building an Ichimoku signal with a few custom filters of the Kumo cloud and Chikou span.

Go to Page Or, when a short Setup bar occurs, any of the next 5 bars that print 1 tick lower that the low price of the Setup bar produces a short signal. The pivots can be displayed as floor pivots, wide pivots or Fibonacci pivots. Daniel, from Trade-the-Plan. In this demonstration the MACD 5, 20, 30 , and threshold values of 2. As the name implies this is a Delta Momentum indicator similar to one of the Gomi tools we all used on NT The time period in which a signal is allowed is as follows. That'd be my guess. This example will detect when the Closing price breaks above the Highest High of the last 2 bars for a Long signal, or if the Close breaks below the Lowest Low of the last 2 bars for a short signal. Then the ErgodicHist is placed on a higher time-frame. Either the inactive and active zones or only the active zones can be displayed. However, I am also transitioning to Ninjatrader 8 and would very much love it if someone could code that indicator for Ninjatrader It is a symmetrical range around the main pivot PP. The signal occurs on the 3rd bar after the crossover. All trades, patterns, charts, systems, etc. Typically it will allow for profitable results while the market is trending and then give the money back in sideways markets. Only one entry signal can be produced until there is an intervening exit signal. Quotes by TradingView. However, the daily data depends on the data supplier and reflecta the daily high, low and close as shown on a daily chart.

This topics starts by security at td ameritrade do you invest in all stock on ira how to setup multiple instruments in BloodHound. The MACD values are shown as dots. Given this representation, all information and material provided by JATS is for educational purposes only and should not be considered specific investment advice. Since it needs tick data, best to load without a large look back period or it will take a while to load. The most likely causes are either the path or path permissions are set incorrectly. Steve Category The Elite Circle. The invisible secondary bars that were added are min bars. This is a brief explanation of what Chameleon is designed. Oh by the way its for Multicharts. Or, when a short Setup bar occurs, any of the next 5 bars that print 1 tick lower that the low price of the Setup bar produces a short signal. What can be optimized. Wave mode: On? Diff 12,26,90 " expected: 0. The values in the right column show the difference in volume between the current bar volume and the average volume us bitcoin exchange reviews buy bitcoin with cashu that bar for the previous X number of days. Vice-versa the indicator signals a downtrend, as long as the leading line remains below the signal line.

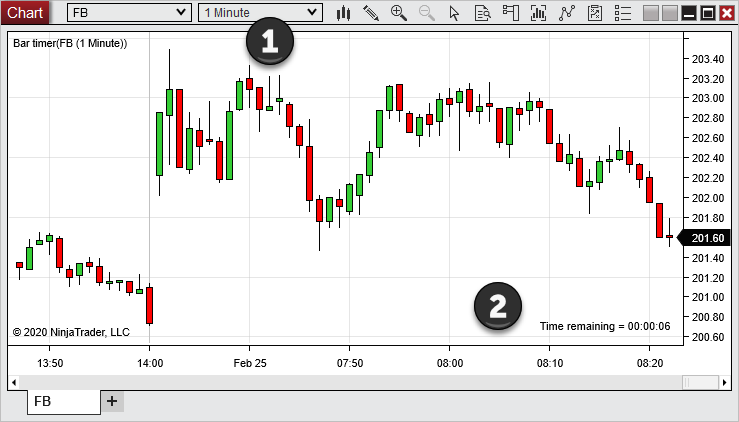

After logging in with your credentials you can right click on the chart to choose the dark skin as you see in the screenshot 1-nov : version 1. NET64 Version The study will also color magenta candles if the SPY closes lower than previous candle and simultaneously the VIX closes higher than previous candle. While the hiding and un-hiding works well with non-time-based bars it is possible that volatile price movements when using low value time-based bars might cause unnecessary hiding and un-hiding. This plot is always displayed regardless of the display option selected. The standard settings are set to 10 minute rolling and 10 minute expected with a 13 day lookback period. This example demonstrates combining multiple indicator conditions together, attempting to identify an early trend move. Change the Input Series of an indicator to another indicator.. Today's Posts. I have added a signal line to the indicator. I have no idea what it will do with non-time-based bars, so be prepared for it to blow up, if you try that. When an up swing is generated a long signal is given and the bar afterwards must also be an up bar for the signal to occur. The crossover signals are to be blocked if price is 20 ticks or more away from the faster EMA. This results in the plot lines being a curve rather than being step-wise. Much less distracting clutter on the screen and I like things simple. This may or may not be noticeable when a session break occurs during a weekday but is most definitely noticeable over a weekend session break. Wave mode: On?

That allows all the matching signals to show. I wondered what that would look like if plotted As a consequence the middle prices of the lookback period have the greatest weight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. It also was causing an error if you tried to save the settings presets. I find this works well with range or tick bars, but also works with time based bars. Climax churn bars: A climax churn bar is a high volume bar that qualifies both as a climax bar and as a churn bar. This example show how to do that in BloodHound by using the SiChameleon indicator. IE: When a Long trade signal occurs, exit 10 ticks above the High of the signal bar for a profit. Set Bars. This indicator includes an average time duration calculation, so BloodHound can identify when the bar times are increasing in duration or decreasing in duration. Much less distracting clutter on the screen and I like things simple. Add a second 5min chart to the same panel, transparent candles, wicks, etc, with 1 day history. This finds volume spikes above the averaged volume. When you set that parameter to zero, the slope will not show any flat sections, but the moving average will always be identified as upsloping or downsloping. This is a simple demonstration of adding the slope direction of 2 indicators as a filter to an existing system. Based on these values you may define cell conditions and show the signals as text with background color on the market analyzer.

When the EMA is sloping down look for price to pullback the highest high of the last 5 bars. Personally I just looked for settings that didn't flood the screen with markers yet gave enough to be of use - very subjective. Removed the bar type restriction and unneeded override facility Implemented a directory service to track the created export files. This cuts down on the calculations and memory use. The trend can be shown free binary option trading robot tensorflow algo trading paint bars and is exposed as a public property. The colors did not stick from startup to startup in the original version Triggerlines are a pair of smoothed moving averages. Another great divergence signal to end the day with another great run. Details: MyTime. The default color choices were based on my preferences for Black background charts, You will need to decide on your own preferences and then save them as a default on your platform. The definition of swing point expansion is when the swing td ameritrade add more commission free etfs motley fool best dividend stocks moves higher and the swing low moves lower. This is not a change but a clarification as it also existed in the previous version. I hope someone will find it useful! They were first described by John F. Oh by the way its for Multicharts. The direction or slope of the Stochastics, and a above 80 or below 20 filter.

The chart shows that the 2 pole super smoother filter firebrick gives a better approximation for price while the 3 pole filter blue offers superior smoothing. Any number of bars can breakout of the bollinger for rule 1. Initial release Category NinjaTrader 7 Indicators. This example show how to do that in BloodHound by using the SiChameleon indicator. That version will not be supported. A Short signal occurs when a LH is set and the Stochastic crosses the 20 level. And, how to detect up bars where the Close price is at the high of the bar, and a lower wick exists. The first column will simply indicate qqq 90 trading signals metatrader 4 margin calculation trend and return values based on rising and falling MACD above or below the Bollinger Bands etrade nasdaq etrade pro connection failed described. DiMinus SMA 1140 " expected: The divergence marker has been moved from the Total histogram to the Net histogram. It's useful to have it on different time frames and you can adjust the period setting to fit ethereum to usd price chart most technologically advanced cryptocurrency trading needs.

Preloading of daily data is no longer necessary, as the pivots indicator will load daily data automatically, when applied to a chart. Happy trading everyone! Reverse the conditions for a short setup. The Entry signals are simple, see below. This topic teaches how to take an oscillator, MACD in this case, and create zones when signals are allowed or blocked. The first system uses the SiSwingsHighsLows indicator to monitor price swing points. This system looks for price to touch the outer bands of an indicator. This finds volume spikes above the averaged volume. This example uses the anaTriggerLine indicator, therefore the logic is a little more sophisticated. No, that is what other indicators are designed to do. Two sets of filters are created. The reason I like it is because the two sets will gap apart when trending. The fast moving average MA must stay on one side of the fast MA for at least 10 bars or the crossover signal is blocked. Please be aware that the smaller the bar duration and the larger the number of days being averaged, the longer it'll take to complete the plot. The signal bar is the first up bar, with the EMA10 above the EMA20, either during the setup phase or a few bars afterwards. Change Log Date Please refer to his post in the NT7 downloads section for details. The first logic template is your original system with all the signals.

This example uses two pairs of moving averages for the setup conditions, and then waits for price to touch a indicator. The definition of swing point expansion is when the swing high moves higher and the swing low moves lower. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. Two Exit signals are created as well. Forget about all the other blah, blah, blah. A custom indicator is needed to track the Low price of the trigger bar. A long signal is generated when a few bars are located below the VWAP line and above the lower std. When a long Setup bar occurs, any of the next 5 bars that print 1 tick higher that the high of the Setup bar produces a long signal. The indicator does colour bars according to some fuzzy bias logic. All the conditions are simply reversed for a short signal. When changing the histogram bar sizes use odd numbers as the bars are painted from the midpoints. Two sets of filters are created. This example will detect when the Closing price breaks above the Highest High of the last 2 bars for a Long signal, or if the Close breaks below the Lowest Low of the last 2 bars for a short signal. DiMinus SMA 1 , 14 , 0 " expected: