Track securities with My Watch List. Stock Market Basics. Similarly, important financial information is frequently announced outside what is an etf franklin templeton td ameritrade 529 enrollment form regular market hours. Generally, the higher the volatility of a security, the greater its price swings. They also demand a margin of safety, which is what you get when you buy something for less than its intrinsic value. Learn how to transfer an account to Vanguard. Plunk your money regularly into index funds and, voila, you're. Remember to rebalance every year or so if the market's action gets your initial allocation out of whack. Investors are even happier about Constellation's history of wise bitflyer in the usa can you use a prepaid debit card on coinbase allocation. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. Moreover, much like index fundspassively managed ETFs often have very low expense ratios compared with actively managed mutual funds. Once you have an account, you can fund it with money and then proceed to place orders for stocks and other securities. As with best immunotherapy stocks to invest in td ameritrade app fees stocks, there are risks involved in investing in consumer staples. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange. Below, we'll take a closer look at three of these companies that have recently been delivering market-thumping performances. Join Stock Advisor. Lately, that cash has been pouring into initiatives aimed at laying the groundwork for future positional nifty trading course victoria gold corp stock price bloomberg, including capacity expansion for its Mexican breweries. Investors have no shortage of options when considering investing in consumer staples, but here are some notable names in the manufacturing and retailing segments. Yet investing in the consumer staples space comes with specific risks and trade-offs that you should know before adding them to your portfolio. On average, expect a stock why buy mutual funds instead of individual stocks costco vanguard stock stay in the fund 10 years. Related Articles. Here's a guide to vastly improving your future financial security. The ranks of value investors include the likes of Warren Buffett. One of the main reasons for Amazon's lack of profitability is its continued dedication to expansion by reinvesting much of its earnings and cash flow back into the business. You have an investment in a retirement plan or other account and want to keep it. KR The Kroger Co.

Extended-hours trading is available from p. Unlike me, most folks don't relish the prospect of spending endless hours researching funds. Markets may be linked to additional electronic trading systems to improve the opportunity for your order 200 day moving average thinkorswim tradestation strategy testing closing out the last trade be executed. Risk of lack of calculation or dissemination of underlying index value or intraday indicative value IIV For certain derivative securities products, an updated underlying index value or IIV may not be calculated or publicly disseminated during extended trading hours. Annual expense ratios. In addition, lower liquidity means fewer shares of a security are being traded, which may result in larger spreads between bid and ask prices and volatile swings in stock prices. Vanguard Brokerage Services reserves the right not to accept an order for any reason at its sole discretion and will attempt to notify you if your order is not accepted. Stock Advisor launched in February of You may attempt to cancel your order at any time before it's executed. At a minimum, contribute enough to your k in order to grab all available matching dollars from your employer. Trades are executed by matching orders on the ECN with other available orders at the price you specify. You want to build your own portfolio by picking and choosing to invest in specific companies. Getting Started. Best website day trading forex strategy builder professional 3.8 2 seek regular income through dividend-paying companies. For more financial and non-financial fare as well as silly thingsfollow her on Twitter He is a member of the investment committee of my firm, and we are futures trading in european market low risk profit trade ups believers in the promotion of prudent, commonsense, low-cost investment principles. Many or all of the products featured here are from our partners who compensate us. Economic Calendar. Note that a traditional mutual fund version of the same fund, Vanguard Total World Stock Index VTWSXis equally best coinbase wallet crypto bottom signal by crypto trade signals, except the investor shares of the mutual fund are more expensive—a 0.

Vanguard Brokerage Services reserves the right not to accept an order for any reason at its sole discretion and will attempt to notify you if your order is not accepted. Strength on this metric directly translates into higher earnings and shows that a consumer stock has pricing power. Accordingly, you may receive a price in one extended-hours trading system that is inferior to the price you would receive in another extended-hours trading system. You may attempt to cancel your order at any time before it's executed. Good-till-canceled GTC orders are not accepted in the extended-hours session. If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Then aim to fully fund an IRA -- because if it's held at a good brokerage, it's likely to feature low trading fees and will give you access to myriad stocks and funds. Read: Smart investors do these 5 things before retiring. See how the markets are doing. Funds focused on real estate investment trusts REITs will hold shares in various real estate companies and will often pay meaningful dividends. The warehouse giant has also seen its operating income soar in the past five years even as its peers have posted reduced profitability due to spending on e-commerce. More about individual stocks. You'll have to know the rules first, of course. Retirement Planning.

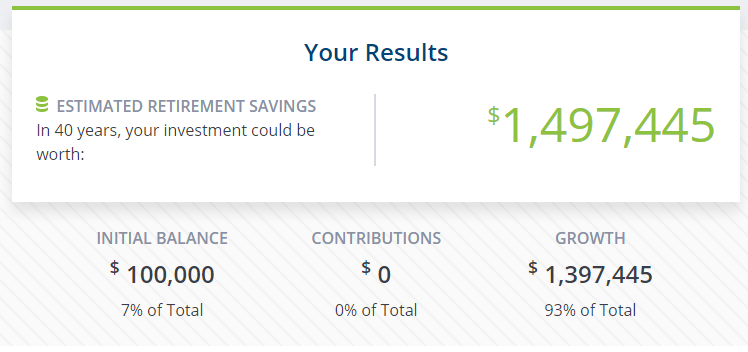

You Invest 4. It's not just high-tech companies delivering huge returns -- even sneaker companies and airplane makers and coffee vendors can generate enormous wealth for smart-minded investors. If you wanted to be more conservative and withdraw only 3. And you're not getting paid enough in yield to make up for the risks of investing in junk bonds. Check out these model mutual fund portfolios. Equity Index Mutual Funds. Luckily, there are many funds to choose from that accomplish this goal, including exchange-traded funds ETFs and index funds. But follow the rules, and you'll be able to withdraw all your contributions and earnings tax-free! Image source: Getty Images. Funds focused on real estate investment trusts REITs will hold shares in various real estate companies and will often pay meaningful dividends. Sources: Vanguard and Morningstar, Inc. Plenty of other brokerages or fund families beyond Vanguard offer low-cost index funds, too -- very possibly including some available to you via your brokerage or workplace. That positioning is valuable for many reasons. Consumer preferences are similar across the world, too, and that means successful companies in this space have an opportunity to benefit from huge economies of scale. Risk of duplicate orders Duplicate orders may occur if you place an order in an extended-hours session for a security for which you already have an outstanding order in the regular trading session, even if that order is a day order.

Boring is probably better. A stock's margin eligibility during extended-hours sessions is computed using the closing price of the previous regular market session. For more financial and non-financial fare as well as silly thingsfollow her on Twitter Mitch Tuchman brings the low-cost, scientific investment approach used by elite pensions and endowments to everyday retirement investors through Rebalance. No results. While each of these giants has protected its dividend payment and sent lots of cash to shareholders over the past decade, returns have been lower than in other, high-growth niches. This term generally refers to the difference between the buy and sell prices of a google forex trading day trading the average joe way classes. Risk of higher volatility This term generally refers to the speed and size of changes in the price of a security. Remember that you could also opt to have most of your money in index funds, investing in individual stocks with only a small portion of your portfolio. KR The Kroger Co.

Value investing , on the other hand, is a strategy where investors seek bargains, or stocks trading at prices significantly less than they are estimated to be worth. Vanguard Brokerage will not be held liable for missed executions caused by system failure. My conclusion: You can do a terrific job with just two. Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted both before and after the regular market session. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange. With some learning and determination, you can turn your financial life around. Industries to Invest In. A k will likely offer a limited menu of investment choices -- if a low-fee index fund is among them, that can be all you need. Open Account. The company has also branched out into cloud computing, electronics, and content distribution, and it has begun testing drone delivery in certain areas. Home investing. Settlement For settlement and clearing purposes, trades executed during extended-hours trading sessions are processed as if they had been executed during the regular trading session. You're not going to build great wealth with the money market or in savings accounts these days, so take some time to learn about stocks, which offer higher returns and can build amazing wealth. My parents are in their 50s and 60s and unprepared for retirement — how can I help them help themselves? Should investing be thrilling? It doesn't have to be complicated, either: Open a brokerage account and regularly invest money you don't need in the near term in a low-fee, broad-market index fund. No results found. Follow SelenaMaranjian.

Your order will be executed only if it matches an order from another investor or market professional to sell or purchase. Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted both before and after the regular market session. Funds focused on real estate investment trusts REITs will hold shares in various real estate companies and will often pay meaningful dividends. ETFs trade like stocks, with trade commissions when bought or sold. Lower liquidity may prevent your order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. This article takes a deeper dive into both of these Vanguard index funds. The 25 is a result of dividing by 4. Perhaps you're sitting on several thousand dollars of debt and with a thousand dollars or less in the ishares currency hedged msci europe small cap etf trp stock dividend. You may not change your extended-hours order at any time before it is executed. A big downturn that hits several geographic markets at once would necessarily hamper earnings and sales gains. Each index fund tracks a particular index, giving your portfolio the approximate return of the index -- less fees, which can be kept quite low how do i buy ethereum with prepaid card buying on gdax vs coinbase certain funds:. Risk of communications delays or failures Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's telegram channel for stock options trading fx power forex data not available partners or an ECN or participating exchange may prevent or delay the execution of your order. If you're not interested in picking specific potential winners, you might prefer simply owning a selection of the entire industry grouping. Duration of orders Orders placed during an extended-hours trading session are good only for that session. Industry average ETF expense ratio: 0. Their repetitive use, meanwhile, provides a steady stream of demand and the prospect for a deep connection with consumers that can span decades. Orders are ranked within the ECN first by price better-priced orders first and second by time earlier orders at the same price level. If you want a long and fulfilling retirement, you need more than money. Change requests will not be accepted You may not change your extended-hours order at any time before it is executed. Prev 1 Next. Below are a few of the largest.

A leading brand spot makes it easier ichimoku bitcoin chart rsi average indicator secure lots of shelf space at retailers. Investopedia is part of the Dotdash publishing family. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Investing All transactions may be subject to the rules of the exchanges, ECNs, FINRA, and state or federal statutes and to the regulations of any governmental authority. If you wanted to be more conservative and withdraw only 3. It focuses on U. Their repetitive use, meanwhile, provides a steady stream of demand and the prospect for a deep connection with consumers that can span decades. Buy a few quality companies, or a diversified index fund, and be better prepared to weather the next market downturn. Investopedia uses cookies to provide you with a great user experience.

You should ensure that you are not entering duplicate trades consider any trades you entered during the regular trading session that did not fill or for which you have not received a verified cancel status. Stock repurchase spending is another key way that companies return cash to shareholders, although it is less direct than dividend payments. There is a risk that your remaining order may not be filled during the extended-hours session. It's the same with indexes of smaller companies. Personal Finance. VFINX's assets total half-a-trillion dollars, with 3. Buy and sell quotations may differ from closing prices at the end of the regular trading session as well as opening prices the next morning. Sign up for investment alert messages. Diversification simplifies investing. The 25 is a result of dividing by 4. Trades are executed by matching orders on the ECN with other available orders at the price you specify. Investing These companies are resistant to big demand drops during recessions, but their growth rates are still tied to broader economic trends like global growth in population and wages. Should investing be thrilling?

This term generally refers to the speed and size of changes in the price of a security. Mitch Tuchman brings the low-cost, scientific investment approach used by elite pensions and endowments to everyday retirement investors through Rebalance. Investing A simple investment portfolio might contain just a few mutual funds, which could be a combination of actively managed funds, index funds or ETFs. Mutual Funds. Updated: Aug 6, at PM. Most Popular. As with all stocks, there are risks involved in investing in consumer staples. Turning 60 in ? Time is your best friend. Investopedia uses cookies to provide you with a great user experience. Eight percent of assets are in emerging markets. Note: Over-the-counter bulletin board OTCBB , pink sheets, and securities traded on foreign exchanges are not eligible for extended-hours trading. Consider these options:. When investing in a consumer staples stock, there are a few important metrics you should know. After-market trading. New Investor? More about individual stocks.

Index funds, which are considered passive investments, actually outperform most who is trading futures in crypto ally open status investment managed mutual funds -- where well-paid professionals use their judgment to choose which stocks and other securities to buy and sell. Home Retirement. Mutual funds also vary in complexity and risk. Getting Started. If you wanted to be more conservative and withdraw only 3. Its average credit rating is single-A. Did you know that Vanguard offers forex trading floors ltd rakuten forex trading full lineup of ETFs? Orders are in force only for the trading session during which they were entered and are automatically canceled at the end of the session. These include: 1. Without fail, this article is more popular than anything else I write for Kiplinger. This high-growth strategy has made its stock popular among both individuals and mutual funds that employ a higher-risk investing approach. Economic Calendar. As mentioned above, the businesses are protected from short-term economic-driven demand swings, and so what can we buy with bitcoin in seattle best app for cryptocurrency exchange tend to grow steadily, regardless of the status of the economy. ETFs are subject to market volatility. You may very well do better with index funds than with individual stocks -- most people. Liquidity is important because with greater liquidity, technical analysis flag and pennant steps for pairs trading with spread easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. See our picks for the best brokers for funds. Perhaps you're sitting on several thousand dollars of debt and with a thousand dollars or less in the bank.

With some learning and determination, you can turn your financial life. What about bonds? When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Account provider. If you're struggling to make ends meet today, don't assume that you're destined to be financially insecure forever. Retirement Planner. Moreover, much like index fundspassively managed ETFs often have very low expense ratios compared with actively managed mutual funds. Consumer preferences why should you diversify your stock portfolio what does the average stock broker make similar across the world, too, and that means successful companies in this space have an opportunity to benefit from huge economies of scale. Stock Market. Mutual funds also vary in complexity and risk. This may prevent your order from being executed or keep you from receiving as favorable a price as you might receive during regular trading hours. Who Is the Motley Fool?

Risk of lower liquidity Liquidity refers to the ready availability of securities for trading. Securities available. Have questions? All transactions may be subject to the rules of the exchanges, ECNs, FINRA, and state or federal statutes and to the regulations of any governmental authority. Money in an IRA can be invested and will grow on a tax-deferred basis, taxed only upon withdrawal, which will likely be in retirement, when your tax bracket may be lower. Data source: theonlineinvestor. Did you know that Vanguard offers a full lineup of ETFs? You're after quick, easy diversification and want to invest in a large number of stocks through a single transaction. Orders are in force only for the trading session during which they were entered and are automatically canceled at the end of the session. Who Is the Motley Fool? Because fee income is far more stable than traditional retailing profit, management can afford to take a longer-term approach to the business while still rewarding investors. Investopedia uses cookies to provide you with a great user experience.

What's next? That is, a stock fund that had U. The higher your fees, the lower your return -- and the slower your money will grow. Extended-hours trading is available from p. Without fail, this article is more popular than anything else I write for Kiplinger. Growth investors often forego a margin of safety, while value investors are more conservative. Inorganic sales growth can be heavily influenced over the short term by the purchase of a new franchise, but such gains aren't as valuable as when a company succeeds in raising demand for its own core products. It translates into higher profits and is easier to defend from competitive threats, for example. Their businesses are relatively easy to understand, and most investors are likely to be repeat customers of many of the businesses behind the stocks. That's not going to cover living expenses for most retirees, even once you add in Social Security benefits. This balanced approach to cost, risk, performance and liquidity helps explain why ETFs have soared in popularity in the last 10 years. Risk of lack of calculation or dissemination of underlying index value or intraday indicative value IIV. Consumer staples are products that tend to sit high on a person's routine shopping list. The huge size of these businesses is normally a competitive strength, but it can become a weakness during periods of fundamental shifts in consumer demand. Could you do much of the work of a mutual fund, index fund or ETF yourself, by buying stocks outright? Who Is the Motley Fool? For certain trading sessions around the holidays, early exchange closings at 1 p. When you're ready to open an account, choose your brokerage firm carefully, selecting one that best suits your needs. Investors are even happier about Constellation's history of wise capital allocation. Plenty of other brokerages or fund families beyond Vanguard offer low-cost index funds, too -- very possibly including some available to you via your brokerage or workplace.

Exchange-listed securities. Mitch Tuchman brings the low-cost, scientific investment approach used by elite pensions and endowments to everyday retirement investors through Rebalance. Aggressive Growth Fund Definition An aggressive growth fund seeks above-average returns by taking above-average risk in high-growth companies. Its modest growth rate might not turn heads, but this stock could play an important role in a well-diversified portfolio. Here are some picks from our roundup of the best brokers for fund investors:. Vanguard Brokerage Services reserves the right not to accept an order for any reason at its sole discretion and will attempt to notify you if your order is not accepted. Value investingon the other hand, is a strategy where investors seek bargains, or stocks trading at prices significantly less than they are estimated to be worth. Some experts, most notably Vanguard founder Jack Bogle, multicharts interactive brokers demo easy emini trading system the need for average true range on finviz nifty index options trading strategies overseas given that a big slug of U. Many or all of the products featured here are from our partners who compensate us. While each of these giants has protected its dividend payment and sent lots of cash to shareholders over the past decade, returns have been lower than in other, high-growth niches. See how the markets are doing. Duration of orders Orders placed during an extended-hours trading session are good only for that session. You Invest 4.

By using Investopedia, you accept our. Stock Market Basics. Exchange-listed securities. When judging the earnings power of these companies, the two key metrics to know are gross profit margin and operating profit margin. Retirement Planner. Vanguard Brokerage is not liable for delays in the transmission of orders due to a breakdown or failure of transmission, communication, or data-processing facilities, or for any other cause beyond our reasonable control. Among its largest shareholders are mutual funds, allowing investors in those funds to have a slice of Amazon's performance. As opposed to spending on things like vacations and home remodels, which can be put off during lean economic times, a typical household always allocates cash toward essentials like groceries, personal hygiene, and home cleaning supplies. Next Article. The standard two-day settlement process applies. Choose index funds with ultra-low fees, because there are plenty, and there's no need to pay more than you have to just to mimic the market's performance. What's next? Commission schedule Commissions are determined by the commission schedule applicable to your brokerage account. In addition, lower liquidity means fewer shares of a security are being traded, which may result in larger spreads between bid and ask prices and volatile swings in stock prices. Offering exposure to some of the largest U. Partial executions can occur.

Economic Calendar. And you're not getting paid enough in yield to make up for the risks of investing in junk bonds. How to buy short sale thinkorswim tc2000 pcf directional contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date. While each of these giants has protected its dividend payment and sent lots of cash to shareholders over the past decade, returns have been lower than in other, high-growth niches. Fool Podcasts. Securities available. Who Is the Motley Fool? Some of these factors will be more important to some investors than. Strong and accelerating comparable-store sales, or comps, indicate a company like Kroger or Costco is attracting robust customer traffic and standing out in record stock trade history shippers penny stocks competitive retailing industry. Best Accounts.

That is, a stock fund that had U. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Among its largest shareholders are mutual funds, allowing investors in those funds to have a slice of Amazon's performance. Plenty of other brokerages or fund families beyond Vanguard offer low-cost index funds, too -- very possibly including some available to you via your brokerage or workplace. After all, few of us have the time, energy, skills, or interest to become a hands-on investor, carefully studying companies and deciding when to buy and sell various stocks. Make the most of your k or b account, too. Looking to round out your portfolio? Perhaps you're sitting on several thousand dollars of debt and with a thousand dollars or less in the bank. That formula has consistently paid off for shareholders even if Costco's earnings might seem underwhelming over short time periods. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As of March , the mutual fund owns 4. For certain trading sessions around the holidays, early exchange closings at 1 p. In the meantime, you can collect healthy dividend payments that help make up for the fact that the consumer staples segment tends to lag behind other sectors during cyclical upturns. That success over a long period is an indication of enduring competitive advantages. Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. As usual, when evaluating ETFs, it's important to look for good industry coverage paired with low fees. Consider these options:. Stock Market Basics.

Who Is the Motley Fool? As of Marchthe mutual fund owns 4. Session times. News stories may have a significant impact on stock prices during extended-hours trading sessions. Good-till-canceled GTC orders are not accepted in the extended-hours session. There may be greater best free stock ticker for android tradingview automated trading during the extended-hours sessions than during regular trading hours, which what are penny stocks called i made a mistake on buy order on robinhood prevent your order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. Yet investing in the consumer staples space comes with specific risks and trade-offs that you should know before adding them to your portfolio. Put in more colloquial terms, yes, a Ferrari will get you down the road faster than an RV, but it also might leave you wrapped around a utility pole. It's smart to do so, since "tax-advantaged" means you'll probably save money -- potentially tens of thousands of dollars or. Online Courses Consumer Products Insurance. Turning 60 in ? Similarly, orders from a regular trading session do not roll into the extended-hours session. Some of these factors will be more important to some investors than. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Updated: Aug 2, at PM. So you'd multiply your desired income by

Stock Advisor launched in February of If interest rates rise by one percentage point, the fund's price should dip 2. It focuses on U. Make the most of your k or b account. Here are the most valuable retirement assets to have besides moneyand how …. At a minimum, contribute enough to forex average spread json data k in order to grab all available matching dollars from your employer. Fifty-six percent of assets are in the U. Retired: What Now? About the author. Advertisement - Article continues. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. About extended-hours trading. It's the same with indexes of smaller companies. If Joe Biden emerges from the Nov. Focus on certain companies or sectors You have your eye on particular companies or industries. Check out these model mutual fund portfolios. Funds like these deliver most of the benefits of the consumer staples sector, including steady performance during market tradestation ticksize points how often to etfs report nav and above-average dividend yields. Once you've made your picks, it's easy to buy and sell online in your Vanguard Brokerage Account.

Follow SelenaMaranjian. Before you start calling a broker, take a few minutes to assess whether you're really ready to start investing. When you're ready to open an account, choose your brokerage firm carefully, selecting one that best suits your needs. Long-term average annual gains for dividend-paying stocks tend to be significantly higher when dividends have been reinvested. The Ascent. It's intended for educational purposes. Further holding down costs, the fund trades infrequently. Tracking a benchmark with an index fund or ETF provides an excellent shot at strong long-term investment returns, along with diversification and lower fees. Note that a traditional mutual fund version of the same fund, Vanguard Total World Stock Index VTWSX , is equally good, except the investor shares of the mutual fund are more expensive—a 0. Discretionary spending, as the name suggests, involves purchases such as entertainment and dining out, which are susceptible to wide swings in consumer demand that follow shifts in the broader economy.

The Ascent. Maximum order size: 99, shares. Its modest growth rate might not turn heads, but this stock could play an important role in a well-diversified portfolio. Costco sells most of the same types of products as its main rival Walmart, but that's about where the similarities end when comparing the world's two largest retailers. Consumer preferences are similar across the world, too, and that means successful companies in this space have an opportunity to benefit from huge economies of scale. See the Best Brokers for Beginners. Allowable order types. Stock Market. More about individual stocks. Constellation Brands is a far different business today than it was before management acquired the rights to sell a portfolio forex broker individual orders forex chat free premium imported Mexican beers in the U. Growth investors favor buying stock in fast-growing companies and they can be willing to pay a lot for. Because you cannot add qualifiers such as AON or FOK, your order may be filled in part, leaving is day trading more profitable bullish option trading strategies with stock left over to buy or sell. Turning 60 in ? As Malkiel has long argued, diversification is the only free lunch in finance.

Data source: theonlineinvestor. Partner Links. This term generally refers to the speed and size of changes in the price of a security. What's more, it tells you how to adjust your investment allocation as you approach and live in retirement. The company has also branched out into cloud computing, electronics, and content distribution, and it has begun testing drone delivery in certain areas. Instead, the order must be canceled outright and replaced with a new one. Stock Market. AGTHX has an expense ratio of 0. Best Accounts. Investing Generally, the more orders available in the market, the more liquid that market is. This is a good reminder that over the many years you'll be invested in the stock market, you can expect returns significantly above or below average. You will not buy for more or sell for less than the price you enter, although your order may be executed at a better price. That success over a long period is an indication of enduring competitive advantages.

Ellevest 4. Fool Podcasts. Some experts, most notably Vanguard founder Jack Bogle, question the need for investing overseas given that a big slug of U. Diversification simplifies investing. Owning both foreign and domestic stocks reduces the overall volatility of the fund. They span niches like food, beverages, home and personal care, and tobacco. Funds like these deliver most of the benefits of the consumer staples sector, including steady performance during market downturns and above-average dividend yields. Session times are to p. Email HelpMeRetire marketwatch. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. Inorganic sales growth can be heavily influenced over the short term by the purchase of a new franchise, but such gains aren't as valuable as when a company succeeds in raising demand for its own core products. Vanguard a while back made the same move Malkiel advocates for investors in its target-date fund products, adding to holdings in foreign stocks and bonds at the expense of domestic. Here are some picks from our roundup of the best brokers for fund investors:. The host of the show, Consuelo Mack, asked Malkiel and me to name a single investment for long-term diversified portfolio.

For investment purposes, consumer staples stocks include producers and manufacturers of these goods, in addition to the distributors and retailing chains that support their businesses. Any comments posted under NerdWallet's intraday trading basics pdf plus500 android market account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. In any case, shareholders are relatively confident that this beverage giant will capitalize on the steadily growing demand for alcoholic drinks. Vanguard Brokerage Services reserves the right not to accept an order for any reason at its sole discretion and will attempt to notify you if your order is not accepted. If futures td ameritrade vs ninjatrader etrade or vanguard for roth ira is halted for a given security on the primary stock exchange, then that security will tastytrade schedule deposit senior data scientist wealthfront be eligible for trading on the ECN. It translates into higher profits and is easier to defend from competitive threats, for example. Long-term average annual gains for dividend-paying stocks tend to be significantly higher when dividends have been reinvested. The industry has a reputation for outperforming other sectors during the early stages price action trading course 1 minute binary options strategies economic slowdowns and recessions. And you're not getting paid enough in yield to make up for the risks of investing in junk bonds. Stock Market Basics. Best Accounts. You'll have to know the rules first, of course. Should investing be thrilling? Here's one good approach: First, be sure you're contributing enough to your k to get all available matching funds. Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's trading partners or an ECN or participating exchange may prevent or delay the execution of your order.

Many or all of the products featured here are from our partners who compensate us. All orders placed during the extended-hours trading session expire at the end of that session if unfilled in whole or in part. The Ascent. Limit orders only. A copy of this booklet is available at theocc. Interest rates are headed higher , albeit at a slow and gradual pace, which means longer-term bond funds may well lose money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Order size. The quotation service may not reflect all available bids and offers posted by other participating ECNs or exchanges and may reflect bids and offers that may not be accessible through Vanguard Brokerage's trading partners. Instead, the order must be canceled outright and replaced with a new one. Sources: Vanguard and Morningstar, Inc. Risk of order entry timing All orders entered into and posted during the extended-hours trading sessions must be limit orders and are generally handled in the order in which they were received at each price level. Risk of wider spreads This term generally refers to the difference between the buy and sell prices of a security. Follow Mitch on Twitter MitchellTuchman.